Summary:

- Shares of fuboTV took a dive on November 1st after management announced results for the third quarter of the 2024 fiscal year.

- This came amidst worse-than-expected results in North America, though the business did grow nicely, and it’s getting closer to profitability.

- Until FUBO can get its house in order, which is something it is making nice progress toward, it’s a risky play.

hapabapa

One company that I have been consistently bearish about has been fuboTV (NYSE:FUBO). Even though I am a big fan of the streaming space, I worry about competitive pressures that the company has to contend with, plus I struggle with accepting the firm’s overall cash flow position. So far, this bearishness has worked well. Since I last wrote about the company in an article that was published in August of this year, an article in which I kept that business rated a ‘sell’, shares have dropped by 15.1%. By comparison, the S&P 500 has increased by 2.3%. And since I initially rated it a ‘sell’ in February of this year, shares are down 22.5% at a time when the S&P 500 is up 14.6%.

Much, but certainly not all, of this downside came on November 1st, when shares closed down 12.6% for the day. This drop was in response to management announcing financial results for the third quarter of the company’s 2024 fiscal year. Even though the company exhibited impressive growth on its top line and smaller losses on its bottom line, results that actually exceeded analysts’ estimates, revenue growth in North America fell short of expectations. This might seem an odd reason, maybe even a small reason, for the company to experience such a big decline. But when your cash flow situation is as tough as fuboTV’s is, the picture often has to be perfect in order to avoid further downside.

Fundamentally speaking, I acknowledge that fuboTV is doing better than it was doing previously. But at this point, it is still difficult to become even neutral on the firm. I am most certainly impressed by its continued growth. But until we see even more progress on the bottom line, I believe that maintaining it as a ‘sell’ candidate makes the most sense.

A solid quarter… mostly

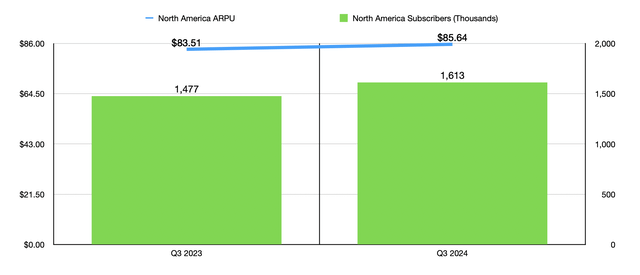

As I mentioned at the start of this article, fuboTV saw some rather impressive results for the third quarter of its 2024 fiscal year. Revenue for the quarter came in at $386.2 million. This represents an increase of 20.3% compared to the $320.9 million the company reported one year earlier. Revenue also ended up being $9.5 million above what analysts were expecting. This overall growth was driven by three factors. For starters, the number of paid subscribers that the company has throughout North America hit 1.61 million. That’s well above the 1.45 million reported for the second quarter of the year, and it is comfortably above the 1.48 million paid subscribers that the company had for the third quarter of 2023.

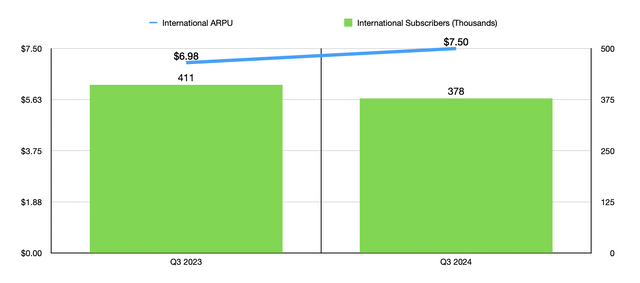

In addition to benefiting from paid subscriber growth, fuboTV also enjoyed a rise in its monthly ARPU (average revenue per user) in North America from $83.51 to $85.64. This might not seem like that much of an increase. But when applied to the number of subscribers that the company had at the end of the third quarter, this translates to an extra $41.2 million worth of revenue annually. And finally, there was also an increase in monthly ARPU when it came to the company’s international operations. This figure grew nicely from $6.98 to $7.50.

This is not to say that there were no weak spots. Even though the number of subscribers grew in North America, the number of international subscribers fell to 378,000. That’s down from 399,000 in the second quarter of this year, and it’s down from 411,000 for the third quarter of 2023. Given the lower ARPU, this is not horrible in and of itself. But any sort of decline in size is always discouraging. Management also reported a drop in advertising revenue from $30.6 million to $27.1 million because of a reduction in the number of impressions.

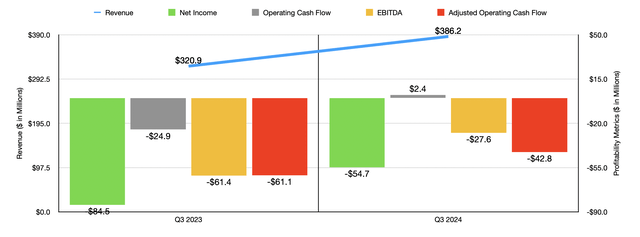

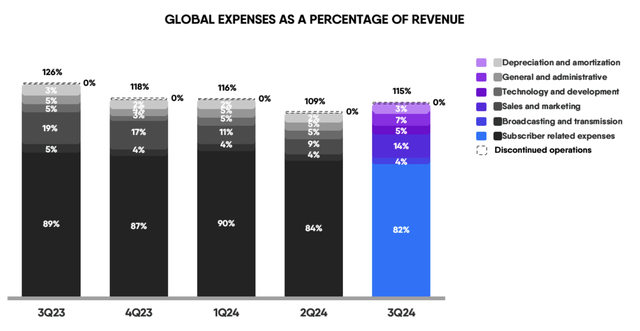

On the bottom line, fuboTV exhibited year over year improvements as well. The firm went from a loss per share of $0.29 to a loss per share of $0.17. This happens to be $0.01 per share better than what analysts anticipated. Put in other terms, the firm went from losing $84.5 million last year to losing $54.7 million this year. This has been part of a trend as of late. Management has made it a priority to make the company profitable next year. And in the investor call related to these earnings, the company stated that they have so far delivered almost $100 million of year over year improvement in adjusted EBITDA over the trailing 12-month window ending for the third quarter. As you can tell in the image below, much of its margin improvement has come from reduced subscriber-related expenses.

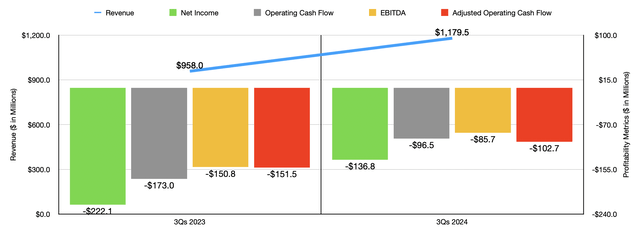

Other profitability metrics improved as well. Operating cash flow went from negative $24.9 million to positive $2.4 million. If we adjust for changes in working capital, we get an improvement from negative $61.1 million to negative $42.8 million. And finally, EBITDA for the company improved from negative $61.4 million to negative $27.6 million. In the chart below, you can see financial results for the first nine months of the 2024 fiscal year compared to the first nine months of last year. As was the case for the third quarter on its own, the company exhibited continued growth in revenue and continued profit and cash flow improvements.

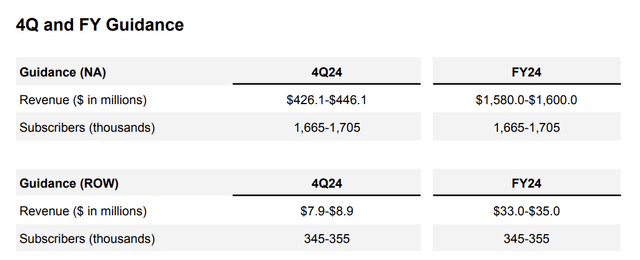

For this year in its entirety, management has come out with some revised guidance. Currently, revenue in North America is expected to be between $1.58 billion and $1.60 billion for 2024. While this should mark an improvement over the $1.57 billion to $1.59 billion range previously anticipated, it’s actually below the consensus estimate that Seeking Alpha provides of $1.62 billion. That is likely one of the triggers that sent shares lower. By the end of the year, management is forecasting between 1.67 million paid subscribers and 1.71 million paid subscribers when it comes to the North American operations. However, with paid subscribers internationally expected to be between 345,000 and 355,000, revenue abroad should only be between $33 million and $35 million.

We don’t know what to expect when it comes to the 2025 fiscal year, but as I said before, management is pushing to achieve profitability. We do know that the company has been working hard to achieve this. They have also been working to manage their debt. In my latest article about the firm, I detailed how it had $199.4 million worth of net debt on its books. That was up from $148.3 million in 2023 and up from $58.5 million back in 2022. Despite the meaningful cash outflows, management has been able to reduce net debt slightly to $188.4 million. This was because management bought back some of the 2026 convertible notes at a discount to their value. In the first nine months of this year, the company allocated $27.1 million to reduce the amount of convertible notes by $46.9 million. But given its current cash flow position, it’s unclear whether that can we continue.

At the same time that the company is trying to control costs, it is focusing on various growth initiatives. On October 22nd, for instance, management announced the launch of additional standalone premium subscription services that will allow consumers to subscribe to certain content without having a base Fubo channel plan. These subscription services are FanDuel Sports Network, NBA League Pass, and Paramount+. In exchange for subscribing to these, customers will also receive Fubo Free, which provides access to almost 200 free ad-supported streaming television channels. And just three days after this announcement was made, the firm issued a press release stating that it reached a multi-year agreement with Chicago Sports Network to provide access to live telecasts of different Chicago related game coverage.

There are multiple other examples that I could point to as well. Last month, The Athletic, which is owned by The New York Times Company (NYT), entered into a partnership with fuboTV that will see the streaming platform become the official live TV streaming partner of The Athletic. This will see Fubo integrated into live game blogs and other content on The Athletic’s sports platform and will see it advertised as a ‘go-to sports streaming destination’. This arrangement also involves the two parties jointly developing new product features in order to create a better user experience. When you add on top of these moves certain favorable market conditions, like the fact that there are still nearly 50 million households in the US that subscribe to legacy pay-TV (down from 105 million 14 years ago) and that they continue to shift away from legacy services and to streaming platforms, there are reasons to be optimistic.

There is also some movement regarding fuboTV’s pushback against a joint venture between The Walt Disney Company (DIS), Fox Corporation (FOX), and Warner Bros. Discovery (WBD), whereby the three businesses have been working on a bundling arrangement to provide customers with joint access to their sports related content. As I wrote about previously, this will be known as Venu Sports and, according to my own analysis and according to fuboTV, this could pose a significant competitive threat to fuboTV. After much back and forth through the courts, it does look as though a trial is currently scheduled to begin on October 6th of 2025. So while this will continue to be a risk factor for investors, it looks as though fuboTV will not have to deal with this new competitor until at least next year. And if everything goes well for them, they may not have to deal with it at all.

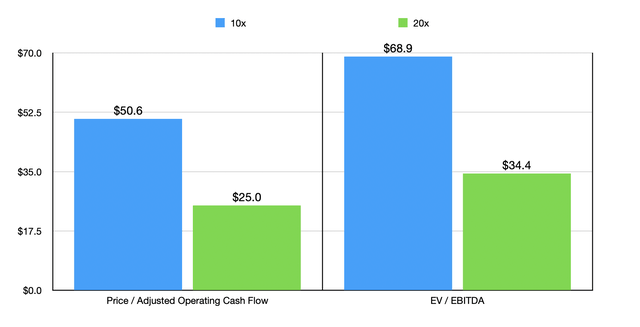

Because of how long these legal issues will probably take and because of the recent growth that the company has exhibited, it might be surprising that I’m keeping a bearish stance on the business right now. However, I believe this is justified because of how far apart cash flow is from where it needs to be in order for fuboTV to be even fairly valued. In the chart above, you can see how much adjusted operating cash flow the company would need to generate on an annualized basis to trade at either 10 or 20 times on a price to adjusted operating cash flow basis. I did the same thing with EBITDA for the EV to EBITDA picture. While the figures involving the multiple of 20 might be possible next year if management truly can turn the company profitable by then, there are still a lot of risk factors here, such as competitive pressures and cash outflows, that I believe warrant additional caution.

Takeaway

Based on the data provided, I must say that while I do appreciate the impressive top line growth that fuboTV has exhibited, I am not ready to pull the trigger on an upgrade yet. We are seeing improvements year over year, and additional growth will likely help even more. But to me, this is still a pretty risky opportunity and, absent something significant changing, I believe that the risk is not worth the reward.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!