Summary:

- Amazon’s AWS business, leveraging NVIDIA GPUs and custom AI chips, drives high profitability and productivity gains, supporting strong investment potential despite eCommerce risks.

- AWS’s vertically integrated AI ecosystem and GenAI productivity improvements enhance margins, with AWS contributing significantly to Amazon’s operating income.

- Despite high CapEx and competition, AMZN’s differentiated AI offerings and productivity gains justify a premium valuation, with a targeted 23.5% upside.

- Q3 guidance suggests the potential for Amazon to beat EPS estimates, driven by resilient consumer sentiment and strong demand for AWS and retail services.

- Do expect volatility in case some key economic indicators point to rates staying higher for longer.

Sundry Photography

Since I last covered Amazon (NASDAQ:AMZN) in January 2023, it has increased by more than 100%. At that time, I compared it with Oracle (ORCL) and showed how its AWS cloud business was better positioned to monetize GenAI opportunities.

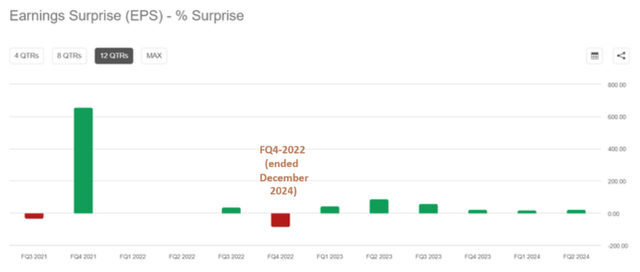

This has been the case when looking at profitability, with quarterly EPS beating consensus estimates for the last seven quarters, as shown below.

Now, with third-quarter fiscal 2024 (Q3) results likely to be reported on October 31, this thesis aims to show the stock is a buy, after considering GenAI-related productivity gains, high ROI from leasing GPUs, and weighing the risks for its core eCommerce business. To start with, I show how the billions of dollars spent on buying NVIDIA’s (NVDA) GPUs (graphics processor units) are being monetized.

AWS is Highly Profitable as Leasing GPUs Can Yield 500% Returns

First, hyperscalers which are the large public cloud providers like Amazon, Microsoft (MSFT), and Alphabet (GOOG) have been actively purchasing NVIDIA’s advanced GPU chips since early 2023 and collectively accounted for more than 50% of the chipmaker’s data center segment revenues in the May quarter of this year. Subsequently, they make money by leasing these GPUs as part of their cloud subscription plans, and, according to an estimate by the semiconductor giant itself, they can obtain $5 to $7 of revenues for every $1 invested in GPUs over four years, or an ROI of 500% ((6-1)/1 x 100) considering the midpoint of $6.

This means high returns and, on top, Amazon has experienced strong demand for cloud services, meaning pricing power. As a result, AWS, its most profitable segment, saw revenues increase to $26.3 billion in the second quarter of 2024 (Q2), or a 19% YoY surge constituting only 17.8% of overall sales, but accounting for a sizeable 63.3% of its operating income. In Q1, AWS accounted for about 61.4% of its operating income despite constituting only 17% of its total revenues of $25 billion.

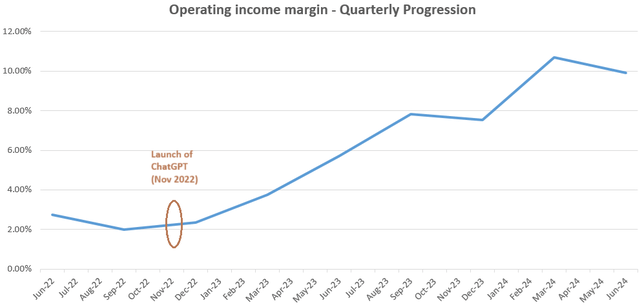

Thus, with more income from its lucrative cloud business, the giant online retailer has seen operating margins climb since the launch of ChatGPT in November 2022 as shown below.

The chart was prepared using data from Seeking Alpha

Thus, more companies migrating their IT workloads from on-premises to the cloud while tapping into GenAI partly explains why it has been beating EPS estimates with another reason being a productivity-led reduction in operating expenses as I detail later, but, in the meantime, it is important to assess whether such upbeat demand is sustainable.

Risks of IT Spending Fatigue and High Capital Expenses Incurred to Build the AI Infrastructure

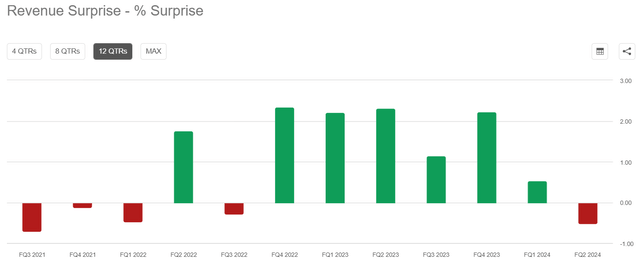

In this connection, the revenue miss (compared to what analysts were expecting) suffered in Q2, especially after six quarters of beats raises doubts about whether more than one and a half years since the launch of ChatGPT, enterprises are still willing to spend money on GPUs.

Now, any deceleration in IT spending by enterprises would be concerning because of the “significant amount” being spent by Amazon on building its AI infrastructure, both for GenAI and conventional IT workloads. Hence, for the first half of 2024, CapEx was $30.5 billion, with more planned in the second half, with the majority dedicated to AWS. Moreover, the giant retailer already held $61.8 billion worth of debt at the end of Q2 and even higher capital leases of $78.1 billion, so there is a lot of interest on loans plus depreciation on leases to be paid away, not to mention taxes.

Furthermore, there is also competition to contend with from other hyperscalers and Oracle, just to name a few. This means that customers looking to lease GPUs to develop AI apps have a choice and may look for bargains that could impact AWS’s profitability.

Vertically Integrated Services, Customized Chips, and Improved Productivity mean Improved Margins

However, to differentiate itself, Amazon proposes a vertically integrated AI ecosystem, meaning that in addition to GPUs, it proposes value-added services, namely through services like Amazon Bedrock, to facilitate the lives of AI model builders by easing their access to hardware, software, and data. Additionally, there is Amazon Q, a generative AI-powered assistant that answers technical questions, provides summaries, and automates certain tasks allowing AWS customers to be more productive.

Another differentiating factor, especially compared to Oracle as I had detailed in my earlier piece is that in addition to purchasing readily made chips like the H100 from NVIDIA, it also designs its customized AI silicon (Trainium and Inferentia) which makes for a more cost-effective solution given the more profound way they can be integrated in its cloud ecosystem (compared to NVIDIA’s H100). This not only allows for lower operating costs but also increases Amazon’s competitiveness in contrast to those who differentiate their AI-as-a-Service offerings solely on a price basis. Also, customized chips can help mitigate the effects of NVIDIA hiking prices because of the high demand for its chips.

Coming to the productivity part, GenAI is credited with improving the quality while reducing completion time in the software engineering field, with McKinsey estimating that software development can be accomplished twice as fast. Tellingly, Amazon, whose vast AWS cloud infrastructure utilizes a lot of software codes including multi-platform, and object-oriented, Java has achieved much more. Thus, the average time to upgrade Java plummeted from 50 developer days before to just a few hours using GenAI, according to its CEO, Andy Jassy, in a LinkedIn article two months back.

Talking productivity gains, this has saved Amazon the equivalent of 4,500 developer years of work, and given the annual salary of a software engineer is roughly $136K, this comes to $612 million of savings or about 1% of Q2’s operating expenses. Now, combined with AWS’s vertically integrated solutions and ability to leverage customized chips, the eCommerce giant is on a path to more profits, signifying it deserves to be valued better.

Valuing, Considering AI Opportunities and Risks Related to the eCommerce Business

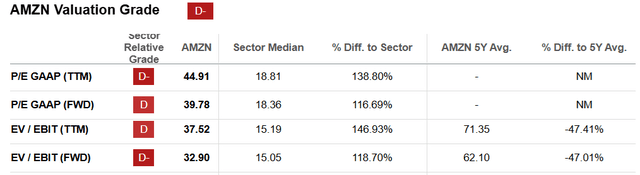

Now, the company’s forward GAAP P/E of 39.9x exceeds the IT sector median by more than 100%, suggesting it is overpriced, but it has come down from 50.4x during my last coverage, showing that the market has not yet priced in the rapid pace at which it has grown earnings. Moreover, for a big tech actively reinvesting profits to grow both its AI infrastructure and logistics business, which in turn impacts earnings, this time I consider the EV/EBIT ratio which also takes into account its relatively high debt level versus equity. Also, since EBIT (earnings before interest and taxation) is not impacted by debt servicing (interest payments) expenses, it gives a more objective picture of this capital-intensive business, especially for comparison purposes.

Now, with a forward EV/EBIT of 32.9x, the stock trades at a premium when compared to the sector median of 15x. However, this is below its 5-year average by 47% while AWS continues to weigh more on Amazon’s operating income and is helping beat EPS estimates. Also, with AI-driven returns and productivity gains, it deserves better.

On the other hand, as a consumer discretionary play, it could suffer from economic cyclicality risks for its eCommerce and advertising businesses while interest rates staying at 5% could play on business sentiment in general. For this matter, the reason for sales relative weakness in Q2 was due to its core eCommerce business being negatively impacted by slower growth due mostly to lower consumer spending.

To this end, as shown in the orange chart below, the company has been more volatile than the Invesco QQQ Trust ETF (QQQ) for the past six months, especially in July-August (as encircled in red below) when some stocks in the discretionary sector including apparel and electronics, missed expectations and comments from Mr. Powell hinted that rates could stay higher for longer while most market participants were expecting a cut. On the other hand, when the U.S. Central Bank turned dovish in September, Amazon gained more than 10% as highlighted in green.

Thus, balancing the AI opportunities, cyclicality, and rate-sensitivity risks, I target a 23.5% upside or half the potential 47% identified earlier, which translates to a share price of $232.6 based on the current share price of $188.4. Moreover, given that it is just two days before earnings, I further justify my bullish position by showing there are chances for beating both the topline and bottom-line estimates.

Q3’s Earnings Preview and Potential Beat

In this respect, as per Q3’s guidance, net sales are expected to vary from $154.0 billion and $158.5 billion, or a mid-point of $156.25 billion, translating into a growth of 9.5% over the third quarter of 2023. This would mark a deceleration from the recent trend for a company that has grown at double-digits, but, this seems irrational given the demand for AWS and the resilience of the U.S. economy.

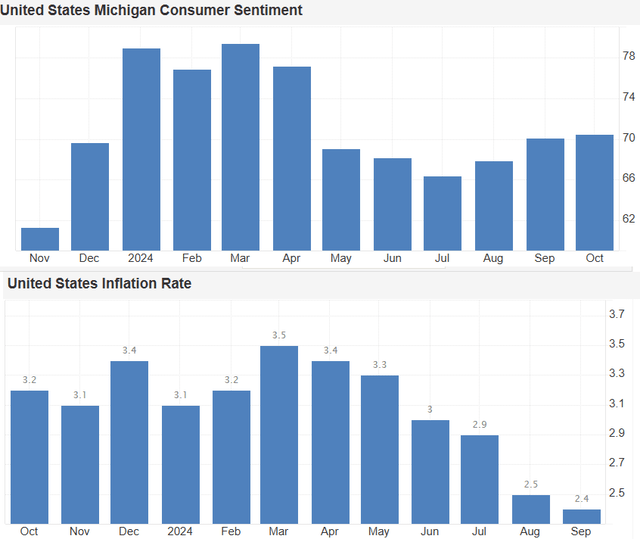

For this matter, consumer spending increased slightly in August and inflation was reduced to 2.4% in September, signifying that Amazon online retail sales could benefit. Also, the Michigan Consumer Sentiment survey below shows an improvement for Q3, in sharp contrast to Q2. Thus, with its wide range of product offerings including Amazon Prime, the giant is well positioned to benefit from Halloween and the holiday season for discretionary spending both in goods and services. Also, more dynamism in the retail business thanks to the 10th Prime Day, the largest ever where epic deals on top brands were proposed, could motivate brands to advertise more using its platform, thereby contributing to its advertising business. Thus, the topline could beat analysts’ consensus estimate of $157.27 billion.

The charts were prepared using data from (Trading Economics)

Shifting to the EPS, the guided operating income for Q3 is expected to be $13.25 billion (mid-point), compared with $11.2 billion generated in the third quarter of 2023, an 18.3% YoY surge. Now, given the 1% software-related productivity gains and 500% ROI generated from GPUs could favorably impact operating income, the company could again beat the $1.14 EPS estimate for Q3.

Finally, I am bullish because while there have been a lot of estimates of productivity gains from various sources, I believe Amazon is the only one to have produced concrete figures as to the potential gains. This reduces operating expenses while, at the same time, it stands to harvest more from leasing GPUs and selling products online in the second half. This ultimately means more revenues spread over a lower cost base, leading to better profitability.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.