Summary:

- Amazon is a great company, but is it a great stock? After producing T-bill-like returns for a few years, it has my attention.

- In this article, I review a series of my “go-to” analysis techniques with a long-term focus, apart from my existing trading and options work with this stock.

- I rate AMZN a Buy based on my view that it has more potential upside than most giant stocks, as a price laggard with top-level profitability and financial strength.

tigerstrawberry

Amazon (NASDAQ:AMZN) is one of my favorite companies. I’m old enough to remember when it was simply a seller of books. Heck, I’m old enough to remember when “Amazon” was simply a river in South America! But today, I’m guessing if we asked 100 people what Amazon is, at least 3/4 of them would describe the company that brings stuff to our doors, faster than it would take for us to drive to the store. Not because we can’t get in our car and drive there, but because we now have the choice. And our time is valuable. So Amazon is as remarkable a change agent as we’ve ever seen in the history of commerce.

But that doesn’t make it a “good stock,” when that is defined as something that has produced competitive returns in the last 3-4 years. Because AMZN hasn’t. In fact, here’s a pop quiz, all true or false questions:

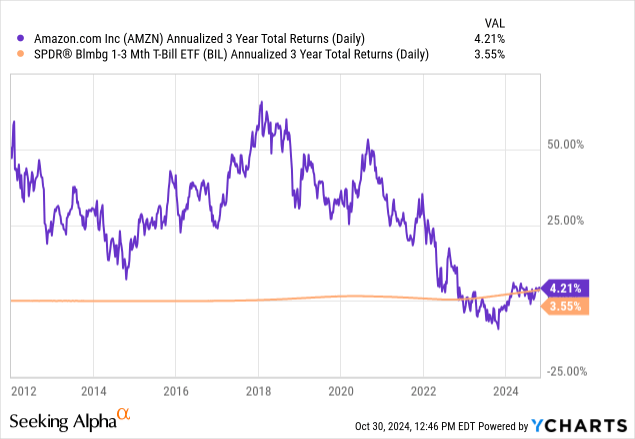

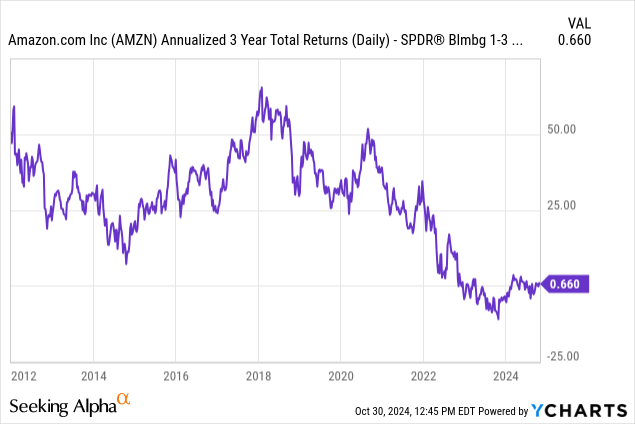

1. AMZN’s annualized returns the past 3 years are under 5%

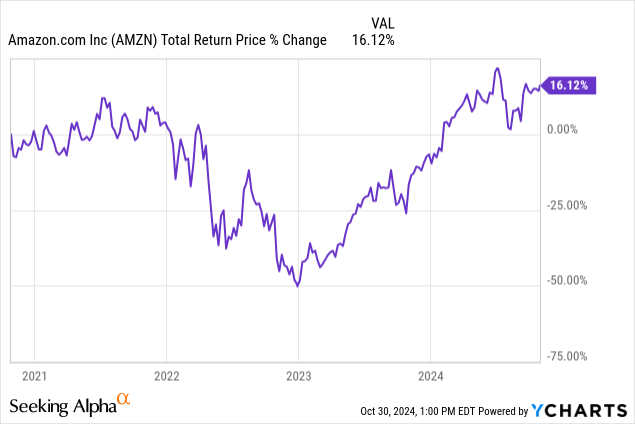

2. AMZN’s total return the past 4 years (mid-October 2020 through yesterday) was just 16%, under 4% a year on average

3. AMZN has been correctly analyzed by Wall Street analysts, who foresaw what would occur with this iconic company’s stock the past few years

4. I was a professional athlete, inducted into multiple halls of fame

Answers: the first two are true, and the last two are as false as false can be. Yes, AMZN’s returns have been closer to T-bills than the Nasdaq 100 index, where it is currently the sixth largest member. And while I used to have decent hand-eye coordination, thinking that #4 above might be true is about as silly as thinking Wall Street analyst consensus could be that prescient!

Amazon: my current analysis

Now, to the details and to my conclusion on AMZN. I have assessed it the way I’ve operated for decades. I leave the deep dive fundamental scrutiny to the 21 analysts who have written about the stock in just the past 30 days, and the 21 fine Investing Groups that cover the stock, as well as many others who follow it but have not written it up over the past month.

My technique is rooted in first finding stocks to pass my fundamental and quantitative screens, then actively managing a portfolio, keeping the positions largely intact, but rotating the position sizes up and down. That helps me avoid big losses, and in the case of dividend stocks (AMZN is not one), helps me to earn more dividend income than I would with a buy and hold strategy, that forces me to sit there and take it when a stock tanks.

Risk management is where its at for me. Because while any stock can go up in price at any time, for any reason, the difference between any stock or ETF and any other is how much risk of major loss is attached at any point in time. That means studying price patterns for a living, more so than creating discounted cash flow analysis, which I have no skills doing.

So here’s a quant plus technical view of AMZN, which concludes with my assessment that AMZN has moderate risk, but high return potential over the next few years. Sure, I have and will trade it, and even consider owning it via a covered call ETF as I wrote about recently with Nvidia (NVDA) and Microsoft (MSFT). I’m not there yet, as AMZN recently hit my radar from the standpoint of price appreciation potential.

Amazon: quantitative review

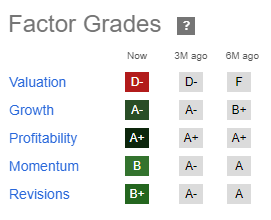

As I’ve stated here before, I’m a big fan of Seeking Alpha’s Quant Factor Ratings. I lean on several, but not all of them in the front part of my investment process, the part that involves deciding what I’m willing to own “at a price.” That results in a watchlist, from which I choose the stocks to allocate between 1% and 5% to.

While AMZN is outside that primary, Yield At a Reasonable Price (YARP™) methodology because it doesn’t pay a dividend (and would likely pay a very low yielding one if it did), I still review all of my key inputs to the process, many of which are quantitative and technical (price chart trends). That’s how I became comfortable with adding some covered call ETFs to my YARP portfolio. The yields are high, and my price analysis was favorable enough to prompt me to add small positions. I’m not yet there with AMZN, but I do and will own and trade it over time, especially given what I see here.

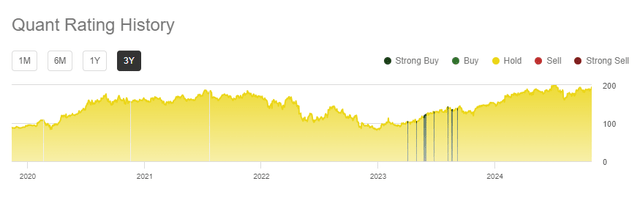

Here’s the Seeking Alpha Quant Rating history on AMZN going back to late 2019. This is not one of my usual go-to’s within that system, but I did find it interesting that through AMZN’s period of mediocre performance, it fairly judged it as a hold. Not a buy. Because that would be grading on a huge curve, which is what brokerage analysts tend to do.

Seeking Alpha

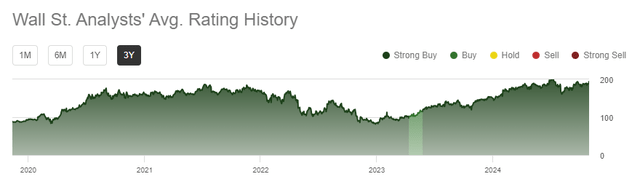

And, as it turns out, that’s exactly what they’ve done! See below, where strong buy and buy ratings on AMZN have been almost universal from the time it peaked in late 2020, through today. Recall that the stock has appreciated by just 16% during the past 48 months. Buy and strong buy? On what scale, other than seeking to retain one’s spot in investment banking business for your firm, or because an analyst fears they will get canned if they dare put even a hold rating on a Magnificent 7 stock? So frankly, these folks are of no help, other than as a contrarian indicator.

Seeking Alpha

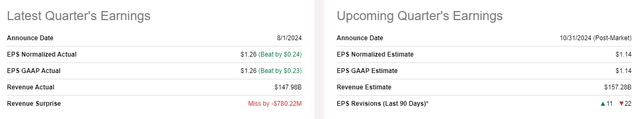

Earnings hit Thursday night, but since this article analysis is thinking more long-term, I’m not putting much emphasis on a single quarterly report. That said, while I will trade something around earnings in my side-trading accounts, when it comes to my main portfolio (YARP), approaching earnings report dates are an automatic negative. Too many things are out of investors’ control when they are subject to the emotions of the market from earnings outside of market hours, as most are. I won’t “not own” a stock through earnings, I just consider it a “demerit” in the full picture, all other things being equal.

Seeking Alpha

So we’ll see how AMZN’s report goes. Since I own just a tiny amount now and only via out of the money call options, I’m currently in a fixed risk/high upside potential situation here. But that’s just trading, and not the primary focus I have with AMZN.

Amazon: laggard or leader?

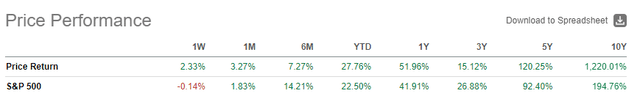

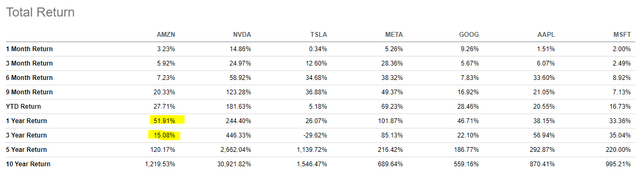

Now let’s zero in on the details behind that pop quiz at the beginning. What stands out to me here is that big gap in 3-year trailing performance versus the S&P 500, and (not shown) more so versus QQQ. AMZN’s strong past 1-year return masks the fact that most of that gain was just shareholders getting back value they had lost previously.

Seeking Alpha

And while a 1,200% return over 10 years is hall of fame material (unlike me), I frequently make a point that such great returns don’t mean anything if you didn’t own the stock. They are in the past. Frankly, I’m thrilled to even be able to consider some of the Magnificent 7 stocks this year, since I’ve judged them to be way out of reach for my investment process. But as some of my recent articles have laid out, that’s changing a bit.

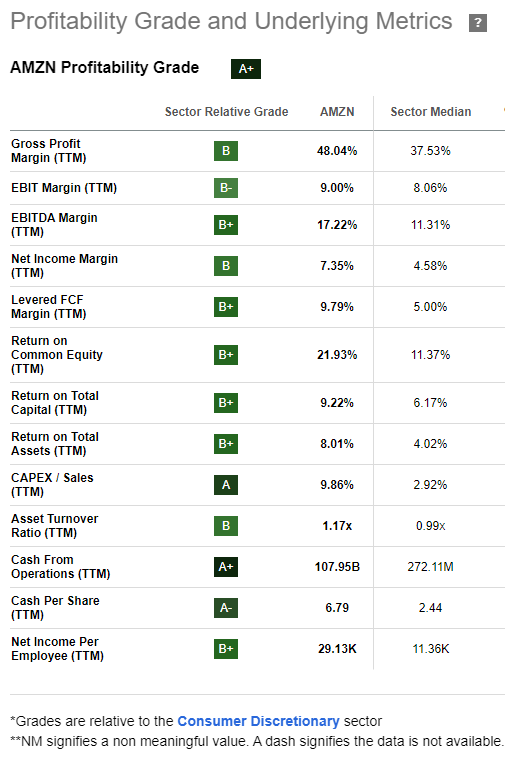

AMZN gets an A+ for profitability, and I won’t consider a stock that is lower than a B rating in that category. Growth is solid as we’d expect, though for decades AMZN has been a company known for investing massive amounts of earnings growth back into the business. Thankfully they did that, often against the wishes of some investors, because that continuous plowing back into the operation ultimately took this company from bookseller to retail dominator.

Seeking Alpha

Within that key profitability grade, the sub-grades are very solid. AMZN may disappoint investors here and there, but it is hard to imagine a stock with a competitive advantage stronger than theirs. So unlike a newbie growth stock, this one already has a network effect of sorts.

Seeking Alpha

Sure folks can switch to Walmart or one of many alternatives. But as one analyst commented during the recent wave of subscriber cancellations to the Washington Post, which is not part of AMZN but is also owned by founder Jeff Bezos, “let’s see how urgent people are to cancel their Amazon Prime subscriptions.” I’m guessing not so much. And of course, AMZN is much more than retail shopping now.

AMZN is the low performer in the Mag-7 the past three years, other than Tesla (TSLA) which is really the oddball in the group for many reasons. Chief among them, TSLA it is not nearly as established from a financial stability standpoint as are the other six. So when one of these lags the other five, it is worth noticing.

Seeking Alpha

Amazon vs. T-bills: a surprising recent winner

Here’s the visual to one of those pop quiz questions above. 4.2% a year for AMZN the past three years is near its low in the post-financial crisis era. That low point was recent, but the bounce off the bottom is one of those things that gets the attention of a price trend watcher like me.

Perhaps more significantly, AMZN is coming off a period where, for the first time in recent memory, its 3-year return was below 1-3 month Treasury Bills. That’s what I’ve charted below, and we see that the 3-year rolling return is back in positive territory. But wow does that get my attention!

Here’s that 4-year chart. For most of this time, AMZN was underwater from mid-October of 2020, a fairly long time ago, given that we’ve since entered a new Fed rate cycle (up 11 times, now down 1 so far) and we’ve seen Mag 7 take over the hearts and minds of so many investors. Through all of that, it has gained 16% in over four years’ time. If this were a business in decline, I would not spend much thought on it. But that’s not what we have here.

I like my coffee iced and my earnings smoothed

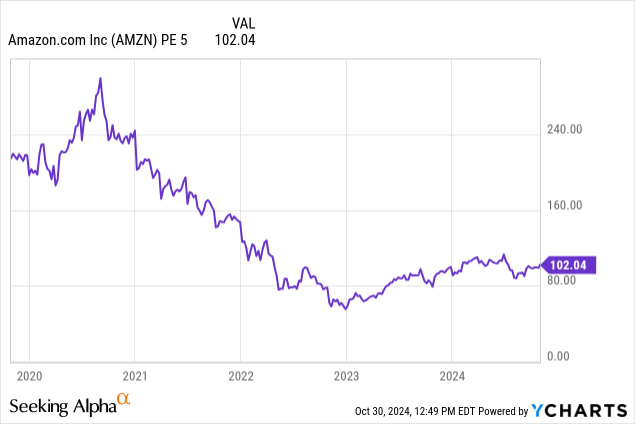

Both are true, for what it is worth. And while AMZN’s worth is typically a sky-high multiple of its trailing 5 years of earnings, remember that they tend to spend so much that they suppress their own “E” in the P/E multiple. I’ve never written this until now, but maybe at least for a little while, this stock is relatively cheap at 100x P/E 5 earnings (current stock price divided by the average EPS from the previous five years). It is certainly a long way down from its 2020 peak.

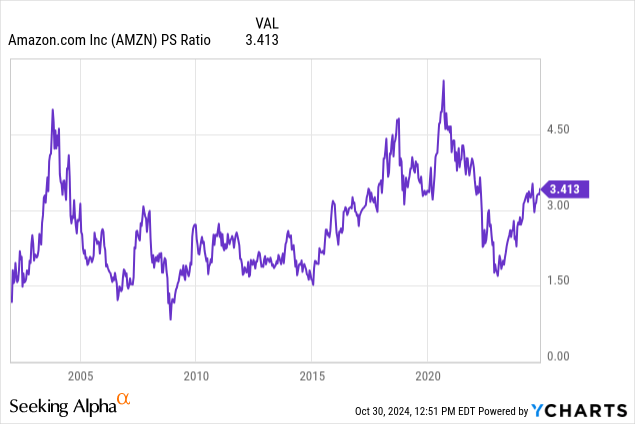

Price to sales is middle of range, which is encouraging, given some of the stark measures of laggard-ness I’ve cited above. I’m a technician at heart, and so I quickly see a middle of range chart here, which is fine if some of the other metrics check out.

This is a biggie to me, and I will be doing more research and writing on this. With companies buying back so much stock and/or not paying dividends at all, dividend yields are somewhat suppressed in this market climate. That, and price appreciation over the years, puts many large cap stocks at yield levels that I find to be long-term dangerous. Selection is simply more challenging, but quite worth the effort.

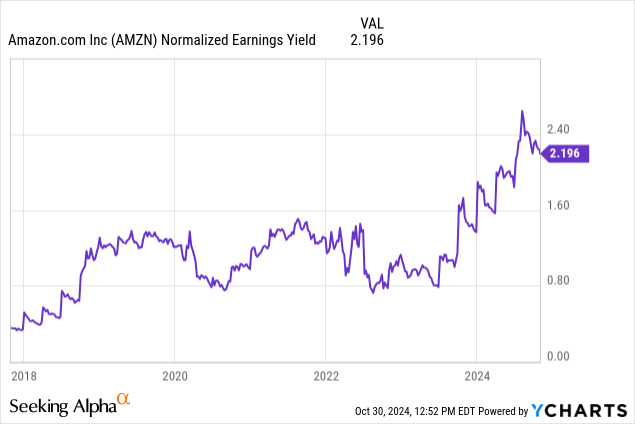

But there’s no dividend here, so instead I’m starting to consider earnings yield as well. And when I do a YARP-style analysis of AMZN, I like what I see. Below, I observe the past seven years’ (earnings) yield, see where it is currently on that spectrum, and look for a signal that it could be moving down from a recent peak, that’s where the YARP valuation starts. The far-right side of this chart shows that AMZN is in about the 95th percentile of its 5-year earnings yield range and hinting at going lower on that spectrum. That’s a positive long-term signal to me.

AMZN: technical analysis

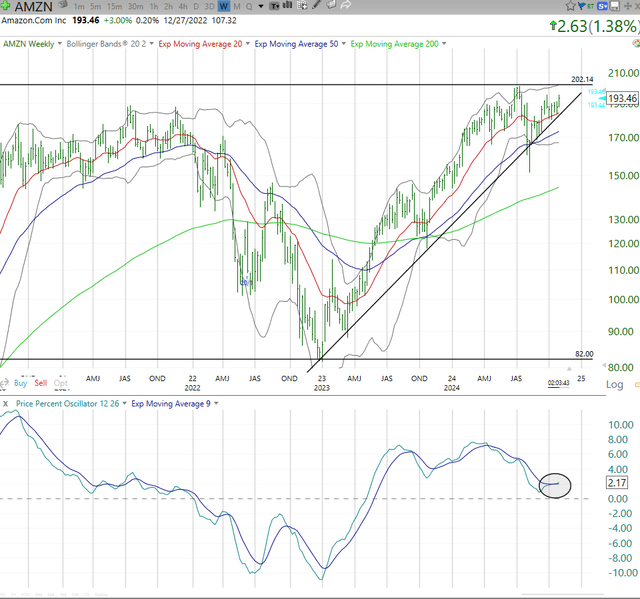

Finally, here is an intriguing chart picture, using my standard approach. This is a chart of weekly prices, and while I’ll note that the daily price chart (not pictured) is positive, that only gets me so far. That’s more of a trading time frame.

Here I see that AMZN is reaching a point where it likely tells us what the future will hold, more substantially than a trader’s perspective. A sustained move to new highs is what I’m looking for. And with the trend line from the past 2 years showing the nice comeback in the stock’s price, it is not far from breaking below this rising trend. So this is one of those situations where AMZN could throw off a high-percentage signal, one way or the other, soon. That always gets my attention. The lower section of the chart (PPO: momentum indicator) tells me that over the next 1-3 months we should get a more informed view.

Seeking Alpha

AMZN: summary views

I’m assigning a buy rating to AMZN, but with my usual and specific caveats:

1. It is very eligible for my trading accounts, given that long-term potential price recovery

2. It is intriguing as a long-term investment, and I think it has more upside potential than any other Magnificent 7 stock. However, potential is nothing until it follows through and realizes that. And there’s still a big possibility of a market-wide meltdown, or a temporary, exciting but ultimately failed melt up, a la early 2000, for big QQQ names.

3. The in-between decision for me is to consider doing what I did with NVDA and MSFT. That is, consider an AMZN covered call ETF as one of many tactical yield positions I rotate through within my YARP portfolio. AMZN has not yet made it to that “big dance” with me, but I like its odds, all things considered.

I’ll be following this one, just as I follow the seemingly daily deliveries to our doorstep from this remarkable business. Now, let’s see if it can again be a remarkable stock.

MY YARP PORTFOLIO IS COMING TO SEEKING ALPHA. Thanks for reading my research. My investment process and my personal YARP active, risk-managed, dividend and total return portfolio will soon be available as a Seeking Alpha Investing Group subscription service. We are launching within the next few weeks, and the first wave of subscribers will get a lifetime discount. Details coming soon, so keep reading my articles and be on the lookout for the launch announcement.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I own call options on AMZN, and frequently trade the stock However, this article is focused more on my increasing interest in owning it for a longer time frame, perhaps via a covered call ETF with AMZN as the underlying.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.