Summary:

- Advanced Micro Devices, Inc.’s stock cratered due to a minuscule guidance miss ($50M).

- Despite this minor disappointment, AMD posted excellent numbers, including a record 122% revenue increase in its data center segment.

- AMD remains relatively inexpensive, presenting substantial opportunities as we advance.

- AMD’s stock could go much higher as the company increases sales and boosts profitability substantially in future years.

Kitinut/iStock via Getty Images

Advanced Micro Devices, Inc. (NASDAQ:AMD) delivered quarterly results, and its stock is dropping (down 9% in pre-market). For Q3 2024, AMD announced $0.92 in EPS, a 31% YoY increase. Revenue came in at $6.82B, an 18% YoY increase, bettering the estimate for $6.71B in sales. The results were highlighted by solid data center segment revenues of $3.5B, a 122% YoY increase (25% increase sequentially).

However, despite the robust results in AMD’s AI and data center segments, its gaming and embedded segment revenues cratered by 69% and 25% YoY. Perhaps more importantly, AMD guided to $7.3-7.8B in revenues for Q4, slightly below the consensus midpoint estimate of $7.55B.

AMD’s stock experienced a considerable run-up in earnings. However, due to the disappointing guidance, it is dropping in pre-market (Wednesday, October 30th), which likely presents a buying opportunity.

Despite the softer-than-expected guidance, the market may be overreacting here, as AMD’s prospects remain solid, especially considering its solid growth in data center AI.

Moreover, AMD is relatively inexpensive, and its stock remains a solid intermediate and long-term buy, given the excellent growth and profitability potential in future quarters.

AI Data Center Growth To Continue

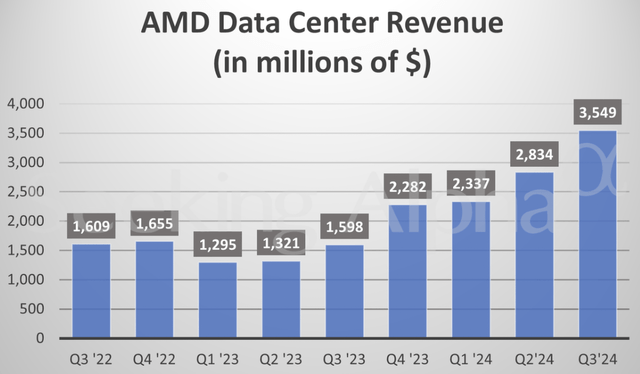

Data center revenues (seekingalpha.com)

AMD registered its highest YoY data center growth on record at 122%. Additionally, AMD posted its second-best sequential data center growth at 25%, showing robust demand for AMD’s data center GPUs, APUs, and other processors. AMD’s MI325X and MI300X accelerators are particularly interesting, as these powerful processors compete well with Nvidia’s AI offerings.

Data Center Market Size Estimates

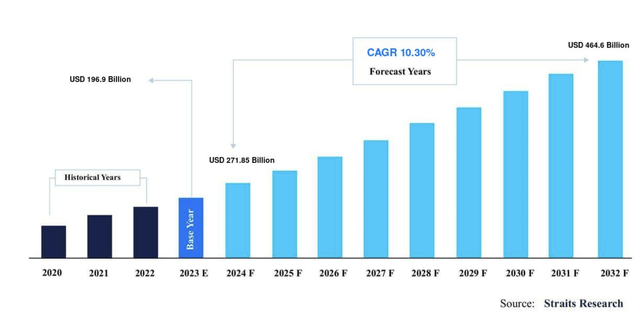

Data center growth (straitsresearch.com)

The data center market could experience a 10%+ CAGR in future years. Its size is expected to increase to approximately $465B by 2032. This dynamic implies that AMD could continue expanding its data center segment revenues as it continues providing top-performing processors to power AI.

Furthermore, NVIDIA Corporation (NVDA) and AMD have an essential duopoly in data center GPUs, APUs, and other accelerators. Of course, Nvidia’s data center segment is much larger than AMD’s, which illustrates Nvidia’s lead in the lucrative market.

Nonetheless, AMD illustrates solid growth in the data center segment and could continue gaining momentum, potentially narrowing the gap with Nvidia in future quarters. Nvidia delivered $26.3B in data center revenues last quarter, a 154% YoY gain.

This dynamic illustrates that Nvidia’s data center segment is about 7.5 times that of AMD. Still, both companies have bright prospects in this space, and AMD could see improvements in its gaming segment and other lagging businesses as we move forward.

Another critical factor to consider is how instrumental Nvidia and AMD are to the broader AI segment. The companies’ GPUs, APUs, and other accelerators power the AI industry at its base, providing the “picks and shovels” and doing much of the heavy lifting required to power the massive AI industry.

AMD Is Relatively Inexpensive

Due to the solid demand in data center AI, and other segments, AMD’s sales will likely continue expanding substantially in future years. The consensus estimate is for around 28% revenue growth next year, and approximately 15-20% for the next 2-3 years.

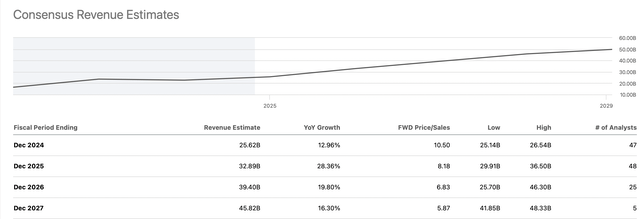

Sales growth (seekingalpha.com)

AMD’s sales will be about $25-26 billion this year, but we could see a substantial increase to approximately $48-50 billion by 2028. Moreover, AMD will likely become increasingly profitable in the coming years. In Q3,AMD reported a GAAP gross margin of 50% (54% non-GAAP), a solid improvement over last year’s 47% (51%) and the previous quarter’s 49% (53%) gross margin.

Additionally, AMD’s operating margin was 11% last quarter, much higher than the previous quarter’s 5% and the 4% operating margin in the same quarter one year ago. AMD’s non-GAAP operating margin was 25% last quarter, better than the previous quarter’s 22%. Therefore, we see AMD’s profitability improving as it increases sales in its higher-margin data center/AI segments.

AMD’s Profitability Likely To Continue Increasing

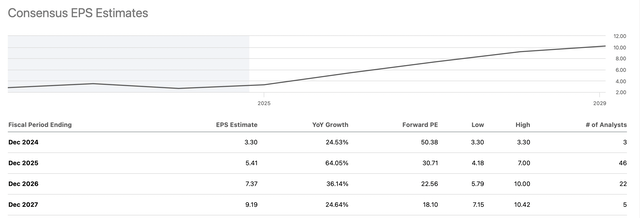

EPS estimates (seekingalpha.com)

AMD’s EPS is approaching $4 this year, and we could see EPS around $6 in 2025, potentially increasing to approximately $8 in 2026. This dynamic illustrates excellent EPS growth, which should continue due to AMD’s solid position in the AI/data center accelerator market.

Furthermore, AMD could see improvements in gaming and other underperforming segments, which could boost the bottom line more than anticipated in future quarters.

With continued growth for AMD in its lucrative data center market and AI, my estimates call for EPS in the $6-6.50 range in 2025 and approximately $8 in 2026. EPS of $6-6.50 implies AMD trades at a forward P/E ratio of about 23-25, which is relatively cheap considering AMD’s solid market position, substantial growth prospects, and considerable profitability potential.

Moreover, applying a potential $8 in EPS in 2026 suggests that AMD may be trading around 18-20 times forward (2026 EPS estimates), underscoring its inexpensive valuation, making the stock attractive here at around $150.

Where AMD’s stock could be in future years

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue (in billions) | $25.7 | $34 | $41 | $48 | $56 | $64 | $72 |

| Revenue growth | 13% | 32% | 20% | 18% | 16% | 14% | 12% |

| EPS | $3.40 | $6.25 | $8 | $10 | $12 | $14 | $16 |

| EPS growth | 28% | 83% | 28% | 26% | 18% | 16% | 14% |

| Forward P/E | 30 | 31 | 32 | 33 | 32 | 31 | 30 |

| Stock price | $188 | $248 | $320 | $400 | $448 | $496 | $540 |

Source: The Financial Prophet.

AMD’s revenues can continue increasing at a healthy pace due to its solid positioning in the data center/AI market and other segments. My 2025 sales figure is only $1B above the consensus estimate of $33B. Therefore, AMD should post very robust sales growth in 2025. Additionally, AMD should become increasingly more profitable, so we will likely see EPS growth outperforming in future years.

Moreover, due to its excellent sales increases, AMD could increase EPS substantially in future years. This dynamic could lead to multiple expansion, enabling AMD’s forward P/E ratio to be around 30-33 or higher in the coming years. The combination of multiple expansion and earnings growth could enable AMD’s stock to move much higher in the future.

Risks to AMD

Investing in AMD comes with risk, despite my bullish assessment. A substantial risk for AMD comes from its intense competition with Nvidia. AMD is still chasing Nvidia in the AI/data center market and must close the gap. Nvidia’s data center business is much bigger, about 7-8 times that of AMD. Therefore, AMD has its work cut out as it races to capture more market share in this lucrative space. AMD also faces a resurgent Intel, who is intent on taking back its lost market share from AMD in the CPU race. AMD must continue innovating, maintain growth, and move forward, being highly profitable. Please consider these and other risks before investing in AMD.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.