Summary:

- We’re upgrading Advanced Micro Devices, Inc. stock to a buy from sell as the AI outlook is tampered for now.

- AMD just reported 3Q24 results and a softer-than-expected outlook for Q4 and tailing whisper numbers of AI GPU sales at $5B vs. $6B, causing the stock to pullback over 9%.

- Our negative thesis on AMD lacking material upside to current AI growth expectations continues to be at play, but we see a window for an intra quarter trade.

Marco VDM/E+ via Getty Images

We’re upgrading Advanced Micro Devices, Inc. (NASDAQ:AMD) to a buy after the company reported its third quarter of FY2024 results and outlook Tuesday, pulling the stock down over 9% at the market open Wednesday. We downgraded AMD to a sell back in August, expecting high AI growth expectations to burn the stock. Then, we reaffirmed our negative thesis after AMD announced its acquisition of ZT Systems and, in doing so, somewhat protected its AI growth narrative for the year; that was until it gave Q4 guidance. We think our negative thesis on AMD’s lacking competitive position within the AI accelerator market remains at play for the mid-to-long term, but not for the near term after management’s outlook somewhat tampered AI outlook this quarter.

For the quarter, AMD reported a top beat that was massively overshadowed by the softer-than-expected outlook for Q4. Q3 sales grew 17% Q/Q to $6.82B versus consensus at $6.71B and EPS of 92 cents, in line with expectations. The real catch was guidance; the company said it now expects sales to grow 10% Q/Q next quarter to $7.5B, trailing consensus of $7.54B. AMD’s pace of growth and guidance vs. consensus confirm our belief that the company is not the next Nvidia (NVDA), nor is it likely to see material upside to its AI business sales compared to expectations for the year.

Even after management raised its 2024 AI-related sales outlook this quarter, bringing its AI GPU sales outlook for 2024 to $5B from last quarter’s $4.5B and the prior quarter’s $4B, AMD continues to trail whisper numbers, which sit at $6B. The real slap in the face to Wall Street’s high AI expectations for AMD isn’t even for this year’s whisper numbers; it’s next year’s, with street estimates already in the $8-9B range for CY25. We think AMD won’t show more upside to buy side estimates this year or next year, especially as NVDA AI GPU supply has already moved on to the next best thing, i.e., the next-gen B200 and GB200 platforms. We think NVDA will continue to be the provider of choice, but we do see a window for an intra-quarter trade.

Currently, we think AMD could see some near-term upside after its post-earnings pullback. This is based on the now reset AI-related growth expectations, resulting in a lower threshold to revive investor confidence, and its continued share gain from Intel (INTC) on the CPU front until the latter releases its Lunar Lake CPU. That CPU should be released in Q3 and ramp in Q4. We see room for an intra-quarter trade on the name.

So, what happened?

All eyes are on AMD’s data center business, which reported 25% Q/Q growth to $3.55B, supported by shipments of 1. AMD’s new EYPC server CPU (which is enabling share gain against INTC) and 2. continued ramp of its MI300X AI GPU. AMD’s MI300X AI GPU, a GPU-centric chip that acts as a targeted solution for AI applications/workloads, is ramping up for the second quarter. The product is supposed to compete with NVDA H100 GPU, which quickly became the industry go-to for AI accelerators. Management had announced its new AI GPU, MI235X, earlier in October and guided the AI GPU market to hit a value of $500B by 2028, in around four years’ time with Lisa Su, AMD CEO, noting, “Customer and partner interest for MI325X is high. Production shipments are planned to start this quarter.” We don’t believe AMD will be a big part of this market in the mid-to-long run, nor in the near-term, although we think hype could take the stock higher into Q4.

The other piece of bad news was gaming sales, which management had already forecasted to decline Q/Q last quarter. Despite management’s disclaimer, the decline was still worse than expected, with gaming sales down 29% Q/Q and 69% Y/Y to $462M following a 30% Q/Q decline last quarter and Q/Q declines each quarter since 2QFY23. This decline comes as the gaming consulate market approaches its 5th-year cycle; gaming consoles usually get sold on five to seven-year cycles or generations, and we’re wrapping up this cycle. It’s fair to say the market has priced in the negatives from the slower AI growth story and gaming decline for now.

Having said that, there were some positives, particularly Client and embedded-related sales growing Q/Q by 26% and 8%, respectively, to $1.88B and $927M. The former’s sequential growth was the result of the new CPU ramp, while the latter rebounded on customer inventory replenishment. Embedded sales declined 25% Y/Y, but that sequential uptick is important, as it signals the end of the inventory correction that lasts around four quarters. Gross margins expanded around 50 bps sequentially for the quarter and are expected to expand to 54% in Q4 on higher data center sales and as management guides for sequential growth in all its end markets for Q4.

Heading in & out of earnings — what got priced in?

Heading into Tuesday’s print, the market didn’t seem to have gotten too far ahead of itself, with AMD underperforming the S&P 500 (SP500) and NVDA on the six-month chart but outperforming the S&P 500 on the three-month one. The stock headed into the print with an RSI of around 58, and it has now deflated to the low 40s level at ~41, making for an attractive window to jump in. The following chart outlines AMD’s stock price performance on the one-day chart and corresponding RSI.

Webull

Share take from Intel is still happening, for now

AMD has been steadily gaining share from INTC in data center and laptop CPU markets, according to CPU market tracker Mercury Research, and this is expected to spill into the 2HFY24, benefiting AMD. This is not to say INTC is just losing shares without any gains, nor to say that AMD is now the dominant player; neither of these statements are true. What this goes to say, however, is that the momentum is on AMD’s side for this year until INTC launches its Lunar Lake.

INTC continues to hold the majority of the PC Client market with a 78.9% share of the market versus AMD’s 21.1%. While this seems disincentivizing at first, it’s not. AMD is impressively competing with INTC, which has a more diverse client product lineup. AMD managed to add 0.5% to its share Q/Q and 3.8% Y/Y in 2Q24. On the server front, AMD had more success, capturing another 0.5% Q/Q and a nice 5.6% Y/Y from INTC, bringing its total share of the data center CPU market to 24.1%, supported by its EPYC CPU. We think this is a trend that will uniquely work in AMD’s favor for a limited time as INTC starts to slowly but surely get back on its feet with Lunar Lake. This is INTC’s 3nm CPU, which should be more competitive than AMD’s Client CPU offering.

Valuation & word on Wall Street

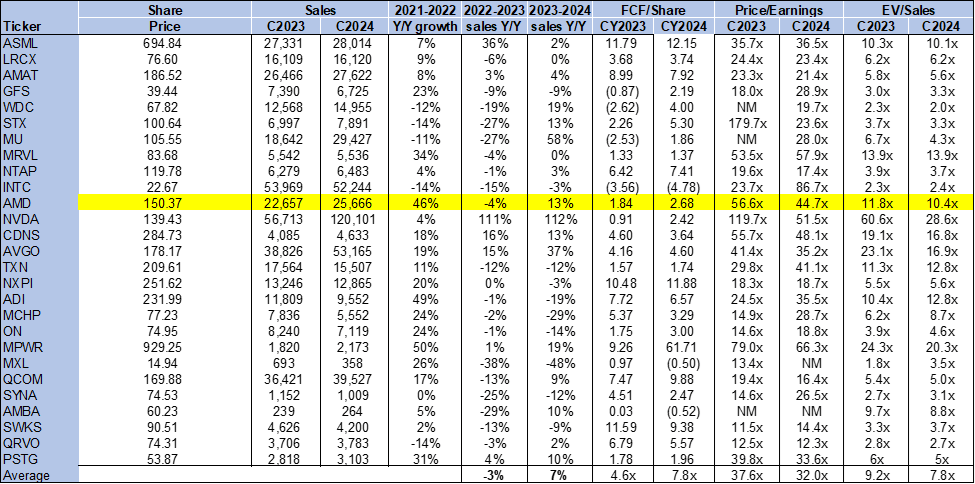

AMD continues to be unjustifiably expensive compared to the semi-peer group, but is still good for a near-term trade, in our opinion. On a P/E basis, the stock trades at 44.7x C2024 against a group average of 32.0x, compared to a ratio of 45.8x against an average of 33.1x in our last article in September. Having said that, the stock valuation really reset after the earnings report as the P/E ratio was 46.9x the day of earnings against a group average of 31.9x.

The EV/Sales confirm more of the same, with AMD’s EV/Sales ratio at 10.4x C2024 versus the group average of 7.6x and a previous ratio of 9.7x against a group average of 7.4x. AMD is more expensive today than it was in late September, but is now better positioned for a near-term bounce back. The following chart outlines AMD’s valuation against the peer group average.

TechStockPros

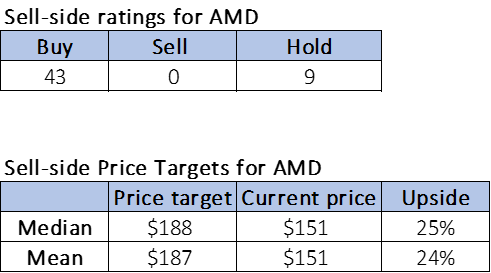

Wall Street is just as bullish as it was in late September, if not more so. Of the 52 analysts covering the stock, 43 are buy-rated, and the remaining nine are hold-rated. The stock is currently priced at around $151 per share with a median sell-side price target of $188 and a mean of $187 for a potential 24-25% upside, better than the price targets’ upside potential in our last article. The following charts outline AMD’s sell-side ratings and price targets.

TechStockPros

What to do with the stock?

AMD has been a distant second to NVDA according to the larger market, which is false, in our opinion, considering the performance gap between the two companies’ offerings. Still, we don’t think this means the stock price won’t perform well at the back end of the year on better-than-feared AI growth. We think more hype will get baked into the stock intra-quarter and recommend swing investors jump into the stock at current levels to get in on that.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.