Summary:

- Microsoft remains a household name, integral to daily activities even for those outside finance, investing, or technology.

- I believe recent bearish sentiments and the current sell-off of Microsoft are based on misconceptions that I aim to clarify.

- Microsoft keeps breaking the bank and beats already high expectations.

- The Company is not losing its growth prospects, which are secured through ever-growing cloud and AI business segments that keep bringing us to the new era.

- Do you like highly profitable, innovative, and dynamically growing businesses that hold leadership positions in attractive sectors accompanied by secular growth? Choose Microsoft!

HJBC

Microsoft (NASDAQ:MSFT) is one of those businesses that doesn’t need much of an introduction. Even for those completely outside the finance, investing, or technology world – ‘Microsoft’ rings a bell and facilitates their daily activities.

Recently, the amount of bearish or semi-bearish voices regarding Microsoft has amazed me. Many of these cases are oriented around a few statements that I consider misconceptions. Moreover, Microsoft has just experienced a solid sell-off, leaving an opportunity for me and other investors to increase our long-term positions. Today, let me tackle some of them and explain why I believe that Microsoft:

- is NOT set to fail with its AI projects

- is NOT losing its growth drivers

- is NOT overvalued, especially given the current sell-off

Misconception #1: Microsoft Is Set To Fail With Its AI Projects

How could one arrive at such a conclusion? Well, as mentioned in RAND’s recent study:

- over 80% of AI-related projects fail

- just 14% of organizations stated to are ready to fully implement AI

I purposely abstract from technical matters such as the definition of ‘AI project’, ‘organization’, or ‘fully implement’. Why? Because in the case of Microsoft, these statistics just don’t matter.

Microsoft is easily one of the best businesses ever created and one of the most prominent technological giants, gathering brilliant minds all over the world. Its AI adoption is not just any ‘AI project’. It’s a true revolution of its already existing, broadly used environment of Azure or Microsoft 365:

MSFT’s AI investments facilitate customer endorsement and retention, encouraging them to rely even more on its solution environment. For instance, Microsoft 365 is the first platform to combine long-known products such as Office or Windows with the AI platform Copilot.

There are already meaningful numbers behind Microsoft’s AI-powered solutions, and the demand is ever-increasing. The matter of potential ‘failure’ is already out of the question, as (for example) Copilot adoption just keeps on increasing rapidly and is set to become a new day-to-day solution for a broad workforce. That’s how the ‘14% of organizations stated to are ready to fully implement AI’ doesn’t even apply to Microsoft, as its clients can harness the power of AI-based solutions seamlessly by simply extending their existing subscriptions (one can consider Copilot an ‘add-on’ to Microsoft 365).

Another thing that differentiates Microsoft’s solutions from ‘AI projects’ is the technological landscape it has access to. What we broadly understand as ‘AI’ or ‘Generative AI’ is developed thanks to highly complex Large Language Models (LLMs) that require thousands of simultaneous operations to train.

The only way to be able to meet such requirements is to utilize the state-of-the-art hardware designed purposefully for the task. 80% of AI projects fail? I guess that it wouldn’t be a stretch to state that the lion’s share of AI players don’t have access to the technology that Microsoft has. For instance, MSFT has recently shared its excitement about being the first cloud provider to utilize NVIDIA’s (NVDA) Blackwell architecture (currently the best GPU for LLM training).

Misconception #2: MSFT Loses Its Growth Drivers

Again, I’m glad to point out that AI is more than just a story. Rapidly increasing numbers prove that it’s a revolution in terms of productivity, effectiveness, and the way businesses and workers operate.

Microsoft is one of the leading players in space, driving the AI revolution. While the likes of NVIDIA make it possible through their outstanding products that bring the computing world into a new era, software providers are the businesses that transform our world. Microsoft, without a doubt, is one of them. Thanks to its already globally utilized Microsoft 365 environment and still gaining market share with Azure, I consider MSFT the most capable of facilitating the broad adoption of AI-based tools.

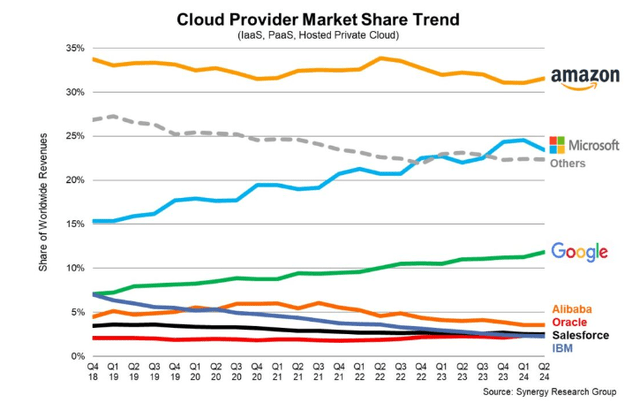

Seamless adoption of AI-powered tools under the Copilot drives the adoption each quarter. On the cloud front, although Azure is not the leading cloud provider in the market, as it still lags behind Amazon’s (AMZN) AWS in terms of market share, it’s the most dynamically rising one.

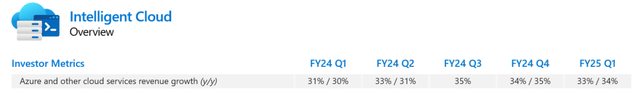

Microsoft continues to record significant growth within its cloud business, which has been driven by Azure, which records over 30% growth rates each quarter.

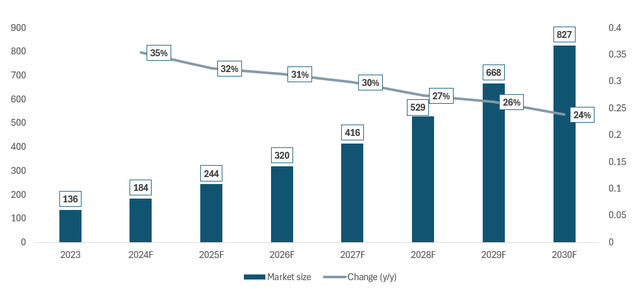

Moreover, the market is not shrinking. On the contrary, it keeps on expanding. According to Statista’s research, the global AI market size will record an overwhelming CAGR of 29.4% until 2030.

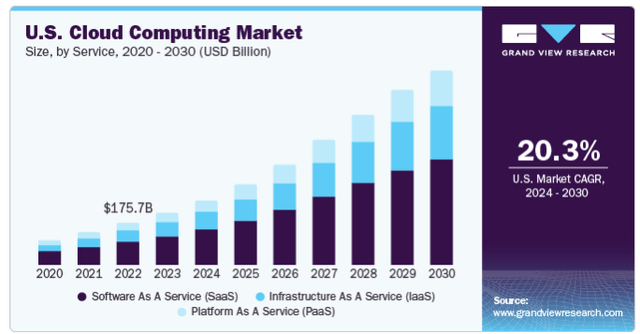

The case is similar for the US Cloud Computing Market, which, according to Grand View Research, is expected to grow at a CAGR of over 20% until 2030.

Misconception #3: Microsoft Is Overvalued

How can investors examine valuation? Let me assure you that the stock price itself is not enough, as it doesn’t account for changes in the business size, quality, and potential dilution. Multiple valuation method comes to our safety, utilizing intuitive ratios that combine ‘value’ metrics (e.g. Enterprise Value) with ‘financial’ metrics (e.g. EBITDA).

As an M&A advisor (fancy name for advising on buying and selling businesses), I usually rely on a multiple valuation method that is a leading tool in transaction processes, as it allows for accessible and market-driven benchmarking.

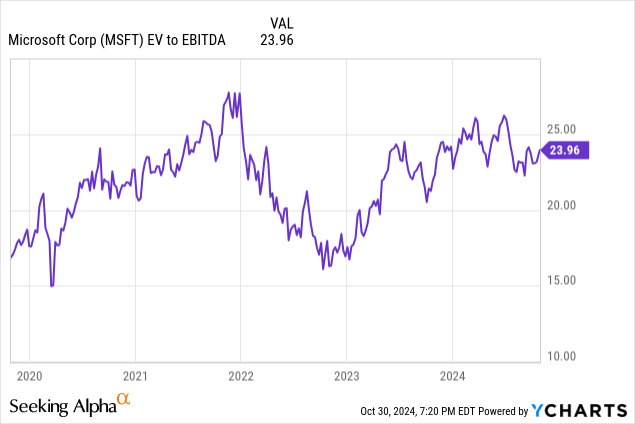

Let’s examine the development of MSFT’s EV/EBITDA multiple. I chose a 5-year time frame, as (especially 2022) set a new growth prospect for Microsoft when OpenAI brought ChatGPT and large language models to broad awareness.

Do I consider these multiples high in general? Well, yes, as in my advisory experience, I didn’t have many opportunities to reach ~25 EV/EBITDA ratios. However, one has to keep in mind that I worked predominantly with privately held, much smaller businesses that didn’t have such a competitive position as Microsoft does. With that in mind, its forward-looking EV/EBITDA of ~21.7x seems justified. Especially given my strong conviction that MSFT will continue to grow into its valuation and benefit its shareholders.

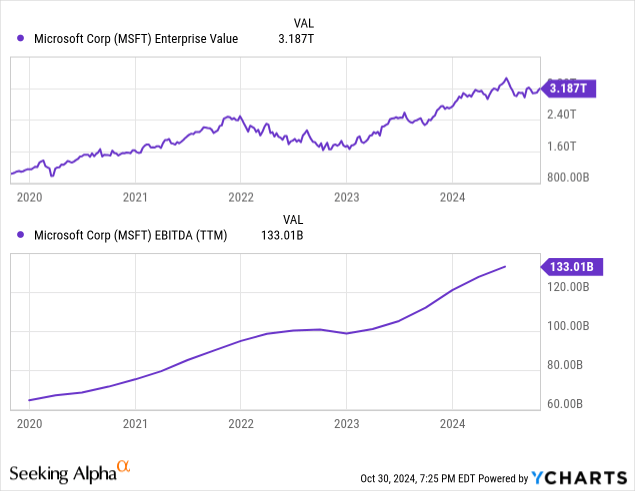

To further emphasize my point, please review the chart below and see how MSFT’s EBITDA has developed over the last five years. Naturally, it’s valuation followed, but I don’t think we’ve seen the end of it. Microsoft will continue to develop, innovate, and lead the AI revolution from a software standpoint. That’s the business worth paying a ‘premium’ for and holding in a well-structured portfolio.

Investment Thesis and Q1 2025 Overview

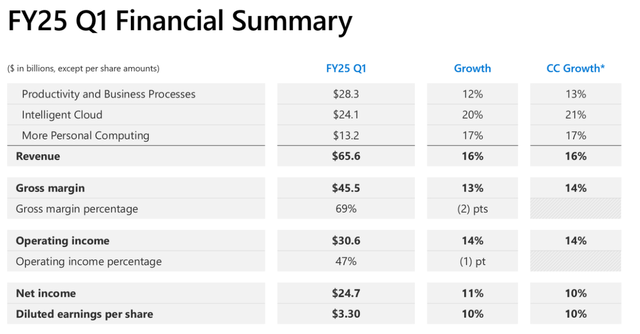

For more details, please refer to the (already written) many great summaries of MSFT’s results, which I wouldn’t like to restate. To put it briefly, once again, the Company crushed expectations, especially regarding its cloud business (driven by Azure, which beat expectations, delivering 33% growth vs the expected 29.4%) and profitability (adj. EPS of $3.3 vs estimated $3.1).

As Satya Nadella powerfully summarized:

AI-driven transformation is changing work, work artifacts, and workflow across every role, function, and business process. (…) We are expanding our opportunity and winning new customers as we help them apply our AI platforms and tools to drive new growth and operating leverage.

Your Takeaway

Given that Microsoft:

- has a top-tier profitability

- operates a diversified business model, with great performance across each sector and phenomenal across some of them

- leads the way for the software AI revolution

- has access to the state-of-the-art hardware to facilitate its innovations and solutions

- keeps exceeding expectations (even if it missed slightly, long-term oriented investors shouldn’t be worried too much)

- has an impressive history of M&A deals

- is NOT set to fail with its AI projects

- is NOT losing its growth prospects

- is NOT overvalued, especially given the current sell-off

I am happy to reiterate my previously assigned ‘strong buy’ rating with an even higher conviction. I’ve just added to my long-term position and will gladly observe Microsoft’s journey to the new era of productivity and software. The solid sell-off we just experienced poses a highly attractive opportunity for long-term-oriented investors who value leadership businesses with strong growth prospects and outstanding profitability.

Regardless, each stock market investment carries certain risks, which in the case of MSFT include:

- uncertainty regarding the economy and interest rate environment

- highly competitive market

- sensitivity to data breaches or cybersecurity issues

- stock price volatility

- usually very high (sometimes unreasonable) expectations

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, AMZN, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.