Summary:

- Super Micro Computer’s auditing firm Ernst & Young has just resigned.

- Investors are concerned with Super Micro’s accounts’ accuracy.

- Super Micro may be delisted from Nasdaq.

Khanchit Khirisutchalual

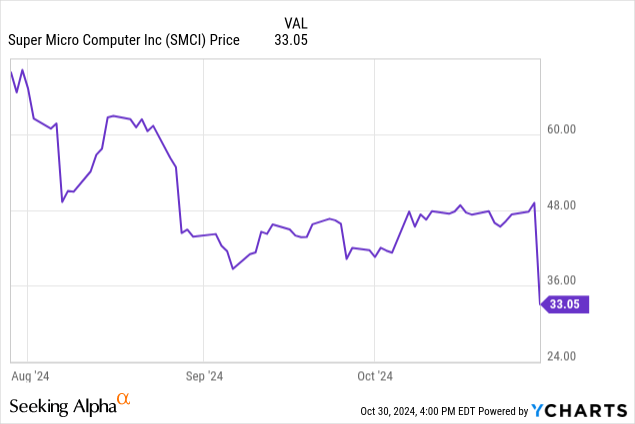

Super Micro Computer, Inc. (NASDAQ:SMCI) stock has just crashed as Ernst & Young LLP, Super Micro’s auditor, decided to resign as the company’s independent registered public accounting firm. After this was announced, SMCI’s stock price dropped by almost 30%. However, concerns about the company’s financial statements began in late August after Hindenburg Research issued a report stating it was selling Super Micro’s stock short. Super Micro also said its annual 10-K filing was delayed. Here is my take on the matter.

My previous coverage of Super Micro’s stock

In my previous analysis of Super Micro’s stock, I wrote that SMCI stock plunged in value after the company’s 10-K filing delay. Also, Super Micro’s fundamentals were not brilliant, in my view. The company’s cash flows seemed a cause for concern to me. This was in contrast to surging revenues. Then, the stock was not a bargain despite Super Micro Computer’s situation. Let me see how this has or has not changed.

Here is what’s happened to Super Micro

As I have mentioned at the beginning of this article, Ernst & Young refused to serve as Super Micro’s independent auditing firm. According to Ernst & Young’s resignation letter:

“We are resigning due to information that has recently come to our attention, which has led us to no longer be able to rely on management’s and the Audit Committee’s representations and to be unwilling to be associated with the financial statements prepared by management, and after concluding we can no longer provide the Audit Services in accordance with applicable law or professional obligations.”

In plain words, this official statement suggests the auditing company questions the accuracy of Super Micro’s accounts and does not want to be held responsible. Obviously, this is a good enough reason for investors to worry.

Additionally, the auditing firm’s resignation also means Super Micro would further have to delay the filing of its 10-K form, and the company may therefore be delisted from Nasdaq. On 17 September 2024, a letter was sent from Nasdaq due to Super Micro’s delay in filing its annual report on form 10-K for the period ending 30 June 2024. The form was due on 29 August 2024. Companies are required to have their 10-K forms audited in order to be allowed to submit them. So, if a new auditor is not appointed and does not approve the company’s accounts, SMCI stock could be delisted from Nasdaq.

Super Micro Computer’s upcoming quarterly earnings report

Since my last article about Super Micro, the company has not reported any earnings results. As I have mentioned in my previous analysis, despite having reported excellent sales growth, the company has recently had very poor cash flows, which, at its very best, signals the management’s desire to expand the business at all costs. So, I would not be as interested in knowing its net profit and sales figures. Instead, I would prefer the management to explain the current situation with its accounts, the new auditor’s appointment, and the delisting threat.

Super Micro Computer is set to report its quarterly earnings on November 5, 2024.

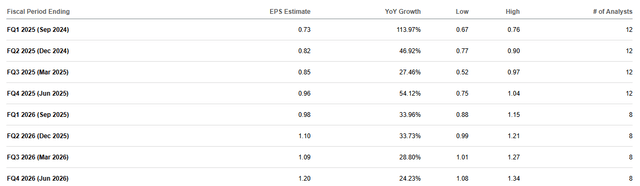

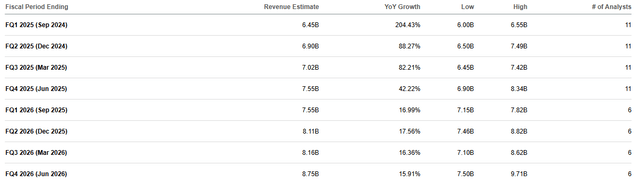

The average expected EPS for the quarter is 0.73, which suggests 113.97% growth.

Even more brilliant is the expected sales increase. The average revenue estimate is $6.45 billion, suggesting 204.43% growth.

However, as I have mentioned before, this is not the most important part of Super Micro’s story.

Downside risks

The downside risks are very clear. The first one is the loss of investors’ confidence. Accounting scandals lead to substantial reputational damages. This may lead to the stock depreciating further in value. Then, Super Micro may be delisted from Nasdaq. The company’s business may, therefore, face challenges in attracting new capital because it may not be able to issue and publicly sell new shares. Apart from the obvious risks related to the new situation the company is in, as an AI stock, SMCI may further plunge in value if investors’ over-enthusiasm with AI stocks fades. I appreciate Super Micro’s shares are not as popular as they used to be. But they may depreciate further together with the overhyped high-tech sector.

Upside risks

Upside risks include the possibility of a good earnings report. The company will report its quarterly earnings soon, and investors may be positively surprised if sales and profit figures exceed analysts’ expectations. In my opinion, these numbers are not highly relevant now when the company is going through an accounting scandal. However, some investors may treat this earnings announcement with some optimism. Then, there is a possibility new auditors will be appointed soon, and these new auditors will confirm the financial statements’ accuracy. This is not my base-case scenario. However, this is possible.

Valuations

Super Micro has lost a substantial part of its market capitalization. On Wednesday, it had lost almost a third of its value.

YCharts

Data by YCharts

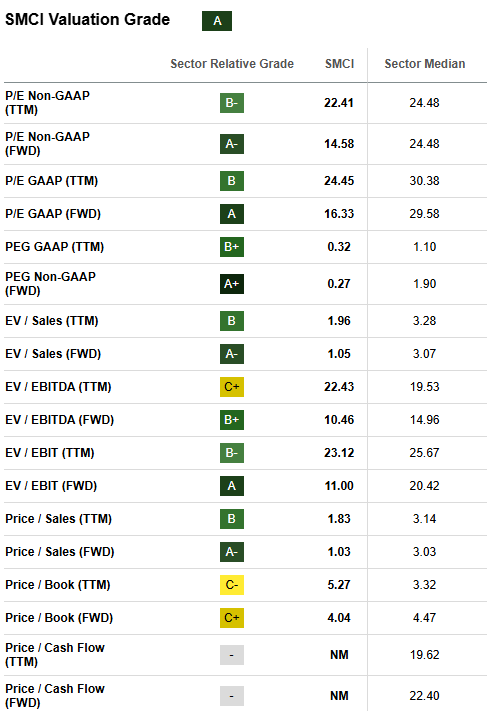

Moreover, valuation ratios also point to the company’s undervaluation. This is especially true of SMCI’s P/S and P/E ratios. However, as can be seen from the table below, the price-to-cash flow ratios are negative. That is because Super Micro has been reporting negative net cash flows for a while, which is concerning for the company’s debt and cash position.

Seeking Alpha

Conclusion

I would personally refrain from purchasing SMCI stock in the current situation because of the accounting scandal. It is uncertain whether Super Micro will soon find a new auditor and submit its 10-K form. My base-case scenario is that matters would probably get even worse while SMCI stock will further plunge in value. However, if Super Micro manages to somehow restore the market’s confidence in its accounts, its stockholders will be here to gain. However, I am highly skeptical that it will manage to do so in the near future. So, my rating on the stock is still “Hold”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.