cemagraphics

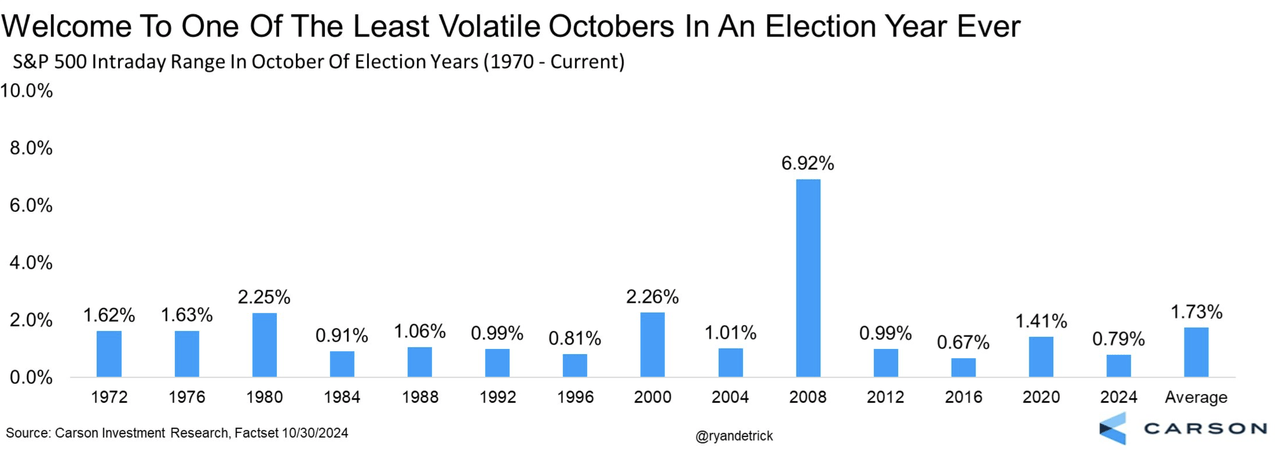

Wall Street’s volatility gauge (VIX) jumped on Thursday, and the S&P 500’s (SP500) monthly performance hangs on the daily move, but the month is set to be one of the least volatile Octobers in an election year, according to Carson Group’s Ryan Detrick.

The chief market strategist looked at October intraday ranges on the benchmark (SP500) in election years going back to the 1970s. This October, the average intraday range has been 0.79%, resulting in the second-smallest range running back more than 50 years, he said in a post on X (formerly Twitter) and posted this chart:

The average intraday range is 1.79%. The chart showed 6.92% as the highest intraday range, occurring in October 2008, during the global financial crisis.

During Thursday’s session, the (VIX) shot up more than 8%, climbing over a 22 reading. The S&P 500 (SP500) fell 1.2%, with Meta (META) and Microsoft (MSFT) losing ground after their quarterly updates.

Here are some ETFs tracking the S&P 500 (SP500): (SPY), (VOO), (UPRO), (SH), and (SPXU).