Summary:

- PayPal’s current stock price does not reflect its true market potential, offering investors a rare chance to capitalize on its undervaluation.

- The company’s strategic focus on launching innovative products and initiatives is set to drive substantial profitability growth.

- With its strong market position and forward-thinking strategies, PayPal is poised for significant upside, making it an attractive investment opportunity.

Michael Vi

Investment thesis

My previous bullish thesis about PayPal’s (NASDAQ:PYPL) stock aged well, as the stock rallied by more than 21% since August. The company recently released its Q3 2024 earnings, which I have analyzed in deep detail.

Despite a mild after-earnings selloff, I do not share pessimism of the market. The Q3 earnings release was solid both from the perspective of financials and underlying business metrics. New products and offerings appear to be working well so far, and the management’s guidance raise indicates confidence in the company’s foreseeable future. Moreover, the stock is still very attractively valued with a massive upside potential. All in all, I reiterate a “Strong Buy” rating for PYPL.

Recent developments

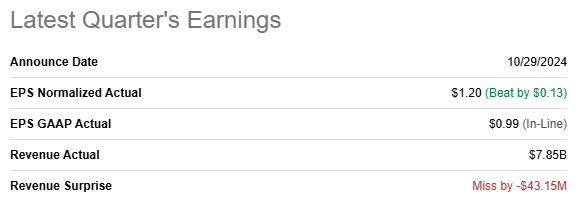

The company released its latest quarterly earnings on October 29 when it missed revenue consensus expectations. On the other hand, the miss was quite narrow and almost invisible in relative terms. Moreover, there was a relatively wide positive adjusted EPS surprise.

Seeking Alpha

Quarterly YoY revenue growth slowed to 5.8%, down from the 8.2% growth reported in Q2 2024. However, PayPal showed strong improvement in vital profitability ratios. The gross margin increased YoY 39.03% to 41.12%, and the operating margin was up from 16.03% to 19.19%.

Seeking Alpha

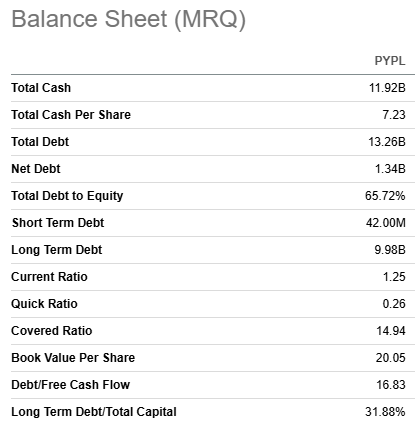

As a result of expanding profitability ratios, PYPL generated $1.6 billion in cash from operations [CFO] during Q3. The CFO was up by almost 30% YoY, which is certainly a strong performance. Strong CFO allowed the management to inject around $1.8 billion in stock buyback, which was beneficial for shareholders. PayPal’s financial position is robust, with the cash balance just around 10% lower compared to the total debt.

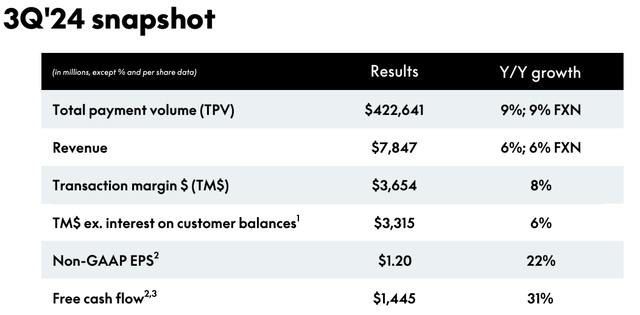

PYPL’s Q3 earnings presentation

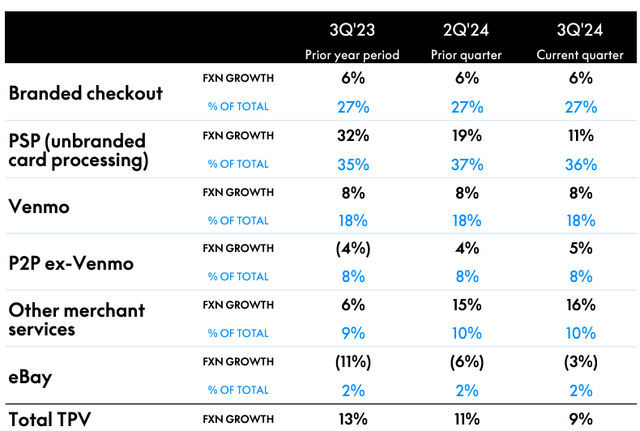

Therefore, PayPal’s financials look good from the big picture perspective. Underlying business metrics also add optimism. The total payment volume [TPV] demonstrated a solid 9% YoY growth, and transaction margin expanded almost perfectly in line with the TPV. The number of active accounts was about flat on a YoY basis, which means that PYPL continues focusing on profitability instead of just expanding the customer base. It is well-known that the new management’s strategic shift focuses on prioritizing profitability improvements over growth at all costs. This indicates that management is delivering on its promises, which I view positively as an investor.

PYPL’s Q3 earnings presentation

I think that growth of the key financial and business metrics is highly likely sustainable because the management did good job in expanding its set of offerings to customers.

The company’s focus on its own branded checkout experience is paying off. Vaulted checkout experienced over 100 basis points of improvement, whereas one-time checkout saw up to 400 basis points of improvement, as new mobile and desktop checkout experiences have been launched. The introduction of Fastlane — targeting the 60% of online orders without a branding label — is another growth driver. Since Fastlane is already used by more than 1,000 merchants, PayPal has an excellent chance of capturing more of the guest checkout share.

The transition of Venmo from peer-to-peer [P2P] to a holistic financial solution is taking shape. Venmo debit card and Pay with Venmo are also driving increased engagement and monetization, with monthly active debit card accounts up 30% and Pay with Venmo users increasing 20% during the quarter. Such developments demonstrate Venmo’s capacity to become a powerful revenue generator.

PayPal’s Everywhere initiative, which was created to reshape PayPal’s consumer experience, uses cashback promotions and an enhanced app to encourage daily omnichannel spending. The early success of PayPal Everywhere — more than 1 million new debit card users registered on the site since its launch — confirms its potential to increase consumer usage and transactional volumes.

PYPL’s Q3 earnings presentation

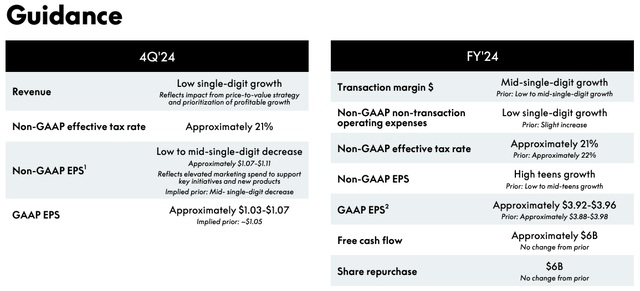

As a result of solid performance demonstrated by new offerings, the management is quite optimistic regarding remainder of the fiscal year. During the earnings call, the management announced that it is raising its guidance for transaction margin dollars and non-GAAP earnings per share. I also find guidance improvements as a big bullish sign as this indicates the management’s confidence in the company’s near-term prospects.

Valuation update

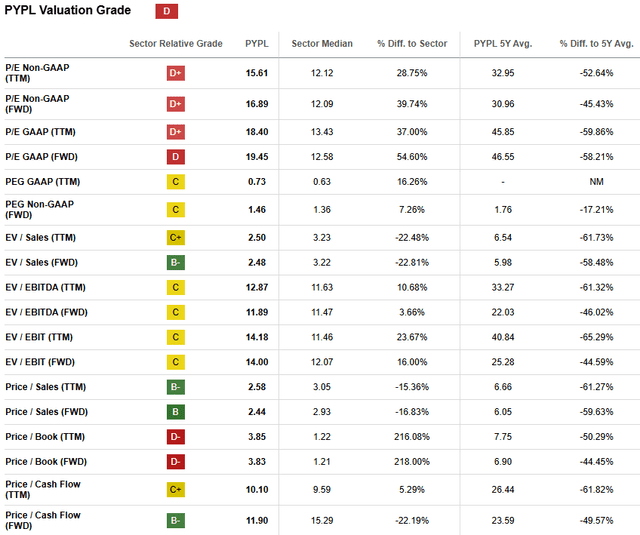

PYPL rallied by around 50% over the last 12 months, notably outperforming the broader U.S. stock market. Performance in 2024 is also ahead of the S&P 500 index with a 26% YTD rally. Despite a low “D” valuation grade from Seeking Alpha Quant, I find PYPL’s valuation ratios extremely attractive since they are significantly lower compared to historical averages.

Seeking Alpha

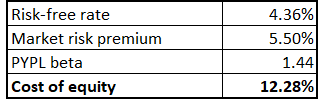

Looking only at valuation ratios is never enough for me, so I proceed with the discounted cash flow [DCF] simulation. The CAPM approach helps me in figuring out the discount rate, which is the cost of equity. According to the below formula, PYPL’s cost of equity is 12.28%.

Author’s calculations

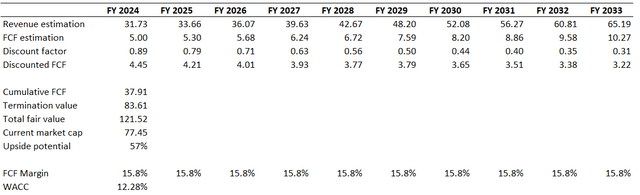

As usual, I take the next decade’s revenue forecast from consensus and incorporate it into my DCF. I think that this trajectory is fair enough because an 8.3% CAGR for the next decade looks conservative compared to the previous decade’s around 15% revenue CAGR. The last five years’ FCF margin average is 15.8%, and I use this level flat for the entire decade.

Author’s calculations

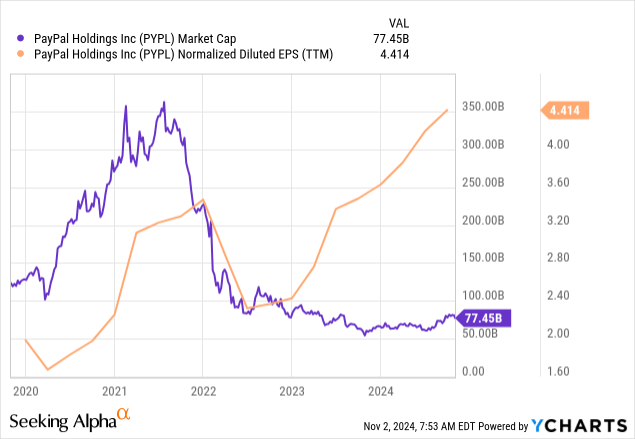

The business’s fair value is $122 billion, significantly higher compared to PayPal’s current market cap. The upside potential is 57%, which makes PYPL an extremely attractive investment opportunity. Some readers might say that a 57% upside potential suggested by my DCF is unrealistic, but just take a look at the below chart. My $122 billion fair value estimate looks very conservative compared to the market cap’s historical maximums. Please also note that PYPL’s EPS is currently at an all-time high.

Risks update

PayPal is doing well and has a strong position in the market, but it faces several challenges that could affect its future growth and profits. The digital payments industry is very competitive, with both well-known companies and new startups trying to capture market share. To stay ahead, PayPal needs to keep innovating and offering unique services.

Being a global payments company, PayPal has to comply with many regulations. Changes in laws, especially those concerning data protection and cybersecurity, could increase its costs and affect how it operates. Economic factors like inflation and changes in interest rates can influence how much people spend and how many transactions occur. Since PayPal earns money from interest, it is also at risk if interest rates change.

The fast pace of technological change and new payment methods could challenge PayPal’s current business model. Therefore, the company needs to keep investing in technology to remain competitive. Additionally, as a digital payments provider, PayPal is at risk of cyberattacks and security breaches. Any security issues could harm its reputation and lead to financial losses.

Bottom line

To conclude, PYPL is still a “Strong Buy”. The valuation is still compelling, even after the recent rally. Despite the stock’s slight after-earnings dip, I am very optimistic about the latest earnings release. The management is delivering on its promises, which is crucial for a company that experiences strategic transformation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.