Summary:

- Intel Corporation is up after reporting Q3 earnings.

- While the report was concerning on its face, the results show progress on a restructuring plan.

- Guidance and progress on 18A reaffirm INTC is a stock to own.

hapabapa

Intel Corporation (NASDAQ:INTC) is soaring after hours on Thursday after reporting third quarter earnings that were better than expected (though that’s not saying much). It showed progress on a restructuring plan that the company hopes can turn around their fortunes, specifically in the foundry business. I covered this turnaround plan in a previous article, which can be read here, and think this report demonstrates the company is on the right track to achieving its goals. I continue to see INTC as a Buy despite the risks.

If there exists a curse of high expectations, there must also be a blessing of low expectations, and Intel was the beneficiary on Thursday. The company reported third quarter earnings that, on its face, were quite concerning, but digging deeper into the numbers demonstrates that some of the more doomsday scenarios the stock has been pricing in might not come to pass.

As a quick recap, Intel reported revenue of $13.3 billion (-6% YoY) and non-GAAP EPS of -$0.46 (down from $0.41 a year ago), which represents a mild beat on revenue and a fairly significant miss on earnings. However, the company also reported accelerated depreciation of manufacturing equipment (related to the reduced projected lifetime of the Intel 7 process node) and an impairment charge that impacted non-GAAP EPS by $0.63, making the “real” EPS for the quarter $0.17 (I put real in quotes because while these charges were mostly non-cash, they are still factors to note). In addition, Intel reported $2.8 billion in restructuring charges as part of its effort to undertake a “structural and operating realignment.”

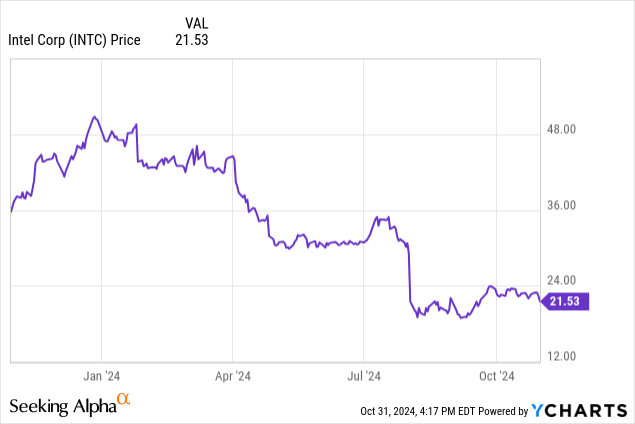

Okay, so the stock is up 5%+ and you might be thinking: when do we get to the good news? Well, let’s not forget INTC is still down more than 50% year-to-date and expectations going into this quarter were that foundry losses would continue to mount, earnings and revenue would decline precipitously, and guidance would be grim. So far, it looks like none of these have been as bad as the market thought.

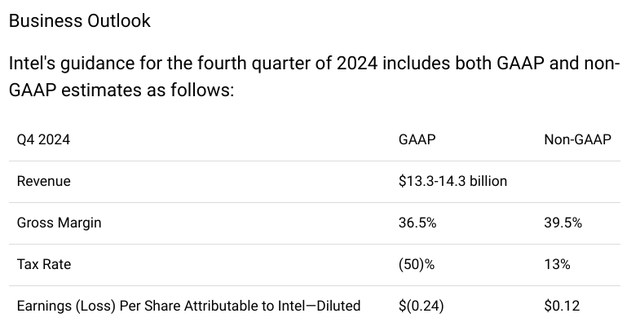

In fact, guidance shows at worst a stabilization of results and the optimistic view might even be that Q3 2024 was a bottom. At the midpoint, this outlook indicates revenue growth of around 4% and a bounce away from zero for EPS when profitability was a concern. The cost reductions from the restructuring initiatives appear to already be paying dividends. Intel provided guidance for FY2025 capital expenditures of between $12 billion and $14 billion as it ramps its all-important 18A node. This is up from $10 billion expected CapEx in FY2024, which could indicate the company is gearing up for a robust order pipeline for its foundry.

There is a discussion to be had here about how much of this jump in share price is due to a genuinely solid report and how much is due to how beaten down the stock has been. Personally, I think it’s both. Financially, the turnaround effort appears to be bearing fruit and operationally, Intel says 18A is still on pace to achieve yield benchmarks and has hit early milestones for upcoming Panther Lake and Clearwater Forest products. The company has, of course, fooled us before with claims on similar nodes, but the endorsement from Amazon.com, Inc. (AMZN) committing to building its new custom AI chip at Intel gives room for optimism.

I remain bullish on the plan to have the foundry business be an internal, independent unit, paving the way for an eventual spin-off, and remain bullish on the prospects of 18A. Investors should be on the lookout for design wins from companies that have sampled Intel’s yields and are satisfied with the node’s progress, as these would be further votes of confidence. I continue to recommend INTC as a Buy.

Thanks for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.