Summary:

- Connectivity and media giant Comcast Corp. released its third quarter 2024 results today, beating both adjusted earnings per share and revenue estimates.

- The market reacted positively to what, I believe, were solid results, although I suspect the business separation hinted at by management played a role in today’s trading in CMCSA stock.

- In this update, I’ll share my thoughts on Comcast’s Q3 2024 earnings, focusing specifically on the bread-and-butter segment.

- I will also offer my opinion on the potential separation of the cable business and the impact such a transaction would have on my Comcast stock position.

JHVEPhoto/iStock Editorial via Getty Images

Introduction

Connectivity and media giant Comcast Corporation (NASDAQ:CMCSA) released its third quarter 2024 results this morning. The results were well received by the market, sending shares above $43 in early Thursday trading – back to levels last seen in late 2023 and early 2024. Comcast is up 18% from its 52-week low hit in mid-June, less than five months ago.

However, CMCSA stock has more or less treaded water since early 2022, with no significant catalysts in sight – at least not before today’s earnings report. That raises the question of whether it’s time to move on, or whether Comcast’s recent results and the business separation speculation should reinvigorate patience.

My last article on Comcast was published in early 2023, so quite some time ago. I’ll use today’s earnings announcement to share my thoughts on Comcast’s latest results, focusing in particular on its bread-and-butter segment. Importantly, however, I will also offer my opinion on management’s hinted separation of the cable business and the impact such a transaction would have on my position.

Comcast’s Q3 2024 Earnings And A Brief Look At Adjustments

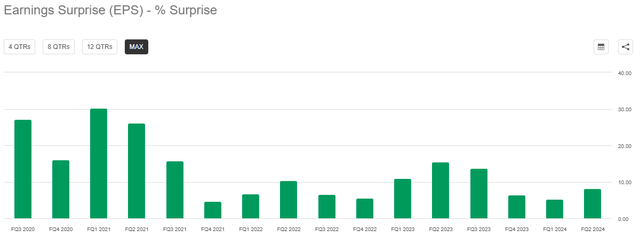

For the third quarter of 2024, Comcast reported adjusted earnings per share (EPS) of $1.12 and revenue of $32.07 billion, both above estimates. However, this double beat was to be expected, at least based on the company’s track record, which shows a tendency to underpromise and overdeliver (Figure 1).

Figure 1: Comcast Corp. (CMCSA): Earnings per share surprise on a quarterly basis (Seeking Alpha)

Analyst estimates for quarterly revenue implied 5.3% growth, while the actual result translates to 6.5% year-over-year growth. Either way, this is pretty solid for a $164 billion company “suffering from severe cord cutting” (the bears’ main argument). This warrants a closer look at Comcast’s segment performance, but first I want to briefly discuss earnings adjustments and free cash flow.

Adjusted EPS was $1.12 in the third quarter, up 3.3% from the third quarter of 2023. However, GAAP earnings per share were only $0.94, down 4.2% year-over-year. The difference between GAAP and reported EPS is attributable to the amortization of acquired intangible assets and revaluation of investments.

Starting with the latter, a minor adjustment – 2.3% of Q3 GAAP net income, or $83 million – is due to an increase in realized and unrealized losses on Comcast’s equity method investments (e.g., Hulu and Atairos). I think there is no doubt that it is appropriate that such valuation changes are not reflected in reported earnings. Investors who want to take a closer look at Comcast’s investments (current market value of $9.0 billion or about 3.3% of total assets at the end of the third quarter) should refer to Note 8 on p. 81 f. in the company’s 2023 10-K.

By excluding the impact of amortization of acquired intangible assets, Comcast was able to increase its reported earnings at the corporate level by nearly $1.5 billion, or 13% of GAAP net income, since the beginning of the year. This amortization expense, which amounted to $624 million or approximately 17% of GAAP net income in Q3, is entirely attributable to acquisition-related intangible assets such as customer relationships. Amortization of intangible assets resulting from capital expenditures (e.g., software) and amortization of acquired intellectual property rights used in Comcast’s theme parks are not excluded from reported earnings.

It’s possible, of course, that some of Comcast’s customer relationships are actually losing value over time, but that can’t be determined with certainty, let alone accuracy, based on the data at hand. Personally, I think it’s perfectly acceptable to adjust earnings for these expenses as long as the underlying performance remains solid (more on that in a moment).

All in all, I think Comcast’s earnings adjustments are reasonable, and it’s worth noting that, unlike many IT companies, Comcast does not exclude stock-based compensation from its reported earnings.

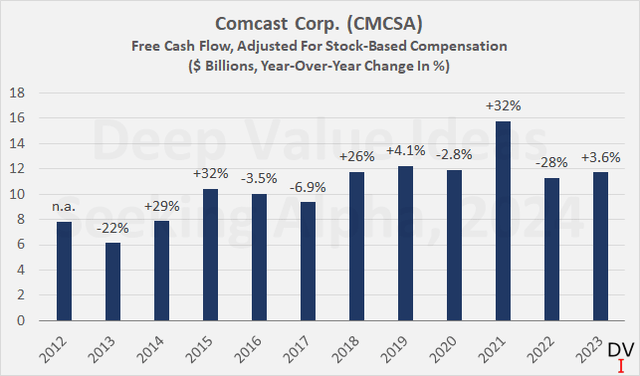

In terms of reported earnings translating into actual cash earnings, it is fairly obvious that Comcast has generated good (and growing) free cash flow over the past decade, although increased capital spending has led to stagnation in recent years (Figure 2). For the third quarter of 2024, reported free cash flow was $3.4 billion, down 16% from $4.0 billion in the third quarter of 2023. Excluding stock-based compensation, quarterly free cash flow was likely close to $3.0 billion, meaning Comcast returned slightly more cash to shareholders via dividends and share repurchases ($3.2 billion). As an aside, Comcast’s share buybacks have been really meaningful in recent years. For example, the number of diluted shares outstanding has fallen by more than 15% since 2018, or about 2.8% per year. Considering the valuation of CMCSA stock, I view this as money well spent.

I don’t see it as a negative that Comcast is temporarily returning more cash to shareholders than it is generating. The connectivity and media giant remains very well capitalized, has a conservative leverage ratio (most recently a 2.4x consolidated net leverage ratio, based on consolidated net debt of $89 billion), has a strong credit rating (A3 with a stable outlook, last affirmed on October 7, 2024) and shines with low free cash flow volatility due to the stability of its core business.

Figure 2: Comcast Corp. (CMCSA): Free cash flow, adjusted for stock-based compensation (own work, based on information from company filings)

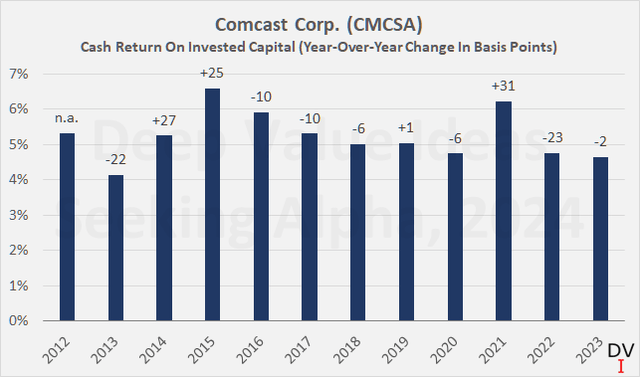

To strike a slightly more conservative tone, the stagnant free cash flow of recent years results in a relatively weak cash return on invested capital (CROIC, Figure 3), which is certainly below any reasonable estimate of the company’s cost of equity. However, it could be argued that the current investments in theme parks, the Peacock digital media platform, and content – which are largely reflected as capital expenditure – should be amortized over a long period of time. As a result, I think that free cash flow and consequently CROIC appear weaker on a forward-looking basis than they actually are.

Figure 3: Comcast Corp. (CMCSA): Cash return on invested capital; note that free cash flow has been adjusted for stock-based compensation (own work, based on information from company filings)

A Closer Look At Comcast’s Connectivity & Platforms Segment Reveals Resilience And Continued Strong Pricing Power

Revenue in the Residential Connectivity & Platforms division remained largely unchanged year-over-year, with a slight headwind due to exchange rate fluctuations.

The company lost 103,000 residential customer relationships domestically, while 78,000 relationships were added internationally. The number of business customer relationships remained largely unchanged. Taking a closer look, Comcast lost 87,000 broadband customers, which sounds like a lot. However, this decline represents less than 0.3% of the company’s total broadband customer base. On an annualized basis, Comcast’s domestic broadband customer base is down 0.95% compared to the end of the third quarter of 2023. However, despite the 0.95% year-over-year decline, Comcast reported revenue growth of 2.7%, indicating continued strong pricing power.

The number of domestic wireless lines increased 4.4% quarter-over-quarter and 20% year-over-year, while the number of video subscribers continued to decline sharply (-2.9% quarter-over-quarter and -11.5% year-over-year). The decline in video subscribers was not fully offset by pricing, resulting in a 6.2% year-over-year decline in revenue, while Comcast likely continued to promote its wireless lines and refrained from raising prices, as evidenced by revenue growth in line with subscriber growth.

Revenue in the Business Services Connectivity segment increased by 4.5% year-over-year, but due to the comparatively low contribution of the business segment, Comcast’s Connectivity & Platforms segment as a whole recorded a revenue of 0.4% year-over-year. The solid revenue growth in the Business Services Connectivity segment is largely due to favorable pricing, as the number of professional customer relationships remained virtually unchanged compared to the previous year (-0.5%).

Adjusted EBITDA margin in the business customer segment decreased by 10 basis points year-over-year to 57.4%, while the much larger but significantly less profitable residential customer segment’s margin improved by 20 basis points to 38.6%.

All in all, I am pleased with the results for the third quarter, which demonstrate continued strong pricing power, resilience, and cost discipline, as underlined by a segment-wide margin expansion of 30 basis points to 40.9%. Nonetheless, further critical review of the Connectivity & Platforms segment is warranted as it contributes more than 60% of total revenues, a whopping 85% of adjusted EBITDA, and thus the lion’s share of free cash flow.

Content & Experiences – Profitability Impacted By Continued High Investments

At $12.6 billion, Content & Experiences represents a growing share of Comcast’s revenue stream. However, as indicated above, the segment’s profitability remains comparatively weak, so investors should not overestimate the revenue growth of 19.3% in Q3 2024.

On closer inspection, the Media sub-segment stands out with revenue growth of 36.5%, although this is largely due to the successful performance at the Olympic Games in Paris. Without this tailwind, revenue growth in the Media sub-segment amounted to 4.9%. Due to significantly higher programming costs in connection with the Olympic Games (which, due to the advertising effect, should not be regarded as outright expenses), but also due to higher expenses in connection with Peacock (Comcast’s streaming offering), adjusted EBITDA declined by 10% year-over-year, resulting in a margin of 7.9% or 410 basis points less than in the third quarter of 2023.

Peacock made a loss of $436 million in adjusted EBITDA, but this includes a promotional impact from the Olympics. The number of paid subscribers increased by a fairly strong 29% year-over-year to 36 million. Even better, revenue was up 82% to $1.5 billion, but of course, that kind of growth shouldn’t be overstated given the high advertising spend and the sub-segment’s still sizable loss. I remain constructive on Peacock, even though I view the streaming business as largely commoditized, and therefore don’t expect it to become a significant cash flow contributor for Comcast, at least in the near term.

In the Studios segment, the release of Despicable Me 4 and Twisters were the main contributors to the 12.3% revenue growth. Operating expenses increased slightly more, resulting in an adjusted EBITDA margin of 16.6%, a decrease of 50 basis points compared to the prior year.

Finally, Comcast’s theme parks recorded lower visitor numbers, resulting in a 5.3% decline in revenue. I believe this is at least partly due to increasingly price-sensitive consumers cutting back on these comparatively costly discretionary expenditures. The fact that the segment’s operating expenses remained largely unchanged underlines the pronounced operating leverage of this sub-segment. As a result, adjusted EBITDA fell by almost 14% year-over-year, which led to a margin decline of 365 basis points to 37.0%.

Conclusion – And What To Make Of The Hinted Business Separation

Comcast reported comparatively solid Q3 results today, beating on both adjusted earnings per share and revenue estimates. The earnings adjustments were reasonable, in my opinion, and the 6.5% year-over-year revenue growth was very encouraging.

However, much of the revenue growth came from the strong performance at the Paris Olympics, which was accompanied by higher associated spend in the Content & Experiences segment. However, I would not consider these to be pure expenses due to their promotional effects on Comcast’s products and services. In addition to the successful performance at the Paris Olympics, the launch of Despicable Me 4 and Twisters was primarily responsible for the solid revenue growth at the company level, and Peacock also shone with continued growth in paid subscriptions to 36 million. While this is of course encouraging, it will likely be a very long time before Peacock contributes to free cash flow.

Speaking of which, a closer look at Comcast’s bread-and-butter segment showed continued strong pricing power, while the decline in customer relationships remains manageable. In addition to the strong cost discipline in this segment, which led to a slight increase in the adjusted EBITDA margin to 40.9%, the 20% year-over-year growth in wireless connections was also quite reassuring. However, it should not be forgotten that the revenue contribution of this sub-segment is still comparatively low and the cash flow profitability is unclear.

Overall, Comcast’s core business is holding up very well, while the Content & Experiences segment is growing. But make no mistake, the core business continues to be the largest contributor to free cash flow. Against this backdrop, I was quite surprised that management hinted at a possible separation of the cable business.

Comcast is a well-capitalized company with manageable leverage and a strong credit rating. In my view, most investors currently owning the stock appreciate the stable legacy business that continues to capitalize on its leading market position and strong pricing power. This cash cow allows the company to expand its wireless network capabilities and invest heavily in its Content & Experiences segment, while paying a growing dividend and significantly reducing the number of shares outstanding. In my view, a significant part of Comcast’s economic moat is rooted in the combination of its content creation engine and connectivity business.

In my view, spinning off the cash cow would only make sense if most of the debt is shouldered by the cable division. This would result in a highly cash-generative legacy business with the ability to significantly deleverage due to reduced capital expenditures, while paying a growing dividend (Comcast’s adjusted FCF payout ratio was only 40% in 2023). However, the standalone content, streaming, and theme parks-focused business would require extremely disciplined cost management and further significant investments. This unit would likely remain a very low-margin business for the foreseeable future, also given the pronounced economic sensitivity of the Theme Parks sub-segment and its operating leverage.

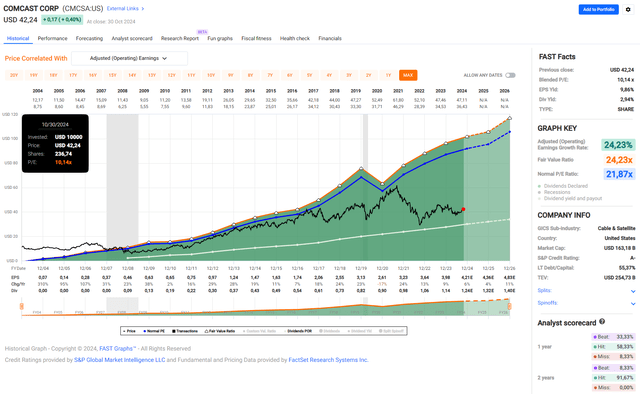

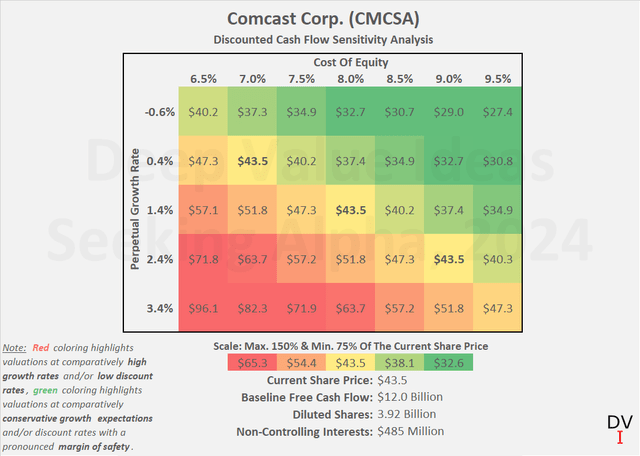

Overall, I’m not really convinced by the hinted separation plan, but I’m not thinking of selling my position at this point. Comcast stock remains favorably valued with a blended price-to-earnings ratio of 10 (Figure 4), a free cash flow yield of more than 7%, and very low implied perpetual growth (Figure 5). In my opinion, Comcast’s – all too familiar – challenges are more than adequately reflected in this undemanding valuation.

Once the details of the separation plans are announced, I will reassess. However, if separation of the cable and media/studios/parks businesses materializes, I would hope that the transaction would be structured as a split-off, similar to the separation of Johnson & Johnson’s (JNJ) consumer health segment, rather than a spin-off. This could result in a significant cash inflow for the parent company, while a small amount of debt could even be separated. Such a transaction would further de-risk the legacy business and I could therefore see myself maintaining my position in this business and not participating in such a hypothetical split-off, which I would leave to more growth-oriented investors. My long-term followers know only too well my preference for companies with reliable and predictable cash flows.

Figure 4: Comcast Corp. (CMCSA): FAST Graphs chart, based on adjusted earnings per share (FAST Graphs) Figure 5: Comcast Corp. (CMCSA): Discounted cash flow sensitivity analysis (own work, based on information from company filings and own estimates)

Thank you very much for reading my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well. As always, please consider this article only as a first step in your own due diligence.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CMCSA, JNJ, KVUE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The contents of this article, my previous articles, and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am a private investor from Europe and share my investing journey here on Seeking Alpha. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice, and I am in no way qualified to do so. Although I do my best to make sure that what I write is accurate and well researched, I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.