Summary:

- You can collect income from millions of homeowners across the U.S. without ever leaving your home.

- Passive income means fewer stressors and more enjoyment.

- What is the true American dream?

Kirpal Kooner

Co-authored by Treading Softly.

When you consider the American dream, what does that mean for you?

The concept of the American dream has been with us since the Great Depression. It’s been used and abused, defined and redefined multiple times. For many people, the American dream is summed up as a white picket fence around a house. It is the ability to own a home and have a wage that allows you to live a comfortable life from 40 hours of work, and the possibility that anyone can achieve that in America. Yet when the concept of the American dream began, it wasn’t about consumerism or materialism. Quite the opposite, actually. James Truslow Adams, who is credited for popularizing the term, defined it this way:

“The American Dream is that dream of a land in which life should be better and richer and fuller for everyone, with opportunity for each according to ability or achievement… It is not a dream of motor cars and high wages merely, but a dream of social order in which each man and each woman shall be able to attain to the fullest stature of which they are innately capable, and be recognized by others for what they are, regardless of the fortuitous circumstances of birth or position”

So, while the dream of homeownership is one that many of us share, it is not essential to be part of achieving the American dream. The concept revolves around the fact that anyone can start from any starting point and, by virtue of their character, work ethic, and what they’re able to achieve, can climb higher. We’ve seen entrepreneurs of all stripes who come to America from other lands and achieve great success because of their skills, abilities, and tenacity. You don’t have to look far to discover that those individuals are embodying what is believed to be the American dream. Yet, homeownership is still the dream of many, and for good reason. Owning a home can provide you with many intangible benefits outside building equity and developing wealth.

Today, I want to look at a route in which you can benefit from the homeownership of others. The last time we covered this company, we concluded:

“With AGNC, we can pick up a REIT that is trading at a premium to book value in a situation where they should be minting as many shares as possible because their assets are highly discounted and likely to see strong price changes in the future. CEFs, BDCs, and REITs grow the same way, primarily through issuing new shares to ink additional investments that benefit all shareholders. When they’re sold at a premium to book value, it raises the book value for every single shareholder, new and existing. MBS prices are always the first to be impacted by the economy and interest rates. If the economy starts to stumble, investors and institutions take a risk-off approach and start buying up treasury notes, Agency MBS, and triple-A-rated CLO debt. This is because they’re considered to be very low-risk assets. When you take an mREIT wrapper and add in their leverage, it does increase the risk of the investment because now you’re holding not just the safer asset but the safer asset plus all of the additional leverage. With AGNC, we see reasonable levels of leverage being deployed to own these assets and to amp up the income they generate.”

The big question is, how has AGNC done in continuing to use the premium to their book value that they trade for to their benefit or have they squandered that benefit so far? Today, I want to take a look at the most recent quarterly earnings and see if there are any insights we can glean as we continue to collect great income for our neighbors.

Let’s dive in!

How’s My Neighborly Income Stream?

AGNC Investment Corp. (NASDAQ:AGNC) is a mortgage real estate investment trust (mREIT) that focuses on buying agency mortgage-backed securities (agency MBS). When adding leverage, it provides massive income to shareholders, with yields of 15.5%.

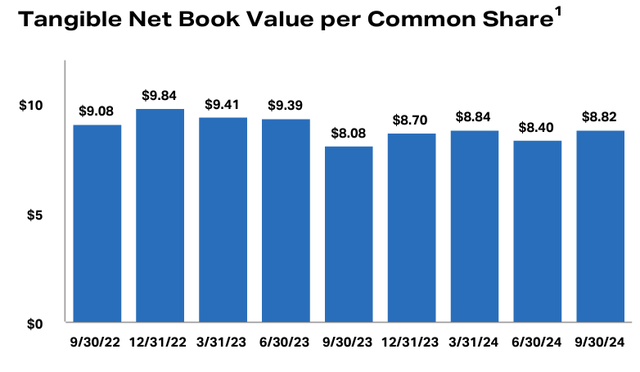

AGNC reported earnings that fell in line with our expectations. Book value was up 5% for the quarter as MBS prices recovered. AGNC continues to trade at a material premium to book value, and it is worth noting that book value is down so far in October. We look at book value, but it is important to remember that it changes every single day, and the book value we see is just one day in a quarter. Source.

MBS prices have stabilized. While they vary, they have been trading in a tighter range than they were during the Fed’s hiking cycle. We can see that looking at the chart for 5.5% coupon MBS over the past 5 years: Source.

MBS prices are nowhere close to a full recovery, but have stopped their decline and have been much more stable.

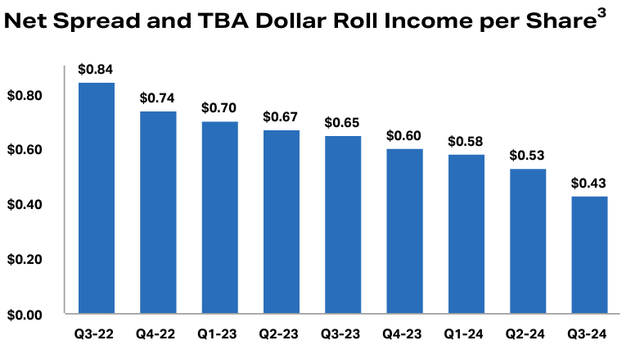

AGNC’s Net Spread & Dollar Roll Income declined significantly in Q3 to $0.43. Still easily covering the dividend, but on a downward trend:

As we explained last quarter, this was expected because AGNC had several very low-paying interest rate swaps that were maturing in Q3. AGNC had inflated earnings thanks to those swaps, and those weren’t sustainable. That’s why AGNC didn’t raise its dividend to match earnings, they knew the swaps would roll off.

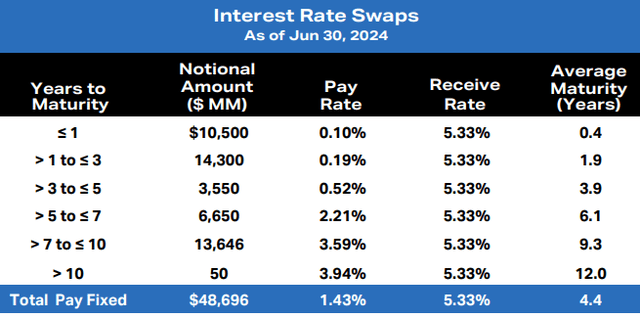

Last quarter, we presented this slide to you, showing the swaps that were rolling off. Note $10.5 billion in swaps paying just 0.1% were maturing in an average of 0.4 years. A large chunk of those rolled off this quarter.

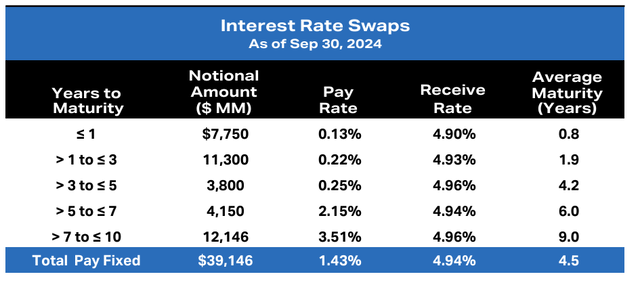

Looking at the same slide from Q3, we can note that the average maturity for the next batch is 0.8 years.

So the big decline in Q3 was expected, and now AGNC has a period where it won’t see significant swaps expiring for another 6 months. So for the next two quarters, we can expect their cash flow to increase. Unless the Fed slashes rates to 0% in the next 6 months, odds are that repo rates will be higher than 0.13% so in Q2 2025 we can expect another increase in interest expense. However, it will be smaller than we saw last quarter.

Meanwhile, AGNC issued equity in Q3 taking advantage of their premium to book value and buying more agency MBS.

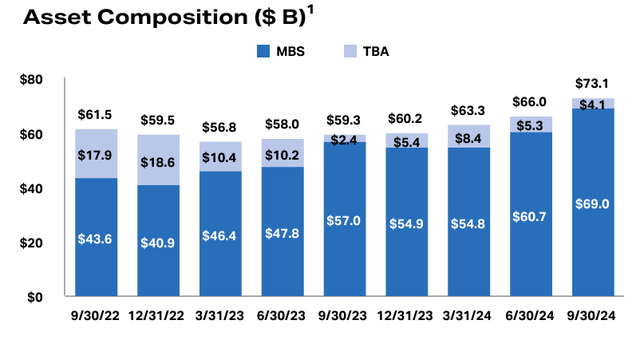

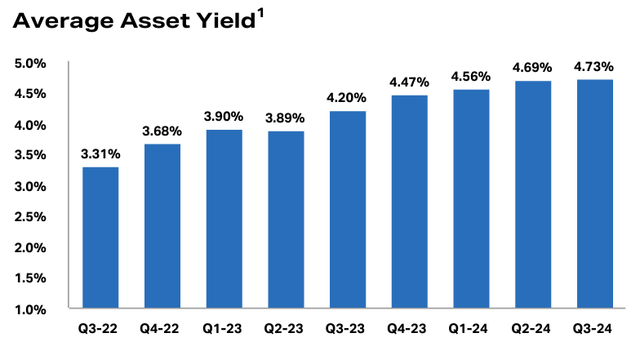

AGNC increased its MBS holdings by $8.3 billion in Q3, and its portfolio is larger than it has been in several years. AGNC’s average asset yield continues to climb upward:

The pace of growth is slowing as the portfolio is approaching the coupon of new MBS (5.5%). This will continue to climb, albeit at a slower pace. This will set them up in a very positive position for when the cost of borrowing comes down further.

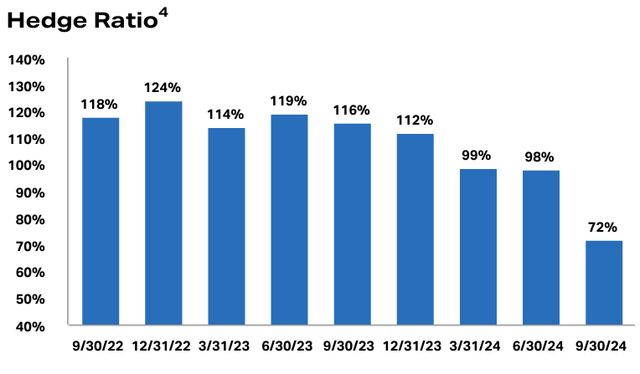

Without hedges, AGNC’s cost of repurchase agreements was 5.26% in Q3, that number will decline quickly in relation to the Fed’s target rate as the average maturity is 14 days. Declining rates will benefit the unhedged portion of AGNC’s portfolio, which for the past two years, AGNC has hedged more than 100% of its debt. In Q2 it was hedging 98% and in Q3 it is hedging 72%:

This decline in hedge ratio is because AGNC anticipates the Fed will keep cutting, and it will allow their portfolio to benefit from lower rates. A 72% hedge ratio tells us that 28% of AGNC’s debt will decline in cost whenever the Fed cuts rates.

In the earnings call, management said they expect the long-term economics to be a ROE (return on equity) of 16-18%, which is where they expect their net spread income to end up as the moving parts normalize. Here is an excerpt from the call:

“That’s still above the long-run economics as you point out. Today, the economics of new mortgages are in the 16% to really 18% range right now. I would expect our net spread and dollar roll income on our margin, to compress consistent with that. And the speed and pace of growth of our portfolio, also has an impact on that compression.”

This is consistent with the current dividend, and possibly a dividend increase. We saw an increase from peer Dynex Capital (DX) this quarter. DX was more conservative with the payout ratio to begin with. However, we believe that the dynamics are improving for the whole sector and DX’s raise was the first of several we will see throughout the sector going into 2025. A steepening yield curve is a massive benefit for these companies, and the negative headwinds are being relieved every time the Fed cuts.

Agency MBS remains a sector we are extremely bullish on.

Conclusion

With AGNC, we can continue to collect wonderful monthly income while the mREIT leverages its unique position to grow its portfolio and, by extension, our exposure to the homeownership of millions of Americans. Looking forward, agency MBS remains attractively priced, and falling rates benefit AGNC over time as their old hedging continues to fall off.

When it comes to retirement, I like to encourage my readers to dream big. A big retirement dream isn’t defined in dollars and cents; it’s defined in goals you want to achieve during retirement, places you wish to visit, or the lifestyle you would like to live. Money is a tool, not an endpoint. It enables you to live life more effortlessly but makes a miserable life when it forms the sole focus. Enrich your life with experiences and relationships, and allow money to support you. A lack of money can lead to massive issues in retirement; a surplus of money has limited benefits. My Income Method is designed to be a tool you use to achieve your dreams, not the dream itself. Your dream should be as beautiful and unique as you are.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AGNC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Treading Softly, Beyond Saving, Philip Mause, and Hidden Opportunities, all are supporting contributors for High Dividend Opportunities. Any recommendation posted in this article is not indefinite. We closely monitor all of our positions. We issue Buy and Sell alerts on our recommendations, which are exclusive to our members.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

High Dividend Opportunities, #1 On Seeking Alpha

HDO is the largest and most exciting community of income investors and retirees with over +8000 members. We are looking for more members to join our lively group! Our Income Method generates strong returns, regardless of market volatility, making retirement investing less stressful, simple and straightforward.

Invest with the Best! Join us to get access to our Model Portfolio targeting 9-10% yield. Don’t miss out on the Power of Dividends!

We’re offering a limited-time 17% discount on our annual price of $599.99 plus a 14-day free trial via this link only: