Summary:

- SMCI faces major uncertainties both in the positive and negative directions.

- The top positives are the strong earnings reported by Taiwan Semi recently, attractive valuation (~7.7x FWD P/E), and the promise of its liquid cooling racks.

- But the resignation of a reputable auditor like Ernst & Young LLP is a key concern.

- With such uncertainties, we advise against bottom fishing despite the recent valuation contraction.

- Instead, we suggest the consideration of options to manage risks and minimize capital exposure.

Andrii Dodonov/iStock via Getty Images

SMCI stock: previous thesis and new developments

My last work on Super Micro Computer (NASDAQ:SMCI) argued for a HOLD thesis about a month ago. That article was titled “Super Micro Computer: 10-To-1 Split Impact Dampened By DoJ Probe And Margin Uncertainty”. The hold rating was based on my concerning over the following heightened uncertainties:

The 10-for-1 stock split signals management confidence and boosts investor interests. But the positives are dampened by a DoJ investigation into alleged accounting violations. Margin uncertainties due to higher components and operation costs further cloud the picture.

A lot has happened since then to this storied stock. But the three biggest catalysts on my last that motivated this writing up are: the resignation of its auditor, the recent earnings report released by Taiwan Semiconductor (TSM), and also the valuation correction since my last coverage (from ~13x FWD P/E then to the current 7.7x). In the remainder of this article, I will detail my thoughts on these developments and evaluate their potential impacts on the stock. You will see that the main takeaways are threefold.

- I am still seeing tremendous uncertainties surrounding the stock, both on the positive side and also the negative side. On the positive side, besides the 10-to-1 split mentioned in my earlier article, the recent earnings report from TSM also demonstrated to me that the robust demand for AI-related chips continues. As to be elaborated on later, I consider this as a foreshadowing of SMCI’s robust earnings in the upcoming earnings report (ER). However, there are also considerable uncertainties on the negative side. In addition to the auditor’s resignation, the stock is also burdened by other significant uncertainties as detailed in my earlier article.

- As such, I do not recommend potential investors to attempt bottom fishing at this time despite the attractive valuation resulting from the recent price correction. Instead, investors should approach the current P/E ratio with skepticism, considering the possibility of a financial restatement.

- Finally, based on the above analyses, I will discuss some actionable suggestions via the use of options to manage the ongoing uncertainties. I think the use of options is especially timely given that the company is about to report its earnings for FY Q1 2025 (which is scheduled on Nov 6, 2024). As to be elaborated on later, I expect options with expiry shortly after the ER to effectively mitigate the many of the risks during and after the earnings report for both existing shareholders and potential shareholders.

SMCI stock and TSM’s earnings report

With the above overview, let me start with the first positive catalysts on my list: the strong ER reported by TSM recently. For readers who do not follow TSM, its Q3 revenue enjoyed a 36% YOY growth and its EPS grew more than 50%. What is more, the growth was largely driven by the demand from High Performance Computing (HPC) as detailed by the following Seeking Alpha’s report:

High Performance Computing represented 51% of net revenue, up from 42% in the year-ago period… both top and bottom-line numbers surpassed analysts’ expectations. “Our business in the third quarter was supported by strong smartphone and AI-related demand for our industry-leading 3nm and 5nm technologies,” said TSM’s Senior VP and CFO Wendell Huang.

Such strong results indicate robust earnings from SMCI in the past quarter for several reasons in my view. First, both companies are major beneficiaries of the ongoing AI boom and TSM’s strong ER indicates robust demand for advanced chips used in AI applications. Second, TSM, as a major chip manufacturer, supplies chips to various companies, including those that SMCI partners with (such as Nvidia as the most notable example).

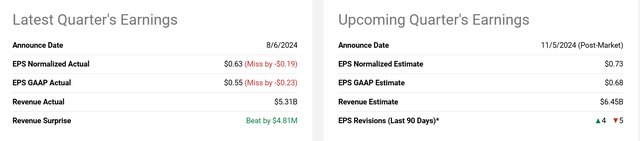

Indeed, I think the prevailing analysts’ expectations reflect such tailwinds as you can see from the next chart below. As seen, the current consensus estimates expect the company to report a normalized EPS of $0.73 (vs. $0.63 in the past quarter). Furthermore, the consensus estimates expect its GAAP EPS to reach $0.68 and revenue to reach $6.45 billion, translating into a QoQ growth rate of 24% and 21%, respectively.

SMCI stock: auditor resignation

However, the stock is also facing considerable negative risks too, as you can also tell from the recent analyst estimate revisions. To wit, in the past quarter, there have been 4 upward revisions to EPS estimates and 5 downward revisions, suggesting large uncertainties among the investment community.

Such earnings uncertainties are heightened substantially by the recent resignation of its auditor Ernst & Young (EY). More specifically, EY informed the board of directors of the resignation last week (on October 24). The reasons behind EY’s decision include transparency and internal control issues. SMCI’s stock prices fell by more than 1/3 after the news broke. Despite such large price corrections, as aforementioned, I recommend investors refrain from any bottom fishing attempts. Our past experiences have taught us that the resignation of a reputable auditor like EY should be a crucial factor to be factored into any investment decisions. Other recent resignation cases (such as those involving EY and also Deloitte) all went down badly for investors shortly afterwards.

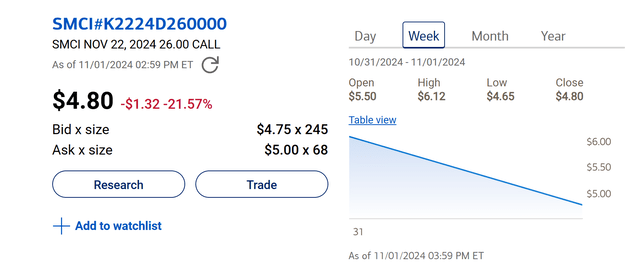

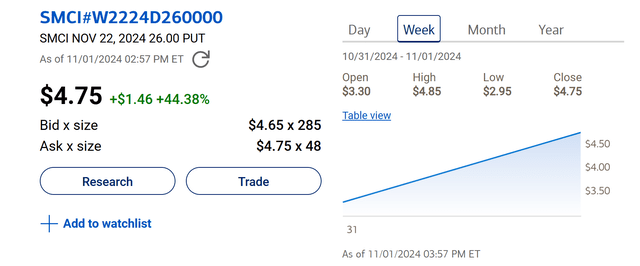

Instead, I recommend investors to consider the use of options to manage the risks. For example, potential investors could consider the use of a call option. The chart below displays the information about an SMCI call option expiring on November 22, 2024 (i.e., about 1 week after its upcoming ER) with a strike price of $26 (i.e., a near-the-money call at its current price as of this writing). As seen, the option last traded around $4.80. Thus, a total of ~$480 would provide the option’s holder the right to buy 100 shares at $26, a limited exposure of capital compared to directly buying shares (which would require about $2600 for 100 shares). Similarly, existing investors could consider the use of a put option to hedge their position in the next 1~2 weeks. The put options with the same expiry dates and strike price also last traded around $4.8 as seen.

Bank of America data Bank of America data

Other risks and final thoughts

Besides those risks mentioned, a few other risks, both in the positive and negative directions, are worth mentioning. As a positive risk, the stock is now every attractively valued at an FWD P/E of 7.7x only as implied from the following consensus EPS estimates. Moreover, the P/E ratio is even more attractive when adjusted by the growth rates. For example, the consensus EPS estimate is $3.37 for FY 2025, representing a significant YOY growth of 52.57%. This is followed by projected growth rates of 31.73% and 23.74% in the next two years. Based on these projections, the PEG ratio is only about 0.25x, vs. the gold standard of 1x for GARP investors (growth at a reasonable price). However, given the EY resignation discussed above, investors should interpret the P/E ratios with a grain of salt and factor in the possibility of a restatement of its financials in their interpretation.

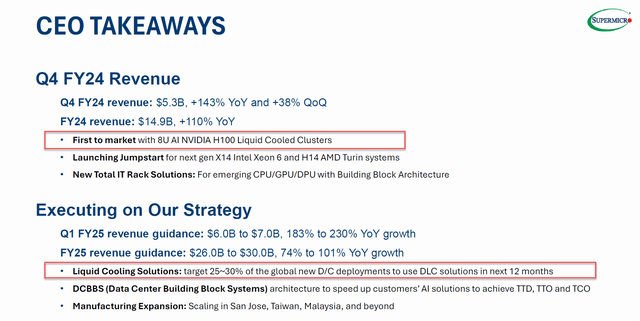

Another strong upward catalyst in my mind is SMCI’s liquid cooling technology. The company reported encouraging progress on this front in its last quarter’s ER as you can see from the chart below. In particular, the company reported the first market application of its liquid cooled clusters for NVDA’s AI chips. Given my professional background (thermal fluid sciences), I consider direct liquid cooling (DLC) to be one of the most promising strategies to address our computational bottleneck. Advanced AI chips generate a tremendous amount of waste heat in a very confined volume. Liquid conducts heat about 1000x better than air, and thus DLC technology can dissipate the waste heat much more efficiently and keep leading AI chips (like those made by NVDA) running at/close to their peak performance for longer. SMCI’s DLC technologies have demonstrated good progress toward this end goal, judging by its recent news release (an example is quoted below with the emphasis added by me):

With Supermicro’s 4U liquid-cooled, NVIDIA recently introduced Blackwell GPUs can fully unleash 20 PetaFLOPS on a single GPU of AI performance and demonstrate 4X better AI training and 30X better inference performance than the previous GPUs with additional cost savings. Aligned with its first-to-market strategy, Supermicro recently announced a complete line of NVIDIA Blackwell architecture-based products for the new NVIDIA HGX™ B100, B200, and GB200 Grace Blackwell Superchip.

Finally, since this article described the use of options, a strong warning is in order for readers who are new to options. The risk analysis for options (or derivative instruments in general) is fundamentally different from that for trading stocks directly. The use of call options as described above, even though it’s a limited total dollar amount of exposure, is riskier when the risk is evaluated differently. For example, holders of the call options can suffer a total loss if the SMCI stock price remains below the strike price between now and its expiry date. As such, investors need to tailor the use of options to their own perspective and investor goals.

To conclude, since my last writing, several catalysts – both in the positive and negative directions – have occurred and investors should reexamine the stock. The most important positive catalysts on my list are the strong ER from TSM (indicating the persisting AI demand), the attractive valuation (about 7.7x FWD P/E vs. about 13x a month ago), and the promise of SMCI’s liquid cooling strategy. However, the negatives are also considerable. In particular, the resignation of a reputable auditor like EY leads us to see a non-negligible probability for SMCI to restate its financials. Given such uncertainties, we advise against any bottom fishing attempts under current conditions and recommend investors to consider the use of options to manage risks and minimize capital exposure.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If you share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat the S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.