Summary:

- Advanced Micro Devices, Inc.’s recent sell-off (over 10%) raises a key question — does ‘buy when others are fearful’ apply?

- Some analysts raised concerns about future growth prospects, but their approach may not apply to long-term oriented investors.

- I don’t expect AMD to overthrow Nvidia, but I believe it will still have enough room to expand, gain market share, and benefit shareholders.

- My bullish case for AMD got even stronger with Q3 results and the downward valuation shift.

- I have my skin in the game and have just increased my AMD position.

peshkov

Investment Thesis

While the earnings season tends to bring some dynamic stock price movements, I am actually surprised with Mr. Market’s reaction to Advanced Micro Devices, Inc. (NASDAQ:AMD) Q3 statement. For those unacquainted with the Mr. Market metaphor, it’s an idea propagated by Benjamin Graham. Essentially, it assumes that the market is not rational and often brings investors opportunities and traps, as it offers undervalued and overvalued businesses each day — depending highly on its mood swings.

Can AMD be such a case? I believe it can. I consider this crush an attractive opportunity to increase your position or build one. Since I already had my skin in the game, I’ve increased my position at AMD. Given the Company’s:

- increasing technological sophistication

- solid results in terms of both growth and margins

- more attractive valuation

- opportunity in the face of Blackwell shortages

- unique position to reiterate a key position in the sector

I have upgraded my rating from “buy” to “strong buy.” I increased my position today and will continue adding if the sell-out continues.

By no means do I consider this a short-term speculation or trading. I take a long-term approach and will evaluate these decisions after the “long-term” actually passes. Should you be willing to get a better grasp of the development of my views on AMD, please refer to the link below. I provided this update as AMD provided solid Q3 returns, which I believe facilitated my previously expressed rating and provided the first floor for a rating upgrade.

Underdog Mentality: Advanced Micro Devices Has A Place In AI Revolution.

Is The Drop Rational? Where Does It Come From?

Such an aggressive sell-out is a reaction to AMD’s Q3 2024 Earnings. Although AMD provided solid returns, Wall Street analysts seem to be worried about its ability to uphold growth in the upcoming year. As Morgan Stanley analyst Joseph Moore commented:

We remain impressed by AMD’s progress in all markets, especially AI — $5B in the first year of a brand-new product is a good achievement. But we have also highlighted that expectations are even higher, and unless the view is that AMD can take market share in CY25, which we do not forecast, there won’t likely be much sequential growth through the year given that we exit CY25 at an $8B run rate vs. the $5B in CY24 – which likely represents 15%+ market share in inference.

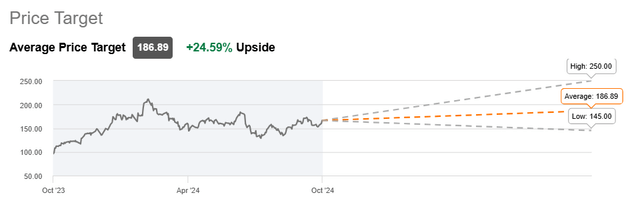

Although the comment doesn’t inspire much optimism, he has a price target of $169 per share (updated downward from the previous $178). However, retail investors (especially them) have to remember that one of the most important aspects of investing is the approach.

Are you a long-term investor? If so, ignore the short-term noise

Wall Street analysts, financial institutions, etc., are typically judged based on their quarterly/yearly results of previous recommendations. That’s a relatively short-term approach, and it doesn’t leave much room for secular trends to unravel and showcase the true intrinsic strength underlying a given business.

That’s where I and many retail investors differ. I have a long-term approach to investing and choose businesses that I feel comfortable holding for years. And I don’t care much about daily and weekly changes and buzz as long as fundamentals and value drivers remain intact. I only perceive them as buying opportunities and “hunt” Mr. Market’s mood swings, which allow me to increase my positions at favorable prices.

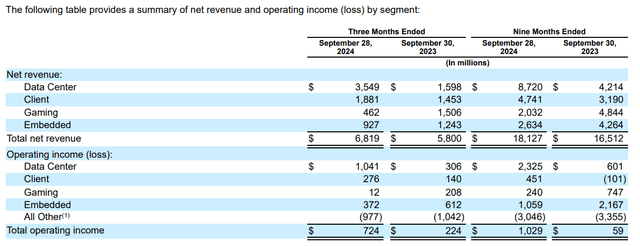

With that approach, AMD’s recent performance just impresses and doesn’t raise doubts regarding its rightful place in a well-structured portfolio. Although AMD saw some struggles in Gaming and Embedded product sales, its other segments cleared any doubts about the fact that Q3 2024 delivered solid results:

Third quarter revenue increased 18% year-over-year to a record $6.8 billion as significantly higher Data Center and Client Processor sales more than offset declines in Gaming and Embedded product sales. We expanded gross margin by 2.5 percentage points and increased earnings per share by 31% year-over-year as Data Center segment revenue more than doubled.

As I recently stated in my coverage regarding AMD, while many consider AMD a non-relevant player in the AI acceleration space living in Nvidia’s (NVDA) shadow, I don’t agree with that:

The ongoing AI revolution is not going anywhere. On the contrary, I believe it’s set to accelerate, providing a favorable environment for the likes of AMD to capitalize on.

Investors have to keep in mind that Data Center and Client segments account for the dominant share of sales, making these segments (especially Data Center) crucial to AMD’s operations and should be a key point of financial review. Therefore, despite worse performance in terms of Gaming ($462m in Q3 2024 vs. $1506m in Q3 2023) and Embedded segments ($927m in Q3 2024 vs. $1243m in Q3 2023), Q3 was an overall success, as Data Center segment indeed more than doubled its revenue recorded last year, while Client segment grew at over 29% rate y/o/y.

What’s also reassuring is the rapid increase in profitability of the Data Center segment, which amounted to 26.6% and 14.3%, respectively, for the nine months of 2024 and 2023 (in terms of operating income margin).

The Case Against AMD: Sector Leadership Is Unreachable, But That’s Not An Issue

I’ll play the devil’s advocate to avoid any confusion. I don’t believe AMD is likely to take over NVIDIA. I very much like the “leadership” case and own many “leaders” of their respective fields in my portfolio. While AMD is not one, the Company remains one of the crucial players in the semiconductor space.

How so? Well, while the Company’s upcoming MI325x compares strongly against one of NVDA’s most prominent solutions — H200 from the Hopper architecture, it will lag NVIDIA’s Blackwell GPUs, which have already started reaching customers.

Possibly, its recently previewed MI350 will stand a better chance, but by then, the Company may innovate its portfolio further. It’s worth noting Evercore ISI’s “analyst,” Mark Lipacis’, insightful comment:

History shows that one ecosystem typically captures 70-80% of the value of each computing era, which we’ve argued would be NVDA, leaving 20-30% of a rapidly growing market for AMD to prosecute as the only other merchant chip supplier.

Therefore, I don’t expect AMD to overthrow NVDA, but I believe it will still have enough room to expand, gain market share, and benefit shareholders.

Valuation Outlook And Growth Prospects

As an M&A advisor (fancy name for advising on buying and selling businesses), I usually rely on a multiple valuation method that is a leading tool in transaction processes, as it allows for accessible and market-driven benchmarking.

AMD’s EV/EBITDA multiple stood at:

- for trailing twelve months: 53.2x

- forward-looking: 45.5x.

Such a disparity between the abovementioned metrics constitutes the market’s expectation of solid growth from AMD, which will help the company grow and further increase its valuation. The important question is whether this growth is possible, which I believe it is certainly.

For reference, the forward-looking EV/EBITDA stood at:

One could conclude that AMD is overvalued by just looking at these numbers. However, it’s essential to understand the business-related metrics behind them. With that in mind, I believe that AMD’s current valuation creates an attractive entry-level, as AMD has much more growth to showcase, even within its AI-accelerating products, which continue to attract customers and drive the company’s financial performance.

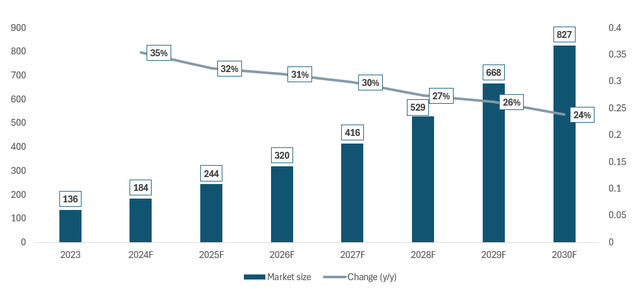

The market will grow, and the AI revolution is not going away, as some claim. According to Statista’s research, the global AI market size will record an overwhelming CAGR of 29.4% until 2030.

AMD is well-prepared to capitalize on these dynamic market changes and increase AI adoption, creating product demand. Referring to my previous points, AMD also likes to take a look at the business from a long-term perspective:

Longer term, we have successfully accelerated our product development pace to deliver an annual cadence of new Instinct products. Our next-gen MI350-series silicon is looking very good and is on track to launch in the second half of 2025 with the largest generational increase in AI performance we have ever delivered.

Development on our MI400 series based on the CDNA Next architecture is also progressing very well towards a 2026 launch. We have built significant momentum across our data center AI business with deployments increasing across an expanding set of Cloud, Enterprise and AI customers. As a result, we now expect Data Center GPU revenue to exceed $5 billion in 2024, up from $4.5 billion we guided in July and our expectation of $2 billion when we started the year.

Despite the noise and massive sell-out, Wall St. price targets (regardless of their comments) uphold expectations for solid upside potential. I believe that AMD will continue to grow into its valuation and expand it further, providing an upside that is at least consistent with Wall St.’s average price target, especially given the sell-off.

However, there are risk factors to consider

Regardless of my thesis, one has to consider risk factors, which include:

- stock price volatility

- susceptibility to geopolitical tensions and political decisions

- sensitivity to the state of the economy

- highly competitive market with a clear leader (Nvidia) that AMD still can’t catch up to on the technological level

- potential delays and struggles in delivering the road map.

Please note that each stock market investment carries market and company-specific risk factors. Furthermore, I’m a long-term-oriented investor and don’t exclude short-term volatility.

Conclusion

“Buy when others are fearful”

“Long-term approach to investing”

“Buy businesses, not stocks”

“Ignore Mr. Market’s mood swings.”

Are these sentences farfetched? Or maybe outdated? Or do they carry timeless wisdom? We may never know for sure, but I firmly believe they all apply perfectly to AMD’s current case. Given the Company’s:

- increasing technological sophistication

- solid results in terms of both growth and margins

- more attractive valuation

- opportunity in the face of Blackwell shortages

- unique position to reiterate a key position in the sector.

I upgraded my rating from “Buy” to “Strong Buy.” I increased my position today and will continue adding if the sell-out continues. By no means do I consider this a short-term speculation or trading. I take a long-term approach and will evaluate these decisions after the ‘long-term’ actually passes.

Regarding potential cons of AMD, investors should be aware that the likelihood of AMD improving its market position to a leadership status is very low, and I don’t believe it’s likely to occur. Moreover, certain risk factors apply, which I mentioned in the section above. Thank you, cheers!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.