Summary:

- Shares of Google parent Alphabet Inc. jumped after management announced robust revenue and earnings results, driven in party by continued improvements in the cloud.

- Big investments in this space should continue to push revenue and profits higher as the rest of the business continues to grow as well.

- Shares aren’t cheap, but they are attractive enough for the quality and growth received to warrant additional upside from here.

hapabapa

October 29th ended up being an excellent day for shareholders of Google parent Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL). Even after seeing the stock rise modestly for the day, shares shot up 5.9% in after-hours trading. This jump was in response to management reporting Q3 revenue and earnings that exceeded analysts’ expectations. The company appears to be incredibly healthy and, through not only the growth of its core operations, but also of its burgeoning Google Cloud unit, the firm appears to be on the way to a bright future.

For some time now, I have been bullish about the business. And so far, that bullishness has paid off. Since I initially rated the company a “buy” back in June 2023, shares are up 41.2%. And that does not factor in the after-hours move higher than the stock experienced on October 29th. By comparison, the S&P 500 (SP500) is up 34.2%. But with a market capitalization now comfortably above $2 trillion, it is a fair question for investors to ask how much more upside exists for shares. The good news, based on recent performance, is that it’s probably enough to continue justifying a “buy” rating.

Big news

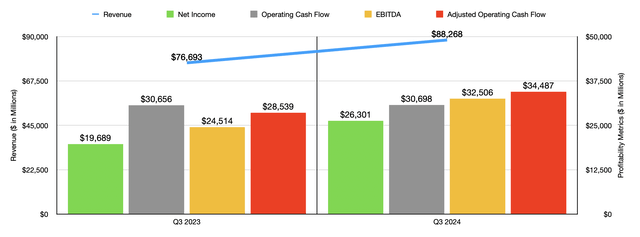

Fundamentally speaking, Alphabet is doing really well at this time. During the third quarter of the company’s 2024 fiscal year, sales came in at a whopping $88.27 billion. That’s an increase of 15.1% compared to the $76.69 billion the business reported one year earlier. It also happens to be $2.05 billion greater than what analysts were anticipating. It’s easy to view Alphabet as a monolith. But the fact of the matter is that it is a collection of large companies and small companies all put together.

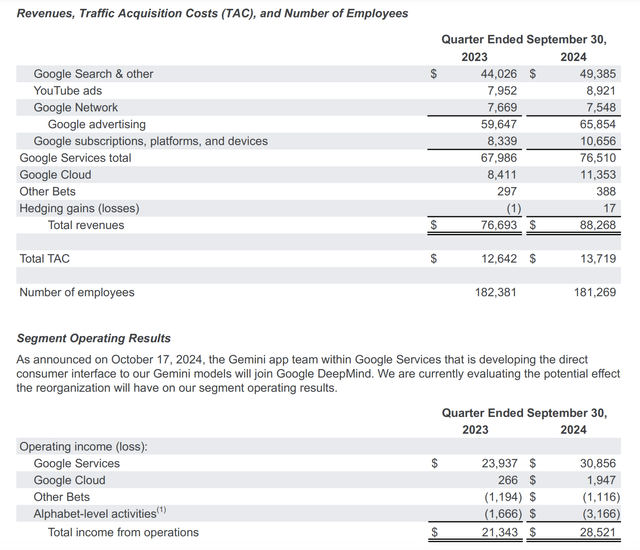

By far, the largest part of the business is its Google Services set of operations. But even this is a collection of other lines of business. The most significant, by far, is the Google Search & other category. Year over year for the third quarter, revenue managed to grow by 12.2% from $44.03 billion to $49.39 billion. However, this wasn’t the only growth area for the enterprise. Advertising revenue associated with YouTube jumped 12.2% from $7.95 billion to $8.92 billion. Google subscriptions, platforms, and devices revenue increased by 27.8% from $8.34 billion to $10.66 billion.

The only weakness of the Google Services unit for the company involved its Google Network. For those not familiar with this, it is the part of the company that includes things like AdMob, AdSense, and Google Ad Manager. From last year to this year, revenue pulled back from $7.67 billion to $7.55 billion.

All of this is great. Well, all of it except for the part that declined. However, since I originally began writing about Alphabet last year, it has been a different part of the company that I have been interested in. And this is the part known as Google Cloud. As you can probably guess, this is the company’s cloud computing business. And it is an industry that I have followed for a little while now, not only in relation to Alphabet, but also in relation to its larger competitors Microsoft Corporation (MSFT) and Amazon.com, Inc. (AMZN).

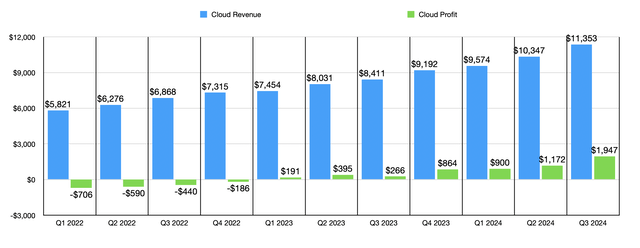

For years, Google Cloud was growing at a nice pace. However, it continued to generate significant operating losses. From 2020 to 2023, this part of the company grew its revenue from $13.06 billion to $33.09 billion. And in 2023, for the first time ever, it achieved an operating profit for the year. That profit was $1.72 billion. In the grand scheme of things, this is a small piece of what makes Alphabet the behemoth it is today. However, that profitability marked a massive improvement from the $5.61 billion loss the segment generated back in 2020.

This year, the picture continues to get better. Revenue in the latest quarter totaled $11.35 billion. That happens to be 35% above the $8.41 billion generated at the same time one year earlier. While Google Services grew as a result of increased traffic, greater subscriptions, more devices sold, and a robust advertising environment, the growth associated with Google Cloud came from increased investments by the firm’s customers in things like AI. The fact of the matter is that the AI space is fueling demand for the cloud computing industry. And that has encouraged Alphabet to continue investing in infrastructure within this space. The same thing holds true of investments being made by the company in various solutions aimed at catering to customers in the AI market.

The dollar amounts being spent in this space are staggering. Global AI investment for the current year is estimated to be around $235 billion. And by 2028, it’s expected to rise to $631 billion. Overall spending in areas like software and Information Services, banking, and retail, can only be described as massive. Those industries, collectively, should see spending of $89.6 billion this year. And over the next five years that spending should grow at an annualized rate of 27%, taking total spending per annum up to $222 billion by the end of that window of time.

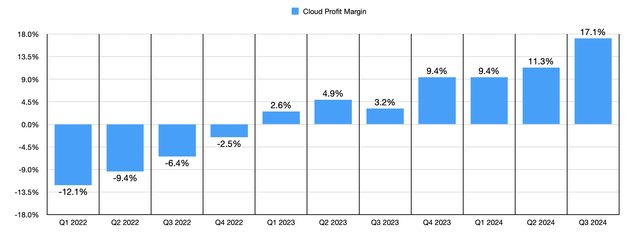

This rise in revenue has brought with it a surge in profitability. In the third quarter of 2023, the Google Cloud unit reported profits of $266 million. But for the third quarter of this year, that figure was $1.95 billion. As illustrated by the chart below, the profit margin for this segment has been improving pretty consistently, turning from negative territory to consistently positive territory. And as this industry continues to grow, it is all but certain that this trend will continue.

Speaking of profitability, for the quarter, Alphabet did quite well. Net profits came in at $26.30 billion. That happens to be 33.6% above the $19.69 billion the business reported one year earlier. This translated to an increase in earnings per share from $1.55 to $2.12. For this year, the earnings per share generated by the company ended up being $0.27 greater than what analysts were anticipating. This is the equivalent of an additional $3.35 billion on the bottom line. No wonder shares are rising by so much.

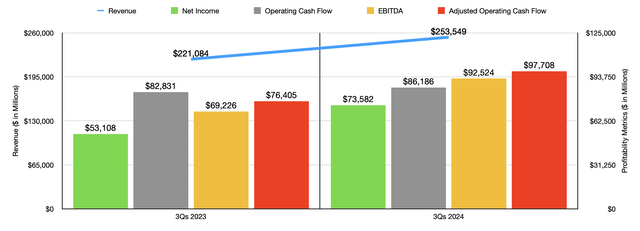

Other profitability metrics for the company have also improved. The most stubborn was operating cash flow, which inched up barely from $30.66 billion to $30.70 billion. But if we adjust for changes in working capital, we get a year-over-year increase of 20.8%, taking the metric from $28.54 billion to $34.49 billion. And finally, EBITDA for the company grew from $24.51 billion to $32.51 billion. In the chart above, you can also see financial results for the first nine months of this year compared to the same time in 2023. As was the case for the third quarter of this year relative to the same time last year, the first nine months of this year saw drastically improved revenue, profits, and cash flows, compared to the same window of time of the 2023 fiscal year.

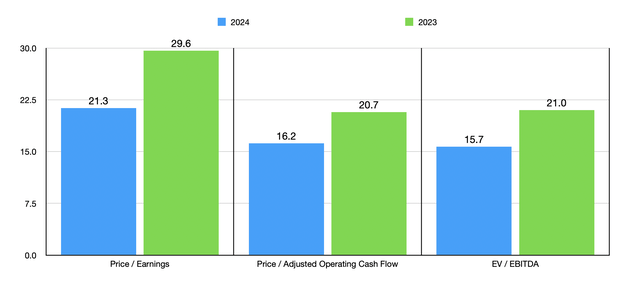

With all major aspects of Alphabet growing nicely and the drastic improvements in profitability associated with its cloud computing business unlikely to reverse the trend, the picture is definitely looking up for shareholders. But the big question is what kind of multiple investors are paying for this kind of quality and growth. If we assume that its profitability metrics will continue to improve at the rate that they have on a year-over-year basis, we should anticipate net profits for this year of $102.24 billion. Adjusted operating cash flow would be around $135.03 billion, while EBITDA would come in at $133.89 billion.

In the chart above, you can see what this means for the online giant from a valuation perspective. Using the forward estimates for 2024, we can see that shares are quite a bit cheaper than if we were to use the figures from 2023. Now, normally, you would still expect a high-quality industry leader that generates a lot of cash to trade at rather lofty multiples. This is especially true when talking about a business that’s growing rapidly and that should continue to expand for the foreseeable future. However, the multiples demonstrated in that chart are in line with what I would consider to be a fairly valued business. When you add on top of this the quality that we are referring to, I would say that this still makes Alphabet undervalued.

Furthermore, compared to similar firms, shares are also trading on the cheap, as the table below illustrates. In that case, only one of the five companies I compared Alphabet to ended up being cheaper than it was when using each of the three valuation metrics.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| Alphabet Inc. | 21.3 | 16.2 | 15.7 |

| Meta Platforms, Inc. (META) | 30.5 | 20.0 | 19.8 |

| Microsoft Corporation | 37.0 | 27.5 | 24.0 |

| Baidu, Inc. (BIDU) | 12.1 | 6.7 | 6.6 |

| Oracle Corporation (ORCL) | 45.2 | 26.0 | 25.1 |

| ServiceNow, Inc. (NOW) | 148.5 | 46.8 | 87.3 |

Another great thing about the enterprise is that it has a fortress balance sheet. The business has $93.23 billion of cash and cash equivalents on its books and only $12.30 billion worth of debt. This gives us a net cash position of $80.93 billion. And this is not factoring in another $36.18 billion that the business has in the form of long-term investment securities. What’s really impressive about this is that the company has all of this cash, even after factoring in share buybacks that it has engaged in. During the most recent quarter, the company allocated $15.29 billion to repurchasing stock. This was on top of $2.46 billion paid out in the form of dividends. For the first nine months of this year, share buybacks have been a whopping $46.67 billion, while dividends have totaled $4.92 billion.

Takeaway

No matter how you stack it, the third quarter of the 2024 fiscal year was a great time for Alphabet and its investors. The company is performing exceptionally well, more or less across the board. Or at least, it’s performing well where it matters most. The continued growth in the cloud computing business and the improvement in profits associated with it are definitely encouraging. When you add on top of this how the stock is currently priced, it’s not difficult for me to justify a “buy” rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.