Summary:

- Broadcom’s heavy reliance on China amidst rising geopolitical tensions and trade restrictions poses significant long-term risks, making the stock overvalued and a strong sell.

- Unlike peers like ASML, Broadcom is not diversifying away from China, which could lead to severe revenue impacts due to US export controls.

- Despite impressive AI chip innovations, Broadcom’s valuation is unjustified given the regulatory environment, with a forward P/E ratio 46.19% above the sector median.

- Broadcom’s 36% revenue exposure to China is unstable due to fluid regulations, and the company should trade at the sector median P/E ratio, implying a 31.58% downside.

Sundry Photography

Investment Thesis

Broadcom (NASDAQ:AVGO) shares have increased 13.53% since my last write-up, which has run against my previous call for a strong sell due to rising geopolitical risks. In essence, the market now believes the present value of future cash-flows for the chip giant are not higher than they were over the summer when I last wrote on them. I could not disagree more.

Broadcom remains heavily exposed to Asia, where earnings data suggests they derive around 54.6% of their revenue as of the last 3 fiscal quarters. Specifically, the company’s vulnerability in Asia is tied to China and their ongoing geopolitical and trade tensions.

Despite highlighting these risks in my earlier analysis, my fundamental concern is not Broadcom’s reliance on the Chinese market.

My biggest concern is that, unlike other semiconductor companies like ASML (ASML), Broadcom does not appear to be making a serious effort to diversify its revenue streams away from China, which should put them at a valuation disadvantage compared to peers that have started mitigating this risk through geographic diversification.

In essence, I don’t see how the company can keep its current elevated share price and a high forward P/E ratio given their concentration. To me, these valuations numbers imply that investors are overly optimistic about Broadcom, especially in a politically charged environment that is unlikely to favor China.

As the US continues to adopt a tough stance on Chinese tech companies, I think that Broadcom’s reliance on this market is a problem. Their lack of diversification away from it is concerning. I think the stock continues to be overvalued, making shares a strong sell.

Why I’m Doing Follow-Up Coverage

Broadcom’s share price has continued to climb, despite what I see as escalating risks associated with their exposure to China. I understand that many bulls are excited about their new chip partnerships (more on this later), but the increasing geopolitical tensions and trade restrictions mean a lot of this could go away overnight.

Since my last analysis in July, when I warned of potential geopolitical risks, the situation has deteriorated further with new export restrictions on chip companies coming from the United States. These new restrictions are aimed at limiting technology transfers to China to curb the country’s advancements in critical technologies, including semiconductors (therefore helping thwart Xi Jinping’s Made in China 2025 initiative).

The Biden administration’s recent measures, which cover controls on quantum computing and key semiconductor tech, are described as necessary for national security and indicate that the US is preparing to further tighten its grip on technology that could enhance China’s capabilities.

With this, while Broadcom’s peers are also feeling the pinch from these export controls, many are taking proactive steps to mitigate their exposure (I’ll dive into ASMLs approach in a minute).

Broadcom’s continued reliance (and in-fact further investment) in relationships with Chinese connected businesses makes me question the long-term viability of their revenue strategy.

Broadcom’s ongoing engagement with Chinese companies, particularly ByteDance, amid increasing scrutiny from US authorities is concerning, especially as investigations into Taiwan Semiconductor Manufacturing Company (TSM) unfold. The US Commerce Department is probing TSMC for potentially supplying chips to Huawei, which could violate US export controls.

TSMC, however, has publicly asserted their commitment to complying with US regulations.

TSMC ended up kicking out a Chinese chipmaker (Sophgo) from its factories when they found out they were ordering chips that resembled a chip that was banned from exporting to China. The TSMC case-study is an example of the length the Commerce Department is going to enforce their regulations. Broadcom is not immune.

The purpose of this follow-up coverage is to show that while there are plenty of chip companies that are exposed to China, other firms have been diversifying their customer base and seeking alternative markets to mitigate Chinese demand risk.

Broadcom is moving in the opposite direction, however, which now singles them out as a hyper-exposed entity within the semiconductor sector. Their unwillingness to pivot away from China signals weak risk management in my opinion.

Other Chip Companies Are Divesting, Broadcom Remains Exposed

Globally, we are seeing rising geopolitical tensions. Most semiconductor companies are actively reducing their reliance on the Chinese market. We see this trend across the industry, but one particular example is ASML, which recently detailed a plan (as part of their earnings) to decrease their revenue exposure from China to around 20% next year, down from 49% in the first half of 2024. ASML has a heavy concentration in China. They are finding a way to work around export restrictions to increase business elsewhere (and still maintain revenue growth next year).

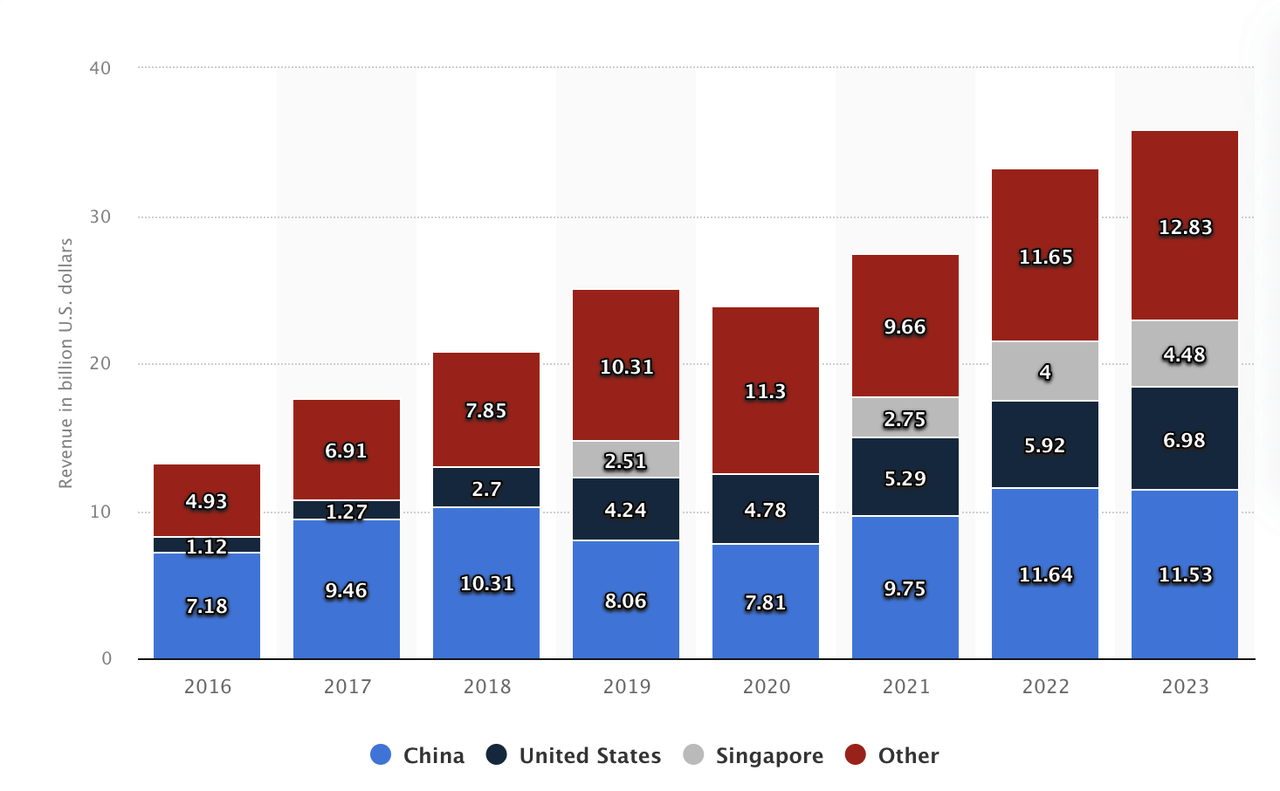

Broadcom’s sales to China over several years show a fluctuating, but large contribution to their overall revenue. In 2023, Broadcom reported approximately $11.5 billion in sales to China, slightly lower than their $11.64 billion record the previous year. Overall, estimates show the company gets roughly 36% of their revenue from China.

Here is why I am most concerned about Broadcom’s revenue in China (compared to other chip companies):

Broadcom offers custom AI chips for major hyperscalers like Google, Microsoft, and Amazon (here in the US) and other players abroad. As these tech giants increasingly invest in AI capabilities, they depend on Broadcom for essential semiconductor solutions that power their cloud services and data centers. These high-end chips become the bedrock for custom LLM training and inferencing. The most advanced AI models will run in data centers. Broadcom chips will play a role for many of them.

My fear (and this appears to be the way the US government is trending) is that as Broadcom builds more advanced chips (both for US and international customers) the odds of Broadcom building chips that get sanctioned increases.

Sure, Broadcom can try to build chips for Chinese customers that don’t run afoul of US export controls. But even as TSMC identified earlier this month, mistakes happen, and good intentioned chip companies build products that end up getting them investigated by the Commerce Department. I think Broadcom faces this same risk. Their deal with ByteDance concerns me the most. I think this deal faces the same Commerce Department enforcement risk.

Valuation

To be clear, I am still overall bullish on the AI revolution. I think there are numerous companies that are going to benefit immensely from this trend (even more than what we are seeing now).

Without these geopolitical challenges, I think Broadcom would be a strong investment opportunity. Unfortunately, the situation between China and the US is unlikely to stabilize in the near future.

Currently, Broadcom’s forward P/E ratio is well above the sector median. Their forward P/E ratio stands at 35.43, which is about 46.19% higher than the sector median of 24.24. Keep in mind, we can buy into a company like ASML which has a forward P/E of 34.51 and decreasing China exposure. From an apples to apples perspective, this does not make sense.

I really don’t think this elevated valuation is justified, especially given the regulatory environment. The company is exposed and could (in one fell swoop) lose a large chunk of their revenue that comes from China.

I think until the company derisks from China, Broadcom should trade at the sector median P/E ratio. This allows the street to price in China risks while also valuing the company well for the other parts of their business that are performing exceptionally.

If we saw shares converge on the sector median P/E ratio, this would represent 31.58% downside.

Bull Thesis

Broadcom’s market position developing custom AI chips helps them find customers that want to move away from Nvidia’s solutions. Just today, as I am writing this, it looks like Broadcom could score a deal with OpenAI to develop custom chips so they can move away from their reliance on Nvidia (NVDA).

Don’t get me wrong, I think Broadcom is a highly innovative company. However, some of these innovations are happening in the wrong places to get them to be geopolitically stable, in my opinion. While deals like the one with OpenAI are a step in the right direction, the company is still likely years from commercializing this specific opportunity.

The irony lies in the more foreign partnerships with geopolitical implications, again its collaboration with ByteDance, which was reported in June, to develop a 5-nanometer application-specific integrated chip (ASIC) and is expected to help ByteDance secure a stable supply of high-end chips. While a source claimed the chipmaker will comply with US regulations and restrictions on China, they are still vulnerable.

Keep in mind, regulations are fluid.

The main aim of these regulations is to reduce China’s access to powerful AI chips. Anything Broadcom and Bytedance (or another Chinese partner) come up with has to be a ‘dumb’ enough chip that the US government doesn’t think it will help China further its AI initiatives.

And that’s the regulations we have today. Most of these chip regulations have emerged in the last 6 years. There is no telling how the regulatory environment will shift under Broadcom’s feet in the next 6 years. All the while, 36% of their revenue is exposed.

What I am trying to say is that 36% of the company’s revenue base is built on ever-changing, fluid rules. This feels unstable (and certainly does not justify a 35x P/E).

Takeaway

Broadcom shares have outperformed, which defied my personal expectations of a strong sell due to geopolitical risks, particularly their exposure to China.

But underneath, the story has not changed (and arguably they are now going against industry trends to divest). The company’s reliance on China still poses significant long-term challenges.

I think other major chip companies (and chip suppliers) are getting the message to divest. Companies like ASML are making the painful move now, for smooth sailing ahead. Broadcom is not doing this.

Broadcom’s product offerings are impressive, and I am bullish on their actual products. However, I am bearish on their current valuation. Given this, I continue to be a strong sell on the custom chipmaker.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM, ASML either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.