Summary:

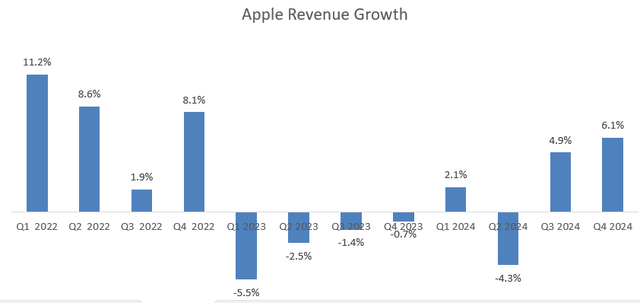

- Apple delivered 6.1% revenue growth in Q4, accelerating from previous quarters, driven by robust service growth and the launch of the new AI-enabled iPhone 16 powered by A18 chips.

- While I remain cautious about Apple’s growth prospects in China, the AI Intelligence platform could potentially shorten its hardware replacement cycle and accelerate its revenue growth.

- I am upgrading to a ‘Buy’ rating on AAPL, with a fair value of $240 per share.

Klaus Vedfelt

I presented my bearish thesis on Apple (NASDAQ:AAPL) in September 2024, citing the risk in the trifold smartphone market. Apple delivered 6.1% revenue growth in Q4, accelerating from previous quarters, driven by robust service growth and the launch of new AI-enabled iPhone 16 powered by A18 chips. I think their recent introduction of Apple Intelligence could further accelerate Apple’s revenue growth in the future. I am upgrading to a ‘Buy’ rating with a fair value of $240 per share.

Apple Intelligence

On October 28th, Apple announced the launch of Apple Intelligence for iPhone, iPad and Mac, a personal AI app to help users refine writings, summarize notifications, mail, messages and third-party apps. In addition, Apple has enhanced their Siri, making it more natural, flexible, and deeply integrated with iOS. These enhancements could enable users to use natural language to perform some AI-powered tasks. I believe Apple Intelligence could benefit Apple in several ways:

Apple Intelligence could potentially strengthen users’ loyalty to Apple’s devices across iPhone, iPad and Mac. With these AI-powered functions, users can easily turn a mobile device into a powerful tool for search, content creation, task management as well as professional writings. As shown in the case below, users can record and transcribe audio in their mobile devices, which Apple Intelligence can easily summarize, saving significant time for users.

Apple Website

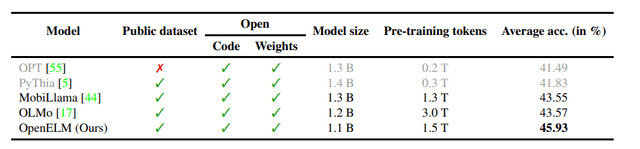

- More AI companies are launching the mini version of LLM models, which can run on mobile devices rather than through cloud servers. For instance, Apple has launched their OpenELM, an open AI language model could operate on a smartphone. According to their whitepaper, OpenELM outperforms comparable-sized existing LLMs pretrained on publicly available datasets, as detailed in the table below.

Apple Website

These smaller AI models could allow Apple to leverage Apple Intelligence to perform AI tasks on-device, improving productivity and saving time for end-users.

Lastly, Apple Intelligence could potentially accelerate the replacement cycle for Apple’s devices. These AI-powered features could encourage end-users to upgrade their iPhone, Mac or iPad. In addition, Apple could build an AI-powered ecosystem fully integrating third-party software and platforms on its devices.

Q4 and Outlook

Apple released its Q4 result on October 31st after the market closes, delivering 6.1% revenue growth and 9.7% operating profit growth. Apple’s growth has been accelerating in recent quarters, driven by strong service growth as well as new products sales like iPhone 16 lineup, Apple Watch Series 10 and AirPods 4. More specifically, iPhone revenue increased by 6% year-over-year, and services grew by 12% year-over-year reaching an all-time high in revenue. My biggest takeaway from the quarter is the management’s strong confidence in Apple Intelligence, which could help Apple grow its both hardware and service businesses going forward.

Apple Quarterly Results

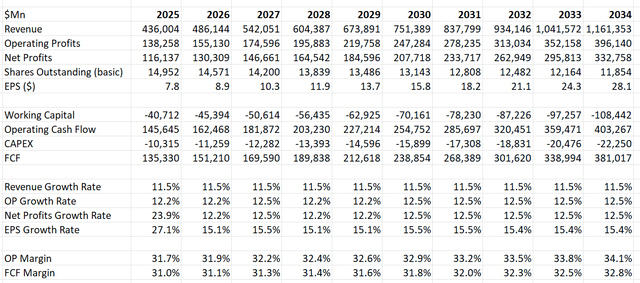

For normalized revenue growth, I am considering the followings:

- As discussed in my previous article, Apple is facing strong competitions in China from local brands like Huawei, Xiaomi, and Vivo. I don’t think China will be a major growth driver for Apple in the future. As such, I continue to forecast China will grow by 5% in the future, reflecting Apple’s potential market share loss.

- With investments in AI and Apple Intelligence, Apple is likely to continue delivering strong growth in their mobile device market. As more AI models run on devices, I anticipate Apple’s replacement cycle will be shorter, and its revenue growth will be accelerated. As such, I have revised their hardware business growth to 9%, up from 7% in the previous model.

- I continue to believe Apple’s service business will sustain strong momentum, growing by 15% annually driven by Apple’s large install base and ongoing investment in services.

Putting together, I have revised Apple’s organic revenue growth to 11.5%, up from 9.1% in my previous DCF model. I continue to model 20bps annual margin expansion, driven by 10bps from gross profits and 10bps from SG&A leverage.

The WACC is calculated to be 12% assuming: risk-free rate 3.8%; beta 1.2; equity risk premium 7%; cost of debt 5.28%; equity $2.84 trillion; debt $111 billion; tax rate 16%. With these assumptions, the DCF can be summarized as follows:

Apple DCF

According to the current DCF model, the fair value is calculated to be $240 per share, after discounting all the future free cash flow.

Key Risks

On September 10th, 2024, the Court of Justice of the European Union (CJEU) ruled that two Irish subsidiaries of the Apple group received unlawful State aid from Ireland. CJEU rules Apple must pay EUR 13 billion in the State Aid case. As a result, Apple indicated that the company would record a charge of up to $10 billion related to the case. During Q4, Apple recorded a one-time income tax charge of $10.2 billion, which relates to the State Aid case, as noted in the earnings call.

End Note

While I remain cautious about Apple’s growth prospects in China, the AI Intelligence platform could potentially shorten its hardware replacement cycle and accelerate its revenue growth. I am upgrading to a ‘Buy’ rating on Apple with a fair value of $240 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.