Summary:

- Even though the economy has been unstable in 2022, the consumer staples sector has proven to be more resilient than others.

- Multiple reasons contributed to the resiliency, including cutting back on luxury items to pay for basics.

- 2023 is expected to be more challenging than 2022, and companies must be cost-effective. PEP’s competitor, KO, is better at this than it is, which could hurt PEP’s performance.

stefanrows/iStock via Getty Images

Investment Thesis

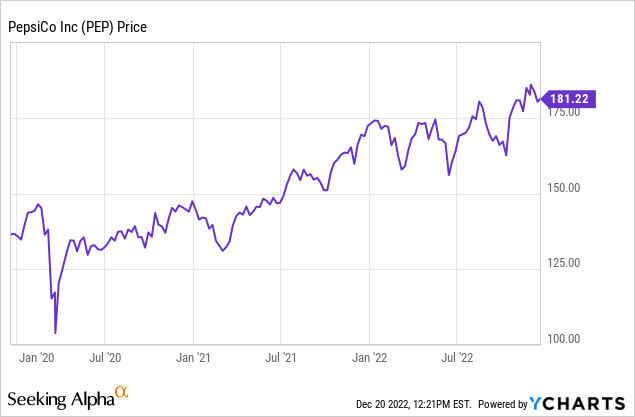

PepsiCo, Inc. (NASDAQ:PEP) is a multinational food and beverage corporation. It operates in the global consumer staples industry, which has historically shown greater resilience than other markets have during periods of economic downturn. Since March 2020, the company has been on an upward trend, which I attribute to the breadth of its product offering and geographic diversity. This is especially true given that consumers have been cutting back on luxury purchases in favor of necessities due to the harsh economic times brought on by covid 19 and historically high inflation rates.

Since investors may be worried about the impact of a possible recession in 2023 on their portfolios, I will analyze this stock from the perspectives of both value and dividend investors. This firm has earned a solid reputation among dividend investors for maintaining a stable dividend payout even in difficult economic times. This makes it, in my opinion, a top dividend payer in its field.

Due to the company’s inability to manage costs like its main competitor, Coca-Cola (KO), its profitability may be weighed down when a recession hits, forcing its share prices down. This current price presents the best opportunity for value investors to cash out at a profit and wait for a cheaper entry point, perhaps during the recession.

Sector Analysis: Insusceptible to Market Turmoil

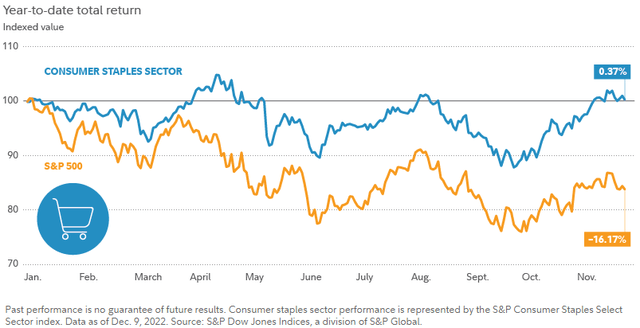

Due to its consistent outperformance during market downturns, consumer staples is regarded as a “defensive” sector. In 2022, it proved its defensive credentials by outperforming the market despite rising input costs.

Fidelity

Several contributing factors helped the industry. As the year progressed, unemployment remained low, and consumers maintained healthy savings rates, allowing them to absorb the year’s price increases more easily. Additionally, consumers became accustomed to seeing price increases, decreasing the likelihood of ” trading down” to less expensive alternatives. Therefore, many businesses could increase prices without experiencing a drop in sales. Those who increased prices rapidly in response did the best. In addition, the unusually high inflation rates caused consumers to reduce their discretionary spending and concentrate on essentials, a boon for the consumer staples industry.

Even while the stocks did better than average compared to other sectors, the industry had a challenging year and is on track for a negative annual return. Companies had difficulties because of the high price of oil, a vital component of many common consumer goods and packaging materials. The value of their international sales suffered due to the strength of the US dollar. As consumers looked for better deals, some businesses saw a decline in sales as private-label alternatives became more appealing.

Many of the 2022 tendencies that began to emerge will likely carry over into 2023. However, if the economy continues to weaken and the unemployment rate continues to increase, consumers may be more sensitive to future price spikes than they were in the past.

Many producers of consumer staples are bracing for another year of adversity by being flexible with package size and frugal with their marketing budgets. Many companies may resort to cost-cutting measures such as layoffs and productivity enhancements if demand continues to fall. While 2023 could be a challenging year for the industry, some businesses should do well despite the difficulties.

PEP Costs Vs. KO: KO Competitive Advantage?

Following the forecast that 2022 challenges could persist to 2023, adding to the looming recession, companies are expected to manage their costs to remain competitive and thrive in the looming downturn.

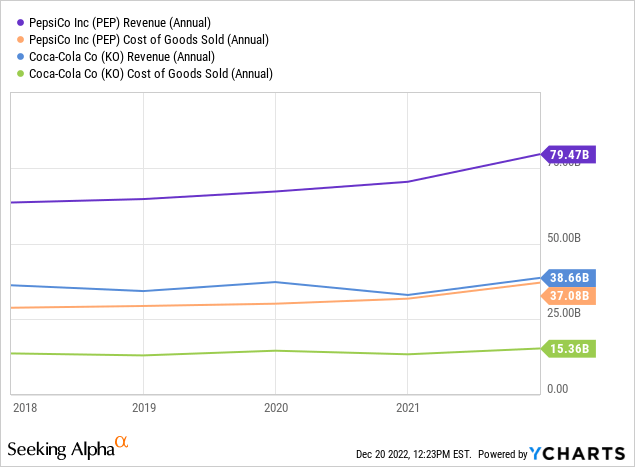

Given this context, I compared the PEP’s costs to the KO’s to determine which company was more adept at controlling expenses. To begin, I looked at the ratio of their COGS to their total sales. PEP’s revenue is on the upswing; at the moment, the company reports $79.47B in revenue compared to KO’s $38.66B, but KO appears to have better control over its cost of goods sold. In making this assertion, I looked at KO’s $15.36B in expenses [representing 39.73% of its revenues] and PEP’s $37.08B in expenses [representing 46.68% of its revenues] and came to my conclusion.

To sum up KO’s sales efficiency, its receivable turnover ratio is 10.31, whereas PEP’s is 8.53. This indicates that despite spending significantly more on sales, PEP is less effective at collecting on them than its competition.

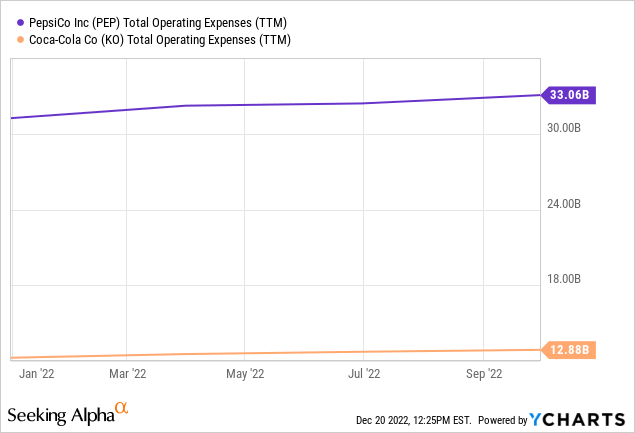

Secondly, in comparing the two companies operating expenses, KO has a total operating expense trailing at $12.88B against PEP’s $33.06B. This figure reflects that PEP is spending 2.6X in total operating expenses than KO. This further illustrates that KO is better at managing its costs than PEP; thus, it’s better positioned to cope with 2023 than KO.

In my perspective, PEP’s inability to control its cost may affect it because it will affect its profitability when sales decrease due to less demand predicted next year. This is based on forecasts that 2023 will be more challenging than 2022. Therefore, I anticipate a deceleration in PEP’s profits in 2023, forcing downward pressure on its share price.

Dividend: Sustainable And Attractive

Regarding paying out dividends, PEP is among the top-tier companies. The company has consecutively paid dividends for 50 years compared to an average of 12 years of the industry. In addition, the firm has a 50-year dividend growth history, while the average in the sector is only 2 years. These factors demonstrate the company’s dividend payment reliability and resilience in economic uncertainty.

With a dividend payout ratio of 66.92%, the company allocates a sizable percentage of its profits to its shareholders, a sign its committed to them. Despite the impending economic slump in 2023, I believe this policy is entirely sustainable and that the company will continue paying dividends.

Conclusion

PEP being in the consumer staple industry has shown a lot of resilience although the harsh economic climate witnessed this year. Generally, the industry has been resilient because of the high inflation rates cut across, so companies could raise prices without fearing losing customers. Additionally, the constrained budgets compelled consumers to cut down discretionary spending in favor of staples.

Moving to 2023, the year is projected to be more challenging than 2022, and companies are expected to manage their costs to remain competitive. On evaluating PEP’s cost against KO’s, PEP has much to improve in terms of cost management to match its competitor. However, despite KO edging PEP in terms of cost management, I don’t expect the anticipated 2023 to be a significant threat to PEP’s dividend payment; however, if the company doesn’t watch its cost, it may weigh its profitability or, rather, its financial performance in general, forcing the shares down. Given these dynamics, I would advise potential investors to wait for this potentially cheap entry point to buy into this good dividend payer.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article was researched and written by January Mbuvi.