Summary:

- Intel just reported its third quarter earnings.

- The earnings figures missed estimates by a wide margin, while revenue beat expectations.

- Increased fourth quarter guidance triggered an after-hours rally.

- I take a much dimmer view of Intel’s earnings than the markets did. The company’s Q3 release showed many signs of a company in decline.

- In this article I explain why I’m not buying Intel’s post-earnings rally.

Intel Headquarters

hapabapa

Intel (NASDAQ:INTC) just released its earnings for its fiscal third quarter 2024. The release missed expectations on revenue and earnings per share (EPS), but the stock rallied on raised fourth quarter guidance. Intel’s release was highly anticipated because the stock has a cult following in the value investing community. Although INTC is not ‘dirt cheap’ going by multiples, it has been optically cheap at various points in the past. Unfortunately, the results just released showed that INTC is ‘cheap’ for a reason. Although INTC rallied 12% due to the raised guidance, the company’s Q3 results also showed weakness in the crucial foundry segment, which declined 8% year over year. For my money that was a bigger deal than the fact that the company’s management upped guidance.

Intel’s foundry business, which includes the former Intel Foundry Services segment, is seen as crucial to the company’s future. Intel is far behind its competitors in designing mobile CPUs and GPUs, so becoming a major foundry for other chip designers is probably the company’s best bet to turn things around. Unfortunately, the actual results from the segment have been even more disappointing than those in Intel’s chip design business. Intel’s foundry results broadly disappointed investors in the second quarter. Results in the third quarter were weak as well, with revenue declining 8% and the EBIT loss swelling to $5.8 billion. The foundry services segment had previously been considered a Taiwan Semiconductor Manufacturing (TSM) competitor, but its precipitous decline in the third quarter cast doubt on Intel’s ability to compete in manufacturing.

Intel Foundry is very important to Intel as a whole. Among other things, the segment helps the company procure billions of dollars per year in CHIPS Act funding. Unfortunately, Intel stopped reported its sales to external clients last quarter. That left investors without access to critical information about INTC’s contract manufacturing business.

Many investors have high hopes for Intel’s foundry sales to external clients. By establishing itself as a manufacturer like TSMC, Intel might be able to compete in foundry services on the global stage. If it does so, then it could gain tens of billions a year in new revenue, going by TSMC’s earnings. Apart from internal sales (i.e. sales from Intel Foundry to Intel), the company’s foundry business is struggling. Doing a few hundred million a year in revenue, the contract manufacturing segment is not taking off. Also, the entire segment’s operating loss is on the rise, having increased to $5.8 last quarter. Unlike in previous quarters, Intel did not provide a figure for foundry sales to external clients. That was disappointing because such sales are critical to the success of Intel’s turnaround.

Investors will want to see the foundry situation turn around before taking positions in Intel because the company’s ventures in design are floundering. In Q3, Intel’s total revenue declined 6%. In the second quarter, AMD (AMD) saw its revenue grow 9%, and NVIDIA’s (NVDA) revenue soared 122%. Intel thrived many years ago, when it had Apple’s (AAPL) business more or less on lock. Since losing Apple’s business to that company’s home-grown chip efforts, INTC has struggled to regain its footing in chip design. The company failed to get a foothold in the mobile revolution and was late to the party in AI GPUs. As a result, it has lost considerable market share.

When I last covered Intel, I rated the stock a weak hold on the basis of the fact that its key segments were in decline. Today, I still take a basically neutral view on Intel, but not a completely neutral view. I am more bearish on Intel than bullish, especially with its stock rallying so hard after hours. However, since Intel is fairly cheap going by some metrics, there is risk here for shorts as well as longs. For this reason I think avoiding Intel after earnings is the best course of action for those looking at the stock right now.

Earnings Recap

Intel’s third quarter earnings release broadly missed estimates, although it did include improved revenue guidance for the fourth quarter. Key metrics from the release included:

-

$13.3 billion in revenue, down 6% (beat by $260 million).

-

$-16.6 million in earnings.

-

$-0.46 in EPS (miss by $0.43 and down by $0.87).

-

$-3.89 in GAAP EPS (miss by $3.64).

-

An 18% gross margin, down 27.5%.

-

A newly announced $3 billion U.S. government Secure Enclave Partnership.

-

$4.1 billion in cash from operations.

-

$-2.7 billion in free cash flow.

-

Guidance for $13.3 billion to $14.3 billion in fourth quarter revenues.

Overall, I found these results pretty disappointing. Intel lost considerable money in the third quarter. The guidance raise triggered a rally after hours, but even with the upped guidance INTC is still on track to see its revenue decline by $1.6 billion year over year.

Competitive Position

One of the biggest reasons to be skeptical about Intel stock right now is the fact that the company has a rather poor competitive position. In the Seeking Alpha Quant rankings for growth and valuation, Intel underperforms its sector, scoring an F and a D, respectively. It does score an A+ on profitability, but the company’s free cash flow margin is deeply negative. Since Seeking Alpha Quant rankings are sector relative, Intel’s low scores on growth and valuation imply that the stock is both more expensive and growing slower than its sector. That’s not a great mix of qualities.

Why is Intel underperforming its sector?

It comes down to experience. Companies get better at what they do as they accumulate experience. Traditionally, Intel supplied chips to laptop and desktop makers, and it was good at that. However, when Apple ditched intel for its own home-grown chips, INTC lost a major part of its business. Additionally, AMD–previously seen as a bargain-basement vendor–became competitive. Finally, Intel failed to gain experience in mobile chips or GPUs when the incumbents in those spaces were building up their competencies. As a result, Intel fell behind the big players in the semi space.

Today Intel is trying to scale up its foundry. Intel Foundry currently does $4.4 billion in quarterly foundry revenue, but most of it is sales to other Intel businesses. The business providing foundry services to other companies had been growing rapidly but appeared to have hit a plateau before Intel stopped reporting it as a separate segment. The foundry as a whole is losing billions of dollars per quarter. The segment does help Intel get billions of dollars per year from the Federal Government, but it does not appear to be competing with TSMC successfully. So I’d call Intel’s competitive position a poor one.

Valuation

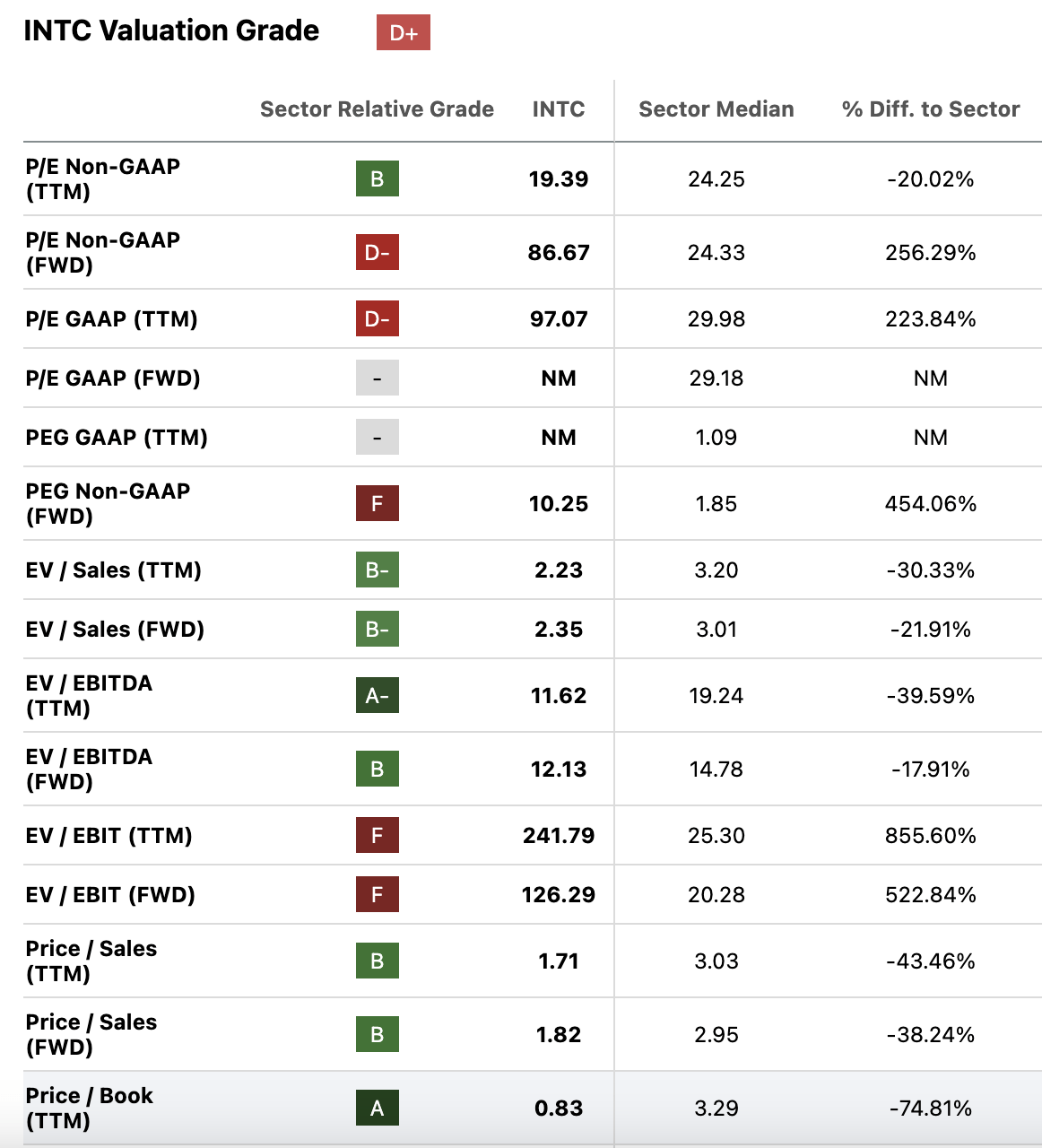

Having looked at Intel’s recent earnings and competitive position, we can now look at the stock’s multiples. Here are the multiples that INTC currently trades at according to Seeking Alpha Quant:

Intel multiples (Seeking Alpha Quant)

These multiples are enough to score INTC a ‘D’ in Seeking Alpha’s Quant ratings, which are sector relative. In other words, Intel is one of the more richly valued semiconductor stocks out there, despite being in decline. Last quarter, Intel’s revenue, earnings and free cash flow all declined. It guided for even more decline in the fourth quarter, and the markets took that as good news. On the whole, Intel is far too pricey for a company that is losing money long term and underperforming its sector. This stock trades at about three times its sector’s GAAP P/E ratio while performing worse than its peers. This is really hard to explain logically.

The Bottom Line

Intel stock is simultaneously performing worse than its peers while being more richly valued than them. Its most recent earnings release was a miss. The upped guidance was one bright spot, but even after increasing the guidance, management still expects revenue to decline. On the whole, I’m not interested in buying Intel stock today.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.