Summary:

- Apple and Amazon’s upcoming Q3 2024 earnings reports are in the spotlight.

- Market participants are concerned about rising AI capital expenditures impacting profit margins.

- Can Amazon rebound from a disappointing Q2?

- Apple iPhone 16 sales in focus after strong debut in China.

Images By Tang Ming Tung/DigitalVision via Getty Images

By Zain Vawda

Earnings Season Brings AI Capital Spending into Focus

Earnings season continues today with two more “Magnificent 7” earnings releases in the form of Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN) expected after market close. Market participants will be keeping a close eye on the releases after Meta (META) and Microsoft (MSFT) yesterday revealed increases in capital expenditure related to AI. Wall Street, however, remains concerned that such expenditure could hurt profit margins, something they may have to accept in the short to medium term as the AI race heats up.

Meta and Microsoft both topped revenue and profit expectations, however, the rising capital expenditure spooked market participants. This left both Meta and Microsoft down around 4% after the earnings release.

Microsoft’s capital expenditure rose 5.3% to $20 billion in the first fiscal quarter, while predicting an increase in spending on AI in Q2. This means that Microsoft now spends more money in one quarter than it used to spend in a whole year before 2020. For Meta, their spending in one quarter matches what they used to spend in a year up until 2017. One can understand the concern by Wall Street despite the potential payoff from AI capital expenditure.

Let us take a look at what to expect and keep an eye on when Amazon and Apple report later today.

Amazon Q3 2024: Amazon to Shake off Poor Q2 Earnings

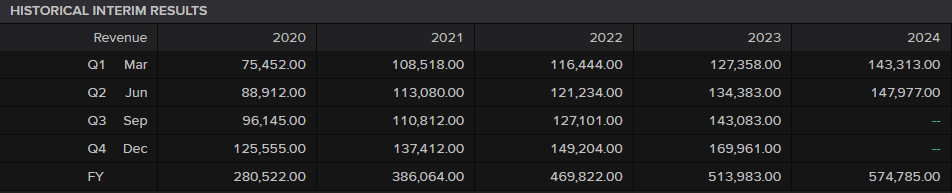

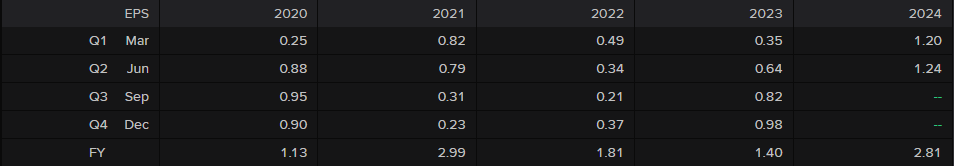

Amazon is getting ready to announce its Q3 2024 earnings, and experts expect a revenue increase of 9.9% over last year, reaching $157.4 billion. This good news comes after a tough Q2 when Amazon’s stock dropped.

Investors want to see if the company can recover and get closer to its previous high stock prices. The main focus will be on how well Amazon’s online shopping and cloud services are doing, as these have been big moneymakers in the past. Market participants will also be interested in how Amazon is managing costs and adjusting to economic changes, especially around AI.

Revenue Historical Results

Source: LSEG

EPS Historical Results

Source: LSEG

Apple Q3 2024: Is AI driving iPhone Demand?

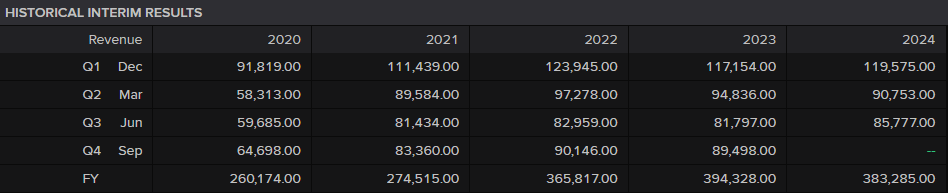

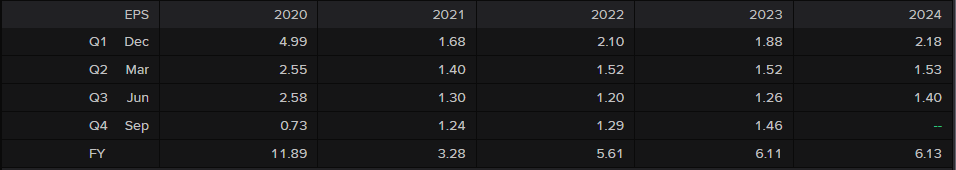

Apple is getting ready to share its Q3 2024 earnings, which is their first report since releasing the iPhone 16. Analysts expect revenue to reach $94.58 billion, up over 5% from last year. A big topic of interest will be how well the iPhone 16 is doing, especially after its strong start in China, where it sold 20% more than older models. With Apple’s stock up 20% this year, people are watching to see if the company can keep this success going.

Market participants will be looking closely at sales numbers for both the older iPhone 15 and the new iPhone 16, as well as the impact of other products like Macs and services. The market is eager to see how Apple plans to continue growing and stay ahead in the tech world.

Revenue Historical Results

Source: LSEG

EPS Historical Results

Source: LSEG

Key Takeaways and Thoughts

Earnings season has thrown a few surprises thus far, not least of which has been the revenue and profit beat by the majority of the Magnificent 7 thus far. However, the performance of the stocks and their impact on major Wall Street Indexes paint a different picture.

This leaves us with the question, what are markets focused on? As we discussed in the opening section of the article, capital expenditure on AI is proven to be a sticky point. This seems to be the main area of focus, as market participants appear concerned that this will have a big impact on margins moving forward.

Apple and Amazon are expected to be no different, with markets likely to pay more attention to the capital expenditure than revenue and profit. This is not to say that markets would ignore a significant miss or beat of expectations, but rather, that should the profit and revenue prints come in around expectations, then focus will likely shift to capex and in particular AI capex and investments.

Lots to consider as AI continues to grow its confluence both on companies’ direction and earnings potential.