Summary:

- Novavax’ Q3 earnings are due on 6th November.

- The vaccine developer was part of Operation Warp Speed, receiving $1.8bn of funding from the US government to develop a COVID vaccine.

- Novavax succeeded, but Nuvaxovid came to the market too late to build market share and the company ended up making heavy losses.

- Sanofi has acquired the rights to nuvaxovid, paying Novavax $500m upfront, and will look to develop a COVID / Influenza combo vaccine using Novavax’ technology.

- Unfortunately, Sanofi milestones and revenues aside, that leaves Novavax with few opportunities to generate revenue, which likely means its valuation will fall over time.

MaximFesenko/iStock via Getty Images

Investment Overview

Novavax (NASDAQ:NVAX), the Gaithersburg, Maryland developer of protein-based vaccines coupled with its proprietary, Martix-M adjuvant, will announce its Q3 earnings next Wednesday, 6th November.

Novavax was a relatively unknown biotech, still chasing its first approval since becoming a public company in 1987, when the company was selected to be part of Operation Warp Speed, the US government’s COVID vaccine development program, in 2020.

As I have written in previous notes on the company:

Novavax received ~$1.8bn of funding from Operation Warp Speed (“OWS”), but despite delivering some strong safety and efficacy readouts, comparable to Moderna’s (MRNA) SpikeVax and Pfizer (PFE) / BioNTech’s (BNTX) Comirnaty, delays to completing Phase 3 studies meant that its candidate Nuvaxovid did not receive Emergency Use Authorisation (“EUA”) in the US until July 2022.

By that time, both Spikevax and Comirnaty, which received their EUAs in December 2020, dominated the COVID vaccine market, and although Novavax secured approvals in the UK, Canada, Australia, Switzerland, Singapore and New Zealand, and thanks to a partnership with the Serum Institute in India, South Korea, Thailand and Bangladesh, the company could not match its rivals’ earnings power, reporting revenues of $476m, $1.15bn, $1.98bn, and $984m in the four years since 2020.

Nor could Novavax return a profit in any of those years, reporting net losses of $(418m), $(1.74bn), $(658m), and $(545m) in the four years since 2020.

Its funding nearly exhausted, Novavax began 2024 warning about its ability to continue as a going concern, and its share price, which reached the dizzy heights of >$290 per share at the height of the pandemic, in early 2021, fell <$5 per share, around the same price it had traded in early 2020, pre-pandemic.

Then, the company took the market by surprise by announcing, alongside its Q1 earnings, that it has signed an agreement with French Pharma giant Sanofi (SNY) to co-commercialise a COVID vaccine. The deal saw Sanofi pay Novavax $500m up-front, and pledge up to $700m in “development, regulatory and launch milestones”, with Novavax receiving:

tiered double-digit percentage royalty payments on sales by Sanofi of COVID-19 vaccines and flu-COVID-19 combination vaccines, plus;

Additional launch and sales milestones opportunities of up to $200 million plus mid-single digit royalties for each additional Sanofi vaccine product developed under a non-exclusive license with Novavax’s Matrix-M adjuvant technology.

Novavax stock skyrocketed to >$20 on the back of this deal, which seemingly solves its funding issues and gives the company a new lease of life, even if, as I discussed in a Q2 earning preview note in July, Sanofi will earn the lion’s share of any future COVID vaccine revenues.

In Q2, Novavax reported $415m of revenues, which included $391m of the $500m Sanofi payment, and net income of $162m – only its second profitable quarter in the past ten – with cost of sales reported as $46m, R&D expenses of $107m, and SG&A expenses of $101m. Cash position was reported as $1.1bn.

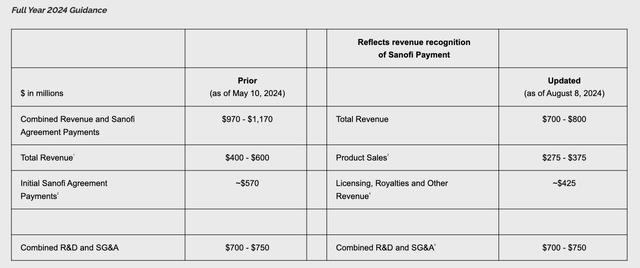

Full year 2024 guidance was presented as per the table below:

Novavax 2024 guidance (press release)

This slightly confusing picture essentially tells us that Novavax expects $175m – $275m of revenues in 2H24, “subject to updated variant manufacturing and regulatory approvals”. Given Novavx’ track record, my prediction is that revenues will ultimately come in at the lower end of guidance.

On the Q2 earnings call CEO John Jacobs discussed the company’s four new value drivers – its Sanofi partnership, late stage pipeline, further partnership opportunities related to its technology platform, and a new early stage pipeline. Let’s explore the potential of each.

Novavax’ New Value Drivers May Offer Limited Promise

From 2025, Sanofi will take over responsibility for commercialising nuvaxovid, with Novavax eligible for up to $350m of milestones, and a “tiered royalty on net product sales in the high teens to low twenties”.

If Sanofi successfully commercialises an influenza / COVID combo vaccine, there is also $350m of milestones on the table for Novavax, plus royalties in the “mid single digits to sub teens percentages”, and Sanofi will also pay Novavax $10m for any new candidate it decides to develop using Novavax’ technology, $200m in launch and sales milestones, and mid-single digit royalties on sales.

Value driver number one is almost guaranteed to generate revenue for Novavax, then, although it is hard to estimate how much, given the future market for COVID vaccination is highly uncertain, and the race to develop a first influenza COVID vaccine highly competitive.

Value driver number two, the proprietary late stage pipeline, has already hit a major road bump. Earlier this month, the FDA opted to place a clinical hold on Novavax’ Investigational New Drug (“IND”) application for its own COVID / Influenza combo (“CIC”) vaccine candidate.

According to a press release:

The clinical hold is due to a spontaneous report of a serious adverse event (SAE) of motor neuropathy in a single CIC Phase 2 trial participant outside of the U.S. who received the vaccine in January 2023

In response, Novavax’ Chief Medical Officer Robert Walker commented:

It is important to note that safety is our top priority, and while we do not believe causality has been established for this serious adverse event, we are committed to working expeditiously to fulfil requests for more information from the FDA. Our goal is to successfully resolve this matter and to start our Phase 3 trial as soon as possible.

It seems slightly bizarre that the Sanofi deal has left the door open for Novavax to produce its own CIC candidate, but nevertheless, Novavax had been promising Phase 3 data by the middle of 2025. As ever, however, there will now be a frustrating delay, and if the safety issues cannot be resolved, the project will have to be shelved altogether.

Value driver three, attracting other partners to work with its platform – is a speculative source of revenues. Granted, Sanofi was prepared to make a substantial payment to Novavax, but my feeling is that the Pharma’s attention is focused solely on squeezing as much revenues as it can from nuvavoxid sales, with all regulatory hurdles already cleared, and developing a CIC.

Would another Pharma or biotech look to develop other vaccine candidates using Novavax’ technology? It is not impossible – management’s execution, not the underlying efficacy of its protein based vaccine – is the main reason why the company has struggled in the past – however, Novavax’ may have to settle for unfavourable deal terms, and it may therefore be doubtful that this value driver will provide much more than ~$100m per annum, even in an optimistic scenario.

Finally, with Novavax’ track record – 35 years without a single approval to its name pre-pandemic – the value of its early stage pipeline must be considered negligible.

The Sanofi Paradox – Why I Still Don’t See Value In A Novavax Investment

Novavax took the market by surprise in Q1 with its announcement of the Sanofi deal, but I don’t see lightning striking twice – especially not in the same year – and I am struggling somewhat to see how Novavax shares will remain at current value – even after the sell-off in response to news of the FDA’s clinical hold, which dropped the share price from ~$13, to <$10.

The positives are that Novavax has cash and investments of >$1bn, and thanks to the Sanofi payments, is likely to break even in 2024. It is also notable that Pfizer has guided for ~$5bn of Comirnaty revenues in 2024, and has struck a bullish note on the long-term sustainability of COVID vaccine revenues.

With Sanofi assuming control of marketing and selling nuvaxovid from next year, if we assume it can gain a 15% share of a global market I’d estimate to be ~$5bn in size (I suspect Pfizer will generate no more than $3bn in coomirnaty revenues in 2025, spikevax perhaps $1bn, and other vaccines up to $1bn), then Novavax could earn ~$150m in royalties, and perhaps another $100m in milestones.

The final exciting catalyst is Sanofi’s CIC vaccine – Sanofi stated its intention on its Q3 earnings call with analysts to “immediately move next year towards Phase 3, assuming Phase 1/2 positive data”. I could see an approved CC vaccine generating ~$2bn per annum, which would generate ~$200m per annum for Novavax.

I don’t foresee any other clear revenues opportunities for Novavax, however, due to its poor track record developing vaccines in-house, which has already been demonstrated with the FDA’s recent clinical hold.

As discussed above, I don’t see many, if any companies approaching Novavax for access to its technology, which is viewed in many quarters as being somewhat antiquated and cumbersome.

My suspicion is that Sanofi made a good deal with Novavax because it benefits directly from nearly $2bn of R&D spending on the COVID vaccine, which it can market and sell every year going forward, and perhaps earn a few hundred million dollars from, while the CIC opportunity is speculative but potentially lucrative, and again, requires minimal R&D effort, the R&D having been completed at great expenses using tax payer funding during the pandemic.

I also suspect that Novavax would have been better off securing a full exit to Sanofi – an M&A deal, as opposed to the deal it has got, which limits its ability to earn from its only obvious source of revenue which is COVID vaccine or CIC revenues in future.

The optimal strategy for Novavax may be to keep reducing staff and costs and to accept that, Sanofi milestones and royalties aside, it has very few opportunities to generate revenue. As such, with SG&A costs falling, and no costs of sales fron next year onward, why not trim the R&D budget also, and passively accept income from Sanofi.

This strategy won’t result in Novavax growing its share price – I’d speculate it would shrink it to ~$1bn, on a maximum of ~$300m in annual revenues from Sanofi, in an optimistic scenario, but I don’t see any other viable strategies for the company, therefore, like it not, Novavax and its management may have to accept the direction the company is headed in and adjust to the new reality.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.