Summary:

- Super Micro Computer, Inc.’s recent loss of Ernst & Young as its auditor has increased risk perception, leading to a major selloff in its stock.

- Despite the auditor concerns, Super Micro continues to benefit from strong demand for data center infrastructure, especially AI-capable servers, and anticipates meeting its Q1 2025 sales target of $6-7 billion.

- Although sales are strong, this loss of market confidence has led to a conservative ‘Hold’ classification ahead of the upcoming earnings report.

MF3d

In my last piece on Super Micro Computer, Inc. (NASDAQ:SMCI) I suggested that the SMCI had a favorable risk/reward relationship and that the technical picture of Super Micro looked compelling for investors with a contrarian bent.

Unfortunately, recent events at Super Micro indicate that I was wrong about my opinion about the server company and stock classification. The main reason for my rating modification just before the release of first quarter 2025 earnings is that the IT solutions company lost its auditor, Ernst & Young, which led to a new round of selling pressure for Super Micro.

Though I anticipate Super Micro’s results for 1Q25 to meet expectations, the risks clearly have increased greatly after the auditor news.

My Rating History

My last stock classification on Super Micro was Buy primarily because I considered Hindenburg’s thesis to be far-fetched and not particularly compelling.

With that said, recent developments affecting the company’s auditor have led to a big selloff that caused Super Micro to lose more than $9 billion of its market valuation on Wednesday. I think that the risk/reward relations, unfortunately, deteriorated, and I am modifying my stock classification to “Hold.”

Super Micro Loses Its Big 4 Auditor: Impact And Implications

It was reported yesterday that Super Micro lost its Big 4 auditor Ernst & Young over internal control and board independence concerns. A filing with the Securities And Exchange Commission, which you can read here, detailed the reasons for why Ernst & Young resigned its audit mandate.

The news triggered a 33% correction for Super Micro’s stock on heavy volume and marks an escalation after the Department of Justice also previously announced that it would take a look at the company’s accounting practices.

Losing an auditor so close ahead of the earnings report date is obviously not inducing confidence in Super Micro’s financial statements. The news on Wednesday also came on the heels of Super Micro delaying its annual report. However, Super Micro yet again said that it does not expect to have to restate its reports for 2024 or prior financial years.

While the news is clearly negative, investors should understand here that the auditor resignation is not an admission of guilt of any kind. Rather, it signifies that Ernst & Young is seeing risks in Super Micro’s financials that make the auditor risk conscious.

What is troubling is that the auditor resignation occurred just before the company is poised to report first quarter earnings: Super Micro’s 1Q25 earnings date is scheduled for November 5, 2024, which is likely to get a lot of attention in light of the recent controversies surrounding the IT solution provider.

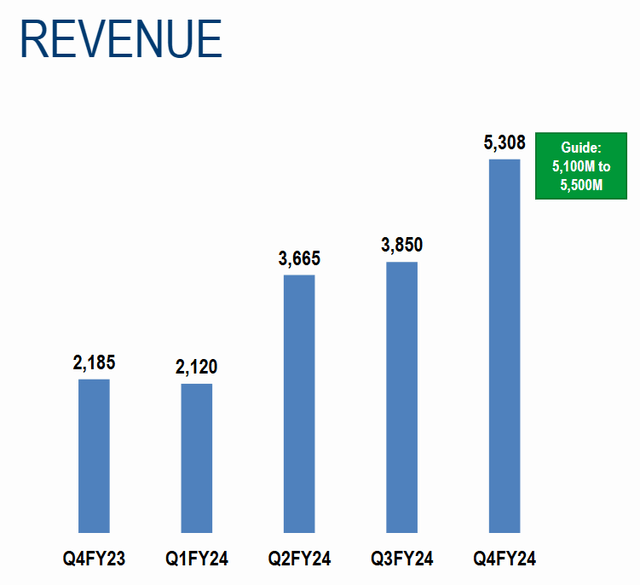

In the last quarter, Super Micro produced $5.308 million in sales, reflecting 143% growth amid robust demand for new Data Center equipment, including server racks and storage systems. The company is profiting greatly from accelerating investments into artificial intelligence-based infrastructure, particularly its liquid-cooled server systems, which are geared to support the new Blackwell chips from Nvidia Corporation (NVDA).

Revenue (Super Micro Computer, Inc.)

Super Micro forecasted $6-7 billion in sales for the first quarter of its new financial year and I anticipate the company to meet this guidance amid an overall favorable spending environment. My expectation is underpinned by robust demand for data center IT systems which include the kind of server racks that Super Micro is selling.

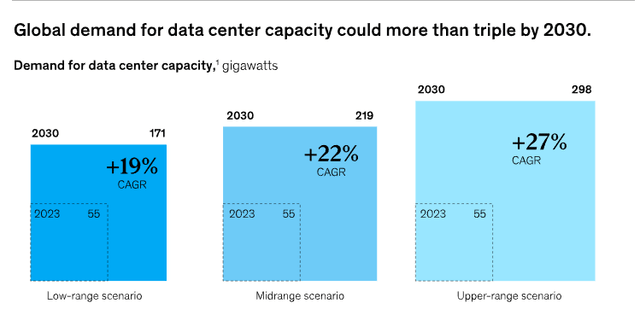

According to McKinsey, demand for AI data centers is poised to go through the roof until the end of the decade, which would undoubtedly be a substantial business driver for Super Micro’s own server and storage systems. Thus, I do anticipate Super Micro to continue to grow its sales moving forward, though the accounting issues mentioned above might depress the company’s stock price for longer.

Global Demand For Data Center Capacity (Super Micro Computer, Inc.)

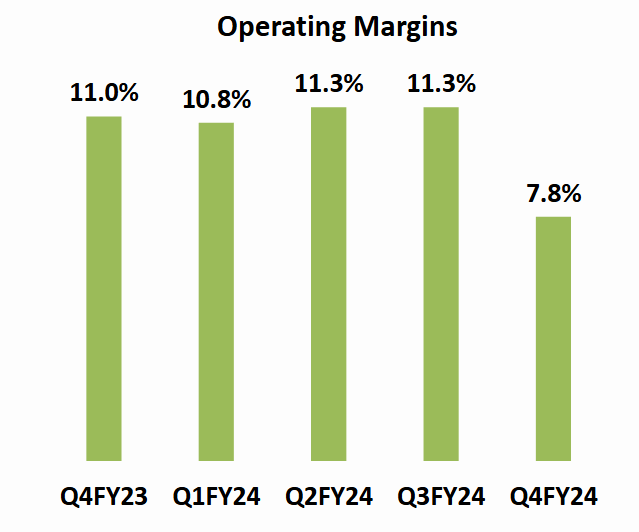

A key figure worth watching on November 5, 2024, will be Super Micro’s operating margin for the first financial quarter of 2025. In 4Q24, the IT solutions provider suffered a drop in its operating margin to 7.8% which was caused by higher operating expenses.

Though sales are rising and connected to skyrocketing demand for AI-capable IT solutions, Super Micro has seen growing pressures on its cost structure in the last year, resulting in operating expenses rising 38% YoY in the last quarter.

Thus, if Super Micro wants to return to the kind of operating income margins of 11% we have seen last year, the company has to slash operating expenditures.

Operating Margins (Super Micro Computer, Inc.)

Probably High Margin Of Safety

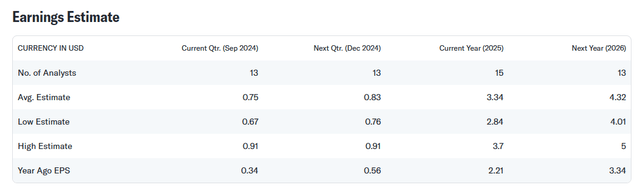

The market models $4.32 per share in profits for the company next year. Given the increased uncertainty about Super Micro’s profit potential and the possible risk of an earnings restatement, the company may see higher-than-average profit corrections after November 5, 2024.

As per consensus, the market anticipates 29% profit growth next year, and 51% this year. With a present stock price of $33, the valuation multiple has compressed to 7.6x, down from more than 20x in July.

Earnings Estimate (Yahoo Finance)

Nvidia is selling for a profit multiple of 34.2x, which obviously makes the stock substantially pricier than Super Micro’s. With that said, though, Nvidia is a leader in AI innovation. If exposure to artificial intelligence-themed investment is a priority to you, then Nvidia might, despite a much higher profit multiple, be the better choice in the market for you. Nvidia is also anticipated to see a 43% jump in its profits next year.

Why The Investment Thesis Might Be Wrong

Super Micro has fallen out of favor with investors, and the stock price decline of 33% on Wednesday can only be described as a disaster. With that said, it is important to give the company the benefit of the doubt.

Only if Super Micro were to announce an earnings restatement, which the company explicitly said in its latest filing it does not expect to do, then there could be a serious bear case to be made for Super Micro.

My Conclusion

For reasons of caution, I am modifying my stock classification on Super Micro to “Hold” though I also think that investors are likely getting a bit emotionally carried away here.

Super Micro lost more than $9 billion in market value on Wednesday and sentiment clearly has taken a turn for the worse. Super Micro’s 1Q25 earnings are therefore going to be released under a cloud of suspicion which may further depress the stock price in the days ahead. I do anticipate Super Micro, however, to meet both its profit and sales guidance amid an ongoing spending boom in the market for IT solutions.

With that said, I can understand that losing a Big 4 auditor creates substantial new uncertainty, and I am modifying my stock classification on SMCI, ahead of the 1Q25 earnings release, to “Hold.”

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SMCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.