Summary:

- On Thursday, zero-emission transportation start-up Nikola Corporation (“Nikola”) reported another set of uninspiring quarterly results.

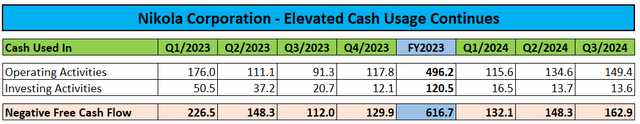

- The company continues to burn substantial amounts of cash. During the quarter, cash usage increased by 10% sequentially to $162.9 million.

- Management warned of funds running out in Q1/2025 – as a result, investors will likely have to prepare for additional, near-term dilution.

- After Thursday’s market close, Nikola filed a prospectus supplement for the sale of up $237.6 million in newly issued common shares into the open market.

- As a result, the stock price is likely to mark new all-time lows sooner rather than later. Given these issues, I am downgrading Nikola Corporation’s shares from “Sell” to “Strong Sell”.

VanderWolf-Images

Note:

I have covered Nikola Corporation (NASDAQ:NKLA) previously, so investors should view this as an update to my earlier articles on the company.

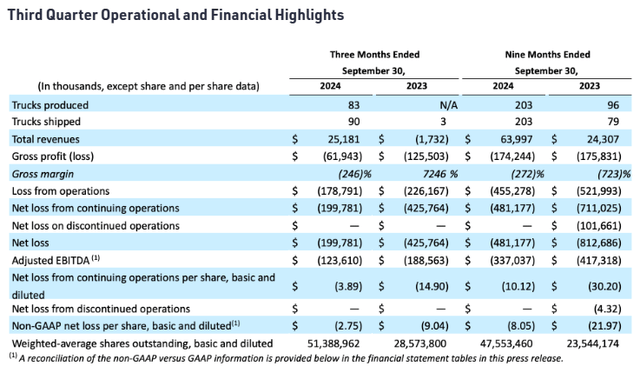

On Thursday, zero-emission transportation start-up Nikola Corporation (“Nikola”) reported another set of uninspiring quarterly results:

While quarterly FCEV truck sales reached a new record, revenues came in well below consensus expectations due to the requirement to repurchase a material number of BEV trucks from dealerships.

However, the company has started to return upgraded BEV trucks to customers following last year’s recall. Over time, Nikola expects to upgrade and sell close to 150 BEV trucks currently held in inventory.

The company continues to burn substantial amounts of cash. During the quarter, cash usage increased by 10% sequentially to $162.9 million:

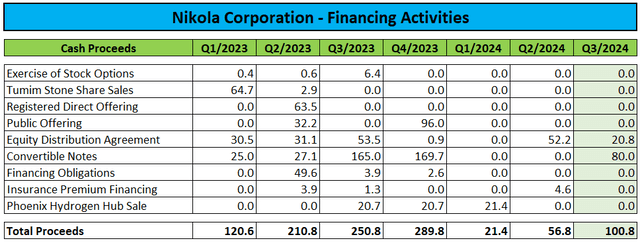

Persistent cash outflows were partially offset by $20.8 million in net proceeds from the sale of additional shares into the open market and $80.0 million from the company’s most recent convertible notes offering:

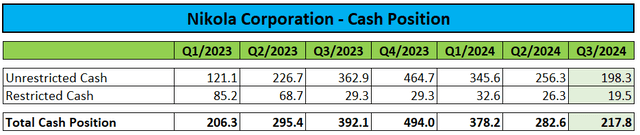

In sum, unrestricted cash was down by more than 20% sequentially to $198.3 million:

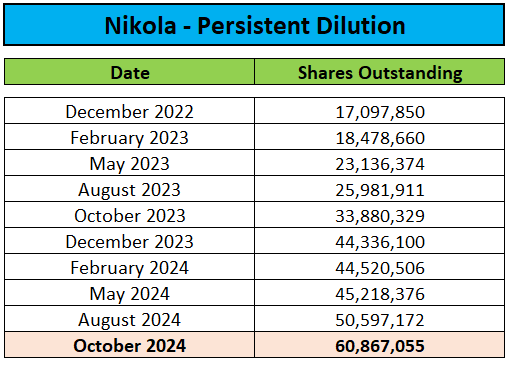

Persistent open market sales resulted in outstanding shares almost doubling on a year-over-year basis:

Regulatory Filings

Total debt and finance lease liabilities amounted to $343.1 million at the end of the quarter.

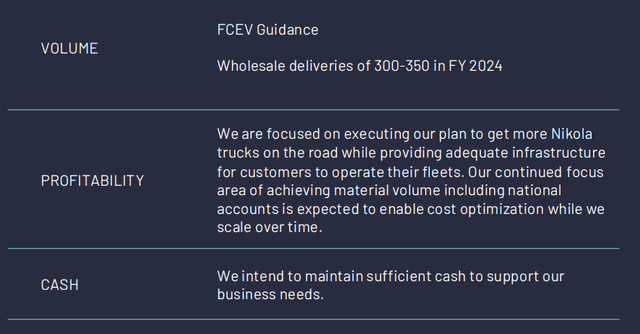

On the conference call, management reiterated full-year expectations of 300-350 FCEV truck deliveries:

With below $200 million in unrestricted cash at quarter-end, Nikola expects to run out of funds in Q1/2025 as stated in the company’s quarterly report on form 10-Q (emphasis added by author):

We estimate that our existing financial resources are only adequate to fund our forecasted operating costs and meet our obligations into, but not beyond, the first quarter of 2025. We have taken steps to reduce our cash requirements in an effort to extend our cash runway and may need to do so again in the future. If we are not able to secure sufficient capital to fund our operations, our business and results of operations will be materially adversely affected.

Given this issue, investors will likely have to prepare for additional, near-term dilution, particularly after Nikola filed a prospectus supplement for the sale of up to $237.6 million in new common shares under the company’s amended equity distribution agreement with Citigroup Global Markets Inc. after the close of Thursday’s session.

Generously assuming an average sales price of $4 per share, outstanding shares would double to approximately 120 million, while proceeds would only provide runway into Q3/2025.

Please note also that the company is currently precluded from converting additional convertible notes into common shares, which has resulted in concerning disclosures in the company’s 10-Q (emphasis added by author):

In October 2024, the Company issued an aggregate 5,513,679 shares of common stock for settlement of conversions of $26.2 million aggregate principal amount, make-whole amount and accrued and unpaid interest pursuant to the Third Purchase Agreement Notes. This resulted in the Company issuing in aggregate 10,114,374 shares under the Third Purchase Agreement Notes, which is the maximum amount of shares that may be issued pursuant to the Third Purchase Agreement without obtaining stockholder approval.

The Company received additional conversion notices for an aggregate of $33.7 million of aggregate principal amount, make-whole amount and accrued and unpaid interest, which the Company is obligated to settle in cash for $39.3 million (the “Exchange Cap Redemption Amounts”).

The holder agreed to defer settlement of the Exchange Cap Redemption Amounts until the earlier of (x) the occurrence of any bankruptcy event of default (as defined in the Third Purchase Agreement Notes), (y) if the Company and the holder mutually agree to exchange, in whole or in part, the Exchange Cap Redemption Amounts into securities of the Company, solely with respect to such applicable portion of the Exchange Cap Redemption Amount that is to be exchanged, the time immediately prior to such exchange and (z) December 31, 2024 (or such other date as the Company and the holder may mutually agree in writing from time to time). As a result, the Exchange Cap Redemption Amounts are not yet due.

In layman’s terms: The company will have to find a way to issue additional shares to the convertible noteholder or face an almost $40 million cash payment by the end of the year.

Taking into account the exchange cap redemption amount, Nikola would be in danger of running out of funds by year-end already.

Consequently, I would expect the company to aggressively sell new shares into the open market in order to gain runway into H2/2025.

With demand for FCEV trucks nowhere near the levels required by Nikola to achieve meaningful economies of scale, elevated cash usage is likely to continue for the time being.

With the company’s market capitalization now below $250 million, raising up to $237.6 million in cash could prove difficult but even if successful, Nikola would have to raise additional capital in Q3/2025 at the latest point.

Bottom Line

At least in my opinion, we might be approaching the final chapter of Nikola Corporation’s efforts to commercialize zero-emission trucks.

With funds running low again and raising sufficient capital becoming increasingly difficult, Nikola might be out of viable financing options by the end of next year already.

Until then, I would expect the company to aggressively sell newly issued shares into the open market in order to make it into 2025.

As a result, the stock price is likely to mark new all-time lows sooner rather than later.

Given these issues, I am downgrading Nikola Corporation’s shares from “Sell” to “Strong Sell“.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.