Summary:

- Super Micro Computer has plummeted after news EY resigned.

- This is a huge red flag and raise even more doubts over SMCI’s accounting.

- The next two weeks will be filled with catalysts that will make or break the stock.

- The company will have to change a lot in order to regain investor confidence.

Three Images

Thesis Summary

Super Micro Computer (NASDAQ:SMCI) plummeted 33% after news of its auditor Ernst & Young resigned came out on Wednesday the 30th. This has been enough to scare a lot of investors away.

We can’t deny that things don’t look great for SMCI here. In my opinion, we should at least expect a slight adjustment to their recent earnings releases, though we won’t know anything for sure until their next release.

Despite the recent collapse in the price, SMCI is still up in the last year, just about.

There’s a real business profiting from AI here, but is that going to be enough to change the stocks’ faith?

Does SMCI have room for redemption? I highlight the five things necessary for this to happen.

The EY Resignation

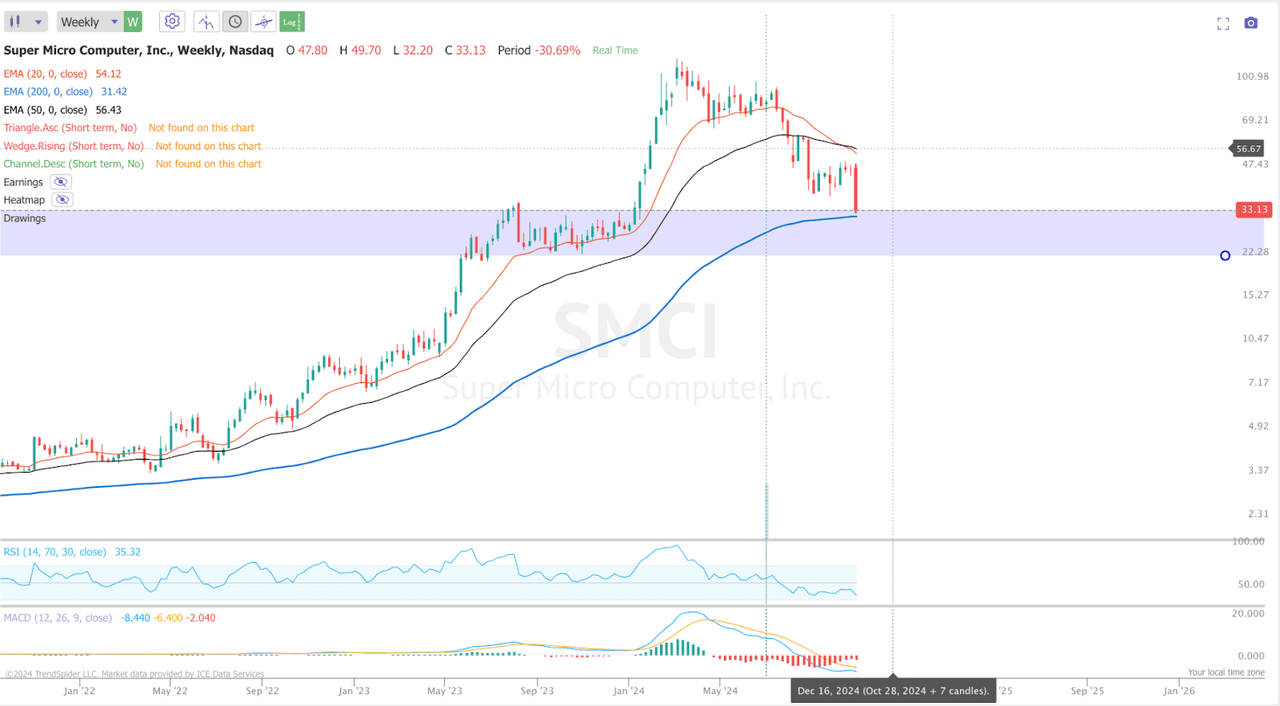

In my last article on SMCI, I highlighted that a lot of the bad news was already priced into the stock. Clearly this was not the case. However, I also point out that the $25 area was the next point of major support. We’re getting quite close to it now.

The sell-off has been catalyzed by the news that EY would be resigning as the company’s auditor.

We are resigning due to information that has recently come to our attention which has led us to no longer be able to rely on management’s and the Audit Committee’s representations and to be unwilling to be associated with the financial statements prepared by management

Source: EY Statement, SA Press Release

EY declined to comment further on the matter, while SMCI said they disagreed with the auditor’s decision and did not expect any of the issues that EY raised to result in a restatement of their results.

Without delving too far into speculation, it’s hard to ignore the different incentives at play here, which makes me think that EY’s resignation is probably a big red flag.

EY is being paid to audit SMCI’s books, which means it is actively turning down what we can only assume is a significant revenue stream for them.

What Happens Next?

That’s what we want to know. What happens next? And how will it affect the stock price?

Firstly, SMCI will have to find another external auditor, as per SEC regulations. Finding one would be a first, and tiny step, towards restoring their reputation.

More importantly, however, the company has announced it will issue a business update on November 5th. That’s next Tuesday, and all eyes will be on this release. From what I understand, this isn’t actually a full earnings release, only an update.

Next, I expect we will at some point get some more information regarding an ongoing probe by the DOJ.

Lastly, as it stands right now, SMCI could get delisted from the Nasdaq as early as soon as November 16th

SMCI currently has a listing noncompliance letter from Nasdaq dated Sept. 17,” Rakesh said in a client note. “We believe this notice gives SMCI 60 days (Nov. 16) to present a plan to return to compliance with Nasdaq requirements or face delisting (the second instance in the last 5 years).

Source: Mizuho Securities analyst Vijay Rakesh

So, we have an action-packed couple of weeks for SMCI. Is there any way this plays out favourably for the company?

Is There Room For Redemption?

Betting in favour of SMCI right now is clearly a contrarian idea. Things aren’t looking great for the company, but I’d argue that if certain criteria are met, we could see a reversal.

Firstly, SMCI needs to secure another auditor, that’s a given.

Secondly, we need to see SMCI’s next earnings. It’s one thing for management to say there will be no material changes, and a whole other for us to see this in the next earnings.

Thirdly, we need to see the DOJ and SMCI situation resolved in some way, as it is also casting more uncertainty on the stock.

Fourth, and perhaps most significantly, we would need to see big changes in management. Specifically, I think a new CEO will have to take charge if SMCI is to recover from this.

And, lastly, I’d like to see the price hold this key area of support.

SMCI is now holding its weekly 200 EMA, and we’re heading into an important area of volume around $25. Technicals can only take us so far in exceptional situations like this, but they are still helpful tools. Despite the recent sell-off, the chart still looks reasonably healthy.

Final Thoughts

SMCI has made a big mess of things, no doubt about that. However, while revenues or margins may have been overstated, there has been real growth in the last year. The company has large and public contracts with many of the other AI players. This is a company selling a product that is still in demand, and at some point, investors will have to look at the fundamental valuation again. When all is said and done, will SMCI still look as undervalued as it does today?

I am downgrading SMCI to hold since I believe the stock is undervalued, but there’s so much uncertainty around the accounting that the price will take a long time to recover.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Macro moves markets, and this is what I do at The Pragmatic Investor

Join today and enjoy:

– Weekly Macro Newsletter

– Access to our Portfolio

– Deep dive reports on stocks.

– Regular news updates

Start your free trial right now!