Summary:

- Nvidia Corporation’s automotive business is growing but remains small compared to its data center segment.

- The DRIVE platform, including advanced SoCs and Nvidia’s software ecosystem, positions the company to capitalize on the rise of autonomous vehicles.

- Analysts project Nvidia’s revenue will reach 400 billion USD by 2030, meaning the company’s automotive business is unlikely to be a material contributor.

- Despite this, self-driving vehicles are an important example of the real-world utility of AI.

Just_Super

Nvidia Corporation (NASDAQ:NVDA) has a sizeable automotive business that continues to grow at a healthy pace. This business is dwarfed by the company’s data center segment, though. Given the size of the end market, and the price sensitive nature of customers, Nvidia’s automotive segment is unlikely to ever be a particularly important standalone business. Training self-driving models is a demand driver for the data center business, though, and there are longer-term strategic considerations in areas like robotics. Nvidia’s efforts in this area also have significant implications for many companies, including Mobileye (MBLY), Qualcomm (QCOM) and Tesla (TSLA).

Market

McKinsey believes that autonomous driving could create 300-400 billion USD revenue by 2035, with most of this value coming from Level 4 capable systems. In terms of volumes, Level 3+ capable vehicles are expected to have a minority market share, though. This is due in large part to the rapidly escalating cost of providing more advanced functionality. Vehicles with LIDAR-based Level 2+ capabilities contain around 1,500-2,000 USD of components. In comparison, hardware- and software-licensing costs per vehicle for L3 and L4 systems are likely to be upwards of $5,000 USD.

While the opportunity is large, demand for different capability levels is still somewhat unclear. Around a quarter of survey respondents have suggested that they are likely to choose advanced AD features when purchasing their next vehicle. Only 26% are ready to switch to an autonomous vehicle, though, as trust is still a barrier to greater adoption.

Goldman Sachs expects autonomous cars to comprise 10% of new vehicle sales by 2030, with level 1 and 2 capable vehicles likely to dominate sales in the near-term. While 60% of current vehicles have some level of driver assistance, only 1-2% of total global vehicles sales in 2026 are expected to have Level 3 features. This is relevant for Nvidia as it is developing an advanced solution that appears to be more targeted at fully autonomous vehicles and robotaxis. Given that near-term demand is likely to be driven by driver assist and safety systems, Nvidia’s auto business may not see a real boost until later in the decade.

By 2030, several million commercial AVs could be deployed for ride-sharing, creating roughly a $25 billion USD robotaxi market. Adoption should be driven by costs, which are expected to fall from around $3 USD per mile for ride-sharing currently, to under $1 USD per mile for robotaxis by 2030 and 58 cents per mile by 2040. While this market could be a growth driver for Nvidia at some point, so far, this appears unlikely, as Google’s (GOOG) Waymo, GM’s (GM) Cruise, and Tesla (TSLA) have all elected to develop their own hardware.

Nvidia’s automotive opportunity is not solely dependent on self-driving, though. In-car entertainment is also a demand driver, and Nvidia wants to eliminate ECUs and centralize compute on its processors. By 2030, the global automotive software and electronics market is expected to be worth around $462 billion USD, representing a 5.5% CAGR from 2019. Of greater relevance to Nvidia, the ECU/DCU market is expected to be worth $144 billion USD and the software market $50 billion USD.

Nvidia Drive

The Drive platform is the heart of Nvidia’s automotive business. It is an open and modular platform that encompasses hardware and software, addressing areas like autonomy and in-vehicle experiences. It includes:

- SoCs – central computer for intelligent vehicles

- Drive OS

- DriveWorks middleware

- Chauffeur driving assistant

- Concierge intelligent services for drivers and passengers.

Drive AGX Orin is an SoC that integrates Nvidia GPUs with Arm Hercules CPU cores and deep learning and computer vision accelerators. It delivers 200 TOPs, nearly 7x the performance of Nvidia’s previous generation Xavier SoC. Nvidia’s hardware is programmable through open CUDA and TensorRT APIs and libraries. The company believes that Orin can support architecturally compatible platforms that scale from Level 2 to full self-driving functionality.

Nvidia also has a higher performance Thor SoC which is targeted specifically at autonomous vehicles. Thor uses Nvidia’s latest CPU and GPU advances, including the Blackwell GPU architecture for transformer and generative AI capabilities. Transformers process video data as a single perception frame, enabling the compute platform to process more data over time. Thor uses an Automotive Enhanced version of the upcoming Arm Neoverse Poseidon Platform, making it one of the highest performance processors in the industry. Thor also introduces 8-bit floating-point precision, making it possible for developers to transfer data types without sacrificing accuracy. It delivers 1,000 teraflops of performance, while reducing overall system cost.

Customers can also choose to connect two Thor SoCs via the NVLink-C2C chip interconnect and operate them as a monolithic platform. The Thor SoC is also capable of multi-domain computing, meaning it can partition tasks for autonomous driving and in-vehicle infotainment. With this capability, Nvidia is trying to centralize traditionally distributed functions, including digital cluster, infotainment, parking and assisted driving. Nvidia is targeting automakers’ 2025 models with Thor.

Drive OS is Nvidia’s in-vehicle operating system. It supports functionality like AI inference, computer vision, advanced graphics, high-end audio, and safety and security use cases. Drive OS also supports autonomous driving and AI-powered cockpit experiences. It includes CUDA libraries for efficient parallel computing implementations, TensorRT for real-time AI inference, and NvMedia for sensor input processing. Drive OS enables Linux or QNX as the application operating system.

DriveWorks provides middleware functions on top of the Drive OS, enabling developers to focus on AV software instead of low-level functionality. This consists of the sensor abstraction layer and sensor plugins, data recorder, vehicle I/O support, and a deep neural network framework. DriveWorks also provides optimized libraries and tools for tasks like image processing, point cloud processing and data manipulation.

Nvidia’s Hyperion reference architecture is designed to accelerate autonomous vehicle development, testing, and validation. It integrates Nvidia’s SoCs with a complete sensor suite, including 12 exterior cameras, three interior cameras, nine radars, one interior radar, 12 ultrasonics, one front-facing LIDAR, and one LIDAR for ground-truth data collection. Hyperion 9 is an open and modular platform for software-defined autonomous vehicle fleets. It features Thor computers and next-generation sensors and delivers 2,000 teraflops of performance. Hyperion 9 will enable level 3 urban and level 4 highway driving capabilities and is slated for a 2027 release.

Nvidia also offers Chauffeur, an AI-assisted driving platform designed to handle both highway and urban traffic. It builds on Hyperion’s high-performance compute and sensors to provide hands-off driving capabilities. It can also be used as a driving assistant, providing active safety features and the ability to intervene in dangerous scenarios.

Concierge is an in-vehicle AI assistant that provides intelligent services for the driver and passengers. Concierge also provides a visualization of what Chauffeur is sensing and planning and supports Chauffeur by monitoring the driver’s attention. In addition, Concierge provides automatic parking and summoning functionality. Intelligent services include an interactive avatar that assists with tasks like recommendations, phone calls, accessing vehicle controls, and the provision of alerts using natural language.

In addition to its solutions for automobiles, Nvidia has a range of solutions that help with the development of self-driving technology. From a revenue perspective, this is likely to be dominated by GPU sales to the cloud hyperscalers, but Nvidia has a suite of solutions that support this part of the business. This includes the company’s Omniverse Cloud Sensor RTX simulation software. The software provides physically accurate sensor simulation, enabling developers to test sensor perception and associated AI software in realistic virtual environments before real-world deployment. Nvidia also offers a range of tools that enable the development and deployment of self-driving software. This encompasses activities like data preparation, model training and optimizing for inference.

Nvidia has a clear strategy in automotive, which is similar to its approach in other end markets. In particular, Nvidia recognizes the importance of the software ecosystem, which enables developers to build on top of its hardware. Nvidia is also supporting the shift toward software-defined vehicles and is trying to centralize compute in vehicles by eliminating distributed ECUs.

I am not overly optimistic about the prospects of Nvidia’s automotive business, though, particularly at the lower levels of autonomy. Nvidia has less of an advantage in inferencing, and its pricing will likely make it a non-starter for many mass market vehicles.

Partners

Nvidia has a wide range of automotive customers, including:

- AutoX

- BYD

- DiDi

- Hyundai

- Jaguar Land Rover

- Li Auto

- Lucid

- Mercedes-Benz

- NIO

- Polestar

- Pony.ai

- Tesla

- TuSimple

- Volvo

- Xpeng

- Zoox.

More than 25 vehicle makers have adopted the Orin SoC, including 20 of the top 30 passenger electric vehicle makers in the world.

Given the functionality that Nvidia offers, customers can use Nvidia for vastly different reasons. For example, Cruise is using Nvidia’s technology to develop autonomous ride hailing services. Ford is working with Nvidia to enhance in-car entertainment and connectivity features, as well as advanced driver assistance systems. Toyota is also collaborating with Nvidia to create self-driving systems and connected car technologies for its vehicles.

BYD Company (OTCPK:BYDDF) is leveraging Nvidia Drive in its EVs and plans on using Nvidia for cloud-based AI development. BYD will also use Nvidia’s Isaac and Omniverse platforms to develop tools and applications for virtual factory planning and retail configurators.

Nvidia has also made selective investments in the self-driving ecosystem, similar to its initiatives in other end markets. This includes an investment in Wayve, a UK-based self-driving startup. Wayve is a Waymo competitor that is taking an end-to-end approach to self-driving technology. The round was led by SoftBank, with Microsoft also participating.

Competitors

While Nvidia currently faces limited competition on the training infrastructure side, competition is robust on the in-vehicle technology side of the business. Competition includes companies like Qualcomm and Mobileye, OEMs like Tesla, and eventually could include self-driving technology companies like Waymo. Nvidia’s solution is targeted upmarket relative to Qualcomm, which is targeting the middle market, and companies like Mobileye and Horizon Robotics that are targeting the lower end of the market.

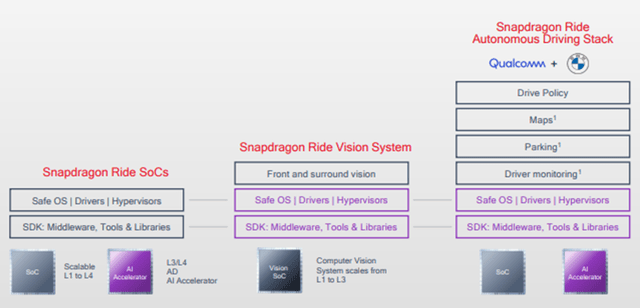

Qualcomm offers OEMs open and scalable solutions that enable internal software development efforts. The company’s Snapdragon Ride platform includes SoCs, tools and SDKs, drive policy and crowdsourced maps. The Snapdragon Ride SoC features ARM-based CPUs, GPUs, DSPs, ISPs and machine learning processors. Performance varies widely depending on the use case, with 30 TOPs for L1/L2 applications and over 700 TOPs at 130W for L4/L5 autonomous driving.

The Snapdragon Ride Vision system was launched in early 2022 and supports L1 to L3 ADAS/AD. It consists of computer vision software and a vision SoC and is designed to work with front and surround-view cameras. The Ride Vision system also enables AD map creation.

The Snapdragon Autonomous Driving Stack includes a multi-sensor environment model, low-level fusion, and AI-supported prediction and planning modules. Qualcomm is collaborating with BMW to develop capabilities across active safety to L3 automated driving.

Qualcomm customers include Volkswagen, Stellantis, General Motors, Ford, and Hyundai. The company also continues to attract new customers to its platform at a healthy pace. While Qualcomm’s automotive business has had significant commercial success recently, the company has a strong in-vehicle experience business, and it is not apparent how much of its growth is coming from ADAS/AD.

Figure 1: Qualcomm Snapdragon Solutions (source: Qualcomm)

Similar to Qualcomm, Mobileye offers a range of solutions across hardware and software, although is developing a more closed solution for customers that want something that is ready to deploy. Mobileye is also differentiated by its vertical integration, which includes developing its own sensors (imaging radar), a greater focus on developing its own self-driving software and plans to introduce an Autonomous-Mobility-as-as-Service solution eventually.

Mobileye has a suite of SoCs in the EyeQ family which are designed to enable functionality across basic driver assist to full autonomy. EyeQ Ultra is probably the most relevant product for Nvidia. It features RISC-V CPUs, a GPU, a vision processor, an image signal processing core, and 16 convolutional neural network clusters. EyeQ Ultra has been purpose-built for end-to-end autonomous driving and offers 176 TOPs. It is capable of processing input from separate camera-only and combined radar / LIDAR subsystems. Mobileye believes that Ultra is capable of providing Level 4 functionality and is more efficient than comparable solutions. Full automotive-grade production is expected in 2025.

Mobileye has been less focused on the in-vehicle entertainment side of the business in the past, although this could be changing with newer chips enabling multi-domain computing. The shift in strategy has likely been brought about by the success that Qualcomm and Nvidia are having.

While Tesla isn’t a direct competitor to Nvidia, it is developing comparable solutions, which could ultimately limit the size of Nvidia’s addressable market. Tesla began developing its own hardware in 2019, in line with the company’s vertical integration strategy. This gave Tesla control of a potentially strategically important technology and could eventually help it to reduce cost. Tesla now has solutions across in-vehicle software/hardware (Full Self-Driving) and training infrastructure (Dojo). The company is now using a vision only architecture with end-to-end neural networks trained on billions of miles of real-world data, meaning all capabilities are inferred from the data by the model, rather than hand coded.

In 2019, Tesla shifted to its internally developed FSD chip, with the new system referred to as Hardware 3. The FSD chip featured ARM CPUs, two neural network arrays and a Mali GPU. Each neural network array is capable of 36 TOPs. Radar sensors were dropped, starting in 2021, followed by the elimination of ultrasonic sensors in 2022. Hardware 4 began shipping in early 2023 and was Tesla’s first vision only system. Hardware 4 features twice the RAM and four times the storage of Hardware 3. It also reportedly offers 3–8 times the computational capabilities. In addition, Hardware 4’s cameras have 4-5x better resolution and fidelity than Hardware 3. Hardware 5 (subsequently renamed AI5) was announced in the middle of 2024 and is scheduled for release in early 2026. Musk has suggested that AI5 will offer a 10x improvement over Hardware 4, with 50x the inference power. It will also reportedly use up to 800 watts, versus 300 watts for Hardware 3 and Hardware 4.

Companies like Waymo and Cruise could also eventually become competitors. If the robotaxi market becomes commoditized and these companies are unable to capture sufficient value, they may choose to license their self-driving technology to OEMs.

Financial Analysis

Nvidia’s automotive revenue was up 11% YoY to 329 million USD in the first quarter. While this is a sizeable business in its own right, it is a sliver next to Nvidia’s enormous and rapidly expanding data center business.

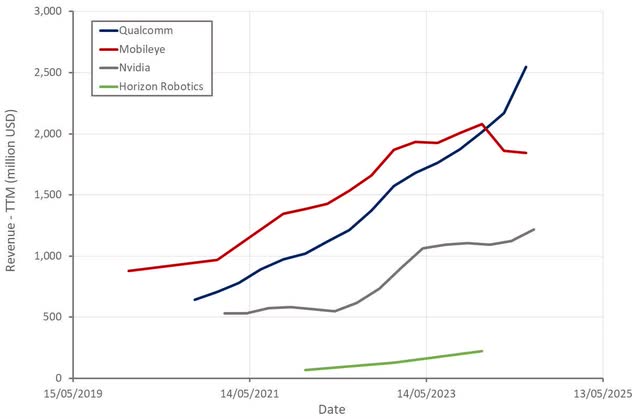

Nvidia’s automotive growth has been solid recently, although it looks soft relative to Qualcomm, which is rapidly establishing itself as a dominant player in the space.

Figure 2: Comparable Company Automotive Revenue (source: Created by author using data from company reports)

Nvidia’s CFO has suggested that nearly every automotive company developing AI is working with Nvidia. This includes companies like Mercedes, Volvo, and Hyundai and presumably refers to both companies deploying Nvidia solutions in their vehicles and companies using Nvidia to develop AI.

For example, Tesla is an important customer, despite investing in its own chips. Tesla currently has around 35,000 H100 equivalent GPUs installed and commissioned, although it has plans to significantly increase this number. The company expects to have around 85,000 H100 equivalent GPUs by the end of 2024 and has hinted at further increases down the road. For example, Musk recently claimed that Tesla’s new AI supercluster will grow to over 500 MW. Tesla’s hardware will reportedly constitute around 50% of the AI supercluster with Nvidia/other hardware constituting the rest. This presumably means about 500,000 H100 equivalent GPUs and roughly $10-20 billion USD CapEx, just on GPUs, although Nvidia is only likely to see around half of this.

Similar data isn’t readily available for Cruise and Waymo, but presumably these companies have lower compute requirements because of their relatively small fleets. In addition, Waymo potentially makes use of Google’s TPUs.

Mobileye also uses up to 500,000 cloud CPU cores to process approximately 100 petabytes of data every month. The company is spending close to 100 million USD on cloud compute and has also been investing in on-prem (H100 and A100 nodes).

Conclusion

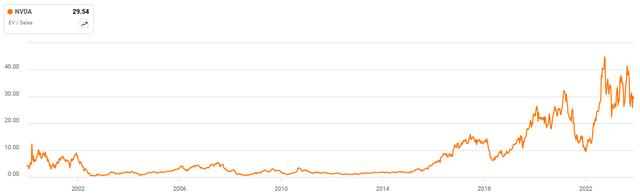

Analysts currently have Nvidia penciled in for close to $400 billion USD revenue by 2030. As a result, it is difficult to see the automotive business being an important contributor in its own right. Self-driving cars are significant for Nvidia, both because training could drive enormous cloud spend and because it is a significant real-world proof point for AI. Given recent investments in training infrastructure, if Tesla doesn’t make meaningful progress in FSD performance over the next 1–2 years, it will be a significant blow to the brute force scaling approach to problem-solving.

While investors remain extremely bullish regarding training infrastructure and foundation models, there is far less optimism regarding the prospects of companies deploying AI in real-world use cases. This probably won’t matter in the short term, but for hardware investment to continue increasing long-term, progress will need to be demonstrated in areas like self-driving.

Nvidia’s automotive business is likely to perform better if most OEMs develop their own self-driving technology. The real bull case is if the problem ends up being significantly more difficult to solve than most expect, requiring an end-to-end model trained on many orders of magnitude more data. This would increase the likelihood of Nvidia’s high-end chips being used for inferencing in vehicles and would create a large amount of data center demand. The risk for Nvidia is that the company’s willing and able to make this type of investment will also be inclined to develop their own hardware, like Waymo and Tesla.

Figure 3: Nvidia EV/S Multiple (source: Seeking Alpha)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MBLY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.