Summary:

- PayPal reported positive Q3 2024 results, including a 1% growth in active accounts and an increase in its transaction margin to 46.6%, driven by growth in Venmo and Braintree.

- The fintech raised its 2024 profit forecast slightly and anticipates up to $6 billion in share buybacks, particularly with seasonal eCommerce spending expected to rise amid lower inflation.

- While PayPal’s growth rate lags behind faster-growing competitors like SoFi, its lower profit multiple presents a compelling valuation, especially as it remains a preferred payment platform among merchants.

JasonDoiy

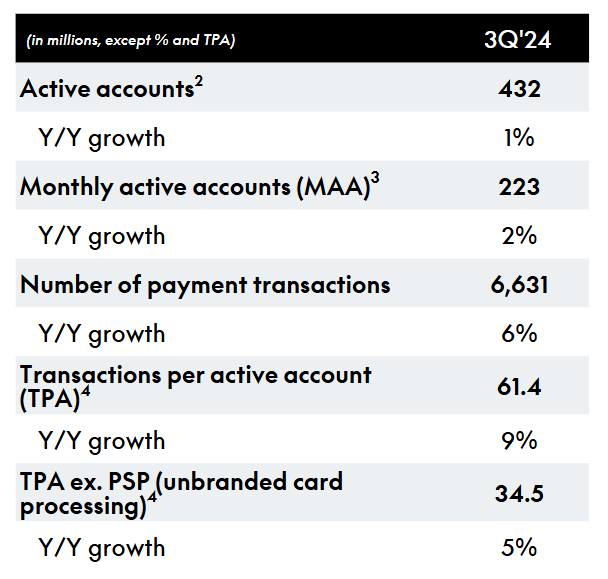

Fintech PayPal Holdings, Inc. (NASDAQ:PYPL) presented third quarter earnings at the end of last month which were in some respects very good. The fintech grew its active accounts by 1% to 432 million, presenting the first quarter since 1Q23.

PayPal Holding also tightened its forecast for 2024 GAAP profits and is benefiting from growth in its transaction margin. PayPal Holdings, obviously, is seeing much more moderate growth than anticipated maybe two or three years ago, but the fintech is on track to repurchase $6 billion of its shares this financial year and PayPal Holdings may have a strong fourth quarter based on receding inflation and seasonally growing eCommerce volumes.

My Rating History

My last stock classification on PayPal Holdings was Buy and my bullish stock classification was underpinned by the fintech growing its operating income margin and buying back shares.

I think that PayPal Holdings may not be as compelling as SoFi Technologies Inc. (SOFI) in terms of growth prospect, but the fintech’s depressed profit multiple leaves a lot of room for a higher valuation.

3Q24 Showed Positive Growth In Accounts And Transaction Margins, Fintech Raises 2024 Profit Guidance

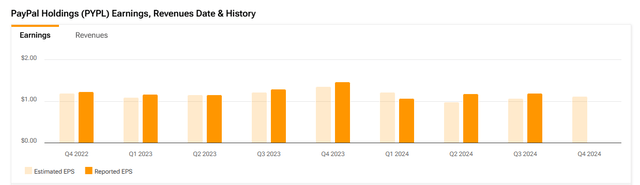

PayPal Holdings’ 3Q24 profits topped Wall Street’s expectations last week. Non-GAAP earnings of $1.20 per share surpassed the consensus EPS forecast of $1.13 by $0.07 per share amid growth in the Braintree and Venmo businesses.

Earnings And Revenues (Yahoo Finance)

PayPal Holdings’ sales rose 6% YoY to $7.8 billion, but the most important piece of information embedded in the fintech’s earnings release was that its accounts are growing again.

PayPal Holdings has dealt with considerable challenges in terms of growing its reach and adding new customers in the last couple of years which is one reason PayPal Holdings’ stock really has gone nowhere as of late. In the third quarter, however, we have seen some improvement in this regard that indicates that account growth concerns are now in the rearview mirror.

PayPal Holdings had 432 million customers using the online bank’s services as of September 30, 2024 which reflected 1% YoY growth. The fintech has struggled to expand its reach with customers in the last couple of quarters and 3Q24 was the first quarter since 1Q23 in which the fintech produced positive growth in customer accounts.

Customer Growth (PayPal Holdings)

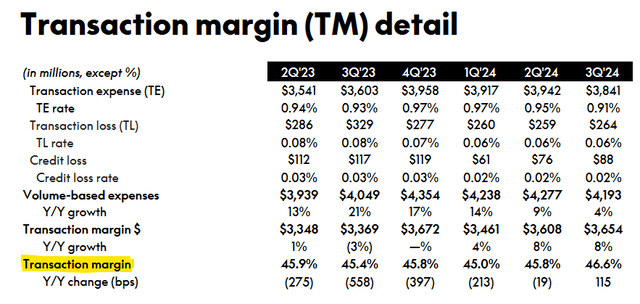

One figure that stood out from PayPal Holdings’ 3Q24 earnings besides accounts was its transaction margin which I think captures the performance of the fintech’s core business quite well.

The transaction margin is calculated as the difference between net sales and transaction expense and credit losses, divided by net sales and it gives investors a feel about how profitable PayPal Holdings’ business is.

In the last two years, PayPal Holdings has not seen much growth at all in this key performance metric, but the third quarter showed some promise: The fintech’s transaction margin climbed to 46.6%, up 0.8 percentage points QoQ. Transaction margins dollars rose 8% YoY to $3.65 billion due to strength in branded checkouts, Venmo and Braintree.

Transaction Margin (PayPal Holdings)

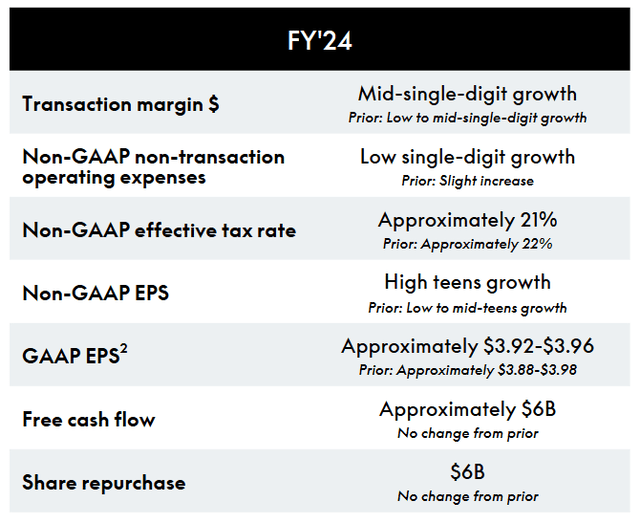

In addition, PayPal Holdings tightened its GAAP profit forecast for 2024 from $3.88-$3.98 to $3.92-$3.96 per share and raised its expectation for non-GAAP profits to high teens growth, from low to mid-teens growth. This is not a ground-breaking change, but it nonetheless illustrated that the fintech is moderately optimistic for its full year performance. Since the fintech has seen positive trends in its transaction margin and accounts, this is also not very surprising.

GAAP Profit Forecast (PayPal Holdings)

What keeps me optimistic about PayPal Holdings in addition to the narrowed profit forecast and a growing transaction margin is that the fintech is buying back more shares. Based on the fintech’s forecast for 2024, the market can expect up to $6 billion in share repurchases which implies additional demand for shares in the fourth quarter.

Moreover, a declining inflation trend could have a favorable impact on PayPal Holdings’ transaction metrics. With 4Q24 most likely to shape up to be a great quarter for PayPal Holdings due to holiday-related surges in consumer spending, I think that PYPL is a solid investment in the fintech market moving forward.

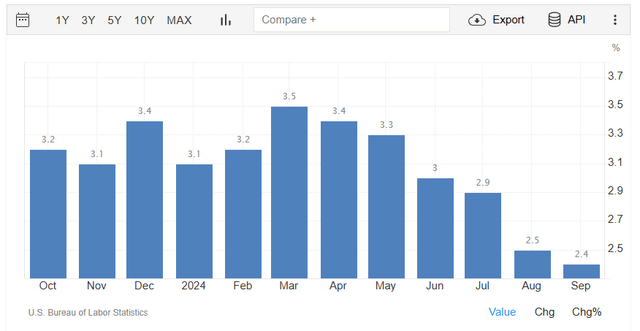

Inflation is receding fast and retreated to just 2.4% in the month of September, creating potential upside in consumer spending from which PayPal Holdings’ eCommerce-related processing business could also profit.

Inflation (U.S. Bureau Of Labor Statistics)

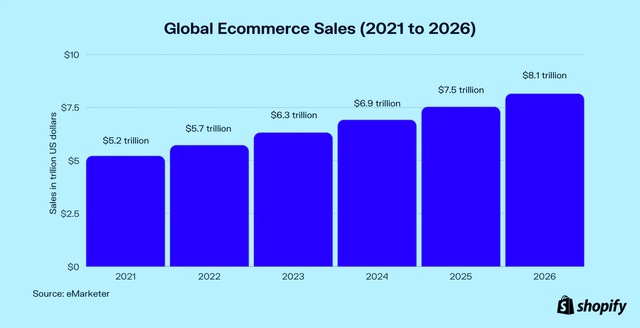

Obviously, with inflation falling and eCommerce volumes anticipated to rise long-term, fintechs that offer payment processing capabilities in return for a small fees are in good position to grow their profits.

PayPal Holdings is still very much a preferred payment solution for merchants, suggesting that the fintech is primed to participate in the growth of eCommerce.

Global Ecommerce Sales (Oberlo)

PayPal Holdings Has A Compelling Valuation Multiple

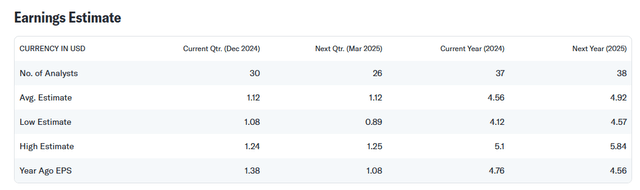

The market presently models $4.92 per share in profits for PayPal which reflects an 8% YoY profit growth rate. SoFi Technologies, which I reviewed just days ago, is anticipated to produce more than 130% profit growth in 2025 which establishes the online bank much more as a growth investment than PayPal.

PayPal is presently selling at an implied leading profit multiple of 16.1x whereas SoFi Technologies costs investors 40.1x next year’s profits. Top peer fintech Block Inc. (SQ) is anticipated to produce $4.56 per share in profits next year which reflects 27% YoY growth in profits. Since the stock is selling for 15.9x leading profits, Block is quite compelling as a growth investment as well.

Earnings Estimate (Yahoo Finance)

Why The Investment Thesis Might Be Faulty

PayPal Holdings is a mature fintech that is growing slowly in a saturated market. This, unfortunately, has led to investors ditching the stock for more compelling growth stories in the fintech market, such as SoFi Technologies.

PayPal Holdings’ key vulnerability is the lack of real substantive growth in accounts and though the fintech has managed to grow its transaction margins via growth in Venmo and Braintree, I think that in order for a real re-rating to materialize, PayPal Holdings will have to excel in terms luring more customers to its platform.

My Conclusion

As far as I am concerned, PayPal Holdings’ earnings for the third quarter were quite good in a number of ways: The fintech’s transaction margin grew in 3Q24 and PayPal Holdings raised its non-GAAP profit outlook for 2024.

PayPal Holdings also did comparatively well in terms of growing its active accounts which in the last couple of quarters have disappointed greatly. With that said, investors need to see a clear path for growth in accounts in order for them to consider buying the fintech’s stock.

In my view, the risk/reward relationship is still leaning to the favorable side of the equation, so I think PayPal Holdings continues to deserve a ‘Buy’ stock classification.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.