Summary:

- Alphabet Inc. aka Google reported impressive 3Q 2024 earnings with 15% revenue growth and a 4% increase in operating margin, leading to strong net income growth.

- Waymo’s robotaxi business is rapidly scaling, with the potential to generate $1 billion in revenue by 2025 and significant long-term profitability.

- Google’s diverse segments, including Google Cloud and YouTube, continue to drive growth and efficiency, positioning it to outperform its peers.

- Shareholder returns are bolstered by strong cash flow, minor dividends, and the potential for increased share buybacks, enhancing Google’s valuation.

JasonDoiy

Alphabet Inc. aka Google (NASDAQ:GOOGL) (NASDAQ:GOOG) announced incredibly impressive Q3 earnings as the company is one of the fastest growing FAANG members. We discussed pre-earnings, just a few weeks ago, how the company has continued growth potential. The company has continued to achieve incredibly impressive numbers with Waymo and continued its growth.

As we’ll see throughout this article, that will make the company the most valuable company in the world.

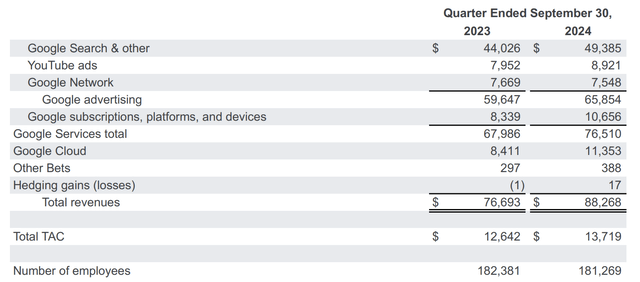

Google Q3 Results

The company had incredibly strong Q3 2024 results, accelerating growth from 2023.

Revenue managed to grow by 15% to more than $300 billion annualized, and the company managed a very impressive 4% growth in operating margin. That led to net income crossing the $100 billion annualized level, putting the company at a P/E of ~22x based on its share price. That incredibly rapid growth is impressive.

Google managing to accelerate both revenue growth and margins enabled incredibly strong net income growth. The company has a large share buyback program, we expect it to ramp up.

Google Segment Results

On a segment by segment basis, Google has continued to perform incredibly well.

The company has continued to build efficiency in its employee count and managed to receive YoY improvement with a ~1K reduction in employee count. The company’s Google Search business continues to be its core, while YouTube has continued its impressive growth along with Google Cloud. For the past several years, Google Cloud has been the fastest growing of the big 3.

While Google Services continues to drive the lion share of profits, Google Cloud earned almost $2 billion in income for the quarter, versus $275 million a year ago. The company’s more than $28 billion in net income for the quarter came with some one-time setbacks such as office space charges as the company has continued its growth.

The company’s strength in all segments will form a strong basis for it outperforming its peers in upcoming years.

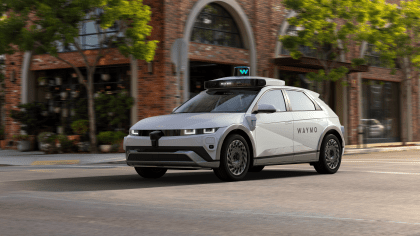

The Real Robotaxi

Waymo announced that its paid taxi service is doing 150k trips per week at 1 million miles per week. At a cost of just under $12 / mile average (keep in mind these are dense cities with slower trips) that works out to ~$150 million / quarter in revenue from the company’s robotaxi business. The company has been designing its infrastructure from the ground up as it rolls out V6.

Waymo and Hyundai enter multi-year, strategic partnership

There are some important things to note. The first is that Waymo is successfully being trusted to do trips for customers, completely autonomously, with no major issues yet. The second is that it’s ramping up. In August, the company passed 100k trips per week, implying a 50% ramp in just a few short months. This is with an estimated 700 cars on the road.

Tesla is still earning $0 from its robotaxi and was forced to delay its event, before following up with an event that many felt was disappointing. The company originally promised 1 million vehicles on the road by 2020. Unlike Waymo, Tesla still has no robotaxis operating.

More importantly, Tesla is still stuck on Level 2 automation, which some experts argue is due to a lack of Lidar, despite the continued reduction in the costs of the sensors. Waymo is at Level 5. With Lidar costs <$10K estimated (Waymo doesn’t share true costs) and the company’s 700 robotaxis averaging at $17K / week in revenue, we see the costs as more than manageable.

Here’s the takeaway. Waymo just raised $5.6 billion in its largest ever funding round. The company’s vehicles are doing fantastic (your author has loved them in San Francisco) and estimated valuations are at $175 billion. Our view is that Waymo could conceivably cross $1 billion in revenue in 2025 and quickly become profitable.

We expect Waymo to quickly take over the market that Tesla wanted too as the company can scale much quicker, build its reputation for safety, and actually deliver on time. Is it tedious to scale? Yes. Do they scale slowly in certain cities? Also yes. However, they have raised capital, signed a new deal with Hyundai (OTCPK:HYMTF), and are operating a robotaxi service successfully.

We see this platform being worth hundreds of billions if not more, and as Waymo solves legal and logistical scaling challenges ahead of Tesla, to actually operating the vehicles, it presents a substantial moat.

Calculating value is tough for a scaling business, but ride hailing vehicles in San Francisco are driving ~4 million miles per week. Waymo has ~300 / 700 vehicles in San Francisco, implying it is driving ~64 thousand miles / week in SF with a 1.5% market share. In Los Angeles, weekly miles driven are more like 7 million by ride-share drivers.

We will make the following assumptions.

- Waymo reduces price per mile by 50% to out compete ride-share long-term ($6 / mile).

- Waymo captures a 50% market share in San Francisco and Los Angeles.

- Waymo costs ~$2 / mile to operate counting all vehicle capital costs.

Putting that together, that implies Waymo driving ~5.5 million miles per week and earning $1.1 billion in annual profit. Given its growth rate (~50% in 3 months) we can see the company scaling to hit this level (150K -> 1 million trips / week) in the next 2 years. From there, we expect the company to move towards higher opportunity cities.

Total ride-share trips in the U.S. are 12 billion miles / year, and Waymo reducing its costs to <$1 / mile in Goldman’s 2030 forecast, with Waymo capturing a 50% market share, could imply $30 billion in annual profit. That’s a business that at Google’s current valuation could be worth >$800 billion.

Waymo’s current growth rate of 5x / year implies it could hit 6 billion miles / year in a mere 5-years by 2029. Given the company’s $1 trillion valuation gap versus its peers, that could make it the largest company in the world.

Google Shareholder Returns

At the end of the day, cash flow and shareholder returns are what’s important.

Google has a minor dividend of .7% so what we’d like to see, especially as the company grows, is shareholder buybacks. The company recently announced its first-ever buyback at $70 billion, and we’d like to see this pace ramped up towards $100 billion annually. That will enable the company, in tangent with its business growth and overall market growth, to see rapid share price growth.

The newfound commitments to efficiency and shareholder returns while growing rapidly show Google’s strengths.

Thesis Risk

The largest risk to our thesis is two-fold. First, many companies are investing in self-driving, such as General Motors’ (GM) Cruise, which was running autonomous taxis in SF but slowed down after an accident. Any of these companies ramping up, including Tesla (TSLA), could hurt Waymo’s market share and therefore Alphabet’s future valuation.

Conclusion

Google just had some fantastic earnings and the market clearly seems to agree after-hours. The company is continuing to throw off massive cash flow, and driving shareholder returns it can comfortably afford, and the company is one of the fastest growing large companies in the world. YouTube is re-surging, and growth is strong in all segments.

At the same time, Waymo is the jewel in the crown. It’s growing at a 5x annualized basis and has no competitors. We expect revenue to grow quickly and margins to be high, and the valuation is likely already >$100 billion. Its continued growth will add hundreds of billions if not more to Google’s valuation, making it very valuable.

Please let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.