Summary:

- Verizon’s Q3 earnings report led to a price dip, presenting a buying opportunity despite limited near-term upside due to the Frontier Communications deal.

- Market overreaction was driven by increased debt and missed revenue estimates, though Verizon’s dividend safety remains strong with a low payout ratio of 46.7%.

- Verizon’s dividend remains safe with a low payout ratio of 46.7%, making it an attractive income play despite recent declines in earnings and cash flow.

- Long-term price appreciation hinges on debt reduction, cash flow growth, and potential share buybacks, with a forward P/E of 9.08x and a dividend yield of 6.4%.

Robert Way

Introduction

Verizon (NYSE:VZ) (NEOE:VZ:CA) recently reported their Q3 earnings, and Mr. Market didn’t seem too happy with the company’s report. For me, it was a typical Verizon quarter. But the price dip offered me a buying opportunity that I took advantage of. I was hoping it would drop below $40, but the stock quickly rebounded.

Either way, I scooped up some shares as I already considered the stock to be trading at a decent valuation, although I thought upside was limited for the near-term due to their deal with Frontier Communications (FYBR).

In this article, I discuss the company’s latest earnings, why I think the market overreacted, and why I’m upgrading them to a buy.

Previous Rating

Despite considering VZ’s share price somewhat attractive, I rated the stock a hold due to the deal with Frontier Communications and the company’s price appreciation to roughly $45 a share.

Although the deal was expected to expand the company’s fiber footprint, the uncertainty surrounding how it would positively impact was evident as management mentioned this would create $500 million in synergies.

Additionally, I knew the deal was subject to approval and would likely be met with pushback, which I’ll touch more on later in the article. Since then, the stock is down more than 6% while the S&P is up slightly over 3%.

I touched on the company’s improvement during Q2 that saw free cash flow improve through the first two quarters. Additionally, management made improvements to its debt year-over-year and increased the dividend by 1.9% to $0.6775. However, EPS of $1.15 declined 5% due to higher expenses.

Nothing To Panic About

I’m a firm believer that sentiment drives the market more so than fundamentals. And when it comes to telecom companies, this is apparent.

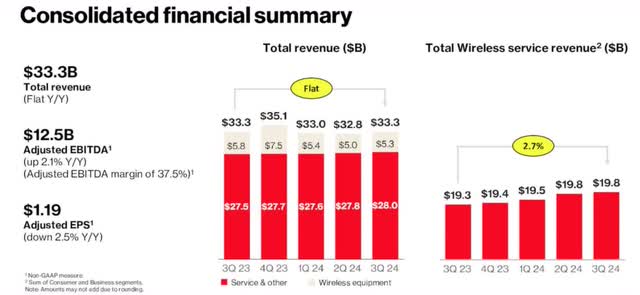

During their latest quarter, Verizon did what they typically do. Earnings per share increased from $1.15 in the prior quarter to $1.19 while revenue missed estimates by $120 million, coming in at $33.3 billion.

Revenue was flat from the previous year while EPS declined $0.03 over the same period. Again, nothing special and a typical day for the telecom giant. So why did the market overreact to the earnings report?

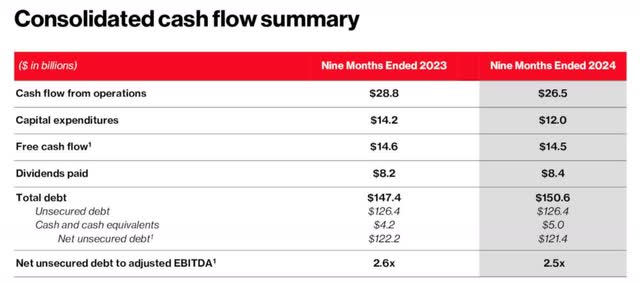

In my opinion, this was due to Verizon’s total debt increasing more than $3 billion to $150.6 billion, up from $147.4 billion the year prior.

With high inflation and interest rates currently, the market is extra sensitive when it comes to anything to do with telecom companies’ debt.

Additionally, this is a reason I downgraded them to a hold in my previous article. The company has been making improvements, however, with net debt declining from $122.2 billion to $121.4 billion.

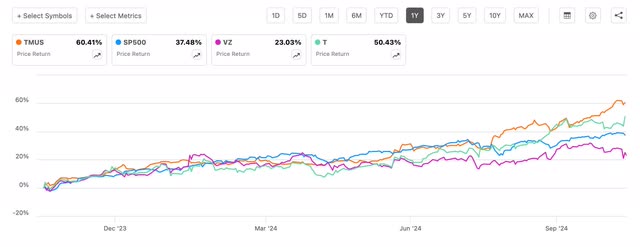

For comparison purposes, AT&T (T) managed to decrease their debt by $1.1 billion sequentially and $2.9 billion year-over-year. Peer T-Mobile US (TMUS) has been annihilating both companies in nearly every aspect over the past year.

They recently beat earnings estimates by $0.19 and revenue estimates by $140 million. And looking by how all three companies have performed in the past year in terms of price appreciation, TMUS has outpaced both and the S&P.

Not only is this due to their top & bottom line beat, but TMUS recently raised its dividend by an impressive 35.4% while announcing a buyback program. This is why I said Verizon should take notes, as their peer has been operating at a high level and doing all the right things investors expect from telecom companies.

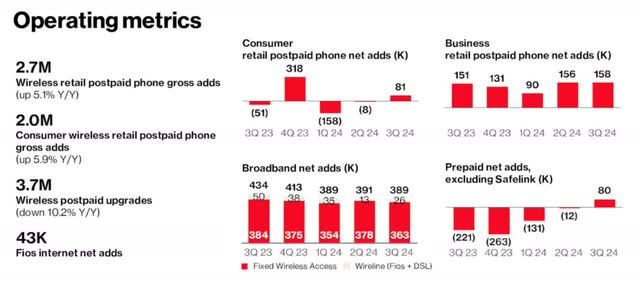

Segments

Regarding their segments, Broadband added an additional 389,000 subscribers, marking their 8th consecutive quarter with more than 375,000 additions. But this was down to the previous year’s quarter that saw 435,000 net additions. In their fixed wireless segment, they added 363,000 subscribers.

EBITDA also grew to $12.5 billion, up from $12.2 billion in Q3’23. T saw adjusted EBITDA growth of 3.4% year-over-year, outperforming their peer in this regard. VZ’s wireless service revenue ticked up from $19.3 billion to $19.8 billion.

Dividend Safety

In terms of dividend safety, the company did see a decline in their cash from operations and free cash flow. Aside from their debt, shareholders are often concerned about a telecom company’s dividend safety during earnings.

This could also be another reason their share price dropped, as investors often like to see cash flows as well as debt improve over time. With them being CAPEX intensive businesses, this is an important metric that is also heavily scrutinized.

During the quarter, VZ’s free cash flow was $6 billion while paying out $2.8 billion in dividends, giving them a safe payout ratio of 46.7%. CFO through 3 quarters was $26.5 billion, down from $28.8 billion, while free cash flow was $14.5 billion, down from $14.6 billion the year prior.

For comparison purposes, peer AT&T’s free cash flow was up $2.4 billion year-over-year to $12.8 billion and $5.1 billion during their Q3. For the full-year, AT&T’s management expects free cash flow in a range of $17 billion to $18 billion. Verizon did not provide free cash flow guidance, but I anticipate this being between $18.5 billion to $19.5 billion for the full-year.

What Will Drive Price Appreciation?

Every time Verizon makes a step in the right direction, they seemingly take two back. I’ve mentioned previously, lower debt, higher cash flow, and buybacks would drive share price growth. But this remains to be seen.

Management is on the right track discussing these during earnings, but as mentioned previously, this is not as easy as expected. Management stated their plan is to continue to pay down debt between now and the Frontier deal closing expected sometime next year. They also mentioned an update to a long-term leverage target of 2.0x – 2.25x.

And if they are able to reach this, they would consider repurchasing shares. Again, all the right moves, but it remains to be seen, especially with the pending FYBR deal. If management is able to successfully deleverage while growing cash flows and buying back shares, this would likely see strong price appreciation over the long term.

Furthermore, with the recent price drop, the stock is currently trading at a forward P/E of just 9.08x. And due to their low payout ratio and dividend yield of 6.4%, the stock remains an attractive income play with upside potential over the next year or two. I really like them below $40 a share, but their valuation is still attractive under $42 at the time of writing.

And because of management’s mention of buybacks and deleveraging, I do think their valuation can expand double-digits should they successfully execute over the next 12 – 24 months.

Using a P/E of 12.0x, which is fair for a company of VZ’s caliber, this would give Verizon a long-term price target of nearly $60 a share. This is attainable as the stock traded near here at the beginning of 2021.

Downside Risks

For the same reasons VZ saw its price dip during their recent earnings, this will also likely result in increased volatility going forward. If investors see debt increase in the coming quarters, the share price will likely see further downside below $40 a share. Moreover, the pending Frontier deal has been met with disregard, as many believe VZ is undervaluing the company. This also limits their capital for things such as buybacks and further deleveraging.

Bottom Line

Verizon has plenty of work to do ahead to drive price appreciation. Management is seemingly on the right track, acknowledging the desire to continue paying down debt, grow cash flows, and conduct share repurchases going forward. But with the pending Frontier deal, this will likely make it more difficult to execute going forward. But lower interest rates could serve as a catalyst as well.

Despite the decline in earnings and cash flow from the previous year, VZ’s dividend safety is secure with a low payout ratio of 46.7%. And although upside may be limited due to the pending Frontier deal as well as how the company will handle the debt, the recent price dip and yield above 6% makes them worth buying. Especially if the company can successfully execute on its growth strategy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.