Summary:

- Unity Software Inc. reports Q3 results next week, with expectations for weak results.

- The company has a ton of potential in 3D and AI game development software, but consensus targets forecast limited growth for the next year.

- The stock isn’t wildly expensive at 4.5x sales targets, but the entirely new management team sets up for a spooky reporting period.

skynesher/E+ via Getty Images

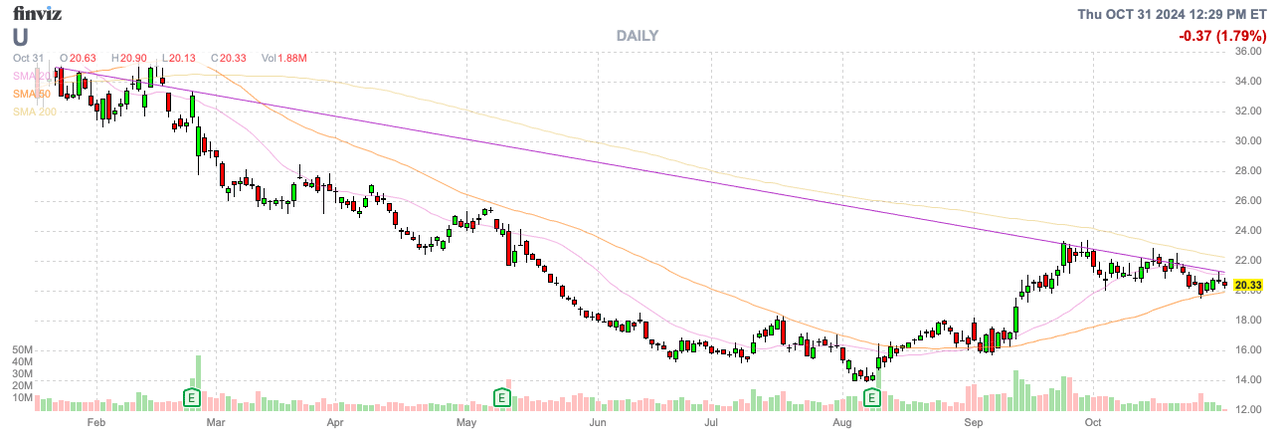

Unity Software Inc. (NYSE:U) is still in the midst of its turnaround, with the stock trending higher since Q2 earnings despite lowering guidance and shaking up management. The company has a massive opportunity ahead, and the stock has likely rallied on beating low expectations. My investment thesis remains Neutral on the stock, looking toward quarterly results next week to see any positive signs to warrant interest in the turnaround story.

Big Q3 Ahead

Unity expects to report Q3 earnings on November 7. Since the company guided down 2024 expectations and further shook up the executive team since ending Q2, the results are difficult to predict.

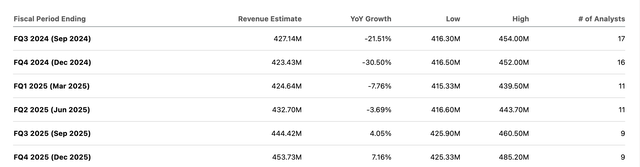

The gaming development software company reported Q2 revenues actually beat consensus targets back in August, but management slashed 2024 numbers. Unity reported quarterly revenues of $449 million, yet the consensus estimates have revenues only topping this number by Q4 ’25 with the lowest analyst estimates still flat with the forecast for Q3 ’24.

A big issue facing the company was the implementation of new fees called the “Runtime Fee.” Unity was planning to charge customers with a fee per install, in conflict with how games are developed.

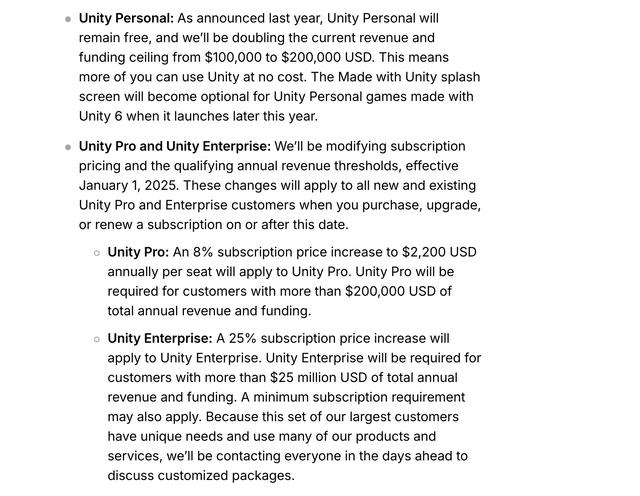

New CEO Matt Bromberg announced the elimination of the fee in September via this blog post. The Runtime Fee was eliminated, with Unity reverting to the seat-based model and hiking subscription fees based on apparent customer agreement to pay higher fees.

Source: Unity Software blog post

Unity will now move forward with price increases reviewed on an annual basis, but notably, the Unity Enterprise subscription price was hiked a rather large 25%. The company just launched the Unity 6 gaming engine on October 17. This could lead to a volatile period with vast changes to the pricing models and new management, along with a new software version with CPU performance improved by 4x in testing and dynamic AI experiences.

Along with the Q2 earnings report, the company announced the CFO was departing and a new Chief Product Officer for Advertising was hired effective August 12. The CEO only started on May 15 and CTO Steve Collins was just hired.

The gaming development platform enters the Q3 results with only the CEO in place for the full quarter and an interim CFO. The updated pricing model was just announced towards the end of Q3 and Unity just launched the new gaming engine with only a few weeks on the market in the earnings report next week.

In reality, Unity won’t have a full picture of the business until the start of 2025. The CEO has already had the chance to kitchen-sink expectations, with guidance cut along with the Q2 results. However, the new executive leader has changed a lot of the management team and the product pricing with unknown impacts, especially from a CEO not completely familiar with the customer base over such a short term on the job.

Stock Trough

While Unity is still in the midst of restructuring the business, the stock has already hit bottom months ago. The market cap has only rebounded to $8 billion versus levels regularly 5x higher when the stock traded above $100 during the COVID-19 boosts to mobile games, but Unity probably won’t rally much from here.

Even under the business reset, Unity still forecasts Q3 ’24 revenues of $420 million. The company is on the pace to produce ~$1.7 billion in annual sales.

The stock trades at just 4.5x 2024 sales targets. The valuation is intriguing, if Unity can return to producing growth via software sold to the gaming development sector and continue to expand into the industrial sector and others to increase the growth opportunity.

The company should be able to use its unique role in the marketplace, sitting at the intersection of mobile, 3D, AI, gaming, data, and digital advertising, to build a much stronger business with solid growth metrics. The disruption from the last year will take time to sort out.

Unity is targeting up to $350 million in adjusted EBITDA now for 2024, but the restructuring of the business makes profit metrics difficult to utilize to value a stock. The company was previously targeting $400+ million in adjusted EBITDA, and the reduced results have a higher impact on the bottom line due to leverage in the system for a high making software application.

Even with the target cut, Unity is attractively priced for a company with an opportunity in AI game development. The issue is that all the executive changes and disruption in the business will make the situation very difficult for the company to blow past current estimates.

If the company only turns the $420 to $425 million Q3 ’24 revenue target into just $454 million by next Q4, the stock likely doesn’t trade much higher for the next year.

Takeaway

The key investor takeaway is that Unity Software is in the midst of a scary turnaround. The quarterly results and guidance aren’t likely to improve until the calendar turns into 2025 and the company shows some stability in management and product pricing.

Investors should continue watching the story from the sidelines knowing Unity isn’t a bargain for the current financial targets, but the story could change fast in the next year, if new management executes.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to end October, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.