Summary:

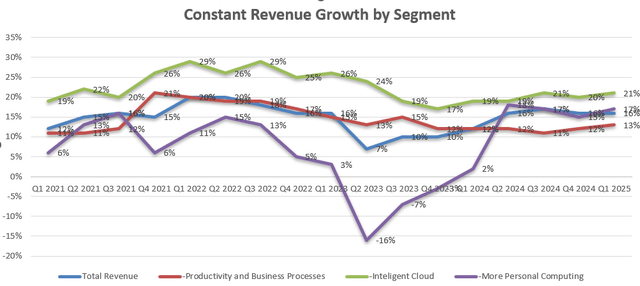

- Microsoft Corporation delivered a strong Q1 result with 21% constant revenue growth in its cloud business.

- Microsoft is well positioned to capture market growth opportunity in cloud and AI, thanks to their substantial investments. I think Microsoft will continue delivering double-digit revenue and earning growth in.

- Satya Nadella’s recent annual letter highlights Microsoft’s ongoing investment in cybersecurity across their platforms, embedding AI into their existing platforms and actively managing their cost structure.

- I reiterate my “Strong Buy” rating for MSFT, with a one-year target price of $550 per share.

Jean-Luc Ichard

In my previous “Strong Buy” thesis for Microsoft Corporation (NASDAQ:MSFT) stock in July 2024, I discussed its strong growth in their cloud business. Microsoft now has delivered a strong Q1 result with 21% constant revenue growth in its cloud business. I believe their cloud business will sustain 20%+ revenue growth in the near future, driven by AI, cybersecurity and data analytics.

CEO Satya Nadella’s recent annual letter highlights Microsoft’s ongoing investment in cybersecurity across their platforms, embedding AI into their existing platforms and actively managing their cost structure. I reiterate my “Strong Buy” rating with a one-year target price of $550 per share.

Satya Nadella’s Annual Letter

Satya Nadella published his annual letter on October 24th and key takeaway can be summarized as follows:

- Microsoft will prioritize cybersecurity in FY25, further building on Microsoft Secure Future Initiative (SFI) launched in 2023. Microsoft offers a comprehensive cybersecurity solutions to protect identities, network, and public & hybrid clouds. The strategic focus on cybersecurity is mission-critical to supporting Microsoft’s cloud infrastructure and their Office 365 platform.

- Microsoft will continue embedding AI features across their key platforms. Over the past years, Microsoft has built three leading platforms — Copilot, Copilot stack and a new category of Copilot devices. In October 2024, Microsoft introduced their new agent capabilities to create autonomous agents with Copilot Studio, which will be in public review in November 2024. I believe these investments will enable Microsoft to leverage their AI technology to enhance their existing software platform and cloud infrastructure.

- Lastly, Satya Nadella emphasized that Microsoft would continue to manage their cost structure to generate durable profitability and long-term operating leverage.

Q1 and Outlook

Microsoft released its Q1 FY25 result on October 30th after the market close, delivering 16% constant revenue growth and 14% adjusted operating profit growth, with Intelligent Cloud growing by 21% year-over-year.

My key takeaway from the quarter is the strong growth momentum in its cloud business, fueled by rising AI demands. Microsoft has invested heavily in AI-related technology, including their $14 billion equity investment in OpenAI, development of Azure Maia AI chip and Azure Cobalt CPU, as well as software solutions.

All major hyperscalers, including Microsoft, Amazon (AMZN) and Alphabet (GOOG) (GOOGL), have been growing at 20%+ recently; therefore, I continue to forecast Microsoft will grow its cloud revenue by 20% in the near future. As indicated in my previous article, Microsoft offers the best technology for hybrid cloud environment, with strengths spanning Office 365, CRM, operating systems, virtual machines, cybersecurity, and data analytics.

Office 365 has gained strong growth momentum in recent quarters, driven by ARPU growth through E5 offerings. I continue to forecast the Productivity and Business Processes segment will grow by 12% annually.

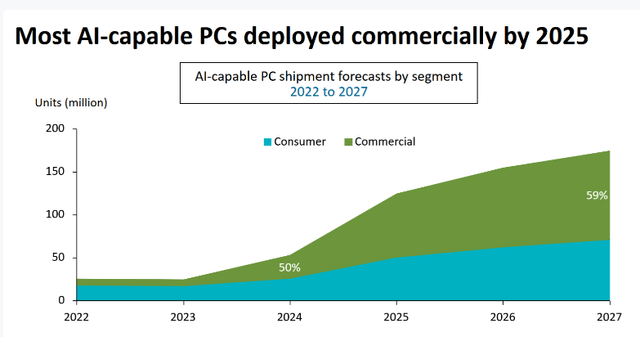

For the long term, the More Personal Computing segment should grow in line with the overall PC market. When AI enters the inference stage, AI-capable PCs will become mainstream, which could drive Microsoft’s More Personal Computing segment growth. Canalys predicts that AI-capable PC shipments will rise from 19% market share in 2024 to 60% by 2027, with a strong focus on the commercial sector. As such, I anticipate the More Personal Computing segment will grow by 6% annually.

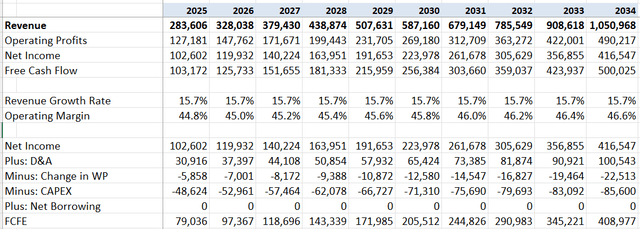

Putting together, I forecast Microsoft will grow its revenue by 14% organically in the near future. I continue to project the company will allocate 6% of total revenue towards M&A, leading to 1% additional revenue growth. I model 30bps margin expansion driven by 10bps from gross profits and 20bps from reduced R&D and SG&A spendings. As discussed previously, Microsoft is focusing on cost management and business optimization, which will lead to margin expansion over time.

I have revised the cost of equity to 11.4% assuming: risk-free rate 3.6%; beta 1.12; equity risk premium 7%. I calculate the free cash flow from equity (FCFE) as follows:

The cost of equity is adjusted to be 11.6% assuming: risk-free rate 3.6%; beta 1.1; equity risk premium 7%. Discounting all the future FCFE, the one-year price target is estimated to be $550 per share.

Key Risks

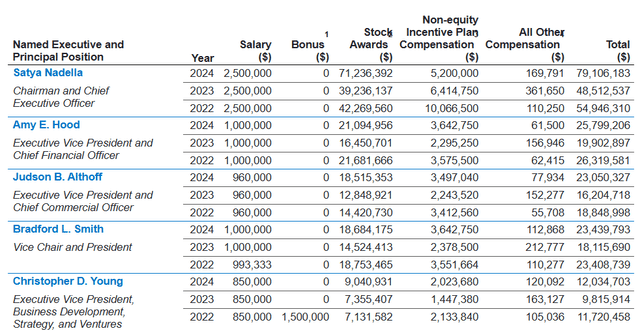

According to Microsoft’s SEC filing on October 24th, Satya Nadella will receive $79 million in total compensation in 2024, approximately 65% higher than in 2023. His stock awards increased from $39.2 million in 2023 to $71.2 million in 2024. The significant increase in executive compensations could potentially impact shareholder interests.

End Notes

Microsoft is well positioned to capture market growth opportunity in cloud and AI, thanks to their substantial investments. I think Microsoft Corporation will continue delivering double-digit revenue and earnings growth in the near future. I reiterate my “Strong Buy” rating with a one-year target price of $550 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.