Summary:

- Super Micro Computer’s auditor resigned.

- This comes on top of previous bad news. Delayed filing of the 10-K, NASDAQ threat to delist the stock, a major report from a noted short seller, and previous accounting controversy.

- I hated this stock when I wrote about it on 9/18/24, but said “Hold” rather than “Sell” figuring many on the Street would stick with SMCI anyway.

- Indeed, many did stay with it until October 30th, when the auditor quit and the stock tanked.

- No more Mr. Nice Guy… I’m saying what I regret not having said on September 18th. “Sell”.

KanawatTH

I introduced coverage of Super Micro Computer (NASDAQ:SMCI) on September 18, 2024.

The stock was then priced at $43.69. And I said, “Hold.”

At that time, the stock was struggling. The Street had been cautious about AI-related stocks. SMCI is one of them. Also, SMCI had announced it would delay filing its 10-K report. And a well-known short seller announced it was betting against SMCI.

Many commentators and analysts have stayed with SMCI despite those issues.

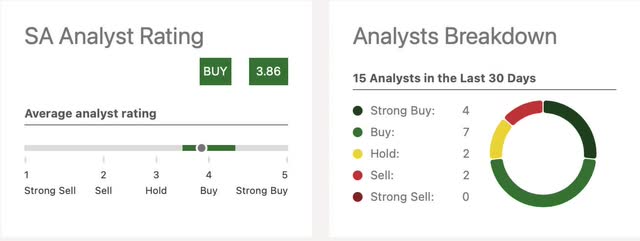

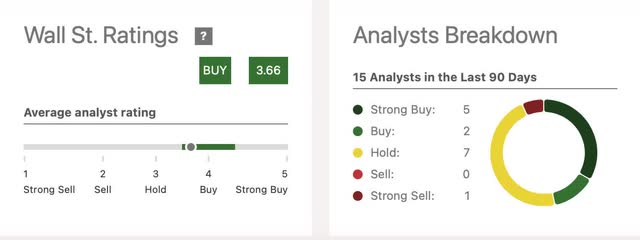

As you can see from the Seeking Alpha Analyst Rating, my “Hold” was out of sync with most analysts.

I was less of an oddball compared to Wall Street.

It looked like I was too conservative about the stock.

On 10/29/24, SMCI closed at $49.12. That was a gain of about 12.5% since my write-up. That was better than the 6% gain in the Invesco QQQ Trust (QQQ).

I understand why many stayed with SMCI.

The company is a leading maker of direct liquid-cooled server and storage solutions that are especially great for AI. Nvidia’s (NVDA) CEO Jensen Huang openly endorsed SMCI’s offering (I further explained the company’s product merits back on September 18th).

Even so…

I said “Hold”, but I hated having done that

There’s an AI angle to SMCI. I knew many wouldn’t likely turn away from that. After all, Jensen Huang endorsed SMCI’s products.

So, imagine me having said “Hold” with my hand behind my back and my fingers crossed. It’s as if I added, “I don’t really mean it.”

I didn’t use those words in print. Instead, after saying “Hold,” I wrote:

But here’s a personal postscript.

In the context of Wall Street as a whole, I’m barely a flea. So I can’t tell you things that bother me will necessarily hurt the stock.

But as for me personally, I lived through other accounting scandals.

I’m too old for more of that. Therefore, none of my money will go anywhere near SMCI as long as the accounting clouds hover.

I may wind up with eggs all over my face. The clouds may dissipate. And SMCI may take off.

If that happens, I’ll get over it. I’ll risk a bad outcome to stick with what I consider, at least for myself, a good process.

In other words, I hated the stock. But I figured many would brush off that which bothered me.

Then, the calendar did its thing. October 29th came and went. Another day arrived. And now…

The Street Is No Longer Looking Away From SMCI’s Problems

On October 30, 2024, before the market opened, SMCI announced that auditor Ernst & Young resigned. That story stated:

Although the Company recognizes EY’s decision is final, it disagrees with EY’s decision to resign as the Company’s independent registered public accounting firm – the Special Committee has not yet obtained all information relevant for the Review and has not concluded the Review,” Super Micro said in the filing. “Nevertheless, the Company has taken the concerns expressed by EY seriously, and will carefully consider the findings of the Special Committee and any remedial or other actions recommended by the Special Committee following conclusion of the Review.”

The company later said that it does not expect any material changes to fiscal 2024.

Liang wrote a letter in September to the company’s customers and partners and said neither the short report nor the delay in the annual report would impact them.

The stock dropped about 9% before the open. And it went downhill from there.

CEO Charles Liang’s persuasiveness is diminishing.

Another Seeking Alpha News story later in the day reported that some sell-side analysts are turning thumbs down.

It also reminds readers that SMCI is under pressure to get in full compliance with NASDAQ listing requirements or else face delisting. The deadline is November 16, 2024.

Ultimately, SMCI closed about 33% lower.

Liang and the company may yet be vindicated. We still don’t have all the facts.

But that’s not really the point…

I Can’t Defend Any Investment Process That Would Support Buying Or Even Holding SMCI Right Now

It’s not about predicting the answer we’ll eventually get.

It’s whether investors should even be asking the questions.

For much of my career, I’ve been involved in quant analysis and stock screening. And perhaps my single biggest takeaway is this…

If you can’t get a good handle on a stock, move on. Don’t force yourself to come up with an answer. “I don’t know” can be the smartest sentence any investor can ever utter.

There are many other fish in the sea besides SMCI. And it’s easier than ever to go fishing.

Seeking Alpha’s stock screening database lists 3,011 possibilities as of this writing. 391 of them are in the information technologies sector.

If SMCI loses viability as an AI play, surely you can find one or more others from among that group. The number of choices expands if you include ETFs.

And it’s so easy to pick among them.

You can build a screen. Seeking Alpha ratings and factor grades can serve as screening factors. This is as good as anything you’ll find with fancy high-priced screeners elsewhere.

Trust me, I know. I’ve been involved with companies that offered screening tools for most of the last 40-plus years.

Or, surely, you can find something in your wheelhouse on one or more of the modules Seeking Alpha offers for its home page nowadays.

I’m not necessarily trying to do a commercial for Seeking Alpha’s offerings. I’m just trying to open your eyes to how easy it is to find ideas that match your goals. You should not have to struggle to answer unanswerable questions about any individual stock.

Here are currently unanswerable issues that make SMCI so challenging right now.

- It ran into accounting and NASDAQ compliance problems back around 2020. I discuss these in my initial article. So today’s issues are akin to a second offense.

- It’s still late in filing its 10-K. This is not even close to the ordinary course of business for a company.

- SMCI’s auditor quit while work remains unfinished on the 10-K and SMCI’s internal controls. In its 8-K SEC filing disclosing the incident, SMCI states that Ernst & Young’s resignation letter said, “information EY received raised questions, including about whether the Company demonstrates a commitment to integrity and ethical values consistent with Principle 1 of the COSO Framework, about the ability and willingness of the Audit Committee and overall Board to demonstrate and act as an oversight body that is independent of the CEO and other members of management in accordance with Principle 2 of the COSO Framework, and whether EY could rely on representations from certain members of management and from the Audit Committee.” In the Resignation Letter, EY stated, in part: “we are resigning due to information that has recently come to our attention which has led us to no longer be able to rely on management’s and the Audit Committee’s representations and to be unwilling to be associated with the financial statements prepared by management, and after concluding we can no longer provide the Audit Services in accordance with applicable law or professional obligations.” (The COSO framework provides “guidance on how organizations can implement controls to prevent, detect, and manage fraud risk related to external financial reporting”).

- I get that Liang is talking the good talk about how the company won’t have to restate anything. Do you believe that?

- Let’s suppose the 10-K, when it eventually surfaces, won’t have any restatements of past results. How confident should we be, considering how this is not the first time SMCI has run into accounting controversies (As noted above, it happened around 2020.) How do we know something new won’t pop up a few years hence, and maybe even raise the question of whether results that don’t get restated now should have been restated?

- Do you think NASDAQ loves delisting companies, or even putting companies on notice of possible delisting? Companies pay handsomely to be listed. So, NASDAQ takes money out of its own pocket if it delists a company. So I can’t imagine, NASDAQ, a publicly owned company in its own right, would do that willy-nilly.

- And there’s still a major short seller out there.

Therefore, one who pounds the table for SMCI and diverts attention from the other 3,010 companies Seeking Alpha covers (390 of which are in tech) is taking on baggage I believe no investor should take on.

What To Do About SMCI Stock

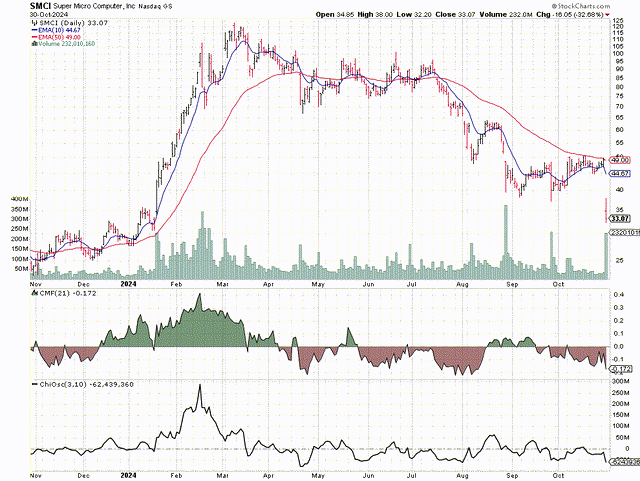

Here’s the price chart.

Even before the monstrous October 30th gap down, the chart was bad.

The meh-at-best 10-day Exponential Moving Average (EMA) crossed below the weak 50-day EMA back in July.

Consider, too, Chaikin Money Flow (CMF) and the Chaikin Oscillator (CO). Both measure which party to trade is more motivated. CMF does it for institutional investors. CO does it for the market in general.

The bigger segments of the investment community (institutional and mainstream Wall Street participants) have been negative on SMCI for a while. Sellers have been more motivated than buyers. That’s not likely to reverse any time soon.

As I’ve said before, my investment stance depends mainly on whether I think a stock will be better than, in line with, or worse than the market.

Here’s how I apply that to the Seeking Alpha rating system:

- “Strong Buy” means I see the stock as being better than the market, and I’m bullish about the direction of the market.

- “Buy” means I see the stock as being better than the market but am not confident about the market’s near-term direction.

- “Hold” means I see the stock as moving in line with the market.

- “Sell” means I see the stock as being worse than the market but am not confident about the market’s near-term direction.

- “Strong Sell” means I see the stock as being worse than the market, and I’m bearish about the direction of the market.

No more Mr. Nice Guy. No more “Hold.”

Based on this scale, I’m rating SMCI as a “Sell.”

Again, I understand this stock would likely soar if all the clouds around SMCI vanish. I don’t care. Any process that would let me own SMCI would be horrible. Even if luck would prevent me from being bitten by SMCI this time around, such a process would probably hurt me in many other tough situations down the road.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.