Summary:

- Meta’s Q3 2024 earnings beat EPS and revenue estimates, yet shares dropped ~3% in after-hours trading.

- Driven by AI advancements and better ad performance, Meta reported 20% revenue growth in constant currency, with ad impressions and price per ad also increasing.

- Meta Platforms’ CapEx is set to increase significantly next year as it continues to invest in AI.

- I previously said META can reach $400 back in 2022. Now that it has surpassed that level by quite a bit, the stock’s large margin of safety is gone, warranting a Hold rating.

- Meta has plenty of growth potential as it leverages AI to increase monetization and keep users on its platforms for longer.

Derick Hudson

Meta Platforms, Inc. (NASDAQ:META) just reported its Q3-2024 earnings results, which beat both EPS and revenue expectations. Nonetheless, the stock still fell in after-hours trading, but only by ~3%.

The last time I wrote about Meta was on April 7, 2022, when its ticker was still FB. The article was titled “Why Meta Platforms Can Hit $400,” and the share price was around $224 at the time. A lot has changed since then, except the fact that META is still a great company, so it’s worth revisiting.

One of the main reasons I thought it would go to $400 was because my valuation method showed that it wouldn’t take too much growth to achieve that share price. Combined with the company’s competitive advantage, META seemed like an obvious play.

With the stock now near $573, more growth is priced in, and I believe the stock is trading closer to fair value. As a result, I view META stock as a Hold, although I definitely see the potential for long-term gains, given its growth potential, which I’ll discuss later on.

Meta Platforms Q3 Earnings Overview

Meta’s Q3 earnings report starts off like this: “We had a good quarter driven by AI progress across our apps and business,” said Mark Zuckerberg, Meta founder and CEO. “We also have strong momentum with Meta AI, Llama adoption, and AI-powered glasses.”

Not bad. So, how does this look in the numbers? Meta Platforms’ revenue came in at $40.59 billion, higher than the $40.31 billion consensus estimate, up 19% year-over-year (20% on a constant-currency basis). At the same time, EPS of $6.03 grew by 37% and beat the consensus estimate of $5.29. Some increase in earnings was due to a lower tax rate (12% compared to 17%), so if we look at operating income, that grew by 26% year-over-year to $17.35 billion.

The company’s family average revenue per person increased from $10.93 in Q3 2023 to $12.29 billion in Q3 2024, while its family daily active people grew 5% YoY to 3.29 billion. Meta’s revenue growth was mainly driven by a 7% increase in ad impressions in its family of apps and an 11% increase in the average price per ad.

Its free cash flow grew by 13.8% YoY to $15.52 billion (this includes principal repayments on finance leases of $944 million), bringing its cash, cash equivalents, and marketable securities to $70.9 billion. When factoring in its debt of $28.82 billion, its net cash position is around $42.08 billion — a bit lower than Q3-2023’s net cash position of $47.018 billion.

The loser remains the Reality Labs segment, which grew its revenue by 28.6% year-over-year to $270 million but saw an operating loss of $4.43 billion.

Meta’s Outlook

For Q4, Meta expects revenue to range between $45 billion and $48 billion. That’s a big range, if you ask me. Still, the midpoint is $46.5 billion, higher than the $46.24 billion consensus estimate. The midpoint also suggests a respectable ~15.9% growth rate.

2024 total expenses got revised lower, from $96-99 billion to $96-98 billion. However, Meta expects 2024 operating losses to “increase meaningfully year-over-year due to [the company’s] ongoing product development efforts and investments to further scale [its] ecosystem.”

CapEx for the year is forecast at $38-40 billion, slightly higher than the previous range of $37-40 billion and much higher than 2023’s CapEx of $27.266 billion. Importantly, Meta expects its CapEx to grow significantly next year. This can hurt free cash flow in the short term but can pay off in the long term if the company executes well.

What Are Meta’s Main Growth Catalysts?

The first growth catalyst Meta has is that it continues to leverage AI to improve user metrics. In the Q3 earnings call, Mark Zuckerberg talked about this, saying the following:

Meta AI now has more than 500,000,000 monthly actives. Improvements to our AI-driven feed and video recommendations to our AI-driven feed and video recommendations have led to an 8% increase in time spent on Facebook and a 6% increase on Instagram this year alone. More than 1,000,000 advertisers used our Gen AI tools to create more than 15,000,000 ads in the last month. And we estimate that businesses using image generation are seeing a 7% increase in conversions and we believe that there’s a lot more upside here.

This improved engagement comes with ad revenue growth potential while improving ad performance.

Further, Meta is finding other ways to monetize its platform more efficiently, such as adopting advanced modeling techniques. Here’s what Susan Li, Meta’s CFO, said in the earnings call:

The second part of improving monetization efficiency is enhancing marketing performance. Similar to organic content ranking, we are finding opportunities to achieve meaningful ads performance gains by adopting new approaches to modeling.

For example, we recently deployed new learning and modeling techniques that enable our ad systems to consider the sequence of actions a person takes before and after seeing an ad. Previously, our ad system could only aggregate those actions together without mapping the sequence. This new approach allows our systems to better anticipate how audiences will respond to specific ads. Since we adopted the new models in the first half of this year, we’ve already seen a 2% to 4% increase in conversions based on testing within selected segments.

Meta’s new modeling approach can better predict audience behavior, leading to a 2- 4% increase in conversions. Even a small increase in conversions like that can greatly increase advertiser ROI, which would make Meta’s platforms (pun intended) more appealing.

A Whole New Category Of Content

Zuckerberg also announced that Meta will roll out a “whole new category of content.” Social media used to be more about seeing what your friends were up to. Then, creator content started getting pushed more, and you see more of that now. Next, the whole new category will be “AI-generated or AI summarized content, or a kind of existing content pulled together by AI in some way,” according to Zuckerberg.

He doesn’t think that it will have a big impact on 2025 financials, but he is confident that it will be an important trend over the next few years. I don’t doubt it. AI-generated content can be entertaining and highly personalized.

Llama Potential

Llama, Meta’s large language model, is open-source, letting anyone use, customize, and improve it. This is different from OpenAI’s GPT, which is closed-source. As outside developers improve Llama, Meta can benefit and reduce costs while driving innovation. As Llama becomes more widely used, Meta can potentially see revenue opportunities through custom applications and integrations.

To give you an idea of how Llama can help Meta, here’s what Zuckerberg said in the earnings call:

There are a lot of researchers and independent developers who do work and because Llama is available, they do the work on Llama and they make improvements and then they publish it and it becomes it’s very easy for us to then incorporate that both back into Llama and into our Meta products like Meta AI or AI Studio or Business AI is because the work, the examples that are being shown are people doing it on our stack.

Perhaps more importantly is just the efficiency and cost. I mean this stuff is obviously very expensive. When someone figures out a way to run this better, if they can run it 20% more effectively then that would save us a huge amount of money.

He also went on to say:

Here, one of the big costs is chips, a lot of the infrastructure there. What we’re seeing is that as Llama gets adopted more, you’re seeing folks like NVIDIA Corporation (NVDA) and Advanced Micro Devices, Inc. (AMD) optimize their chips more to run Llama specifically well, which clearly benefits us. So it benefits everyone who’s using Llama, but it makes our products better, right, rather than if we were just on an island building a model that no one was kind of standardizing around in the industry. So that’s some of what we’re seeing around Llama and why I think it’s good business for us to do this in an open way.

The catalysts mentioned above are already promising, and I didn’t even talk about the potential of WhatsApp, Reality Labs, and Threads. Clearly, Meta has lots of growth areas, but the ones I mentioned are the most important to me at the moment. Now, let’s look at the valuation.

META Stock’s Valuation Looks Fair

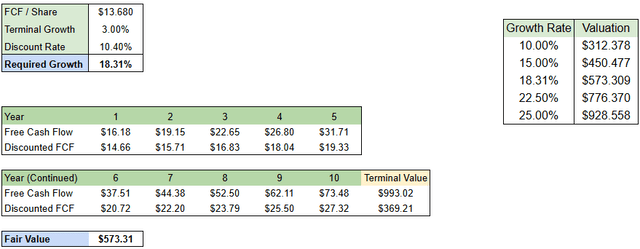

There are a few ways of looking at META’s valuation. In this article, I’ll show five different growth rates using the discounted cash flow method, and you’ll see what fair value they spit out for the company for each growth rate.

As you can see below, for META stock to be fairly valued (as per the most recent price of $573.31 in after-hours trading), it needs to grow its FCF per share by ~18.31% per year for the next 10 years and then 3% in perpetuity. You can see other growth rates and valuations for those growth rates on the right side of the image.

META Stock Reverse DCF Valuation (Author)

Here are some things to keep in mind for the valuation above. First, I took the TTM FCF of $50.45 billion (including lease repayments as CapEx) and subtracted TTM stock-based compensation of $15.852 billion from that figure, giving me $34.598 billion in “adjusted” free cash flow. I used a basic share count of 2.529 billion, based on the weighted average basic share count from Q3. This gave me an adjusted FCF per share of $13.68.

Next, I calculated the 10.4% discount rate using the CAPM model, with an equity risk premium of 5%. I chose 3% as the terminal growth rate, slightly higher than long-term inflation expectations of 2% in the U.S. due to Meta’s long-term growth potential and its dominant positioning in the industry.

Now, the question is, can Meta grow its FCF per share by 18.31% per year to justify its valuation? It’s certainly possible. Not including the most recent report, Meta’s five-year average FCF CAGR comes in at 13.8%. When you factor in the lower share count over the years through buybacks (shares outstanding used to be 2.854 billion in Q2 of 2019), the per-share CAGR would be a few points higher. Thus, in recent history, Meta has achieved similar results.

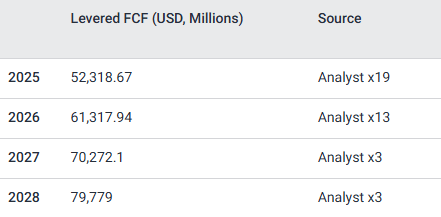

How about looking forward? For 2024, analysts estimate an FCF of $47.71 billion, followed by $52.3187 billion in 2025 and $61.3179 billion in 2026. By the way, I assume these numbers could get revised higher due to the earnings beat, but let’s use them for reference. See the estimates below. The expected increase in 2025 is 9.65%, while the 2026 increase is 17.2%. I wouldn’t focus on forecasts after 2026, though, because they could be very unreliable that far out.

Meta Platforms FCF Forecasts (simplywall.st)

Anyway, for now, it doesn’t look like there’s a huge margin of safety for META stock. For it to be notably undervalued, it would have to grow FCF per share by at least 20% per year for the next 10 years. Of course, it can do that and surprise analysts to the upside, but I’d rather bet on it when expectations are lower.

The major flaw I will say regarding a 10-year DCF is that it could potentially be too conservative. This particular DCF assumes a sudden drop in growth rate to 3% after year 10, which I understand is unlikely. Nonetheless, there are times when stocks are so undervalued that the conservative estimates still show notable upside potential. That’s when I prefer to Buy.

A growth rate of 15% per year, which would be priced at $450 per share, seems like a reasonable entry point. And it’s not as if $450 is long gone. The stock was at that level in August.

The Bottom Line On META Stock

META stock fell by 3% in after-hours trading despite a strong earnings report. Does this present a buying opportunity? Perhaps it does for those with a very long-term view of the company, but I prefer to wait on the sidelines for a bigger margin of safety.

Still, the company continues to impress me and has lots of growth ahead, whether that’s from Meta AI’s potential to keep improving user metrics, a whole new category of content, or other initiatives.

In the final analysis, META is a great stock that I’ll be watching closely for any notable share price dips in order to buy it.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.