Summary:

- Meta Platforms has our most important Stocks In Demand or SID Buy Signal.

- Post earnings pullback will trigger our buy on weakness signals, targeting support at $560.

- We expect our signals like MACD and Chaikin Money Flow to turn up when buyers on weakness come back to Meta Platforms.

Sean Anthony Eddy

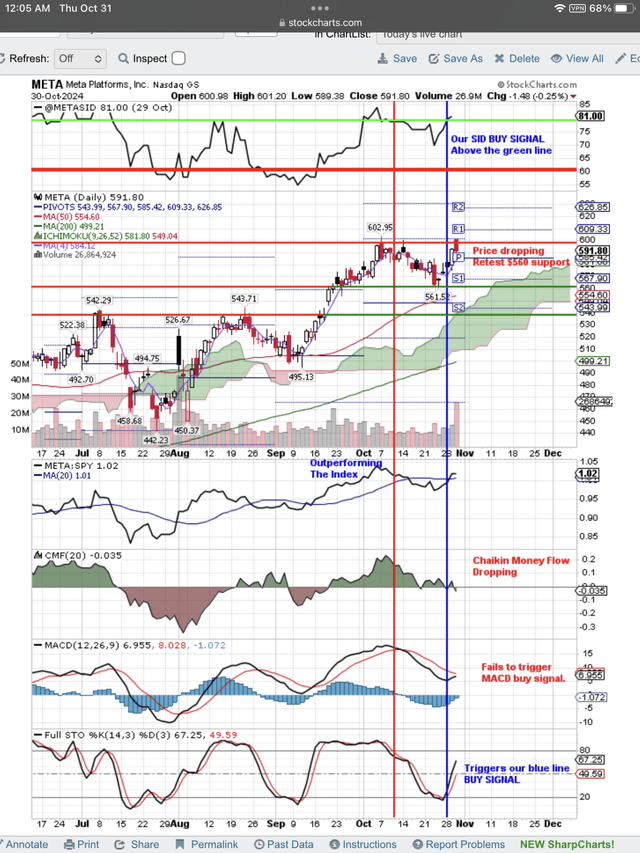

As you can see at the top of the chart below, Meta Platforms (NASDAQ:META) has our most important Stocks In Demand or SID Buy Signal. Price is dropping after reporting earnings, and that usually triggers our buy on weakness signal. Since we don’t know how low the price will go on this post-earnings pullback of 3% so far, we will have to wait for the signals on the chart below to turn up, indicating to us that the sellers are done. We need to see Chaikin Money Flow turn up and the MACD buy signal trigger.

The SID Buy signal at the top of the chart uses both technicals ad fundamentals and gives us the confidence to buy on this post-earnings pullback. So far, this looks like just a normal pullback after earnings and not anything that is going to change our SID Buy Signal.

If you now go down to the price on the chart, you will see the support and resistance lines that we have drawn. It appears to us that the price is targeting a retest of support at the line drawn at $560. If the bounce starts at that point, we will know the buyers on weakness have arrived. In addition to our own SID Buy Signal, notice that both the 50-day and 200-day moving averages are in uptrends. These trends confirm our bullish SID Buy Signal and give us the confidence to buy any pullback in price such as this one we are experiencing after earnings.

Just below the prices on the chart below is our most important technical signal which tells us if META is beating the Index, in this case, the SPY. It compares the price movement of META to the price movement of the SPY and is called Relative Strength, the strength of META relative to the SPY. The title of our service, Daily Index Beaters, tells you that we only want to be in stocks that are outperforming on a trend basis and the trend has to be up. Notice that on price pullbacks it breaks below trend but quickly recovers. If it does not recover, we drop it from our Model Portfolio. Downtrend stocks mean that the stock has become an underperformer.

The next signal on the chart is Chaikin Money Flow. Direction is important, especially changes in direction. You can see when the movement up stopped and turned down, indicating money was flowing out and would probably take the price down as it currently is doing after earnings.

Below Chaikin Money Flow is the MACD signal, and you can see it moves up and down with price to form buying and selling cycles. Whenever this regular pattern is broken, that is an important signal. The crossover signal on the lines provides the buy or sell signal. You can see the lines failed to crossover before earnings, and now we have to wait to see when that buy signal happens so we can buy on weakness.

At the bottom of the chart is the signal that we use to draw our vertical buy (blue) and sell (red) lines up and down the chart as a reference for all the signals on the chart. You can see we had a blue line buy signal going into earnings. Now, the pullback in price after earnings will probably reverse this line to red. When it reverses back to blue, it will tell us to buy on weakness. We will keep you posted for that buy on weakness signal.

Here is the daily chart showing all the signals we have discussed above:

META pullback after earnings will trigger our buy on weakness signals. (StockCharts.com)

We always like to do our due diligence by checking with the SA analysts and Quant ratings. The SA analysts have a Buy rating, while the Wall St analysts have a strong Buy. The Quant rating is only a Hold, so that adds a little caution to our buy signals. Valuation seems to be the problem because all the other Quant grades for Profitability, Growth, Revisions, and Momentum are very good.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in META over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: We are not investment advisers and we never recommend stocks or securities. Nothing on this website, in our reports and emails or in our meetings is a recommendation to buy or sell any security. Options are especially risky and most options expire worthless. You need to do your own due diligence and consult with a professional financial advisor before acting on any information provided on this website or at our meetings. Our meetings and website are for educational purposes only. Any content sent to you is sent out as any newspaper or newsletter, is for educational purposes and never should be taken as a recommendation to buy or sell any security. The use of terms buy, sell or hold are not recommendations to buy sell or hold any security. They are used here strictly for educational purposes. Analysts price targets are educated guesses and can be wrong. Computer systems like ours, using analyst targets therefore can be wrong. Chart buy and sell signals can be wrong and are used by our system which can then be wrong. Therefore you must always do your own due diligence before buying or selling any stock discussed here. Past results may never be repeated again and are no indication of how well our SID score Buy signal will do in the future. We assume no liability for erroneous data or opinions you hear at our meetings and see on this website or its emails and reports. You use this website and our meetings at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

To understand completely our fundamental and technical approach to making money in the stock market read my book “Successful Stock Signals” published by Wiley. This is the method that I taught to professional portfolio managers on Wall St. and now I share these secrets with you with 50 stock picking programs picking winners every day. You receive our daily email of stocks with Buy Signals before the market opens.