Summary:

- We reiterate our buy on Intel Corporation after 3QFY24 earnings, as we continue to believe the outlook will be too easy to miss.

- For the quarter, Intel management reported Q3 sales of $13.28B outpacing consensus of $13.02B and guided for Q4 sales of $13.3-14.3B, with the midpoint ahead of consensus estimates at $13.66B.

- We think INTC should see some share regain in the PC market with Lunar Lake.

- We think investors will enjoy a honeymoon phase until 1H25 before the share threats from ARM Holdings and Nvidia kick in more fully on the server and AI PC front (potentially).

oversnap/E+ via Getty Images

At the end of September, late last quarter, we reiterated our buy recommendation on Intel Corporation (NASDAQ:INTC), arguing that while there remained no near-term catalyst for the business, INTC was undervalued. With a market cap of roughly $93B at the time and a stock price down 55% YTD, INTC was trading significantly below the peer group average on all fronts, and unjustifiably so considering INTC’s longer-term positioning and potential, in our opinion. Our belief was and still is that the Street sentiment on INTC is too negative, and, in turn, the stock should see some outperformance on ground-level expectations. This thesis played out sooner than expected with the market’s positive reaction to the company’s better-than-feared 3QFY24 results and outlook on Thursday. We reiterate our buy after earnings, as we continue to believe the outlook will be too easy to miss.

For the quarter, management reported Q3 sales outpacing consensus, up 3.55% Q/Q to $13.28B versus consensus of $13.02B and guided midpoint above consensus for 0-8% growth Q/Q to $13.3-$14.3B for Q4 sales compared to estimates for $13.66B. This beat caused shares to surge 7% higher in extended trading, further proving just how low expectations were for the company. Part of the uptick in investor confidence came in reaction to management forecasting a better future for its PC and server businesses while still disclaiming that there is “a lot of work to do.” We believe low enough expectations coupled with INTC’s new Lunar Lake Notebook CPU, which should allow for the company to regain some share in the PC market, will provide more upside for the stock.

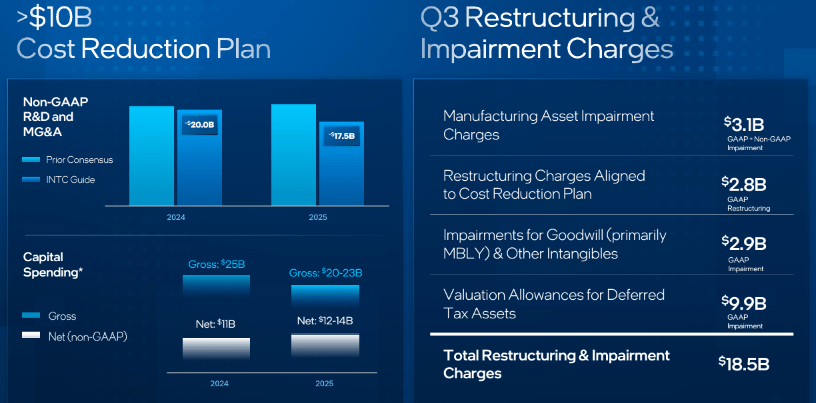

Let’s be honest: It wasn’t all positive with INTC, and it still isn’t, but the worst should be behind us. For the quarter, management reported a hefty net loss, at $16.6B, compared to a net profit of ~$300M in a year ago quarter, due to charges relating to impairment and restructuring. INTC continues to push cost reductions to improve profitability, as shown in the image below.

INTC 3QFY24 Earnings Presentation

We think these charges shouldn’t alarm investors specifically as they’re growing pains and had been disclaimed in the Q2 call. The charges were reflected in the quarter’s gross margin, with non-GAAP gross margin declining to 18% from 38.7% last quarter but is expected to rebound next quarter and expand to 39.5%. Management also interestingly announced a reduction in its capital expenditure plans for the year and provided a softer spending guide for next year. Now, management expects its 2024 gross capex to be $25B, instead of the previous forecast for $25B to $27B, and guided for 2025 capex in the range of $20B to $23B. We recommend investors get in on INTC’s ‘honeymoon’ phase before it faces more intense competition in the PC Client front and Data Center & AI one from potential share loss to Arm Holdings (ARM) and Nvidia (NVDA).

Why is it Only a “Honeymoon” Phase for Now?

For the quarter, INTC reported Client Computing Group or CCG sales down 1% Q/Q to $7.33B, with the segment continuing to account for the bulk of INTC’s total sales. We think INTC should see some share gain in the PC market with its Core Ultra 200V series processors, code name Lunar Lake, which was announced in September, for Notebooks, and its Arrow Lake for Desktop. Lunar Lake is a superb product, in our opinion, and will provide a competitive edge over AMD’s Ryzen AI 300 series processors. It will also allow INTC to reclaim some lost share to AMD on that front. Management noted the following about Lunar Lake:

In September at IFA, we launched our Intel Core Ultra 200V series processors formerly named Lunar Lake. This is the most efficient family of x86 processors ever created, setting a new standard for mobile AI performance and significantly out performing competitor platforms.

Lunar Lake’s combination of superior performance at comparable and competitive battery life positions us well to continue to define and lead the AI PC category.

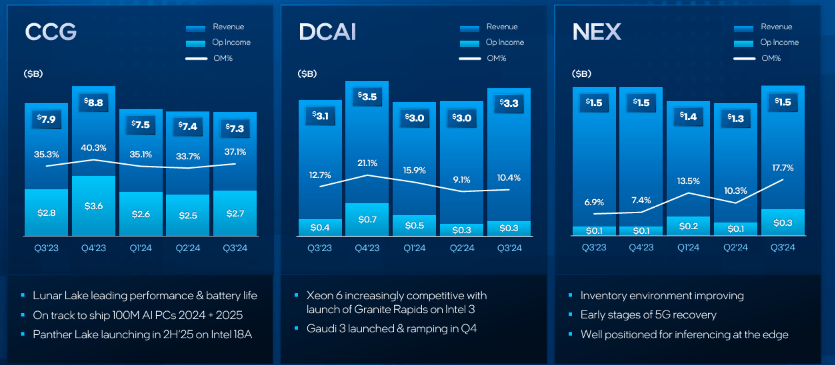

The company’s second-largest revenue stream comes from its Data Center & AI Group, or DCAI. This quarter, DCAI saw a 10% sequential rebound and a 9% Y/Y growth, bringing its sales to $3.35B due to some recovery in demand for traditional servers. We think there’s some stabilizing happening in INTC’s server CPU business with its new Granite Rapid CPU for servers.

The real concern for INTC, as it remains, is pressure on its share of the PC and server markets. We think that by 1H25, INTC will become a high-risk stock due to the threat of losing market share to the ARM CPU on the server front, pressuring the x86 market share. What worsens it are rumors starting that NVDA will be coming into the PC Client market for AI PC; when and if that happens, INTC is really in trouble on all fronts. INTC does not really have anything enough to address the AI accelerator market or compete meaningfully within it, particularly as the performance gap widens as we watch for NVDA’s GB200 NVL36/72 offering. Having said this, we think these share loss risks are 1H25 story, and there’s still some time left in the honeymoon phase for INTC.

The following chart outlines INTC’s business unit sales as of Q3.

INTC 3QFY24 Earnings Presentation

Valuation & Word on Wall Street

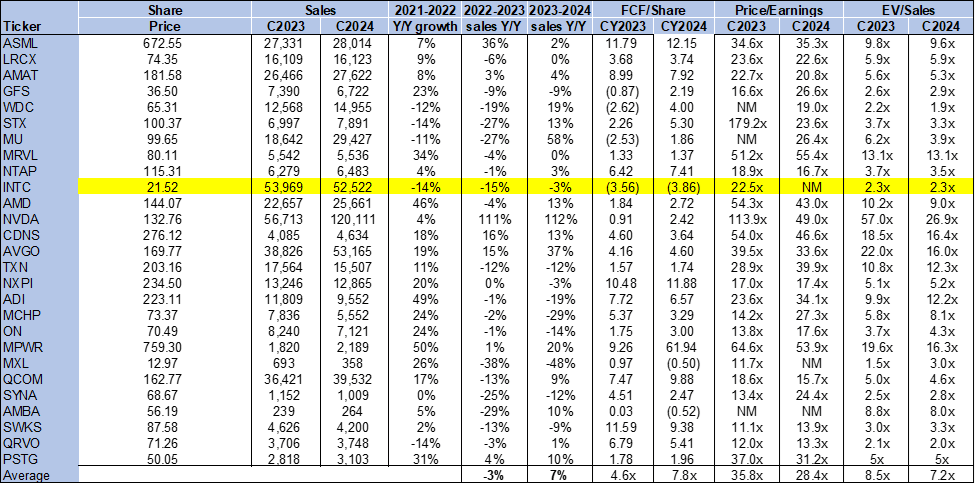

We continue to believe INTC isn’t fairly valued at current levels. The stock is undervalued, trading at 2.3x EV/C2024 sales versus a peer group average of 7.2x. Its two greatest competitors, AMD and NVDA, trade significantly higher than the peer group average in comparison at 9.0x and 26.9x, respectively. We think the stock’s current valuation reflects low market expectations for future earnings and expect INTC, armed with its Lunar Lake and other offerings, to be able to outpace said low expectations. We think this is a name worth adding on weakness. The stock valuation remains the same as in our last September article, where the stock’s EV/Sales was 2.3x against a slightly higher group average of 7.4x. We understand investors’ concerns about profitability and gross margin; in our opinion and management’s, INTC should see more comfortable margin expansion reignite once it ramps volume shipments for its internal 18A-nm based CPU in 2H25 and 2026.

The following chart outlines INTC’s valuation against the peer group.

Tech Stock Pros

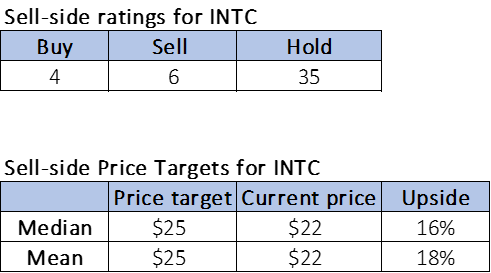

Wall Street’s sentiment also remains more or less unchanged from September ratings. Of the 45 analysts covering the stock, four are buy-rated, 35 are hold-rated, and the remaining six are sell-rated. The sell-side price targets, however, now make room for better potential upside; assuming the stock price at around $22 per share, the median and mean of $25 make for a potential 16-18% upside compared to 11-13% when we last wrote on the stock. The following outlines Wall Street’s sentiment on the stock.

Tech Stock Pros

What to Do With the Stock?

We think INTC still makes for a good trade, considering low expectations and potential upside until the end of the year. INTC should be able to regain some share of the PC market with its upcoming Lunar Lake CPU. We think investors will enjoy a honeymoon phase until 1H25 before the share threats from ARM and NVDA kick in more fully on the server and AI PC front (potentially). We think investors shouldn’t shy away from the stock too early.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.