Summary:

- Amazon.com, Inc. has been actively growing its digital advertisement business, offering more services such as sponsored products and Prime Video ads.

- In Q3, both the advertising business and AWS grew by 19% year-over-year, sustaining a strong growth momentum.

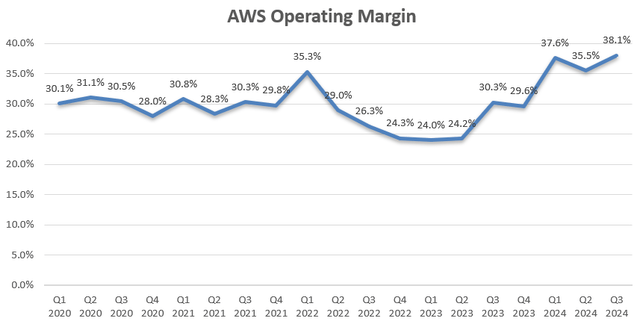

- My key takeaway from the quarter is the strong margin expansion in Amazon’s AWS business, delivering 38.1% of the operating margin in Q3.

- I reiterate a “Strong Buy” rating with a one-year price target of $258 per AMZN share.

FinkAvenue

I reiterated a “Strong Buy” rating on Amazon.com, Inc. (NASDAQ:AMZN) in July 2024, highlighting their business expansion into the grocery delivery market. Amazon has been actively growing its digital advertisement business, offering more services such as sponsored products and Prime Video ads.

Today, Amazon delivered a strong Q3 result, beating the market expectations. I believe the growth in ads will likely accelerate the company’s overall expansion in the future. I reiterate a “Strong Buy” rating with a one-year price target of $258 per share.

AI Creative Studio and Audio Generator

On October 15th, Amazon introduced AI Creative Studio and Audio Generator, two new generative AI tools for marketers. The new AI tools can assist advertisers to create engaging content across media types and eliminate boundaries across ad formats. With these new tools, Amazon expands its suite of AI-powered creative tools, including the Audio generator. According to the release, advertisers who used Image Generator between October 2023 and June 2024 saw almost 5% more sales on average.

As indicated over the earning call, advertising business remains an important contributor to profitability in the North American and international markets. Amazon is offering more advertising-related services like sponsored products and Prime Video ads. Amazon has generated more than $50 billion revenue in advertising business over the trailing 12 months, representing around 8% of total revenue. It is evident that Amazon is still in the early stages of building its advertising business.

Amazon Prime Video is set to introduce advertisements in its streaming business in 2025. As both Netflix, Inc. (NFLX) and The Walt Disney Company (DIS) launched their ads-supported streaming services recently, it has become standard in the industry to offer both ad-supported and ad-free subscription options to cater to different customer segments. Based on the success of Netflix and Disney, I anticipate Amazon will rapidly grow its video ads business in the future.

Q3 Result and Outlook

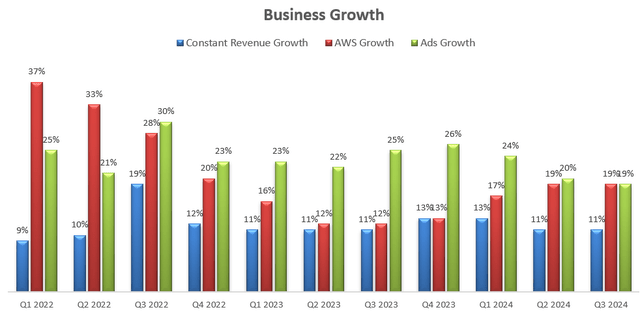

Amazon released its Q3 result on October 31st after the market close, delivering 11% constant revenue growth, as shown in the chart below. Notably, both advertising business and AWS grew by 19% year-over-year, sustaining a strong growth momentum.

My key takeaway from the quarter is the strong margin expansion in the Amazon Web Services, or AWS, business, delivering 38.1% of operating margin in Q3, as depicted in the chart below.

Amazon is guiding for 7% – 11% growth in revenue for Q4, including 10 bps headwinds from foreign exchange.

Microsoft Corporation (MSFT), Alphabet Inc. (GOOG), (GOOGL), and Amazon are dominating the cloud infrastructure space. Over the past few years, the three hyperscalers have expanded their platforms into cybersecurity, data analytics, AI, and database, supported by GUPs chips from NVIDIA Corporation (NVDA), Advanced Micro Devices, Inc. (AMD) and Intel Corporation (INTC). I don’t anticipate any significant market share change in the cloud infrastructure market over the coming years.

Fortune Business Insights predicts global cloud computing will grow at a CAGR of 16.5% from 2024 to 2032. I think the forecast doesn’t fully capture the potential growth from AI-related workloads. As enterprises develop their AI training and inference capabilities, they will likely migrate their workloads to public or hybrid cloud infrastructure, which could further stimulate AWS’s growth. Currently, major hyperscalers are growing their revenue by more than 20% annually. Therefore, I project AWS will sustain 20% revenue growth.

As discussed previously, Amazon is in the early stages of building its advertising business. I anticipate the ads revenue will represent around 15% of total revenue in the near future, contributing an additional 4% to the overall topline growth.

I forecast the North American business will grow by 8% annually, driven by strong business growth in their 3rd party services. Lastly, I continue to predict international business will grow by 12%, aligned with their historical average.

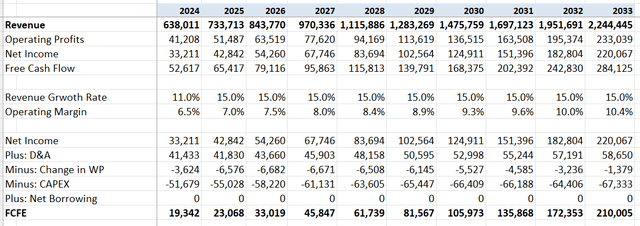

In total, I calculate Amazon will grow its revenue by 15% in the near future. I have revised the margin expansion to 40 bps-50 bps in the current DCF model. As digital ads and cloud businesses carry much higher margins, a shift in revenue mix would likely enhance the overall gross margin. I forecast a 10 bps margin expansion from gross profit due to the revenue mix shift, 10 bps-20 bps from reduced fulfillment expenses, 10 bps from R&D operating leverage and 10 bps from a reduction in marketing expenses.

I have reduced the cost of equity to 13.8% assuming: a risk-free rate of 3.8%; a beta of 1.44; and an equity risk premium of 7%. With these assumptions, I calculate the free cash flow from equity (FCFE) as follows:

Discounting all the future FCFE, the one-year target price is calculated to be $258 per share, as per my estimates.

Key Risks

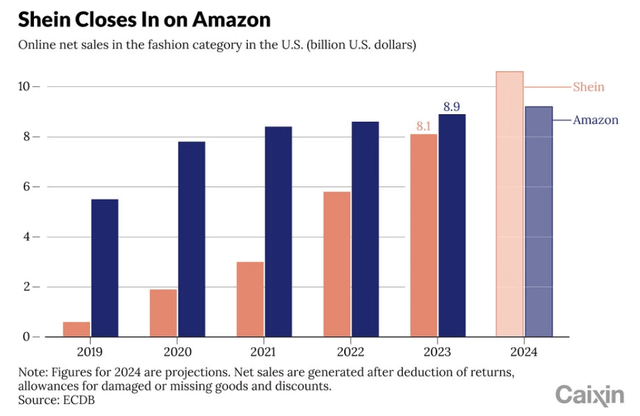

Chinese e-commerce platforms, such as Shein, Temu, AliExpress and TikTok Shop have been gaining market shares globally recently by offering ultra-low prices and free shipping for cross-border purchases. Notably, Shein has become the third-largest online fashion retailer in the US, trailing only Amazon and Walmart Inc. (WMT), and is expected to exceed Amazon in 2024, as illustrated in the chart below. The fast-growing Chinese e-commerce platforms could become a potential threat to Amazon’s e-commerce business.

End Notes

I am optimistic about Amazon’s business in both AWS and e-commerce, and the growing advertisement business could provide an additional growth driver in the future. I reiterate a “Strong Buy” rating with a one-year price target of $258 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.