Summary:

- Adobe is a leader in creative software with impressive growth in sales and net income, driven by innovative AI products like Adobe Firefly.

- The company’s AI advancements, such as AI Assistant in Acrobat and Reader, are transforming user experiences and driving significant engagement and growth.

- Despite increasing competition, Adobe’s high margins, cash flow, and undervaluation at 23.6x forward P/E make it an attractive long-term investment, in my opinion.

- I calculate a 6x risk-to-reward ratio and potential 25-60% upside, making me reward Adobe with a strong buy, ideal for dollar-cost averaging.

gorodenkoff

Investment Thesis

Adobe is a creative software platform that enterprises and individuals around the world use to design exceptional digital experiences. It operates through three diverse business segments: Creative Cloud, Document Cloud, and Experience Cloud. They are the leader in graphic design software and dominate the market share by a wide margin. With customers such as Amazon (AMZN), Alphabet (GOOGL), Disney (DIS), Home Depot (HD), even the U.S. Treasury Department, and many more, it goes to show that some of the biggest and best companies across industries trust and want to use the best products possible to elevate their company and I believe that is with Adobe.

Despite already being the leading platform for creative design they are still growing at a very respectable pace. The company’s sales and net income 5-year CAGR both sit just above 14%, which in my view is phenomenal. On top of that, analysts expect sales and EPS to continue to grow in the low to mid-teens for the next 3-5 years. ADBE is an innovator and continues to offer users more and better experiences and products, but the stock price has not reflected this yet, in my opinion. Growth and user reach are the main focus for now followed by platform monetization.

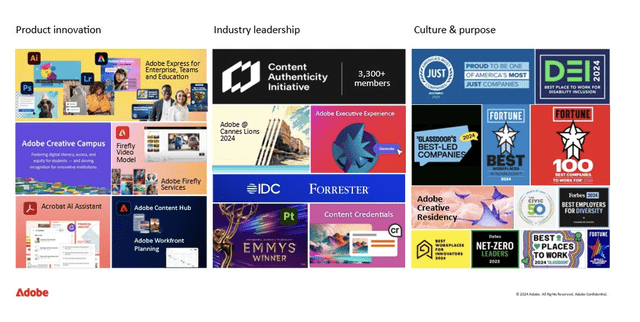

ADBE Overview (ADBE Investor Relations)

Adobe recently released an abundance of new products and services utilizing and embracing the AI momentum. In my eyes, they are one of few companies currently selling a product with AI capabilities and so far it seems like people love them.

Their “Adobe Firefly” has been spectacular as it allows creators to generate videos and images from text. They also have tools to seamlessly edit visuals, extend the length of videos or scenes, and really do whatever a creator wants at the click of a button. They have made it so that generated images load 4 times faster now and it is an easy fix to edit original content. Their goal is to offer the consumer the best of the best tools to create and I believe they are taking every step to do so.

ADBE Innovation – Firefly (ADBE Investor Relations)

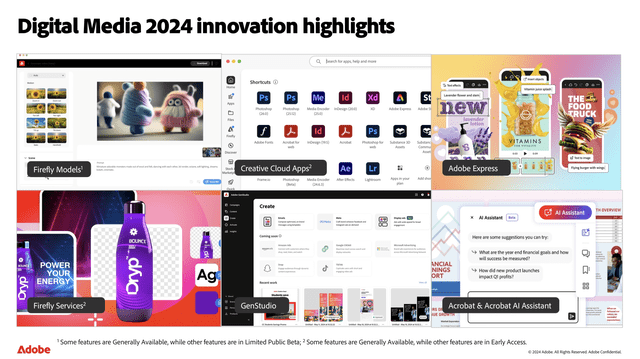

Management said on the Q3 call that already 12 billion Firefly-powered generations with AI tools have been ran and that number will only grow from here. Soon, Adobe will not only be a creative software platform, but also a company with vast amounts of data. It’s not just their Firefly product that’s seeing great growth, either. The Document Cloud business was up a respectable 18% YoY last quarter, Acrobat Web monthly active users were up 35% YoY last quarter, and their new product innovations on PDF collaborations seem to be having a very positive effect according to management:

For decades, PDF has been the de facto standard for storing unstructured data, resulting in the creation and sharing of trillions of PDFs. The introduction of AI Assistant across Adobe Acrobat and Reader has transformed the way people interact with and extract value from these documents. In Q3, we released significant advancements including the ability to have conversations across multiple documents and support for different document formats, saving users valuable time and providing important insights. We’re thrilled to see this value translate into AI Assistant usage, with over 70 percent quarter over quarter growth in AI interactions.

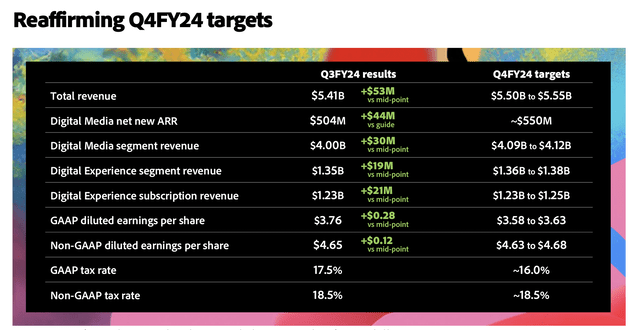

ABDE 2024 Numbers (ADBE Investor Relations)

Overall, my point on ADBE is why wouldn’t you want to own the#1 digital experience platform in the industry? They are the go-to provider not only for enterprises but for most retail or individual workers and creators. They have been a leader for years now with Photoshop, Illustrator, and more. We are just at the beginning of their new capabilities with AI technology, and I believe it has only made the company more dangerous to compete with.

They have outstanding margins, with gross margins at nearly 90% and net income margins just over 25%. This allows them to generate a ton of free cash flow, with a north of 3% FCF yield, based on my calculations. At a historically low 23.6x forward P/E, I see this stock as cheap and attractive. At $485, I calculate a 6x risk to reward at current levels. This leads me to rate the stock a compelling buy!

I do have my concerns, mainly increasing competition, but at this valuation, and with new AI products constantly rolling out from management to improve the platform’s abilities, it’s hard not to like the stock. I love the positioning ADBE has going into the long term and even if the stock drops any lower it would only add to the attractiveness of an already very lucrative long-term hold.

Risks

I briefly mentioned it in the conclusion to my investment thesis, but the big risk I see in ADBE and what could cause this stock to fall more than just a normal 5% or 10% pullback is the increasing competition they face which has the potential to steal market share. Just as much as AI is helping ADBE get more customers and keep existing ones by improving offerings, other competitors are doing the same. Now, not many have the resources, balance sheet, or partners ADBE has, but at the end of the day, it is about the product.

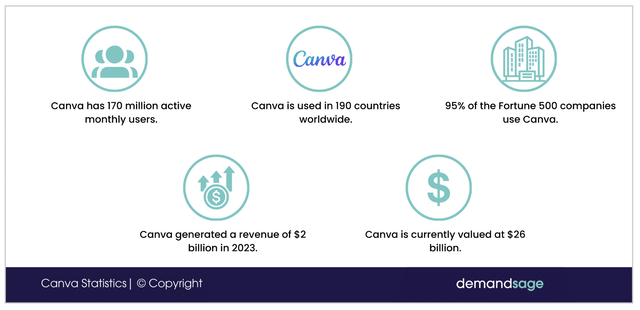

The big-name I believe that is slowly starting to steal market share from ADBE is a private company named Canva. They too, are a graphic design software company, and they have been taking the design world by surprise for the past 5 years or so. I can certainly see a world where the graphic design industry is some sort of duopoly with a one-two punch of Adobe and Canva sucking up all the business. Maybe a Canva-Docusign merge one day? All jokes aside, if ADBE does not consistently upgrade its technology and offerings, users, especially the younger ones, will start to use new tools from other players in the game.

Canva Overview (Google)

I also want to highlight that even though Canva is easily Adobe’s main competitor, they are also fighting off hundreds of other companies including start-ups, mega-caps like Google and Microsoft, DocuSign, and more. Adobe has its hands (business) in a lot of different baskets (industries) and they have to always improve each side of the business. The document business takes on DocuSign, they both compete for market share, Graphic design, and experiences they compete with Canva and others.

I believe, the problem with being at the top is there is always a target on your back and that’s what worries me about ABDE. They have an amazing head start with a magnificent product, but just one quarter, one year taking their foot off the gas, off their opponent’s throat, and its stockholders who could pay the price. Thankfully, I trust management to continue forward at full throttle, but no matter what, I believe, it is critical to know and understand what the main risk are before making an investment. Ask yourself why might this position fail.

Valuation and Price Targets

I have mentioned it before, but I will say it again, at current levels I believe ADBE is cheap. I calculate them trading at 23.6x next year’s earnings which is well below its 10-year average at 33x, roughly. 23.6x P/E is even in line with the industry average. A company that is a leader in its industry, growing on the top and bottom line in the double digits at this valuation is just another indicator to me that the stock is undervalued. Even other industry leaders like Home Depot (HD) trade at 26x and Walmart (WMT) at 31x who are growing much slower and have much lower margins have a higher multiple. I know it is comparing apples to oranges, but I think you get my point.

An industry leader, a cash cow, who is still growing deserves to trade at a competitive premium and ADBE does not. Peer, DocuSign (DOCU), even trades at a close valuation at 20x P/E, which in my opinion, is night and day between the two companies. Even other “peers” INTU and CRM trade at multiples in the high twenties and low 30s further indicating ADBE’s undervaluation. Maybe it’s because the risk of competition stealing market share is bigger than we think, but I still believe in this well-trusted and heavily used brand.

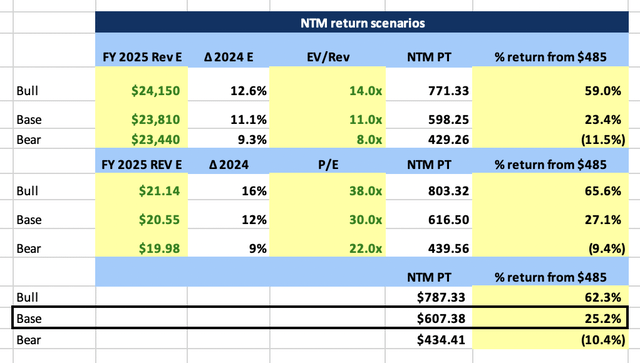

In the chart below, I use the stock’s current forward P/E along with current analyst estimates to create a bull, base, and bear case scenario over the next twelve months. With the stock already down nearly 19% YTD I see an intriguing buying opportunity at current levels. Revenue and earnings have not slowed, but the stock price has still been stagnant really over the last 3 years. I believe this phase is almost over and the stock is one great quarter away from breaking out to eventually new highs. You will see below that I see a 25% upside in my base case scenario and more than 60% upside in my bull case. And with roughly just 10% more downside risk at current levels that is where I get my enticing 6x risk to reward.

ADBE NTM Price Target Scenarios (Author Calculations Based on Data From Seeking Alpha)

This is not a stock I own yet, but every time it drops under $500, my eyes get wide in excitement, full of interest. Dollar-cost averaging into the stock until the next earnings report would be the approach I would take and if it drops on earnings, I would be comfortable buying more, granted no fundamental changes to the company have been made.

Conclusion

I wrote about Adobe and rewarded them with a strong buy rating because I believe they are a top-tier brand offering a graphic design platform that millions of people love and use every day. They have multiple product offerings that are a part of people’s daily routine, day in and out. On top of having a phenomenal, must-have product, in my opinion, ADBE is a cash machine with a good balance sheet and spectacular profit margins. Adobe, an established leader in the software and tech industries is still growing at a double-digit growth rate. With a forward valuation now in the low 20s, I believe now could be a great opportunity to add to this name that has created a moat around its brand and products. This is a valuation I would be happy to buy at. In my view, ADBE is a name investors can feel good about owning. This is a smart long-term growth and value play, in my opinion. As The Richest Man in Babylon States, “Too attract good luck to oneself, it is necessary to take advantage of opportunity.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Jake Blumenthal is a Registered Investment Advisor and Portfolio Analyst with Meridian Wealth Management, a SEC Registered Investment Advisor. The views and opinions expressed in the following content are solely those of Jake Blumenthal and do not necessarily reflect the views and opinions of his employer, Meridian Wealth Management. The content provided is for informational purposes only and should not be considered as financial advice or a recommendation to engage in any investment or financial strategy including the buy or sell of any specific security. Readers are encouraged to conduct their own research and consult with a qualified financial professional before making any investment decisions. Meridian Wealth Management does not endorse or take responsibility for any content shared by Jake Blumenthal outside of his official duties at the company.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.