Summary:

- Shares of Roku have dipped sharply after posting Q3 results, owing to a less-than-optimistic adjusted EBITDA outlook for Q4.

- However, management has noted that the timing of sales and marketing expenses is more seasonal this year, with a heavier load in Q4.

- I’d focus much more on the company’s acceleration in platform revenue growth, which is expected to continue into Q4.

- ROKU stock continues to trade at very buyable valuation multiples, especially for its growth potential.

JHVEPhoto/iStock Editorial via Getty Images

Earnings season is now in full swing, and over the past few quarters, that has proven to be a downside catalyst for Roku (NASDAQ:ROKU), where investors can never really wrap their heads around the company’s guidance. Still, the leading streaming-device maker has shown a robust propensity to bounce back, exceeding its initial expectations.

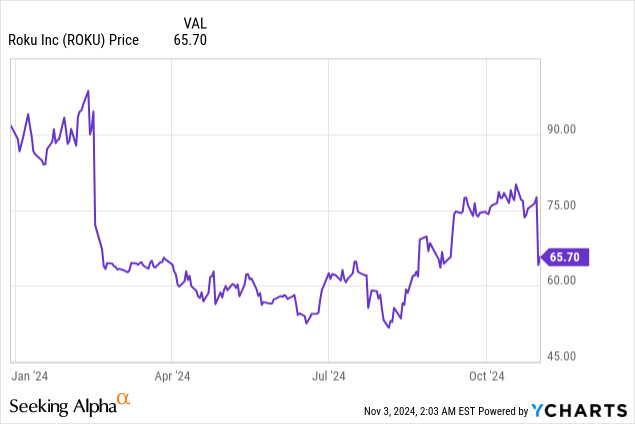

Year to date, shares of Roku have lost more than 25% of their value. Shares bottomed earlier this August near $50 after the company’s last earnings dip, but have rebounded since then. For investors who are keen to get in on an iconic brand while it’s dipping, now is a great chance.

I last wrote a buy rating on Roku in August after the company’s last earnings print, when the stock was still trading close to $53 per share. Now after parsing through the company’s latest Q3 results which featured a healthy acceleration in revenue growth, I’m reiterating my buy rating for Roku.

What continues to be impressive about this company is the fact that it continues to add active streaming accounts each and every quarter. The number of streaming accounts has hit an impressive 85 million, and it’s adding roughly 2 million new households per quarter. Streaming hours and engagement also remain quite high, and rapidly advancing every quarter. This forms a great captive user base for the company’s ever-growing platform services.

For investors who are newer to Roku, here is my updated long-term bull case on this company:

-

Platform business has become the company’s focus, driving high-margin growth. Earlier on, Roku’s revenue split between its low-margin hardware players and its platform revenue was closer to 50/50; now, hardware is barely over. Not only has this improved profitability, but this also means Roku’s revenue is more stable from quarter to quarter and isn’t heavily reliant on the seasonality of device sales.

- Secular tailwinds towards streaming and away from traditional TV. According to Roku, streaming activity continues to grow double digits while traditional linear TV is down (for example, viewership of the recent presidential debates was down -30% y/y). Meanwhile, Roku’s own streaming growth is topping 20%+ each quarter.

-

The company continues to drive growth via the Roku Channel and is also a leader in original programming. The company’s platform is now one of the leading streaming offerings in the U.S. This channel is also now producing original content, including a new documentary in partnership with the NFL that became one of the most popular shows on Roku. Sports-oriented hubs, like the company’s NFL and NBA zones, continue to drive engagement and sign-ups to other companies’ streaming services.

-

International expansion opportunity. Roku has recently set its sights on expanding aggressively overseas, with recent overtures in the UK, Canada, and Mexico – representing the next leg of growth for the company. Though this has dented the company’s ARPU (international markets generate less ad dollars than in the U.S.), we should focus on drawing in eyeballs first and worrying about revenue contribution later.

- Cash-rich balance sheet. The company has over $2 billion of net cash on its books and no debt, giving it plenty of financial flexibility to pursue growth.

Stay long here and ignore the recent guidance-oriented pessimism.

Q3 download

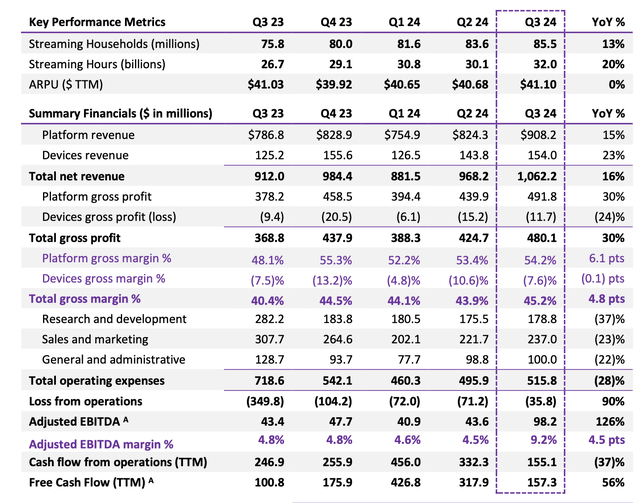

Let’s now go through Roku’s latest quarterly results, as well as the reason for its drop (primarily Q4 guidance), in greater detail. The Q3 earnings summary is shown below:

Roku Q3 highlights (Roku Q3 shareholder letter)

Roku’s total revenue grew at an impressive 16% y/y clip to $1.06 billion, well ahead of Wall Street’s much more modest expectations of $1.02 billion (+11% y/y). We note as well that revenue growth accelerated two points versus 14% y/y growth in Q2. Importantly: we note that platform revenue accelerated four points y/y to 15% growth, versus 11% growth in Q2. We appreciate the 20%+ growth in devices revenue (still driven by a successful launch of the latest Roku Pro models), but Roku continues to use devices as an ecosystem gateway to the Roku platform that generates a negative gross profit.

We especially like the ~2 million net adds in streaming households, as well as the 20% y/y growth in streaming hours. Roku continues to build an engaged and captive audience with which to generate advertising dollars as a recurring revenue stream.

Investors may be discounting Q3 results somewhat because it’s election season, which tends to carry a heavier amount of one-time political advertising. While Roku didn’t disclose the exact contribution from election-related messaging (some companies, like Twilio (TWLO), do), I actually appreciate the fact that ARPU stayed flat y/y at $41.10, indicating to me that despite some contribution from election-related ad load, it hasn’t necessarily skewed Q3 advertising results tremendously.

The company notes as well that it is improving its ad efficiency by integrating more deeply with The Trade Desk (TTD), which is a software-driven marketplace for automating the ad buying process. By targeting ads more efficiently to Roku’s audience, the company can improve its ad pricing over time.

On the profitability front, the company is benefiting from lower y/y opex, stemming from its decision to lay off 10% of its headcount last September. As a result, adjusted EBITDA more than doubled to $98.2 million, representing a respectable 9% adjusted EBITDA margin.

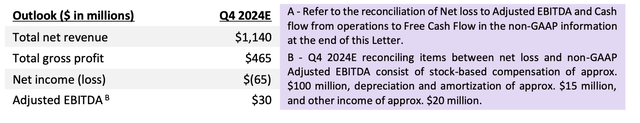

What investors shunned, however, is that the company is guiding to only $30 million of adjusted EBITDA in Q4, or just a 3% margin: despite continuing revenue growth at a 16% y/y pace to $1.14 billion.

Roku Q4 outlook (Roku Q3 shareholder letter)

However, the company notes that this profitability outlook is more related to timing of sales and marketing expenses, which is more seasonal this year than in prior years. For the full year FY24, the company expects sales and marketing to be slightly down, but up 9% y/y in Q4 (perhaps to capture more revenue opportunity from political campaign season). To me, this isn’t an expression of lower profitability at all, and I’m more drawn by the company’s indication that revenue growth isn’t set to decelerate at all heading into the end of FY24.

Valuation and key takeaways

At current share prices near $66, Roku trades at a market cap of $9.51 billion. After we net off the $2.13 billion of cash on the company’s latest balance sheet, the company has an enterprise value of $7.38 billion.

Meanwhile, for next year FY25, Wall Street analysts are expecting Roku to generate revenue of $4.55 billion (+13% y/y). And if we assume a 5.2% adjusted EBITDA margin (flat to implied FY24 guidance) against that revenue profile, the company’s adjusted EBITDA would be $191.1 million. This puts Roku’s valuation multiples at:

- 1.6x EV/FY25 revenue

- 39x EV/FY25 adjusted EBITDA

Given double-digit platform growth, successful hardware releases, the possibility for further margin expansion from headcount efficiencies, and the company’s growth potential overseas, I’d say Roku still trades at very buyable levels.

At least over the past year, Roku has shown a proclivity to bounce back post-earnings, and in my view, the Q3 dip will be no different.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ROKU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.