Summary:

- Advanced Micro Devices, Inc.’s Q3 2024 results showed an 18% revenue increase, driven largely by a 122% growth in its Data Center segment, now comprising over half of total revenue.

- AMD raised its 2024 AI revenue forecast from $2 billion to $5 billion and outlined a multi-generational product roadmap through 2026.

- Despite Nvidia’s lead, AMD’s focus on AI data centers offers high growth potential at more attractive valuation multiples. Continued AI demand and product cadence could drive re-pricing of AMD stock.

JHVEPhoto

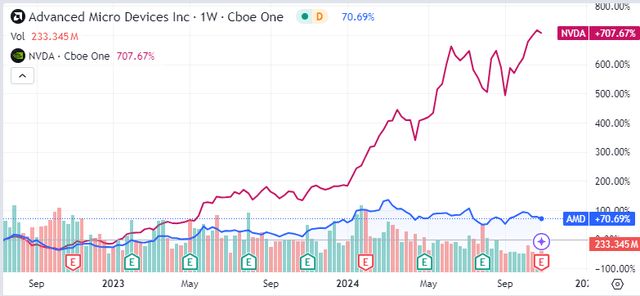

Advanced Micro Devices, Inc. (NASDAQ:AMD) is one of the most reputable GPU makers. Although the company’s stock advanced 70% since the ChatGPT release in November 2022, the truth is that it has lagged Nvidia (NVDA) by a wide margin. We will go through the latest earnings for Q3 to try to test the thesis of a dominant positioning in AI data centers with a multi-generational product roadmap that offers some kind of convergence with Nvidia’s growth profile.

Recent developments

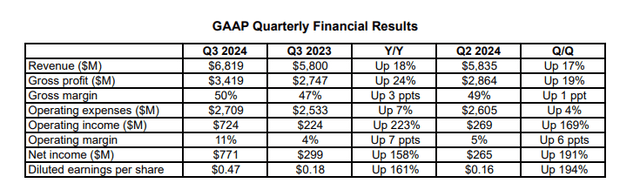

AMD just presented its Q3 2024 results. Revenues increased at a fast clip, around 18%. This was mostly driven by the data center segment, which grew 122% thanks to the adoption of EPYC CPUs. As an example, Meta Platforms (META) is deploying 1.5 million EPYC CPUs. Among other things, Meta has optimized the MI300X GPU to make it fit for live traffic for the Llama 405B model, and it is also working on other potential workloads. This should improve the total cost of ownership, appealing to customers in the cloud AI segments.

The company is accelerating its AI product development, aiming for annual releases. The MI350 series is planned for late 2025 and is a promising leap in AI performance. Thereafter, the MI400 series based on a CDNA Next architecture will likely be released in 2026, allowing an annual product cadence.

Nevertheless, the big driver of revenue growth is the demand for data center GPUs, with the company raising its revenue forecast from $2 billion to $5 billion for 2024, as revealed in the 3Q24 earnings call.

On the flip side, gaming revenue declined 69% year-over-year, mostly due to Sony and Microsoft adjusting their inventory. The transition to the new RDNA 4 architecture may also be to blame, as it is set to be released in early 2025.

Overall, the data center AI accelerator market will likely be the main driver of revenues going forward. The demand for customized hardware suitable for machine learning and inference in cloud data centers is off the charts. AMD projects the market to grow at a remarkable 60% annually until 2028.

A Deep-dive on the financials

The biggest contributor to total revenue, at 52%, is now the data center segment. As we have pointed out earlier, it achieved record revenue of $3.5 billion, growing 122% year-over-year. The client segment reached $1.9 billion, up 29% YoY. The gaming segment declined by 69%, now representing revenues of $462 million. Finally, the embedded segment declined 25% YoY to $927 million. This was a mixed bag, with the good news more than offsetting the bad ones.

Overall, revenue is up 18%, with the gross margin also showing good progress, up 3% percentage points. The same positive trend is witnessed in the operating margin, reaching 11% versus 4% one year ago.

Turning to cash flow, AMD generated $628 million in 3Q24 versus $421 million in 3Q23. This allowed the company to end the quarter with $4.5 billion in cash equivalents and short-term investments. The company exhibits a current ratio of almost 2.5 which seems adequate, while debt to assets stands at 2.5%, a very low level.

Valuation

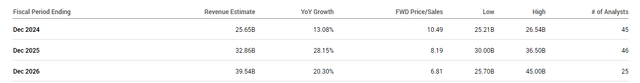

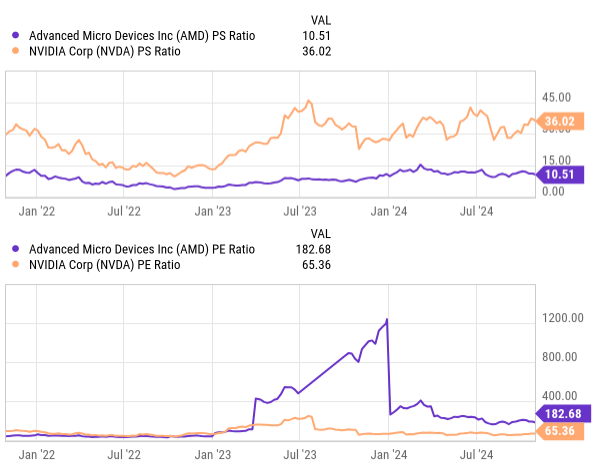

A brief look at the valuation shows that Nvidia has much higher valuation multiples than AMD. With 36x sales multiple, Nvidia has one of the richest sales multiples I have ever seen.

YCharts

Nevertheless, part of this huge difference comes from the fact that Nvidia has delivered massively on revenue growth and gross margin improvement in the past two years. This clearly puts Nvidia in a league of its own.

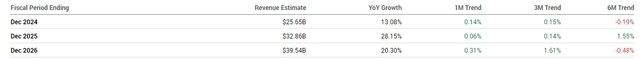

In any case, the important aspect is to determine what will happen going forward, not what happened up to now. For Q4, AMD’s management team expects sales to grow 22% YoY, which would result in a higher annual growth than suggested by the analysts’ estimates.

In my opinion, the current quarter offered good signs that the company is going in the right direction, especially in the data center segment where it is seeing stronger-than-expected momentum. The reports about big tech buying crazy amounts of chips provide support to the thesis that chip demand for AI will remain elevated. Although the market seemed cool about the outlook, the reality seems like the estimates might be revised higher in the near future. If that happens, we might see the company be repriced higher.

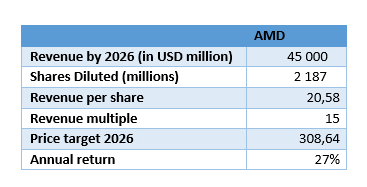

A possible outcome would be for revenue growth to top the highest estimate for 2026 at $45 billion. Considering a 10% annual dilution (the average of the last 3 years), and a sales multiple of 15 (the highest the company had in the past 3 years), we can compile the following annual returns for the stock.

Author’s computations

The model suggests that there is a 27% annual return potential for the stock until 2026 if there is a change in perception toward accelerating growth.

Risks

Our thesis relies on a re-pricing of the stock based on estimate revisions stemming from the strength in the data center business. The biggest risk lies in the market not perceiving it that way, or the company failing to accelerate revenue growth. The truth is that the AI boom is in uncharted waters, and nobody really knows how long it will last. My view is that this earnings release, although a bit bittersweet, showed a lot of strength in the data center segment under the hood.

A parallel risk comes from the company being able to bring the products to market in a timely manner. This is very difficult to assess, and our most convincing argument is that the past decade under the current CEO has brought many improvements in execution. Nevertheless, the competition is merciless, and we have the best engineering minds in the world working in this field. Therefore, the outcome will always be uncertain regarding new products and how they stack against the competition. Nvidia has a strong lead with the H100 and the future-promising Blackwell architecture, and AMD has a tight deadline. Delays might be bumps in the road in terms of share price performance.

Software is also a strong selling point. For instance, the CUDA ecosystem has a clear advantage in AI development. AMD is trying to play catch-up with its ROCm stack, but it might struggle to match the CUDA’s user base, which in turn will be a major barrier to attracting large customers used to the competition ecosystem.

Another point to observe is supply chain issues and inflation. The massive demand for data center GPUs may create difficulty in meeting the demand for the company’s CPUs and GPUs, impacting the revenue growth and potentially trickling down to the share price. Additionally, as the company scales, inflation in materials or even specialized cooling systems such as liquid cooling might pressure gross margins.

Conclusion

My thesis for AMD stock is based on a dominant positioning in AI data centers with a multi-generational product roadmap. The company is poised to be one of the leaders in AI data centers through a multi-generational portfolio of GPUs and CPUs that offer a compelling total cost of ownership (TCO) profile for customers. The strong AI data center growth set to exceed $5 billion in 2024, fueled by the demand from large cloud customers, supports this thesis. The multi-generational roadmap with the current MI300, the MI325 (2025), and the MI400 (2026) should make the growth sustainable. The ability to support backward compatibility will also add a degree of stickiness to the revenue.

That said, I think the company is a buy, offering exposure to the AI data center demand, without having to pay the steep valuation multiples for Nvidia. Another way to put it is that any improvement in AMD will be welcomed by the market, whereas any misstep by Nvidia might be punished by an investment crowd with high expectations of Nvidia.

This is a bit of a contrarian view on this pair of companies, but that doesn’t mean this is a short recommendation on Nvidia. For all that I know, Nvidia is likely to be the winner in the segment. My only take is about AMD and how the recent earnings call affected my thesis on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This text expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.