Summary:

- Intel’s stock price saw a slight recovery after a drastic crash experienced YTD.

- The management takes action to restructure the business and provides a promising outlook on the years to come.

- My conservatively derived price target offers an upside potential with a sufficient margin of safety.

JasonDoiy

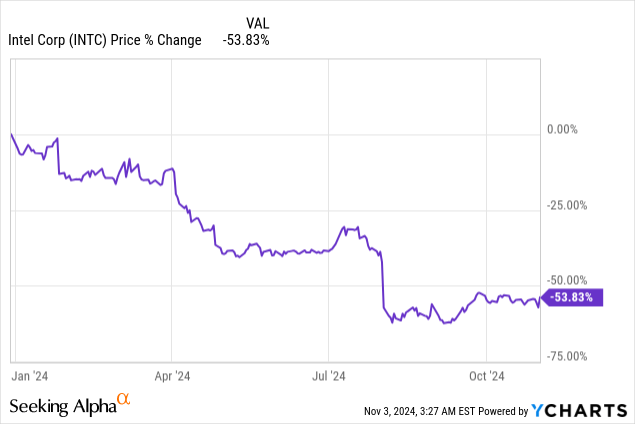

Intel (NASDAQ:INTC) has been one of the most prominent topics in the media regarding the semiconductor space for quite some time now. Naturally, not without a good reason, as the Company’s stock price has lost ~60% during the last five years, especially in 2024. It saw a slight recovery in recent weeks, but YTD performance still paints a horrifying picture with over 50% stock price decrease.

In my last coverage, I explained the reasons for such poor performance and provided a positive outlook for investors. I then established my first position at Intel. Should you be willing to get a better grasp of the development of my views on INTC, please refer to the link below:

Intel: The Night Looks The Darkest Before The Dawn

Since then, INTC’s stock price has increased by over 10%. I decided to take another look at Intel after the publication of its Q3 2024 SEC filings.

Q3 2024 Earnings Summary

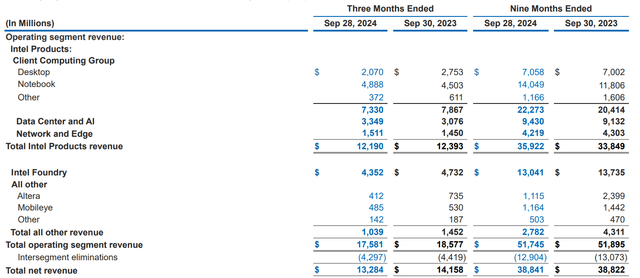

Intel’s total revenue for nine months of 2024 stood at a stable level compared to the previous year’s analogical period. The Notebook segment was a bright point of its performance YTD, offset by negative developments of Altera, Mobileye, and Intel Foundry.

Looking solely at Q3 2024, Intel saw a revenue decrease of ~6%. While the Data Center and AI segment saw a ~10% increase, it was offset by negative development of the Desktop segment, Altera, and Intel Foundry. Nevertheless, INTC’s total revenue aligned with the management’s expectations – in the upper half of the outlook provided in August.

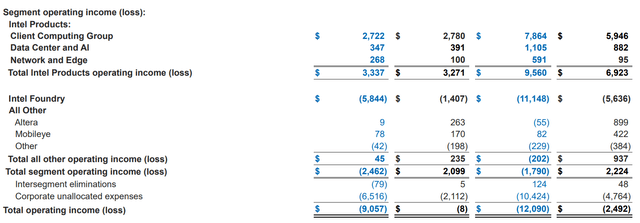

While Intel Products saw a similar operating margin in Q3 2024 vs. Q3 2023, its nine-month performance improved. However, it was more than offset by substantial negative performance within Intel Foundry, further weighed by other corporate expenses (related mainly to restructuring charges, specifically employee severance and asset impairment). On a positive note, close to $3.4B of corporate expenses related to asset impairment charges could be considered an adjustment to the operating income due to its non-cash and one-off nature. Also, employee severance is related to INTC’s plan to reduce operating expenses going forward.

Regarding the management outlook of operating income for Q4 2024 and 2025:

We expect losses to continue at approximately the same rate in Q4, minus this impairment charge. Next year, as we move to nodes with a better cost structure and realize the savings associated with the restructuring actions, we expect operating losses to improve significantly.

Nevertheless, the management recognized that its profitability was significantly below its standards. Its restructuring activities are aimed at returning to profitability and reestablishing a ~30% operating income margin by 2030:

In closing, our profitability remains well below the standards we’ve set and recognize there’s much more work to be done to improve the efficiency of the business. We’re encouraged by the progress we made this quarter to rightsize the spending, and our process and product execution, combined with a strong external customer traction in the quarter, give us confidence our strategy will deliver compelling shareholder returns.

There’s Still Some Upside Left: DCF Valuation

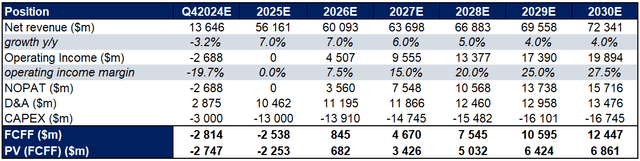

As an M&A advisor (fancy name for buying and selling businesses), I usually rely on multiple valuation method, as it provides market-driven benchmarking. However, in the specific case of Intel and its obviously low EV/EBITDA multiple, such a method doesn’t provide much value and would deliver us a valuation detached from Intel’s current potential. Therefore, I used a DCF valuation.

Key assumptions:

- expected rate of return (cost of capital): 10%

- terminal growth rate: 2.5%

- cash flow formula: FCFF with net working capital excluded, as it would provide me with too much room for subjective assumptions due to recent dynamic and nonlinear changes recognized by Intel

- the conservative approach is reflected in the:

- slower revenue growth beyond 2027 than assumed by Wall St. Analysts

- the assumption that the management will fall slightly short of its 30% operating income margin goal in 2030

- the analogical approach adopted to the residual value calculation

Price target with the above assumptions adopted

I assumed the operating income margin would gradually improve but fall a bit short of the management goal in 2030 (30%). I assumed the US corporate tax rate to arrive at NOPAT (net operating income after tax). CAPEX for 2024 and 2025 has been assumed on a net basis (net of partners’ contributions and government incentives, presented by Intel here) with D&A coherent with historical levels. Both positions were assumed to grow according to revenues moving forward.

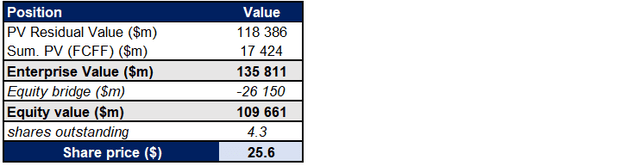

After discounting each cash flow to present value, I arrived at an Enterprise Value of $135.8B, which led to an equity value of $109.7B after adjusting for the equity bridge. The result is a base scenario target share price of $25.6.

Sensitivity analysis: the base scenario is low enough for Intel to deliver

Sensitivity analysis is crucial for investors to understand the strength and impact of their key assumptions on the price target. Let’s consider two perspectives:

- revenue growth and operating income margin (key financial metrics)

- cost of capital and terminal growth rate (key valuation metrics)

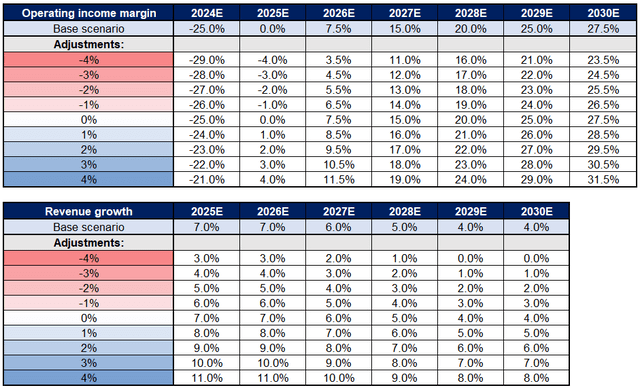

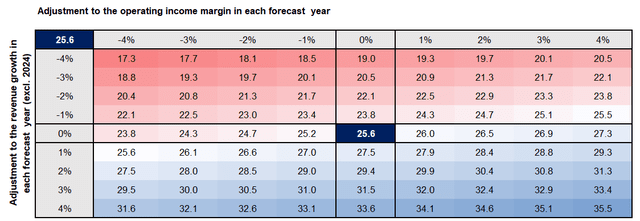

Focusing on key financial metrics, I’ll provide you with price targets, assuming a higher or lower revenue growth or operating income margin by X percentage points. Please review the table below to examine possible scenarios to facilitate the sensitivity analysis.

Naturally, I don’t believe that each scenario listed above is likely to occur. I would be highly surprised if Intel delivered an operating income margin of as much as 400 bps lower/higher each year of the forecast period. Please review the sensitivity analysis (corresponding to the above tables) below.

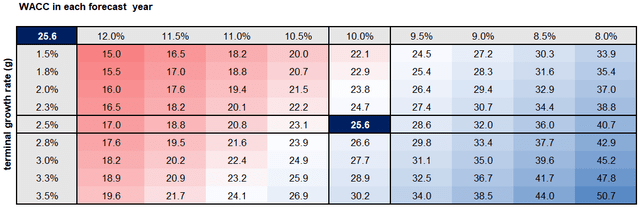

Taking a similar approach to the cost of capital and terminal growth rate (with revenue growth and operating income margin assumed according to the base scenario), please review the sensitivity analysis below.

Your takeaway

Even after recent stock price increases, Intel still offers quite an attractive upside potential, especially given a relatively conservative approach to valuation, ensuring a margin of safety. Management keeps taking action to improve its cost structure, which will likely improve INTC’s profitability moving forward. I believe the expectations set in front of Intel to be too low to miss, but even a slight under-delivery of the base scenario will not result in losses.

I still consider Intel a buying opportunity and believe it will benefit shareholders in the mid to long-term. Therefore, I am happy to reiterate my ‘buy’ rating after the management provided a promising outlook for the future.

Nevertheless, each stock market investment is accompanied by market and company-specific risk factors, which in the case of INTC include:

- Geopolitical risks

- Failure to deliver the promised technological level

- Delays (please note that Intel has a history of failing to hold onto its primarily assumed timeline)

- Inability to transform substantial R&D expenses into cash-generating products

- Ineffectiveness of restructuring initiatives

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.