Summary:

- MCD’s 4Q24 is likely to be pressured by a combination of E. coli impact and weakness in the GCC region and China.

- China’s competitive environment remains intense, with a combination of price deflation and weak consumer demand.

- McDonald’s shares remain mixed amongst investors with fast money shorting and long-only seeking safe harbor.

AntonioGuillem/iStock via Getty Images

McDonald’s (NYSE:MCD) Q3 comps missed consensus estimates driven by weakness in the international market, while the trend in the U.S. showed encouraging signs. Nonetheless, we expect shares to remain under pressure in the foreseeable future as MCD will likely see ongoing pressure post the E. coli outbreak and further weakness in the international segment.

In terms of buy-side expectations, our conversation with fund managers and analysts indicates that there is no clear consensus on the stock. The fast money hedge fund side will continue to see the shares getting hit from the E. coli outbreak, and management guidance along with the current consensus could be underestimating the extent of the impact on U.S. SSSg. On the other hand, the long-only investors are willing to stick with the name for the rest of the year, given the uncertainties surrounding the consumers, the election, and the international outlook regarding China and the Middle East.

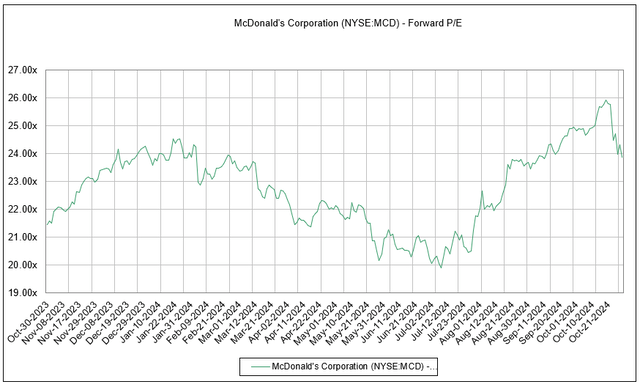

Worth noting that the current valuation of 23x 2025E P/E on the consensus estimate does not scream cheap, and there could be further downside risk should SSSg not show meaningful recovery or international not see signs of stabilization in the near term.

Consolidated SSSg of down -1.5% missed consensus estimate of a -0.67% decline. Although U.S. SSSg of +30bps was well ahead of consensus +19bps, international SSSg decline of -2.1% fell short of cons. -0.88% due to weakness in the U.K. and France, while the GCC and China largely drove the -3.5% decline in the international developmental licensed market (vs. cons. -1.44%).

U.S. recovery was positive with Q3 SSSg improvement driven by positive results from strategic executions that trend well into the first 3 weeks of October with positive MSD SSSg. $5 Meal Deal, Collector’s Edition cups, and Chicken Big Mac all contributed positively on demand and scale. More importantly, MCD saw visible share gain within the lower-income group and higher guest satisfaction scores.

Although we are positive about the recovery in the U.S., the ongoing E. coli outbreak could result in negative store traffic and SSSg since the outbreak, so restoring consumer confidence in a sensitive consumption environment will be management’s top priority as we close out the year. The return of the Quarter Pounder is a positive first step. Still, we feel it is too early to assume accelerated recovery and recommend investors wait for a better entry point. Longer-term speaking, introducing chicken tenders and Chicken Snack Wraps could be accretive to 2025E estimates, assuming a restoration of consumer confidence in the coming quarters.

International remains MCD’s biggest challenge, particularly in the GCC and China regions. In our view, the Middle East situation is largely out of MCD’s control and will likely pressure its regional performance as long as the regional conflict drags on. As for China, we believe a combination of weak macro and competitive micro will likely weigh on the SSSg in Q4.

On the macro side, Reuters reported that China is considering announcing a RMB 10 trillion new package at the end of next week’s National People’s Congress Standing Committee meeting to stimulate the economy. However, the initial read on this package is that the number is mainly within market expectations and that most of the new fund will likely be used to drive local government debt deleveraging rather than stimulating consumer spending. If this is the case, then China’s consumption environment is expected to remain depressed for the rest of the year, and the weak consumer spending is likely to put a further drag on traffic and extend the promotional environment in restaurants and catering, thereby pressuring the operating metrics.

On the micro side, we note that the hypercompetitive environment we have witnessed in coffee (see our report) has extended into fast food, with Burger King rolling out an RMB 9.9 promotion on items previously priced between RMB 14 to RMB22 on items such as single cheeseburger, chicken burger and whopper and in response to BK’s promotion, KFC (YUMC) and MCD also rolled out their aggressive discount. For MCD, they rolled out a RMB 14.9 for two burgers promotion and an RMB 10 buy-one-get-one-free snack promotion.

MCD had a very aggressive August promotion month to lure traffic into the stores. We suspect a similar promotion could surface in Q4 to defend market share.

McDonald’s China August Promo (McDonald’s China)

While promotion and menu innovation could help MCD attract foot traffic, localization remains a key to winning consumer mindshare. We note that the apple pie that was recently rolled out was complained about by many consumers for being overly sweet due to the cinnamon content, citing that the sweetness level may be more suitable for the American taste rather than the Chinese taste. Localization of taste is essential in maintaining market share, as is the case with Luckin Coffee, which has largely diluted its coffee to cater to the local taste.

As of the end of the quarter, MCD has been aggressively expanding its store count across the country, bringing the total number to 6,543, an increase of 961 units, accounting for 60% of MCD’s global new store units. In Q3 alone, MCD China has added 640 stores in total, compared with 36 stores during the same period last year. With a rising number of stores amid a weak consumer backdrop, productivity per store could be pressured.

In conclusion, we are cautious about MCD’s Q4 outlook, given the E. coli outbreak and ongoing uncertainties in China. We would avoid the shares until the operating metrics stabilize.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.