Summary:

- For quarter ended September 2024, Riot Platforms reported top line revenue of $84.8 million – a year over year increase of 63%.

- The company lost 54 cents per share in the quarter. From both net income and earnings per share standpoints, this was Riot’s worst quarter since ‘crypto winter.’

- Riot’s energy curtailment strategy lacks consistency and SG&A is enormous relative to industry peers.

da-kuk/E+ via Getty Images

When I last covered Riot Platforms (NASDAQ:RIOT) for Seeking Alpha, I was actively holding the company’s stock as a trade idea. The thesis behind that trade wasn’t technical in nature, but there was a shelf-life on the viability of the thesis. My argument back in June was that Riot could benefit from a hot Texas summer:

Between now and likely the end of September, Riot should be able to benefit from power credit optionality. If it’s hot and Bitcoin’s price returns are lackluster, Riot can instead go the energy route for monetizing power. This is not something that every public miner is able to do, so it gives Riot Platforms an advantage in the event Bitcoin’s summer month price languishes.

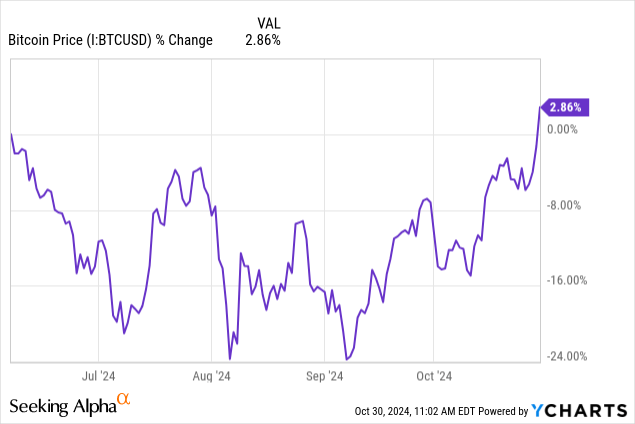

At that time of that publication of that article, the price of Bitcoin (BTC-USD) was topping out before a multi-week selloff that took the coin from $72k down to $53.5k by early-July.

As fate would have, the price of BTC is right back where it was in early June. The BTC pricing angle to my power credit thesis generally held up. The other half of my thesis did not. In this article, we’ll look at Riot’s Q3 earnings and assess whether RIOT is still a good trade with BTC now breaking out of multi-month resistance.

Riot’s Q3 Results

For quarter ended September 2024, Riot Platforms reported top line revenue of $84.8 million. This was a year over year increase of 63% and a sequential increase of 21%. 80% of that headline number came from Bitcoin mining with the rest coming from ‘engineering’ and ‘other.’ Importantly, Riot didn’t sell any BTC during the quarter.

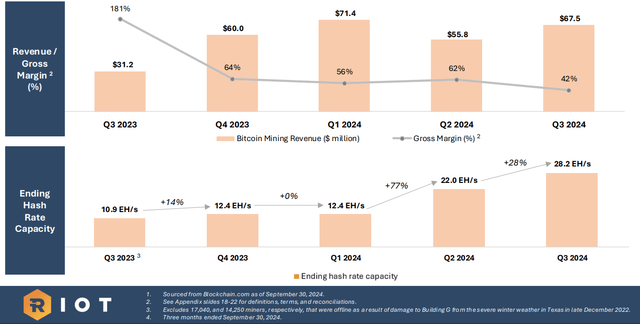

Q3 Investor Deck, Slide 8 (Riot Platforms)

Despite the block reward halving back in April, the company managed to mine 1,104 BTC. This was almost an identical number of Bitcoin compared with the 1,106 mined during the same period from the prior year. However, that post-halving BTC production has come at a considerably higher ‘all-in cost’ when adjusting for the company’s growth in installed exahash capacity.

Riot has simply made up for declines in gross margin by scaling mining capacity up over 28 EH/s. Notably, quarter ending hash rate capacity is more than double the 10.9 EH/s figure from the end of Q3-23. I think this really highlights the problem with long term reliance on the block reward subsidy as the primary incentive for transaction validation. The company’s self-reported cost to mine one Bitcoin including both power costs and hardware depreciation was $75.5k per coin during the quarter – nearly three times the figure from a year ago. And this doesn’t even factor in other opex costs.

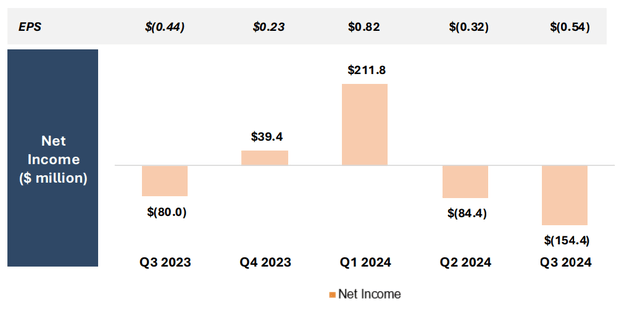

Q3-24 Earnings Deck, Slide 9 (Riot Platforms)

SG&A came in at $66.9 million. For the full quarter, the company reported a net loss of $154.4 million and a loss of 54 cents per share. From both net income and earnings per share standpoints, this was Riot’s worst quarter since ‘crypto winter’ even though Bitcoin spent most of the quarter between $58-65k per coin.

Power Credits

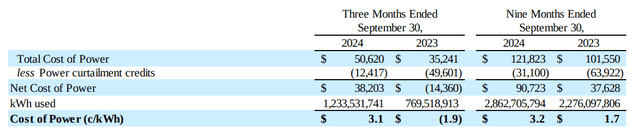

What has saved Riot’s bottom line in the past is the curtailment strategy that the company was able to execute during much of 2023. Riot’s curtailment strategy paid off so well last year, that the company actually reported a negative net power cost for the three months ended September:

Q3-24 Earnings Deck, Slide 18 (Riot Platforms)

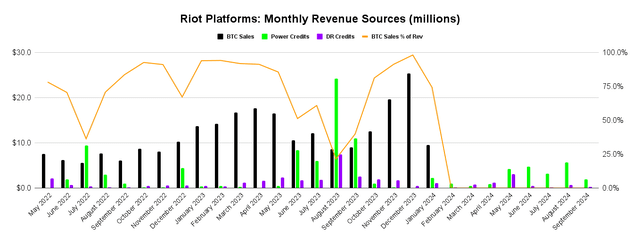

The company never sniffed curtailment credits to that degree this time around. Compared with 2023, the relative lack of energy and demand response credits during the Texas summer months has resulted in much less of an impact on the company’s net power cost. In the chart below, we can get a good visual sense for how the company’s power credit segment performed relative to last year and compared with BTC sales:

Monthly Revenue Breakout (Bitfarms, Author’s Chart)

What complicates things for Riot now financially is the company’s pivot from selling part of its BTC production to a 100% HODL approach. When combining BTC sales, power credits, and DR: 70% of Riot’s monthly monetary production came from BTC sales in 2023. That is no longer the case. So long as Riot is HODLing mined BTC and generating very little in the way of DR/Energy credits, I don’t see how the company can sustain a positive net income under this current strategy without significantly higher BTC prices. But even that doesn’t address the long term asset volatility problem.

Consider that mined BTC that isn’t sold is an unrealized gain rather than an actual sale of goods. If we’re simply leaving the company’s quarterly results to FASB accounting adjustments, I don’t see much of a reason to long RIOT over simply buying a spot ETF. The latter is certainly a lot less expensive to shareholders.

Bitfarms Fiasco

Something that I believe has weighed on RIOT’s stock price is the failed hostile takeover of mining peer Bitfarms (BITF). The result of Riot’s attempted takeover is a temporary truce between the two companies. As part of this agreement, Riot and Bitfarms will table merger talks through Bitfarms’ 2026 annual meeting. Thus, Riot is now the largest holder of BITF stock without a clear path toward full ownership of the company at this point in time.

| Bitfarms: Top 5 Holders | Shares Held or Principal Amt | Market Value |

|---|---|---|

| RIOT PLATFORMS, INC. | 90,110,912 | $184,727,370 |

| Invesco Ltd. | 19,712,032 | $50,659,922 |

| TIDAL INVESTMENTS LLC | 6,617,428 | $17,006,789 |

| VAN ECK ASSOCIATES CORP | 6,075,744 | $11,969,000 |

| STATE STREET CORP | 4,853,813 | $12,474,299 |

Source: Whale Wisdom

Riot’s Bitfarms position represents 19.9% of outstanding BITF common shares and is about four times the daily trading volume for the month of October. This means that even if Riot wanted to unwind its BITF position, it is unlikely to be able to do so without having a fairly significant impact on the share price. One could argue this makes Riot sort of a captive holder of BITF shares. For full disclosure, I actually happen to like BITF as a trade at the moment so I don’t think immediate share price declines in BITF will be an immediate risk to RIOT for the time being. But I do think longer term the BITF shares take away balance sheet optionality from Riot management.

Closing Summary

I’ve maintained for quite some time through my previous Seeking Alpha work that I don’t think Bitcoin miners are great long term investments without a meaningful rise in transaction fees on the primary blockchain layer. That being said, I think there are some miners that are better suited for speculative wagers than others. Yet, I’m struggling to see the bull case for RIOT relative to other opportunities. Perhaps the best thing RIOT has going for it is balance sheet strength with a large cash position and no debt. But the company now seems pot-committed to holding Bitfarms stock, which is eating up a considerable portion of Riot’s capital.

From an operational standpoint, Riot Platforms isn’t historically the most efficient miner measured by BTC per EH/s. The energy/DR credit strategy doesn’t seem to be a reliable way to mitigate energy costs. Riot Platforms has the highest SG&A cost as a percentage of revenue of any mining company with a top ten market cap – and by a wide margin. And for that expense, investors are getting a Bitcoin HODL play and 20% of Bitfarms. At this point, I think there are better opportunities elsewhere in both the industry and in the broad market overall.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BTC-USD, BITF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not an investment advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.