Summary:

- Texas Instruments reported good earnings last week, showing signs of an inflection.

- The company portrayed why its profitability metrics might be misleading at this point: There’s a lot of operating leverage in the model.

- China was a highlight and should serve to tame fears around Texas Instruments’ competitiveness in the country.

Monty Rakusen

Introduction

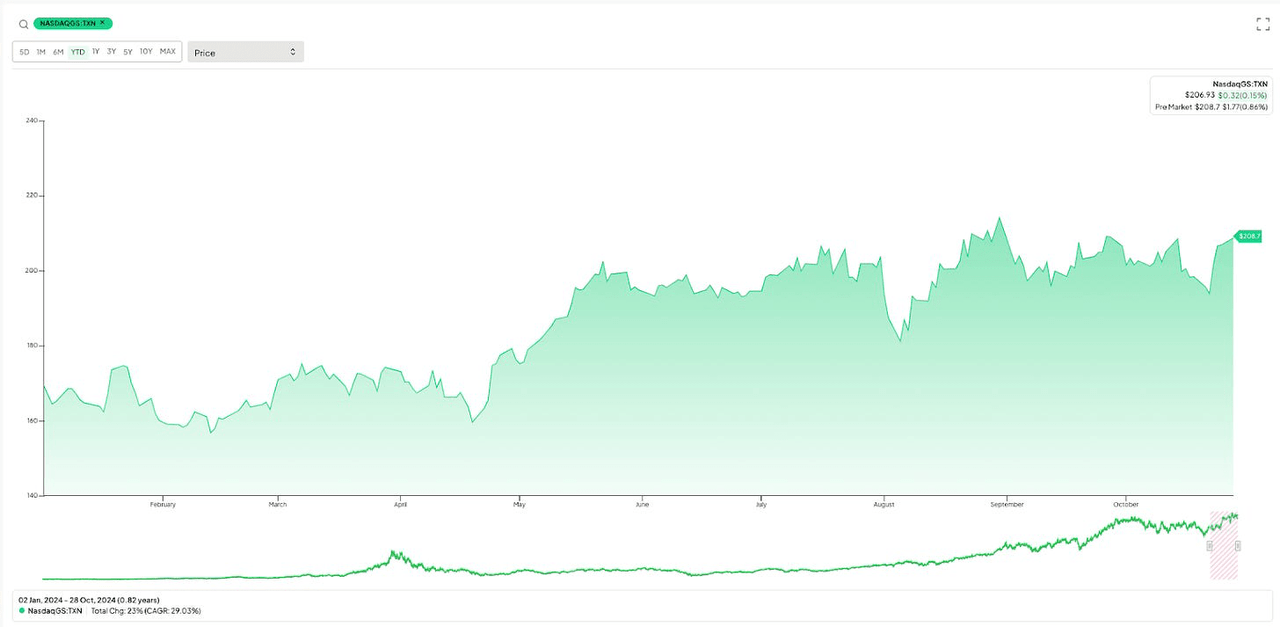

Texas Instruments (NASDAQ:TXN) reported earnings last week, and even though not much of the thesis has changed, I thought it would be a good idea to provide a short commentary. The market took these earnings well and the stock reacted quite positively. The stock is now hovering around all-time highs:

Finchat.io

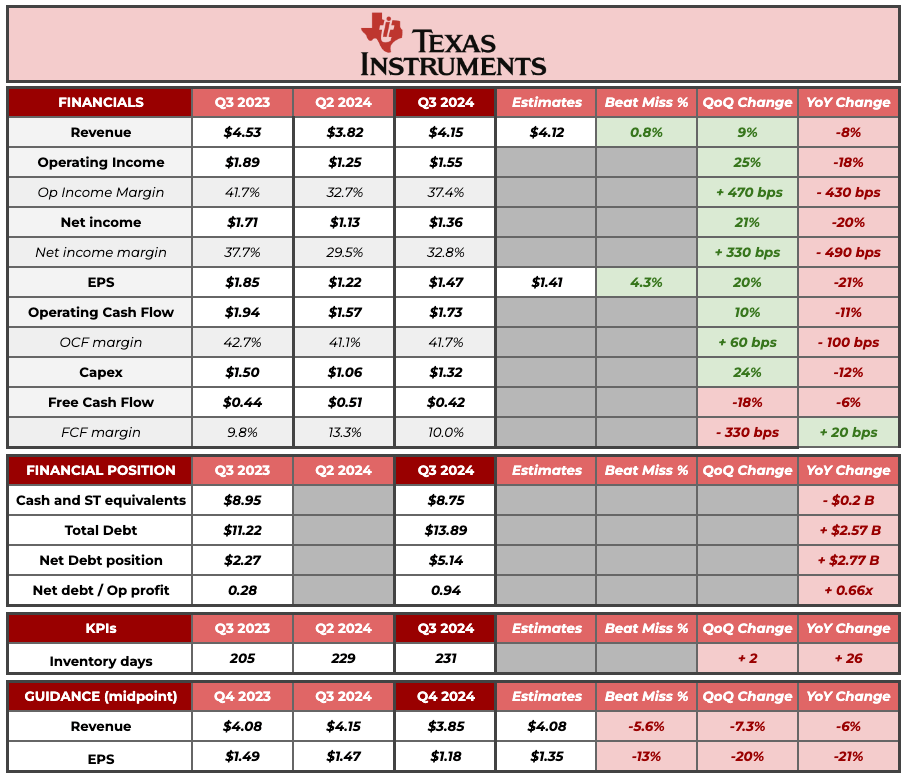

As discussed, nothing was thesis-changing in the results, but there were some interesting highlights. Before jumping directly into these, let me share the company’s summary table. Here it is (for Texas Instruments, I tend to include both the YoY and quarter over quarter performance to get a better idea of where the company is in the cycle):

Made by Best Anchor Stocks

The first thing I’d like to comment on is the current state of the semiconductor cycle. Texas Instruments has been undergoing a semiconductor downcycle for some time, but the cycle might be nearing its inflection point (I will not be the one who calls it).

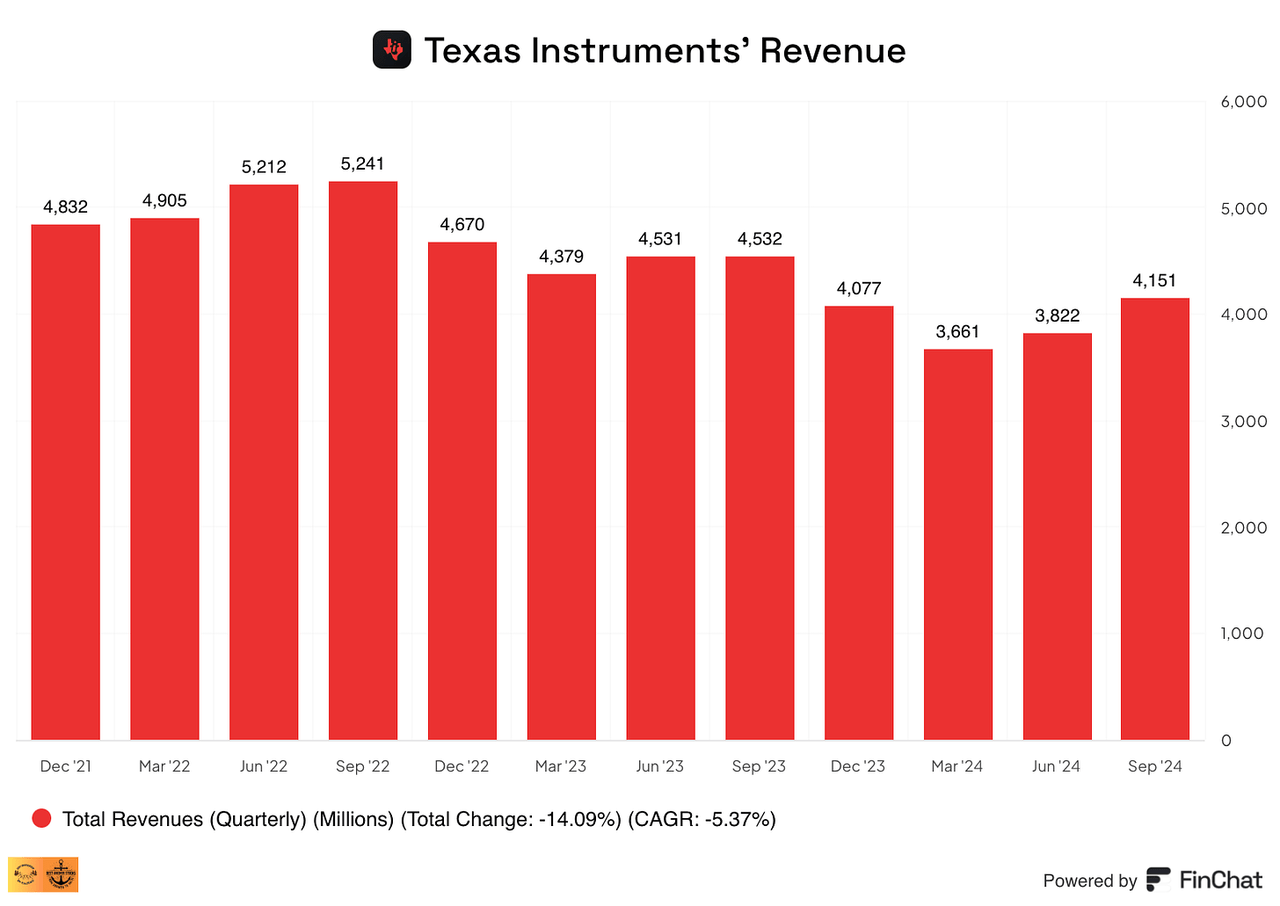

Revenue has been improving throughout the year, but this shouldn’t surprise anyone, considering the inherent seasonality of the business. The company’s revenue chart looks like a descending ladder where revenue increases throughout the year only to fall in Q4 and start at a lower level the following year (what one would expect in a downturn). This has been the case for the past couple of years, but I don’t anticipate it will be the case forever as Texas Instruments is exposed to secular growth markets:

Finchat.io

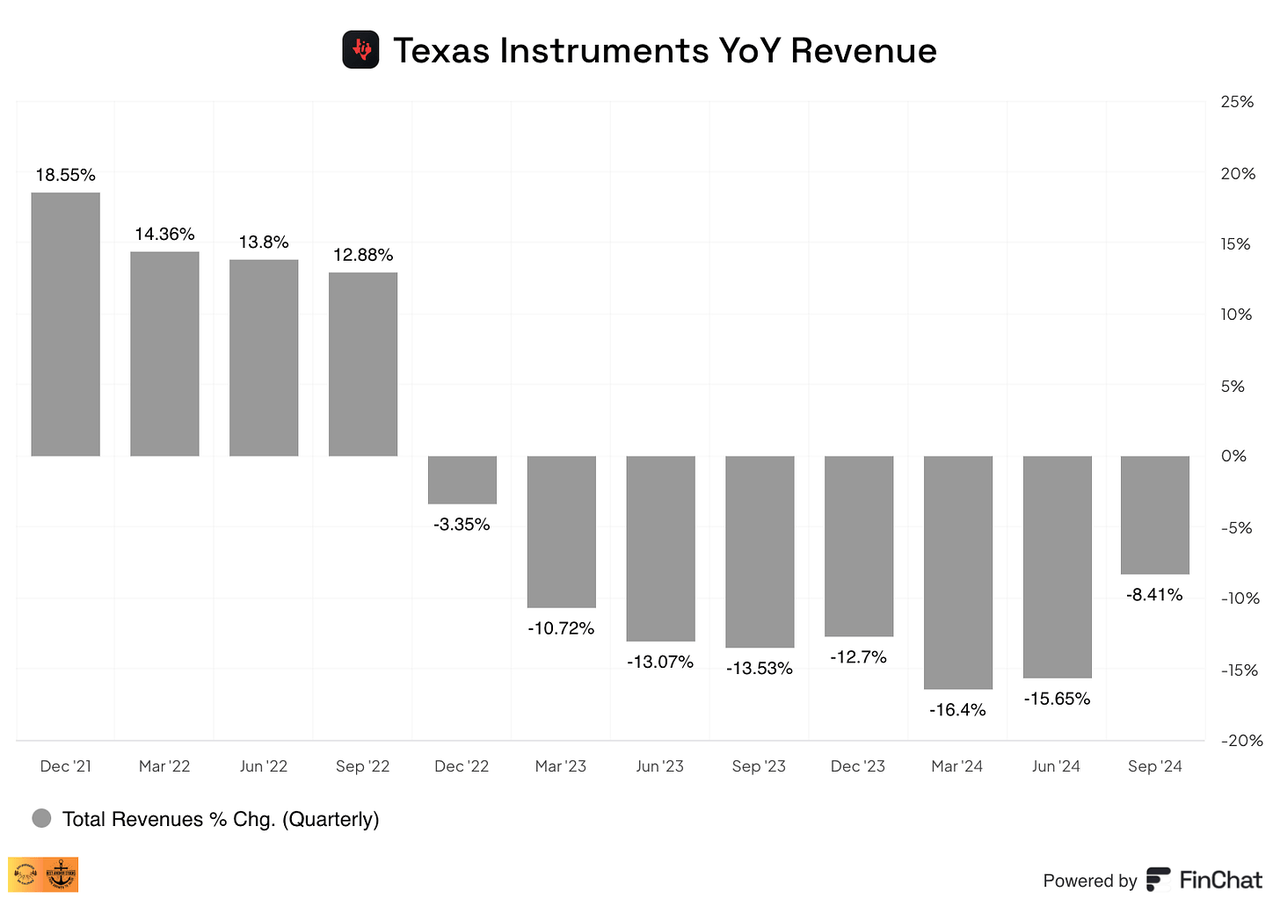

Despite the ongoing revenue downtrend, there are several positive takeaways. This year’s Q3 sequential increase (+9% QoQ) was the most significant in a while, and the expected drop from Q3 to Q4 (-7% QoQ) is also the smallest of the past three years, so things do seem to be improving despite the seasonality. Year-over-year revenue growth rates are also starting to moderate, albeit still remain negative. The graph below shows that the worst part of the cycle might already be behind us:

Finchat.io

Throughout this period, management has shared that it was a “special” cycle due to its asynchronous nature. Automotive and industrial remained strong while the other end markets were doing poorly, something that has somewhat flipped on its head now: Most segments are recovering while industrial and automotive remain weak (baring China):

First, the industrial market was down low single digits as customers continue to reduce their inventory levels. The automotive market increased upper single digit primarily due to strength in China. Personal Electronics grew about 30%, Enterprise Systems was up about 20%, and Communication Equipment was up about 25% as the cyclical recovery continued in these three markets.

This portrays how violent the recovery can be from the bottom once a given end market starts to turn. Management also mentioned that they believe to be close to the bottom in industrial and that automotive should not suffer such a violent cycle as industrial:

I don’t think the peak to through on the automotive market is going to be as pronounced as industrial simply because the secular growth over there, I believe is stronger in the short term.

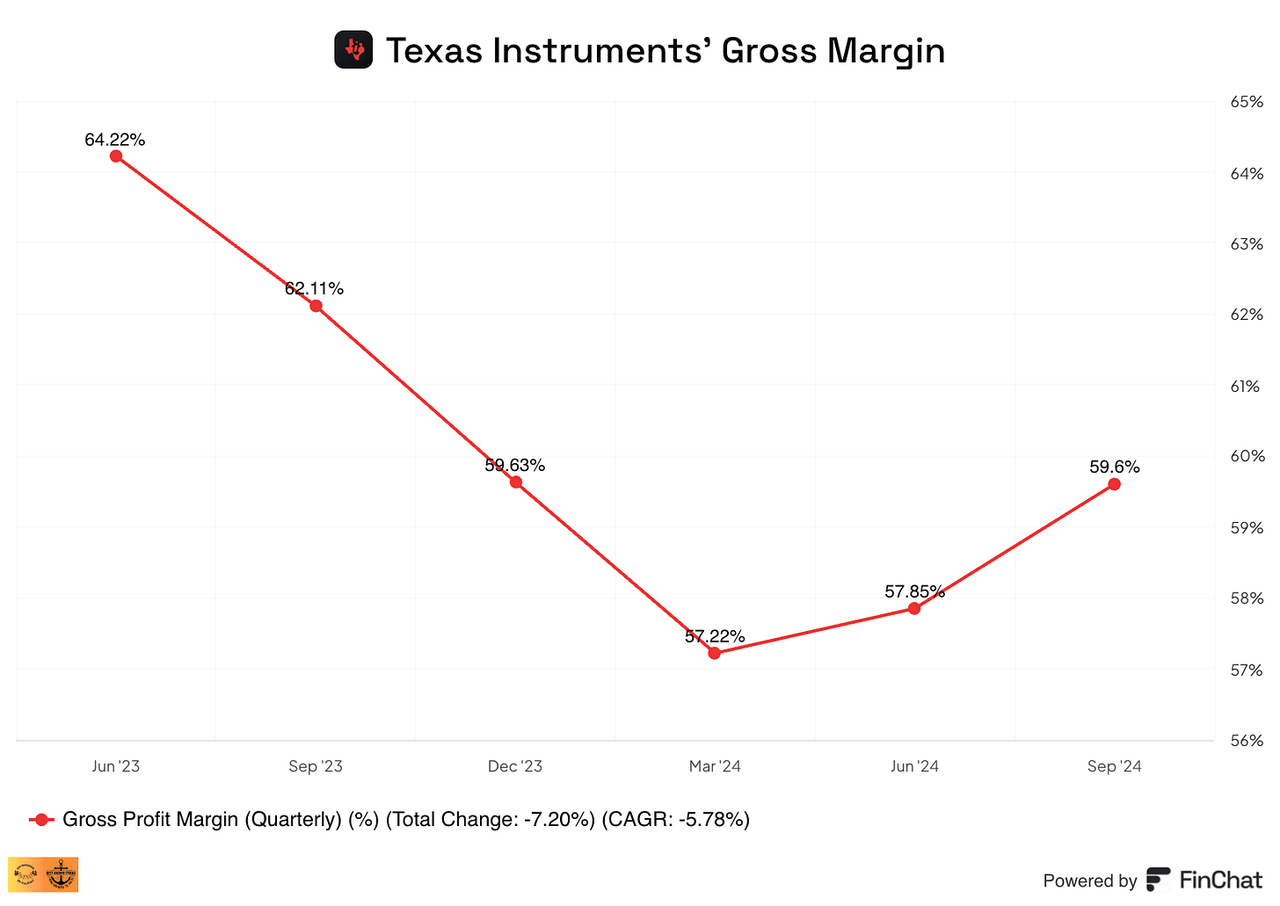

We also got proof of how operating leverage can work in the company’s favor once growth returns. The gross profit margin expanded 180 basis points on a 9% sequential revenue increase:

Finchat.io

Texas Instruments is a fixed-cost business, so it’s normal to see operating deleverage on the way down and operating leverage on the way up. Neither of the things I have just discussed (violent growth from the bottom and operating leverage) are “believable” when a company is in the trough of a cycle because many people tend to forget about a business’ long-term characteristics when it’s going through cyclical pressures.

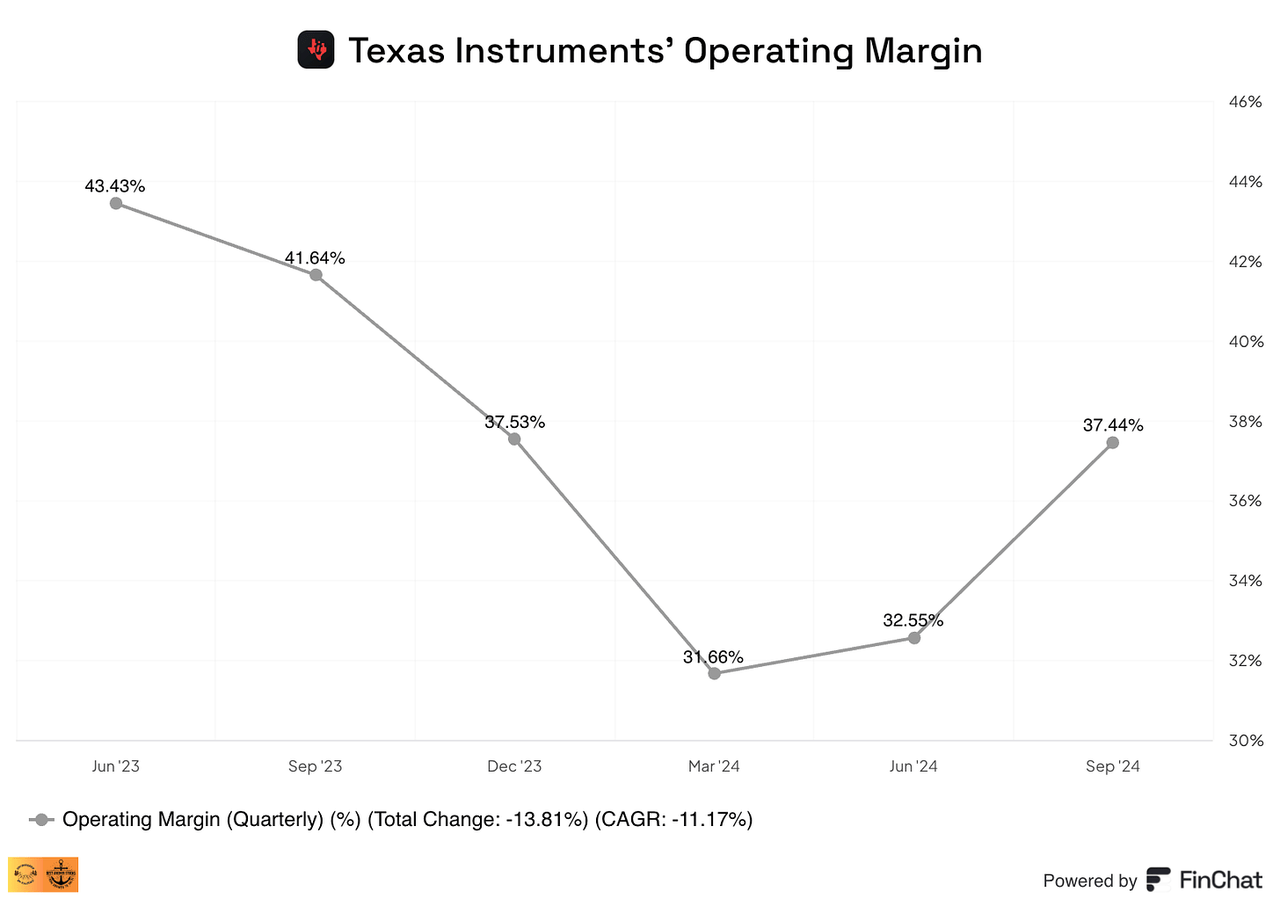

One of the things that’s probably most impressive about Texas Instruments is its profitability. Despite all the operating deleverage the company has suffered during the downturn and the self-inflected capacity expansion “wound,” it currently boasts 37% operating margins! Operating cash flow margins are similar. We can see operating leverage here at play, too. After two consecutive quarters of sequential revenue growth, Texas Instruments’ operating margin has expanded almost 600 basis points:

Finchat.io

This is one of the reasons why I don’t like to compare Texas Instruments’ valuation multiples to that of its less capital intensive peers. The business model is just different, and it’s normal to see Texas Instruments trade at an apparently “richer” valuation than its peers due to its inherent fixed-cost base. Margin incrementals seem pretty substantial for the business, so we shouldn’t be surprised to see Texas Instruments reach all-time high margins once revenue surpasses its prior peak.

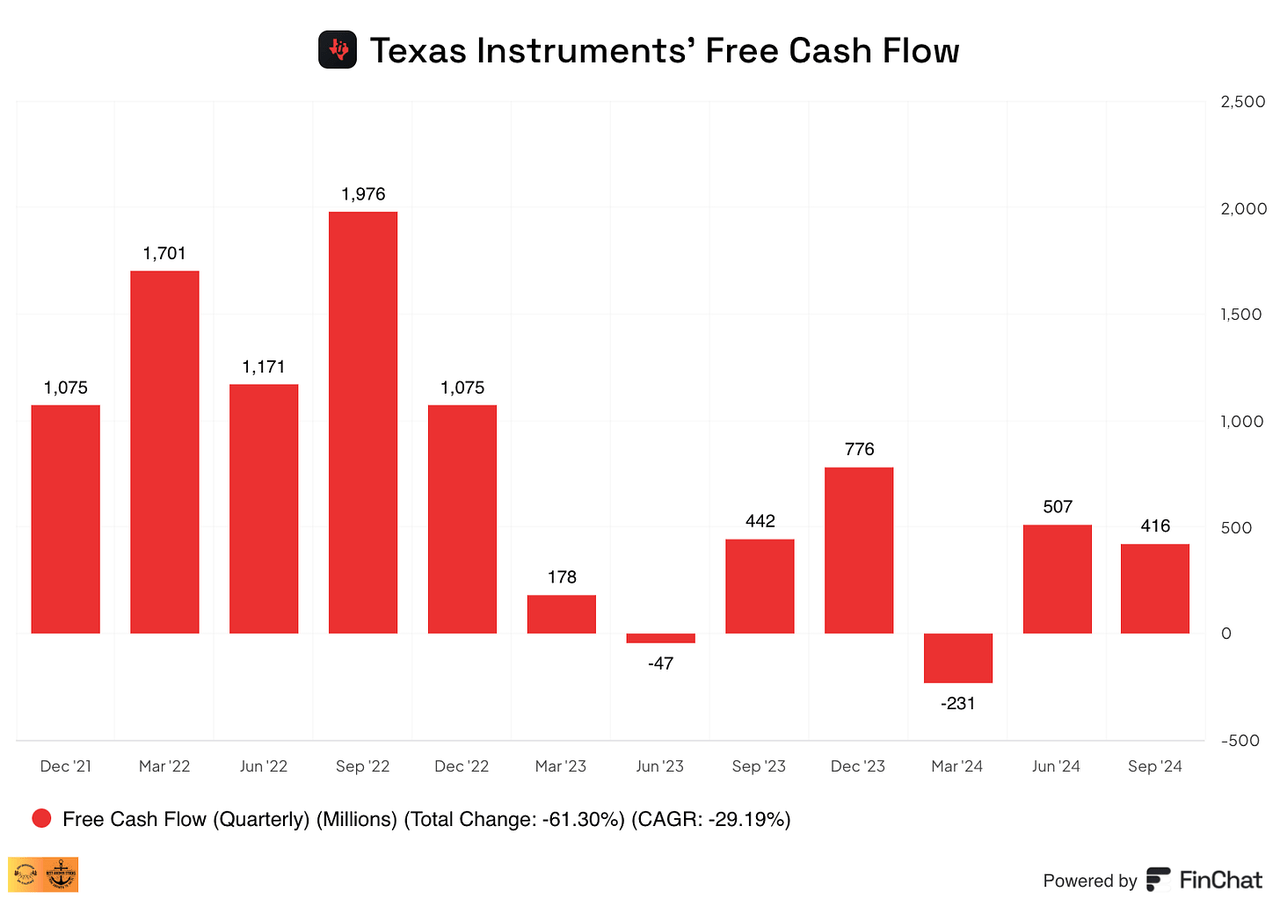

The company is not pulling back on capex just yet, but the improved performance of the underlying business helped the company generate positive free cash flow for yet another quarter:

Finchat.io

The free cash flow margin seems paltry at 10%, but we must not forget this double-digit margin has been achieved through the company’s most significant capacity expansion plan in history and through a downturn. Free cash flow generation should be pretty significant once the company bounces back and the capacity expansion is set and done.

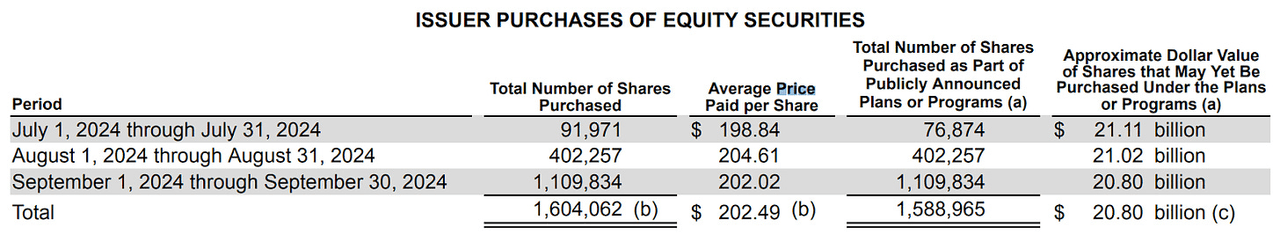

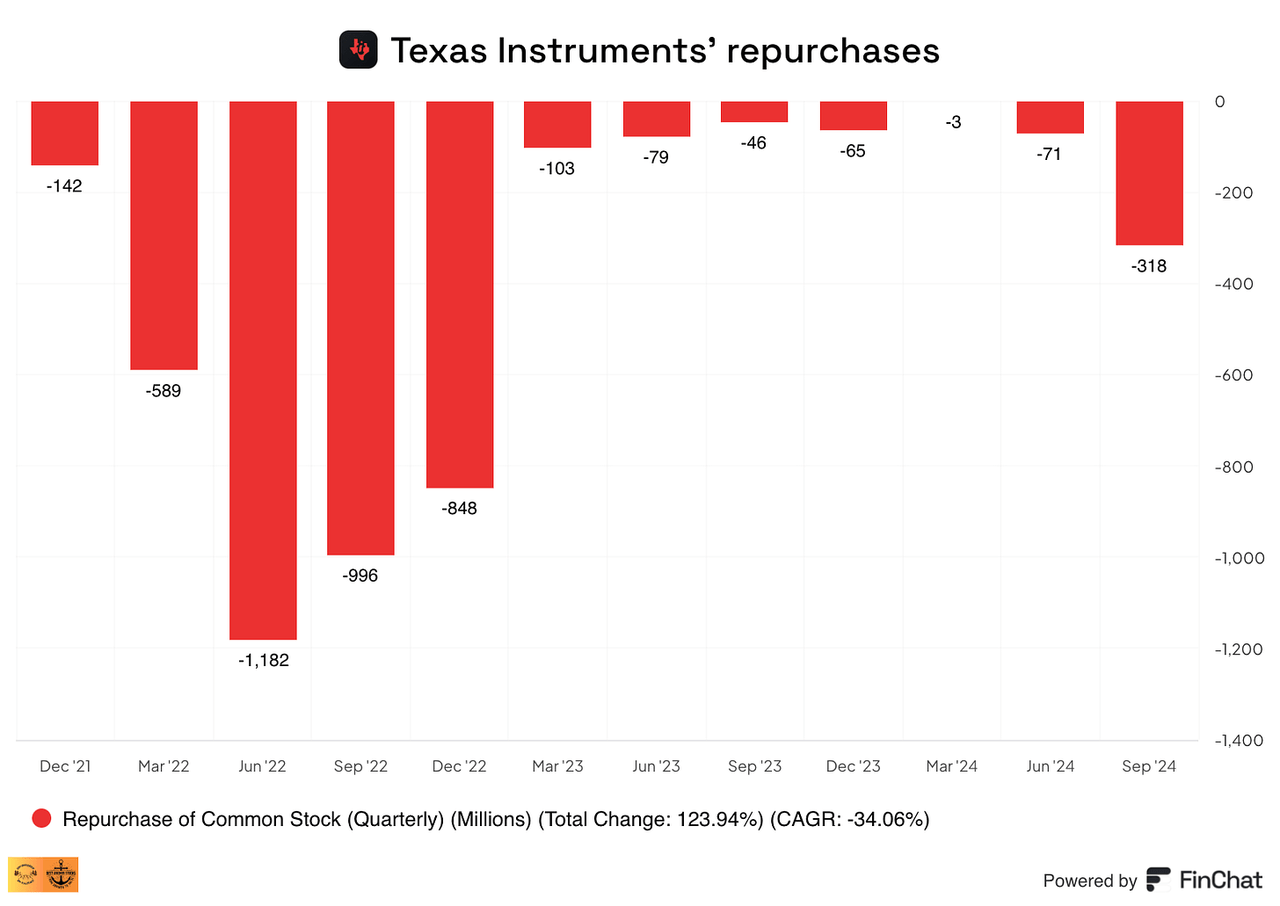

Something interesting to note is that Texas Instruments repurchased $318 million in stock this quarter at an average price of $202:

10Q

This would not be a highlight for any company, but Texas Instruments has a track record of being countercyclical with stock buybacks. It was the most significant quarterly buyback in a while:

Finchat.io

I honestly don’t think Texas Instruments is cheap at $200, but there’s no denying management probably knows better than I do what the business is worth. Not many chief financial officers seem to know what their business is worth (incredible, I know), but Texas Instruments has a track record of countercyclicality and knowing what their business is worth.

The most relevant highlight of the release was probably China. Automotive was up sequentially because Texas Instruments’ automotive business in China is doing very well:

It grew 20% in Q2 and another 20% in Q3. I think it’s not a surprise that there is momentum for EVs in China. Our content is growing there and that’s what really drove the growth in Q3. I think this is not a one quarter thing, I think there is growing momentum there. Our automotive revenue in China is at a new all-time high.

This is good for two reasons. The most straightforward one is that growth is good. The second one, and probably most relevant, is that it somewhat demonstrates that Texas Instruments has what it takes to be successful in China. Many investors were worried about a potential overcapacity in analog in the country (created by the export restrictions) and what this could mean for Texas Instruments. These results might somewhat tame those fears, although bears could argue that it’s still too soon to know, which would be a fair pushback. I don’t think one can simply win in the analog industry by pouring money into capacity. Otherwise, we would’ve seen the high margins competed away long ago (if one believes in capitalism).

All in all, it was a positive quarter for Texas Instruments. The company is not out of the woods yet, but the cycle might be starting to inflect.

In the meantime, keep growing!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TXN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Best Anchor Stocks helps you find the best quality stocks to outperform the market with the lowest volatility/growth ratio. We look for top-notch quality compounders, with solid growth and lower volatility than you would expect.

Best Anchor Stocks picks have a track record of revenue growth combined with below-average volatility. Since the inception in January 2022, our portfolio has significantly beaten both the S&P 500 and the Nasdaq.

There’s a 2-week free trial, so don’t hesitate to join Best Anchor Stocks now!