Summary:

- Amazon was up over 6% on Friday, rallying behind a solid earnings report on Thursday night.

- However, shares are currently bumping up against resistance around the $200 level.

- The selling pressure around the $200 level in July coincided with some major insider activity.

Sundry Photography

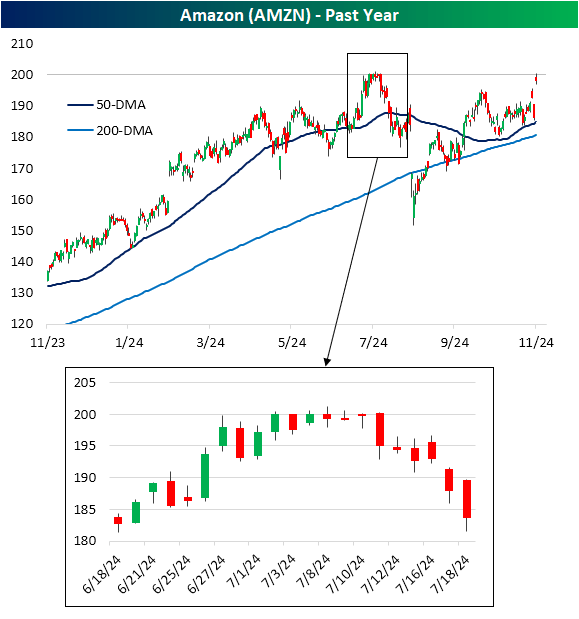

Amazon (NASDAQ:AMZN) was up over 6% on Friday, rallying behind a solid earnings report Thursday night. However, shares are currently bumping up against resistance around the $200 level. In July, the stock reached these same levels but outside of a handful of intraday blips, repeatedly failed to push above $200.

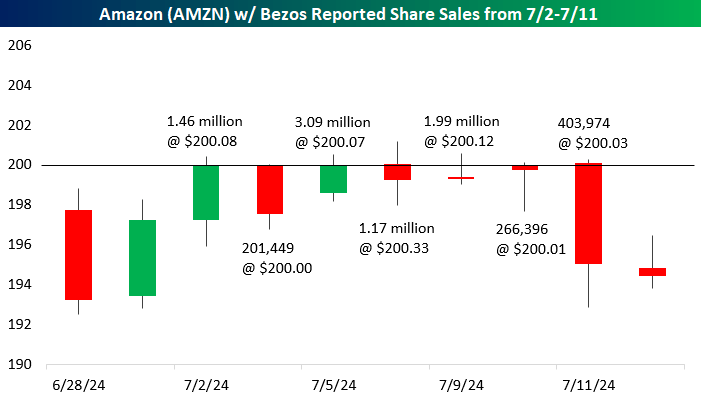

The selling pressure around the $200 level in July coincided with some major insider activity. In March, it was reported that Amazon founder Jeff Bezos planned to sell up to 25 million shares of AMZN by the end of 2025. When AMZN kept unsuccessfully trying to break through $200 in July, we quickly found out why.

Insider transaction filings showed that Bezos seemingly had a limit order to sell millions of shares above $200. As you can see below, from July 2nd through July 11th, Bezos sold millions of shares a day at an average price just above $200.

On July 11th, the last day of reported selling from Bezos, the stock no longer had enough buyers to keep up with Bezos’ sell orders and eventually traded lower. Since then, there have been no more reported Bezos sales, and the stock price didn’t get near $200 again… until today.

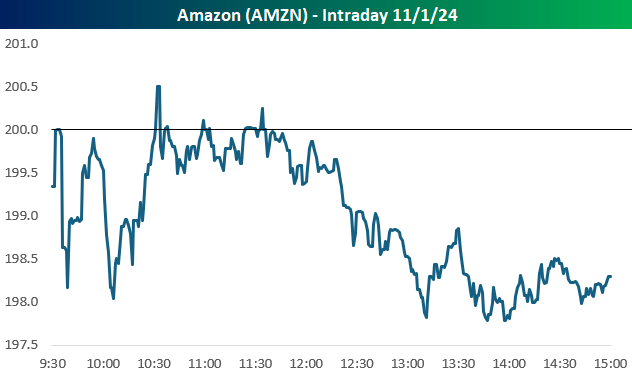

As mentioned earlier, AMZN shares reacted positively to earnings after the close last night and traded up 6%+ in reaction to the news. That took shares up near $200 at the open this morning for the first time since July 11th – when Bezos last reported a sale.

Based on AMZN’s intraday action today, it looks like Bezos still has a live $200 limit sell order because the stock stalled out at $200 once again and couldn’t break through.

Back in July, Bezos managed to unload more than 8 million of the 25 million shares he reportedly plans on selling. The stock has traded over 80 million shares today, but only around 5 million shares have traded at $200 or higher, so we’ll see how many more shares he managed to unload when his next insider sales report gets filed.

For now, it looks like $200 is going to remain stiff resistance until the Bezos shares clear.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.