sefa ozel

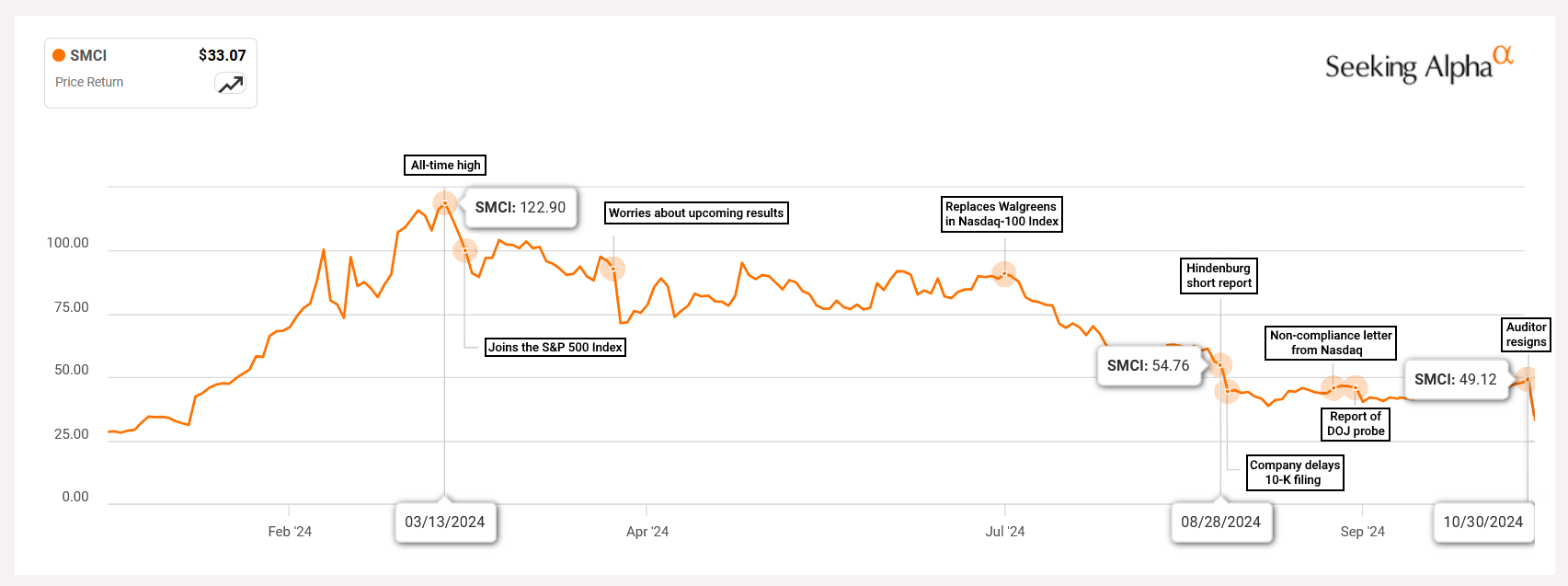

Wednesday was a big day for Super Micro Computer (NASDAQ:SMCI), which plunged over a third in response to its auditor resigning. It added to the worries of alleged financial reporting and governance issues that have cast shadows on the popular AI stock. Since an all-time high of $122.90 in mid-March, shares are down 73%, finishing yesterday’s session at $33.07. Shares are also dropping again premarket, off another 4% to $31.83.

What are investors saying on the matter? Check out the 400+ comment thread from SA subscribers.

What are analysts saying on the matter? Read the latest article from SA Investing Group Leader Value Investor’s Edge.

What’s next for the company? Auditor resignations are rare, but can happen for a range of reasons. In the case of Super Micro (SMCI), Ernst & Young was the second auditor the company had in a span of 18 months. In its resignation letter, the accounting firm announced it was “unwilling to be associated with the financial statements prepared by management” and flagged concerns about the board’s independence from CEO Charles Liang and “other members of management.” Back in 2020, Super Micro also paid a $17.5M penalty to the SEC amid allegations that it prematurely and improperly recorded revenue.

In order to get things back in order, the company will likely need to shake things up at the board level and the C-suite, as well as assuring shareholders that its profits and financial statements do not contain any manipulation. If not, it risks suffering the fate of public companies that have found themselves in similar situations. Firms like SunPower (OTC:SPWRQ) and Tingo Group (OTC:TIOG) were eventually delisted this year after facing notable accountancy resignations that also included independent auditor Ernst & Young.

Check out the chart below showing the big events impacting Super Micro Computer (SMCI) over the past year:

More on Super Micro

- Analysts bail on Super Micro, but contagion is limited as AI trade rolls on

- Super Micro tumbles after Justice Department starts probe: report

- Super Micro Computer receives non-compliance letter from Nasdaq

- Super Micro crashes after company says it will not file 10-K on time

- Super Micro Computer drops after new short report from Hindenburg Research