Summary:

- iPhone demand looks solid, with a demand acceleration expected for 2025.

- App Store revenues rose 13.6% YoY to $7.8 billion in Q4, with total downloads increasing by 5.5% YoY.

- Apple aims to monetize Siri through an auction-based platform, potentially generating $3 billion annually by 2026 and $50 billion by 2036.

Remains

Apple’s (NASDAQ:AAPL) commercial momentum looks solid heading into the upcoming reporting season and the end of CY 2024. Indeed, iPhone 16 sales show solid momentum, with projections of 128-130 million units in 2H 2024 and a possible boom above 300 million units by 2025-2026 as AI features drive demand. At the same time, the App Store continues strong growth with a projected 13.6% YoY revenue increase in Q4 FY 2024, driven by both rising downloads and increasing revenue per download. As a potential long-dated growth angle, I am bullish on Apple’s opportunity to monetize Siri through AI-powered voice automation and an ad auction platform, potentially driving $3 billion in revenue by 2026 and $50 billion in the next decade (according to BofA estimates).

To provide some context on share price momentum, Apple stock has been able to perform relatively in line with the broader market this year (although slightly underperformed). While AAPL shares have climbed approximately 18%, the S&P 500 has posted a gain of around 21%.

iPhone 16 Sales With Solid Momentum

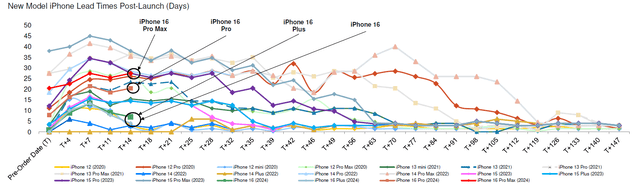

In the past few weeks, there have been reports indicating mixed performance of iPhone sales – see here and here vs. here. Personally, however, I am bullish on the iPhone as an ongoing driver of Apple’s earnings power, as medium-term demand trends look promising as AI continues to drive upgrades and consumer interest. On that note, Apple launched its newest series 16, including Pro, Plus and Max about a month ago, on September 9th. So far, sales trends look encouraging. Despite a softer start, lead times have started to extend, rather than contract, which suggests that demand is accelerating (Source: Morgan Stanley research note on Apple, dated 30th September). I now estimate that total iPhone sales would range 128-130 million units in 2H CY 2024, which is about would bring total year iPhone shipments about 3-5% lower compared to 2023.

Looking further ahead, the broader AI-upgrade cycle should remain a solid driver of demand. On that note, I believe iPhone sales may boom above 300 million units in 2025 and 2026, as AI features should become more widespread. This may bring in about $270-290 billion in revenues, estimating an ASP of $900-975 per iPhone.

App Store Continues To Boom

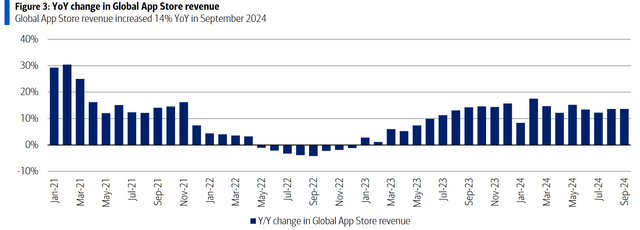

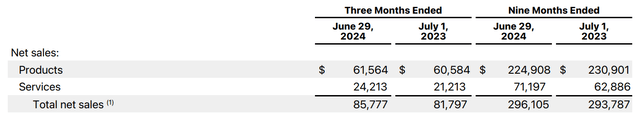

Apple’s second leg, the App Store, building on the iPhone ecosystem, appears to be doing well too. According to data provided by SensorTower, and mapped by Bank of America’s research department (Source: BofA research note on Apple, dated 1st October), App Store revenues for the fourth fiscal quarter is projected to grow by 13.6% YoY, to $7.8 billion. Strong revenue trends were maintained through September, when global App Store revenue increased again by 14% YoY.

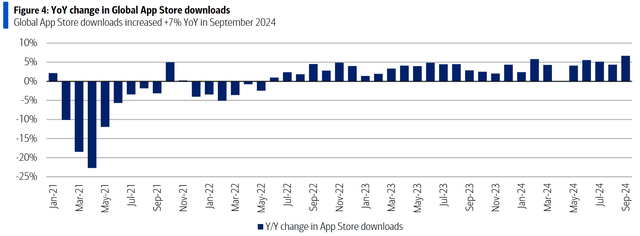

At the same time, total downloads for iPhone and iPad grew by 5.5% YoY, reaching 8.9 billion.

For context, as of Q3 FY 2024, Apple’s Service revenue accounts for about 27-28% of group revenue. And although I have previously argued that Apple’s monopoly power may invite a regulatory push towards reducing the Apple App Store fee, this concern has not yet been reflected in the data. According to SensorTower data, Apple’s revenue per download on the App Store increased by 7.7% YoY during the latest quarter.

Siri Monetization Upside

In addition to the hardware angle of the AI tailwind, Apple also has potential to leverage upside in software – specifically through Siri. Indeed, Apple is positioning Siri as a key monetization driver through deeper integration across its ecosystem. As Siri evolves into a smarter AI-powered assistant, Apple may aim to shift user interactions from manual app selection to voice-activated automation. This could unlock substantial new revenue streams. A major component of this strategy is the development of an auction-based ad platform, mirroring Google’s search ads model. In this setup, companies like Uber or Lyft could bid for top placement in Siri’s responses when users request a ride. This creates opportunities for Apple to earn from advertising and commissions. Bank of America Analyst W. Mohan and his team estimate that Siri integration with apps could drive $3 billion in revenues in 2026 and could approach ~$50 billion in a decade (Source: BofA research note on Apple, dated 27th September)

In our opinion, the interactions with smartphones will go from users choosing apps (currently we navigate to an app on the smartphone and use it) to letting Siri decide what app might be the “best” choice. This can open up an opportunity where apps compete for a user’s business. For example a user might say “Siri, find me a ride to my home” and various ride sharing companies as an example might want that business and bid on it. This is notionally not very different from a Google search result.

Investor Takeaway

Apple’s (AAPL) commercial momentum remains strong heading into FY 2024 Q4: iPhone 16 sales are robust, with expected shipments of 128-130 million units in the second half of the year, and projections for over 300 million units by 2025-2026 as AI features fuel demand. Meanwhile, the App Store continues its growth trajectory with a projected 13.6% YoY revenue increase in Q4 FY 2024, driven by higher downloads and rising revenue per download. Looking ahead, I’m optimistic about Apple’s long-term potential to monetize Siri through AI-powered voice automation and an ad auction platform, which could generate $3 billion in revenue by 2026 and $50 billion within the next decade, according to BofA estimates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.