Summary:

- After a blowout Q3, Wall Street’s current earnings estimates for Google are likely too low and will be revised higher, driven by the company’s success in cloud computing.

- Google’s earnings quality and growth are superior to peers, making its lower valuation compared to Apple and other tech giants increasingly unjustified. This presents a buying opportunity.

- GOOGL deserves to be a more popular stock than it is.

- Updated earnings estimates and price targets for GOOG.

Justin Sullivan/Getty Images News

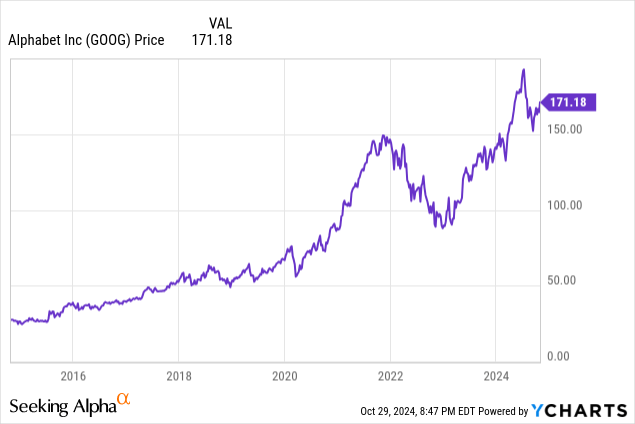

For whatever reason, Wall Street just doesn’t like Google (NASDAQ:GOOG). But the company is proving the doubters wrong. Q3 GAAP EPS came in at $2.12 per share, vs. expectations of $1.85 per share. Google beat on revenue as well, with particular strength coming from its cloud computing segment. Despite this, Google trades for 19.3x 2025 earnings, far less than even the S&P 500 or popular stocks like Costco (COST) or Chipotle (CMG). This isn’t justified. Analyst estimates for Google’s future earnings growth are far above the S&P 500, while the valuation is far below. This is a gift to patient investors and an opportunity you can take advantage of.

Google Crushes Q3 Earnings Estimates

Wall Street analysts currently expect $7.66 in earnings for 2024, $8.70 in earnings for 2025, and $9.98 for 2026. But after Google’s huge beat in Q3, they’re now going to need to revise these earnings estimates higher. My guess is that 2025 earnings will be closer to $10 and 2026 will be closer to $11. Tech companies are well-known for sandbagging on earnings guidance, but Google has seen some real outperformance in their underlying business. I’m particularly interested in Google’s ability to compete in the cloud computing market. For years, Amazon (AMZN) and Microsoft (MSFT) have earned oligopoly profits in cloud computing, but Google’s mountain of cash and scale has allowed them to break through and start to grab market share. Google’s cloud revenue grew 35% year-over-year. Quarterly operating income from cloud roughly tripled. Margins also improved, and the company noted that the cost per AI query has decreased by 90% over the past 18 months. These were all covered in detail in Google’s quarterly earnings conference call.

One of the most telling things about Google is that the company actually reported its GAAP earnings – this is something you rarely if ever see from tech companies! Not only do other Big Tech companies trade for much higher multiples than Google, but their earnings are far lower quality (i.e. overstated by a circus of “one-time” expenses).

Google’s earnings estimates will soon be revised up, and Google should trade higher accordingly. By year-end 2025, Google should be worth $220 (20x P/E) to $253 (23x P/E). It’s always a bit of alchemy to estimate what a business is worth in the stock market. However, if Google’s business grows by 40% over the next 3 years, then that’s the starting point for how much the share price should increase.

Why Isn’t Google A More Popular Stock?

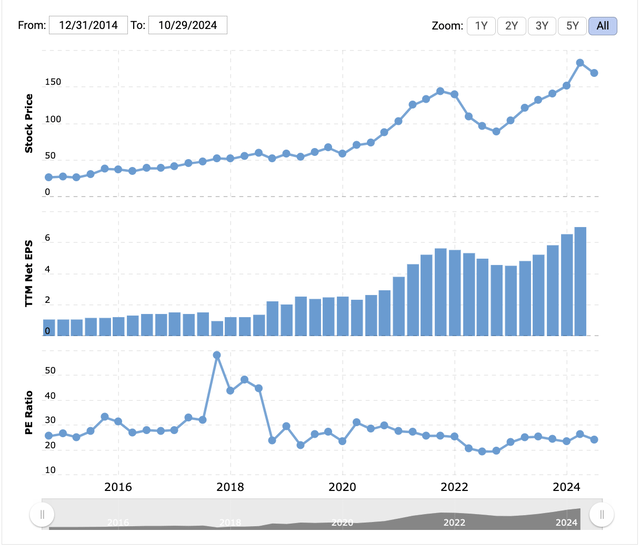

A fun exercise to do with tech stocks is to compare share prices vs. earnings over time. The point of this is that you can see whether huge stock gains are driven by the underlying business, or if investors are paying higher and higher multiples for the same dollar of earnings. For this analysis, I’m using Macrotrends.

For Google, we can see that earnings are driving the bus – not investor enthusiasm. Google trades for roughly the same valuation as it did 10 years ago. Note that these graphs refer to previous year’s earnings, while my price targets are always based on future earnings. However, past TTM P/E data is much easier to get and compare, so that’s what I’m using to compare here.

Google Earnings Vs. Share Price (Macrotrends)

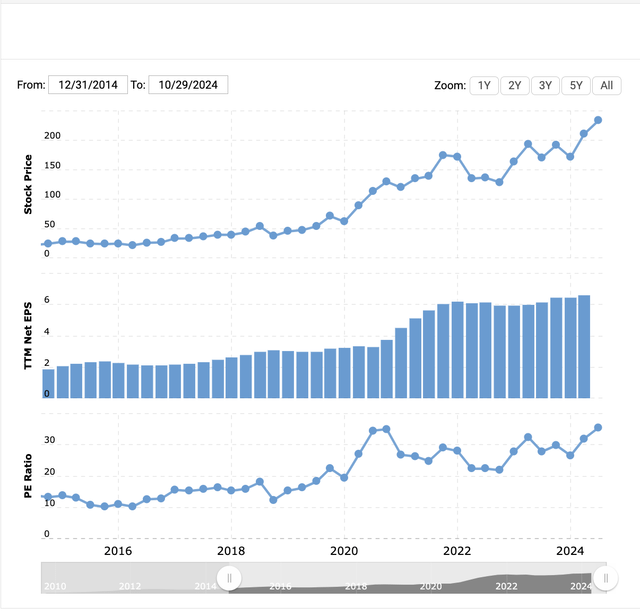

Now we do the same exercise for Apple (AAPL), and we can see that while earnings have tripled, the stock is up over 10x! Therefore, Apple has risen from a P/E ratio of around 10 to a P/E of 35. I’ve argued that this is almost certainly why Warren Buffett is selling Apple.

Apple Earnings Vs. Share Price (Macrotrends)

As it stands, you can get Google shares for a 40% cheaper valuation than Apple shares. This makes no sense to me. Notably, the income of the two companies is closely related because of the Safari default search deal. Neither company has any real alternative to using the other, their headquarters are about 20 minutes apart, and the companies have a tangled web of personal and professional ties. In a way, you’re buying much of the same revenue, so you might as well buy Google for far cheaper.

Wall Street doesn’t really see it this way – it wasn’t long ago that the Twitterati thought ChatGPT would quickly replace Google. Google stock even briefly crashed in 2023 after a poorly done AI product demonstration. But Wall Street also thought Apple should trade for 10x earnings in the 2010s when the Apple stores were obviously, persistently busy and everyone had to have the latest iPhones.

Theoretically, super successful companies will often trade at a discount to fair value (e.g. the disposition effect) because the stocks go up so much that shareholders start selling for personal reasons and diversification. I think this explains what happened with Apple in the 2010s and what is happening with Google now. My pet theory is that in 2019 the discount brokers all cut commissions to zero and asset pricing started to go haywire from retail/recreational investors. COVID accelerated this, and the public is now the longest on stocks that they’ve ever been, even more than the dot-com bubble. This has happened in the past, and it has always corrected in a few years. It will be corrected again, and the people who YOLO all their money into the same few names will get crushed. Everyone piled into the same 20-30 stocks and their valuations don’t make much sense.

There is also the theory that Google will be crushed by antitrust regulators, but with the odds of a Trump victory hovering from 60-67% on various offshore betting markets, I don’t think Lina Khan and the antitrust brigade will get another 4 years to attack Google. Even if so, I don’t think they would win anyway, given that Google isn’t an artificial monopoly. And is Google uniquely vulnerable to antitrust in ways that Meta (META), Apple, and Amazon aren’t? Again, I don’t think antitrust issues justify the valuation spread between Google and its peers, or the market at large. If anything, Google’s competition in the cloud computing sector is helping create competition where there previously wasn’t.

Should You Buy GOOG or GOOGL?

I’ll add an obligatory note on Google’s share classes. Class C stock is GOOG, and class A stock is GOOGL. They represent the same claim on Google’s underlying cash flow. GOOG trades for $171.14 as of my writing this, while GOOGL trades for $169.68. The decision here is easy – buy class A (NASDAQ:GOOGL) as it’s cheaper. Going forward, the company’s buybacks and dividends should eventually ease the gap between these two, and Google’s ability to buy back the cheaper Class A stock helps create a bit of value for holders as well. You also get the same dividend for a bit cheaper. Google’s dividend yield is currently only about 0.5%, but I expect the dividend to see some substantial raises in the coming years.

Bottom Line

Despite year after year of business success. Google is not on the short list of stocks that retail investors like to pile into. Google still trades for a lower valuation than the market at large despite having superior earnings growth to the market. After a blowout Q3, analysts will soon need to re-rate Google’s earnings prospects, creating more upside in the stock. For these reasons, Google is the best buy in Big Tech.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.