Summary:

- The Family of Apps segment is stronger than ever and manages to largely cover the losses of the Reality of Labs.

- Llama is increasingly popular, Ray-Ban Meta AI are in wide demand, and Threads gets 1 million new subscribers a day.

- WhatsApp is growing fast in the U.S., as are young adults on Facebook. CapEx is expected to increase in 2025 but we do not know by how much, which is.

Jose Luis Pelaez Inc/DigitalVision via Getty Images

Meta’s (NASDAQ:META) Q3 2024 was recently released, and it does not seem that the market took it well given the -3% in pre-market. At first glance I thought the worst, but upon analyzing the quarterly report in depth I realized that there is no particularly bad news; in fact, everything seems to be going right. This company continues to grow in double digits and invests several billion dollars each quarter to master the new trend of the future.

I personally invested heavily in Meta in mid-2022 and I do not plan to buy more since it is already my first position in the portfolio. So, for me it remains a hold unless the price falls by 15-20%.

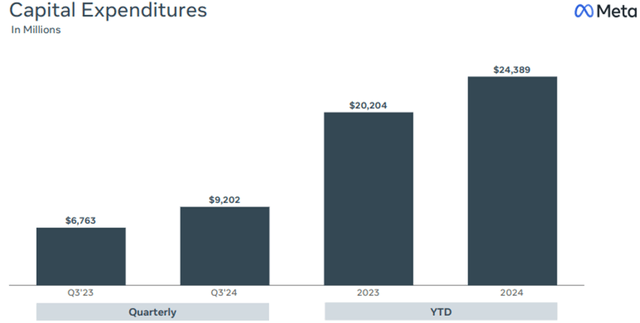

The stock has risen a lot in recent years, and I think a retracement is healthy to make the long-term trend sustainable. The market’s excuse for Meta to go down could be the company’s desire to increase CapEx even more in 2025, something that has caused some concern before.

Honestly, I hope some panic will be generated so I can finally go back to buying Meta.

Highlights Q3 2024

At the end of 2022 Meta was considered a dead company with no room for improvement since it was throwing money into an unrealizable project. Two years later, not everyone believes in the Metaverse, but at least I hope they have realized how strong its core business is.

META Q3 2024

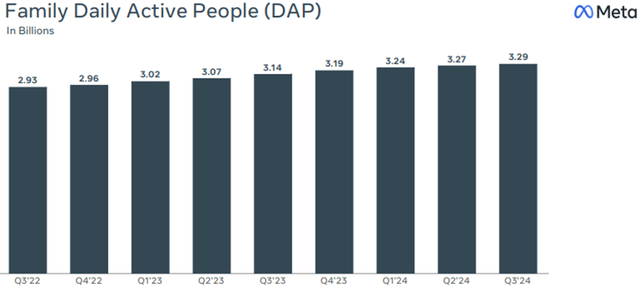

In Q3 2022 I remember that many people were convinced that Facebook was a dead social, WhatsApp useless and unprofitable, and Instagram was destined to be replaced by TikTok. At the time, DAPs were 2.93 billion and two years later they have never slowed their growth: today they are 3.29 billion.

Frankly, I too am surprised how Meta manages to increase this number further; after all, there are 8.20 billion of us on the planet. But there’s more, people are spending more and more time on Family of Apps:

- WhatsApp just hit a record, 2 billion calls in the last 12 months. In addition, the U.S. is one of the fastest growing countries in terms of users since SMS is still widely used. The potential of WhatsApp is huge and I discussed it in depth in this article. In Q3 2024, the other segment of Family of Apps grew by 48% mainly due to the growth of click-to-WhatsApp ads revenue.

- Thanks to the AI-driven feed, time spent on Facebook and Instagram increased from last year by 8% and 6%, respectively. In addition, there has been growing interest on Facebook from young U.S. adults, and Instagram continues to spread strongly around the world. Among other things, teen accounts were recently introduced, within which limits can be set to protect them from inappropriate content and messages.

- Threads has reached 275 million monthly users and every day there are more than 1 million new members, mainly from the U.S., Taiwan, and Japan. Engagement is improving, and new features are ready to keep users up-to-date on any new news that may interest them. Overall, Threads growth is proceeding well but do not expect it to be a main driver of 2025 revenue growth. As in any other case, Meta thinks first about increasing engagement and users, and only then how to make monetization efficient.

The Family of Apps segment has never been more prosperous, and its potential remains huge thanks to new AI integrations. What many people don’t realize is that the billions spent each quarter by Meta are not just for the Metaverse, but mainly to make Family of Apps ads more effective, as this way advertisers are willing to pay more: the results are evident.

META Q3 2024

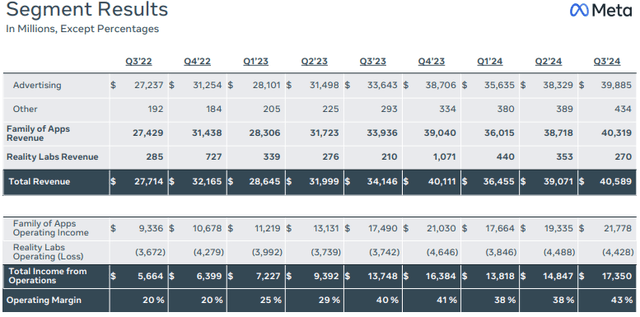

Family of Apps Revenue reached $40.31 billion, an increase of 19% over last year and 47% over Q3 2022. Anyway, what is impressive is the profitability of this segment, in fact the operating margin was 54%.

This result was “soiled” by yet another loss in the Reality Labs segment, this time of $4.42 billion. Years have passed and it does not seem that the losses are decreasing, quite the contrary.

For Reality Labs, we continue to expect 2024 operating losses to increase meaningful year-over-year due to our ongoing product development efforts and investments to further scale our ecosystem.

Turning now to the CapEx outlook. We anticipate our full year 2024 capital expenditures will be in the range of $38 billion to $40 billion, updated from our prior range of $37 billion to $40 billion. We continue to expect significant capital expenditure growth in 2025.

CFO Susan Li, conference call Q3 2024.

Investors probably did not like these words because there are no concrete numbers on what the losses from Reality Labs will be. We know they will increase, but not by how much, and the same goes for CapEx in 2025.

META Q3 2024

This is probably why the quarterly report was unwelcome, as this attitude is very reminiscent of what happened in 2021-2022. The difference is that the Family of Apps segment is so strong that even losses of billions of dollars are minimal.

To be a Meta investor one must have full confidence in Mark Zuckerberg since we obviously cannot know where and in what way every single dollar is invested. What we can evaluate is the data we have available and we can see that there has been a marked improvement in both revenues and operating income: that is what is important. It is clear that the billions invested in the past few years are paying off, and I expect that Meta can continue to focus on high ROI projects.

Dwelling solely on the loss of the Reality Labs segment is wrong in my opinion, as there are important if not yet economically significant improvements. We are still at an early stage of what could be the highest growth segment for Meta.

First of all, the Llama language model due to its characteristic of being available to anyone for research or commercial purposes, it is becoming widely used within the industry. Meta’s strategy of making its technologies accessible is proving to be correct for two reasons:

- On the one hand, Llama is becoming a standard within industry.

- On the other, it allows Meta to innovate without necessarily having a direct approach. If an independent researcher discovers a way to use these models in a more efficient way, his or her insight can also be used by Meta itself.

This process is creating a virtuous circle that can increase not only the users who use Llama, but also new strategies to make the model more effective and efficient:

We got some suggestions also that helped us save costs, and that just ended up being really valuable for us. Here, one of the big costs is chips. A lot of the infrastructure there, what we’re seeing is that as Llama gets adopted more, you’re seeing folks like NVIDIA and AMD and optimize their chips more to run Llama specifically well, which clearly benefits us. So it benefits everyone who’s using Llama, but it makes our products better rather than if we were just on an island building a model that no one was kind of standardizing around in the industry. So that’s some of what we’re seeing around Llama and why I think it’s good business for us to do this in an open way.

CEO Mark Zuckerberg, conference call Q3 2024.

Mark Zuckerberg’s move is proving to be brilliant and is displacing all the other companies that are investing billions in their language models. Obviously these technologies that Meta will have at its disposal will be integrated into both the Family of Apps and the Reality of Labs segments. For the former we have already seen the results, for the latter we still have to wait. Regardless, this does not mean that Meta has wasted time so far.

The Ray-Ban Meta AIs have had an exponential increase in popularity, which is why the collaboration with EssilorLuxottica (OTCPK:ESLOF) has been intensified (I talked about it in this article). These glasses are in high demand, and what they are capable of doing is revolutionary to say the least:

They’re great-looking glasses that let you take photos and videos, listen to music, and take calls, but what makes them really special is the Meta AI integration. With our new updates, it’ll be able to not only answer your questions throughout the day, but also help you remember things, give you suggestions as you’re doing things using real-time multimodal AI, and even translate other languages right in your ear for you.

CEO Mark Zuckerberg, conference call Q3 2024.

No other company is close to experimenting something similar, and Meta is definitely the first to enter this market. Of course, we don’t know how profitable it will be and whether it will prove to be prosperous over the decades, but we do know that people like this product despite it being quite expensive. The new version launched at Connect sold out quickly and is now being sold online for more than $1,000.

Meta is serious about its smart-glasses and has been working on this project for about a decade. Partnering with one of the world’s best companies in lens manufacturing was a very smart move and allows Meta to leverage its global distribution network. We are close to something tangible as far as this market is concerned although I think many investors haven’t realized it yet: there is still a lot of skepticism about it.

As for the Quest, 3S version has been released and its price is very affordable, about $300. There is still not a wide spread of this technology, but there is some enthusiasm for the year-end holiday session.

META Q3 2024

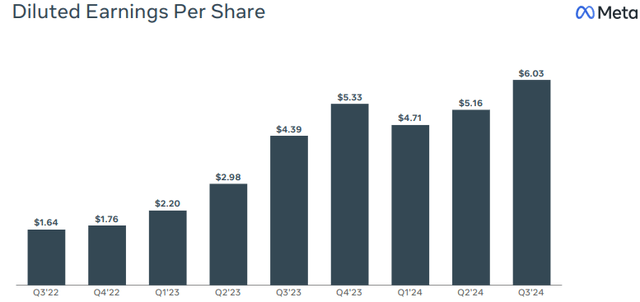

Diluted EPS reached $6.03 in this quarterly, a 37% increase over last year. In the face of such an improvement I wonder how the stock can go down in pre-market, evidently the Reality Labs segment is not liked by many. Without the latter’s losses EPS would have been above $7, but I am happy to miss some short-term gains if it benefits long-term growth. Those who invest in Meta I think need to take this approach if they want to get the most out of their investment; Mark Zuckerberg is not interested in doing what pleases shareholders but what can improve Meta.

In any case, there is no shortage of shareholder remuneration: there has been a major multi-tens of billions of dollars buyback as well as the issuance of a small-growing dividend. That’s no little thing for a company that invests tens of billions of dollars each year and has a heavily loss-making business segment.

META Q3 2024

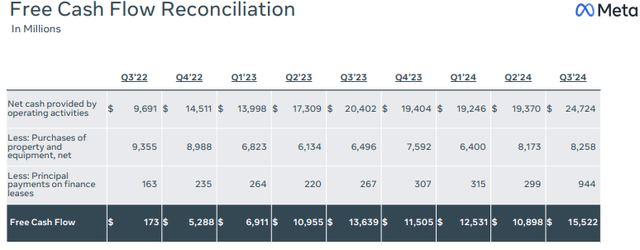

Although there are many outflows, Meta makes so much money that it still presents an outstanding financial condition. Free cash flow in Q3 2024 was $15.52 billion and net debt was -$42 billion.

Conclusion

Q3 2024 was positive overall as far as I am concerned, in fact continuity was given to the positive things observed in previous quarters. Family of Apps is stronger than ever: engagement is increasing, as is operating income. In contrast, Reality Labs keeps generating losses but we are seeing the first tangible results, especially Ray-Ban Meta AI. In all this, the Llama language model is increasingly being used and improves its efficiency, plus the arrival of version 4 has been announced.

Free cash flow is huge, revenues are growing in double digits, and profitability has also improved. As for me, I did not find any negative aspects in this quarter and I am happy that I never sold a single share.

The negative market reaction was unwarranted in my opinion and I am not worried about the increase in CapEx. Meta remains one of the best companies in the world and I hope the market will continue to penalize the stock so I can finally increase my position.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.