Summary:

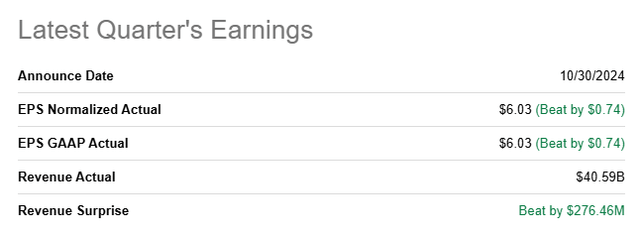

- Meta Platforms reported better-than-expected Q3 earnings on both the top and bottom lines.

- The social media company is growing its revenues at double digits. Users, ARPU, and FCF are also all growing.

- I see upside revaluation potential given the strength in the advertising market. The fourth quarter is typically a strong quarter for ad spending.

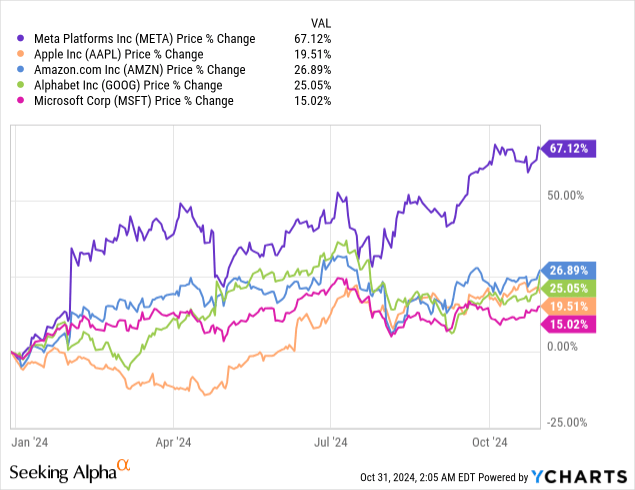

- Meta Platforms has outperformed other big tech companies by a large margin, yet shares remain the most competitively priced. This makes no sense to me, and I upgrade shares to strong buy.

Robert Way

Shares of Meta Platforms (NASDAQ:META) have been the strongest performer in the big tech group of stocks this year and for good reason. Meta benefited from continual momentum in the core digital advertising business, including in the third-quarter, and the amount of users in the Meta’s ecosystem continued to grow as well. The social media company also once again generated a material amount of free cash flow and Meta is buying back a ton of its shares. I believe Meta is undeservedly cheap and considering that the social media company again delivered strong top-line performance in Q4, driven by user and average revenue per user gains, I am upgrading shares to strong buy!

Previous rating

I recommended Meta’s shares in August 2024 after the company submitted its Q3 earnings sheet: Among the things that I liked were Meta’s free cash flow ramp, a rebound in the advertising business as well as considerable AI investments in order to boost new revenue streams (such as AI-powered glasses). In my pre-earnings work on Meta – A Make-Or-Break Moment – I said that the firm was investing heavily in AI to boost its growth. The social media company’s third-quarter earnings sheet was solid, and I continue to see upside revaluation potential.

Strong Q3 earnings and solid outlook for Q4

Meta reported better than expected top and bottom-line results for the third fiscal quarter: Google generated $6.03 per share in earnings in Q3’24 on consolidated revenues of $40.6B. The advertising giant therefore beat the consensus bottom-line estimate by $0.74 per share while its top line was $280M better than expected.

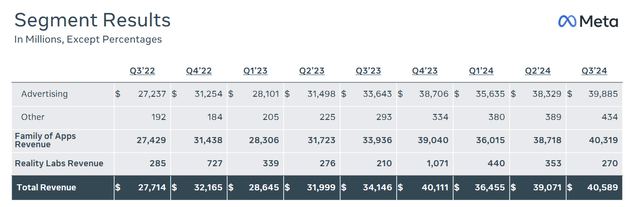

Meta generated $40.6B in revenue in Q3’24, showing 19% growth year-over-year. While revenues are clearly growing in the right direction, the social media company also saw a 3 PP sequential revenue deceleration. However, Meta’s Q3 results were overall very good, in my opinion, and the social media company continues to see a strong performance across advertising platforms.

In my pre-earnings work on Meta, I argued that long-term growth in the digital advertising market is the main reason for investors to own shares in the social media company… which indicates favorable ad pricing trends for Meta going forward. Meta’s growth in Q3 revenues was driven by a higher user count and a strong state of the digital advertising market that led to a high single-digit increase in average revenue per user. About 98% of all revenues came once again from the digital advertising segment.

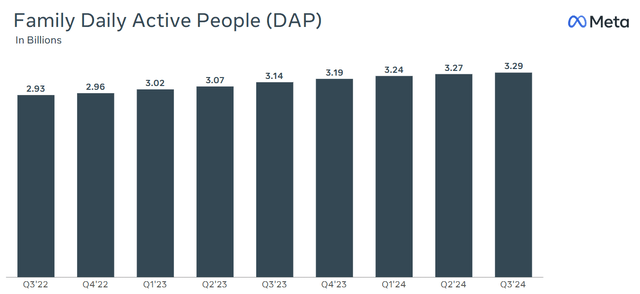

Another reason behind the company’s growth is that Meta is expanding its user base across demographics, highlighting that platforms like Instagram and Facebook are not outdated and still manage to attract both users and advertisers. In the third-quarter, Meta had 3.29B users in its ecosystem, showing an increase of 15M year-over-year (+5% Y/Y).

The main reason why I am up-grading shares of Meta to strong buy relates to a favorable outlook for the advertising industry paired with the company’s relatively low valuation. Meta, as I said in my last work, benefits from long-term growth in advertising spending and more advertiser money is set to be funneled into digital marketing channels. As a result, the outlook for ad pricing is favorable, in my opinion.

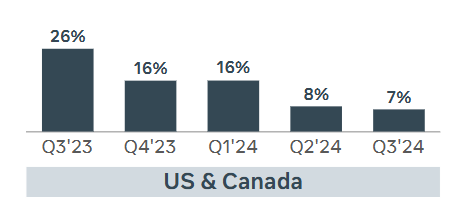

The chart below shows Meta’s growth in average revenue per user/ARPU, a key figure for social media companies, in its most important market, the U.S. & Canada. While ad prices have overall risen in the last year, the rate of growth has declined to 7% in Q3’24. However, the fourth-quarter should lead to a reversal here as it is typically a seasonally strong period for marketing companies due to the inclusion of a number of shopping events, including Black Friday and Christmas.

Meta Platforms

FCF margin expansion

Meta remained a true heavyweight in terms of free cash flow generation in the third fiscal quarter. Meta’s advertising platform generated a total of $15.5B in free cash flow in Q3’24 which reflects a year-over-year growth rate of 13.8%. The free cash flow margin, a strong indicator of platform profitability, managed to expand a massive 10.3 PP quarter-over-quarter to 38.2%.

|

In mil $ |

Q3’23 |

Q4’23 |

Q1’24 |

Q2’24 |

Q3’24 |

Y/Y Growth |

|

Revenues |

$34,146 |

$40,111 |

$36,455 |

$39,071 |

$40,589 |

18.9% |

|

Operating Cash Flow |

$20,402 |

$19,404 |

$19,246 |

$19,370 |

$24,724 |

21.2% |

|

Purchases of Property/Equipment |

($6,496) |

($7,592) |

($6,400) |

($8,173) |

($8,258) |

27.1% |

|

Payments on Finance Leases |

($267) |

($307) |

($315) |

($299) |

($944) |

253.6% |

|

Free Cash Flow |

$13,639 |

$11,505 |

$12,531 |

$10,898 |

$15,522 |

13.8% |

|

Free Cash Flow Margin |

39.9% |

28.7% |

34.4% |

27.9% |

38.2% |

-4.3% |

(Source: Author)

In the third-quarter, Meta repurchased $8.8B worth of its own shares, which calculates to a free cash flow return percentage of 57%. In the first nine months of the year, Meta conducted stock buybacks totaling $30.1B which compares to total free cash flow of $38.9B, implying a 77% free cash flow return percentage.

Meta’s valuation makes no sense

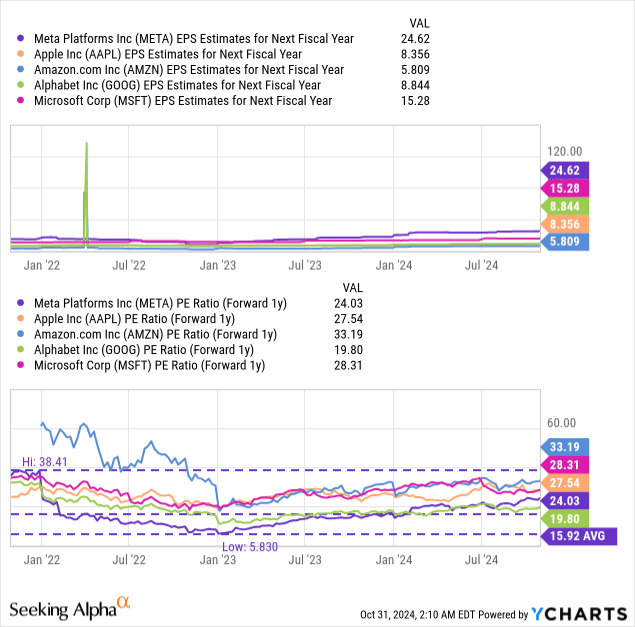

Meta’s shares have had a very good run this year and have been the best-performing stock in the big tech group. Meta’s shares have returned a solid 67% this year, the most of any big tech stock represented in the industry group below, but they are still cheap based off of earnings.

Meta is valued at a 24.0X forward P/E ratio – based off of consensus estimates of $24.62 per share for FY 2025 – which makes the company the second-cheapest big tech company in the industry group. The industry group includes tech stocks, excluding semiconductor companies: Apple (AAPL), Amazon (AMZN), Microsoft (MSFT), and Google (GOOG). The industry group average P/E ratio is 26.6X. Google also just reported rock solid results for its third-quarter, driven by Cloud, and with a P/E ratio of less than 20x, I consider Google’s shares to be steal as well.

I believe Meta could earn ~$25-26 per share in EPS next year, which is slightly better than the consensus estimate of $24.62 per share. In my opinion, a strong U.S. economy, falling inflation, favorable pricing trends for online ads (higher ARPU) and AI investments could drive stronger earnings growth for Meta Platforms going forward. If Meta revalues to the industry group average P/E ratio, then shares could have a fair value of $615-665 per share, implying up to 12%. This fair value range is a dynamic range which may rise or fall with trends in ARPU, users and free cash flow.

Risks with Meta

The only thing that I don’t like about Meta is that the company is not really diversified. Meta runs different apps and social media platforms, but as a whole remains dependent on digital advertising spend… which represented 98% of consolidated revenue in the third-quarter. Therefore, I feel that Meta is lacking in diversification, which makes Meta a riskier big tech play for investors than Microsoft or Amazon, which are more diversified. What would change my mind about Meta is if the company were to lose users or if its free cash flow margins contracted.

Final thoughts

Meta is in a sweet spot: the digital advertising market is in fantastic shape, revenues are surging and the company is swimming in cash, creating a whole bunch of value-creating opportunities for the social media company and its shareholders, like new AI investments or additional stock buybacks. Meta generated an unreal amount of free cash flow in the last quarter and continued to expand its free cash flow margins as well. If this momentum continues, which I expect, I believe Meta has considerable revaluation potential. Despite a 67% upside surge this year, Meta’s shares are still trading at only 24X FY 2025 earnings… which makes them the second-cheapest after Google’s shares in the big tech group. This, given a favorable outlook for the digital ad market and strong growth in revenues and FCF, makes no sense to me and I upgrade shares to strong buy!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, AAPL, AMZN, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.