Summary:

- It is no surprise investors have responded positively to AbbVie’s latest results considering revenue growth, earnings outlook upgrade, and dividend increase.

- The company also has growth catalysts in place, especially with its treatment for Parkinson’s disease showing positive trial results.

- However, its P/E is high for now, and its recent acquisition of Aliada Therapeutics risks being a drag on earnings.

- For medium to long-term investors, though, there is still a lot going for ABBV.

hapabapa/iStock Editorial via Getty Images

Since I last checked on pharmaceutical company AbbVie Inc. (NYSE:ABBV) in August, its share price hasn’t gone anywhere. But the release of its third quarter (Q3 2024) results shows investors are happy with the numbers, rewarding the stock with over a 6% rise in intra-day trading as I write.

To put the increase in perspective, if the stock were to end the day with these gains, they would be the biggest single-day rise year-to-date [YTD]. There’s much to like in these results, but there are cautionary factors for the stock too. Here I consider which way the balance tips to assess what’s next for ABBV.

3 positives in Q3 2024 results

#1. Positive revenue growth in 2024 looks assured

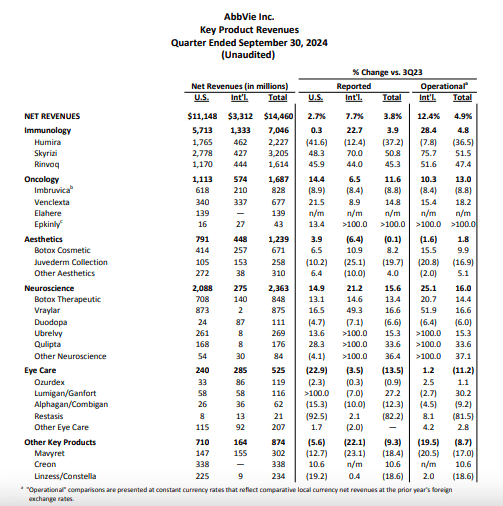

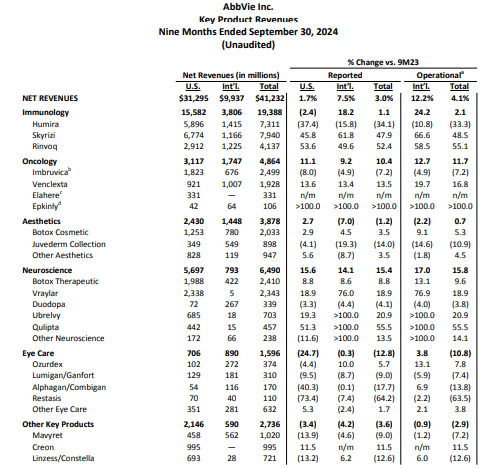

AbbVie’s reported net revenue growth might have come off to 3.8% year-on-year (YoY) during the latest quarter from 4.3% YoY in Q2 2024, but at 3% for the first nine months of the year (9m 2024), the company is well on its way to seeing a turnaround after seeing a contraction of 5.4% in 2023.

Similarly, operational revenues, which are estimated at constant currency, saw a growth softening to 4.9% YoY in Q3 2024, down from 5.6% YoY in Q2 2024, but here too the 9m 2024 figure is vastly improved at 4.9% YoY (2023: -5.4%).

The reasons aren’t hard to find either. The impact of patent expiration for its highly successful immunology treatment Humira, that dragged revenues back last year, has been steadily waning. This is evident from the fact that the company’s reported revenues ex-Humira grew by a notably healthy 17.9% YoY. And it’s also despite the fact that the treatment’s operational revenues dropped by a big 36.5% YoY during the quarter.

Revenue growth ex-Humira is supported by a fast-paced increase in the usage of its two immunology treatments – Skyrizi and Rinvoq – of 51.5% YoY and 47.4% YoY respectively, in operational terms. As a result, despite Humira’s pullback, the immunology segment brings in almost half the company’s revenues. AbbVie’s second and third-biggest segments, Neuroscience and Oncology, also turned in double-digit growth of 16% YoY and 13% YoY increase in operational revenues.

Source: AbbVie Source: AbbVie

#2. Earnings outlook upgraded

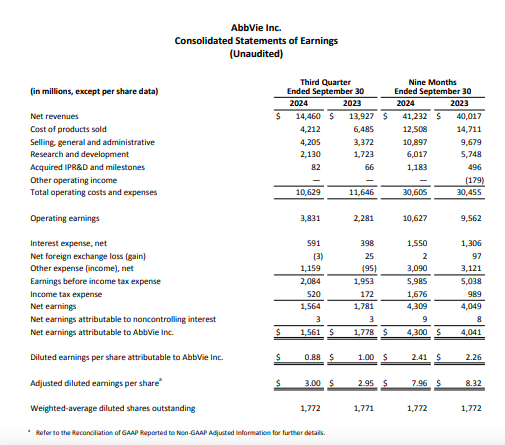

The company also upgraded its adjusted diluted earnings per share [EPS] guidance range for the year to USD 10.9-10.94 from the earlier USD 10.67-10.87, an upgrade made earlier this month, from the USD 10.61-10.81 at the time of its Q2 2024 earnings release. This is a modest 1.4% increase at the midpoint of the ranges.

Even after the upgrade, though, the forecast reflects a 1.7% YoY decline at the midpoint. However, the fact that the guidance has been upgraded despite a slightly bigger drag from acquired IPR&D and milestone expenses of USD 0.64 per share compared to USD 0.6 as per the outlook in Q2 2024, is worth noting.

The improvement in earnings outlook follows a 1.7% YoY increase in adjusted diluted EPS on a far smaller impact from acquired IPR&D and milestone expenses compared with Q2 2024, when the figure shrank by 8.9% YoY. Because of the earlier drag, though, the EPS for 9m 2024 is still down by 4.3% YoY, though.

Source: AbbVie

#3. Dividend increase

The company also increased its quarterly dividend payouts for next year by 5.8% to USD 1.64 per share from the earlier USD 1.55 per share. This brings AbbVie’s forward dividend yield to 3.29%, up from the earlier 3.11%.

This might not sound terribly impressive, especially considering that it’s still over a percentage point lower than the stock’s five-year average of 4.32%, but there are two points to consider here:

- It’s still higher than the median for the healthcare sector at just 1.47%.

- A healthy 153% rise in AbbVie’s share price over the past five years has held the yield low. The five-year yield on cost is actually a lucrative 7.8%.

Future catalysts in place

Beyond the latest results, in recent months AbbVie has also made progress on two counts that could potentially hold it in good stead going forward. These are as follows:

- Rinvoq, the company’s high-performing immunology treatment, is already approved for the treatment of atopic dermatitis or eczema in children over 12 years old and adults. Latest studies further reinforce its efficacy with patients with head and neck involvement, who see a resolution in 16 weeks of medication. Eczema is the most common skin condition, affecting 10% of adults and 25% of adolescents, and the latest studies could stand to encourage further usage of Rinvoq, which is also approved for inflammatory bowel diseases and arthritis.

- AbbVie’s big USD 8.7 billion acquisition of Cerevel last year, has now been completed. This adds to its fast-growing neuroscience portfolio and is, in fact, starting to bear fruit already. Tavapadon, its treatment for managing Parkinson’s disease has found success in its Phase 3 trials with “clinically meaningful improvement in motor aspects of experiences of daily living” at week 26.

Market multiples are high…

At the midpoint of the latest earnings outlook, the stock’s forward non-GAAP price-to-earnings (P/E) ratio is now at 18.3x, which is exactly where it was the last I checked. This is problematic in the short term because it stays much higher than the stock’s five-year average levels of 11.38x.

Also, in comparison with the big five pharmaceutical stocks by market capitalisation, with the others being Eli Lilly and Company (LLY), Novo Nordisk A/S (NVO), Merck & Co., Inc. (MRK) and Johnson & Johnson (JNJ), ABBV sits nicely in the middle.

LLY and NVO, however, have a robust premium on their valuations because of the exceptional demand for their successful weight management and diabetes treatments. This means they should ideally be exempt from the comparison. It also means that ABBV continues to trade at higher valuations than MRK and JNJ, which are at 13.06x and 16.08x respectively.

…and earnings drag is possible

Further, the company just completed its acquisition of Aliada Therapeutics, which focuses on treatments of central nervous system diseases, with a treatment for Alzheimer’s disease being its key asset. The purchase is set to close in Q4 2024 for a cash payout of USD 1.4 billion.

If the expense gets factored into the quarter’s earnings, it will be impacted by USD 0.79 per share. This would reduce the company’s earnings for the full year to USD 10.13, assuming that it was earlier going to come in at the midpoint of the guidance range. This would be an 8.8% YoY drop and the forward non-GAAP P/E would rise to 19.7x.

What next?

There are two sides to the AbbVie story now. All looks good on the revenue front, with a turnaround this year and future catalysts in place. Its adjusted diluted EPS has also seen small growth, presumably following which, the earnings outlook has been slightly upgraded as well. The dividend increase is a positive too.

However, the stock’s forward P/E continues to look higher than warranted, especially as there’s a risk of an earnings drag in Q4 2024 due to the latest acquisition. Based on this, the investor takeaways can depend on their time horizon as follows:

- Short-term: It’s hard to argue for an upside in the near future at the present prices, as earnings can be impacted downwards.

- Medium-to-long-term: With earnings growth seen in the years after 2024, ABBV’s forward P/E drops to a far more acceptable 11.7x by 2028, making it a good medium-term stock to consider. It has also given handsome price returns and dividends to patient investors in the past. With further growth catalysts in place, this could continue.

Based on a longer-term time investing horizon, I’m retaining a Buy rating on ABBV.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—