Summary:

- Altria Group stock has outperformed the market and its peers, as my bullish thesis played out accordingly.

- The market will likely focus next on Altria’s ability to carve out its market leadership in smokeless products.

- MO’s valuation metrics have narrowed relative to its sector peers and long-term averages.

- Given the business transition risks, I assess the need for investors to reflect a reasonable discount.

- As my MO bullish proposition played out to perfection, I explain why MO investors must not throw caution to the wind from here.

krblokhin

Altria: Outperformance Played Out Accordingly

Since my last update in June 2024, Altria Group’s (NYSE:MO) investors have significantly outperformed the S&P 500 (SPX) (SPY) on a total return basis. In my bullish Altria article, I highlighted why its attractive valuations had reflected structural challenges in its legacy segment. As a result, I have confidence that income investors should continue to underpin its highly attractive forward dividend yields.

Consequently, MO has recovered more than 23% (total return) in less than five months, outperforming the market’s 4.6% gain over the same period. Altria stock has also outshone its consumer staples peers (XLP) since February 2024, underscoring its robust fundamental thesis and decisive shift in investor sentiments (from “B-” to “A-” momentum grade). Given the narrowing of its valuation bifurcation relative to its long-term average, should Altria investors chase the recent surge, notwithstanding its still appealing forward yields?

Altria’s Q3 Performance Suggests The Worst Is Likely Over

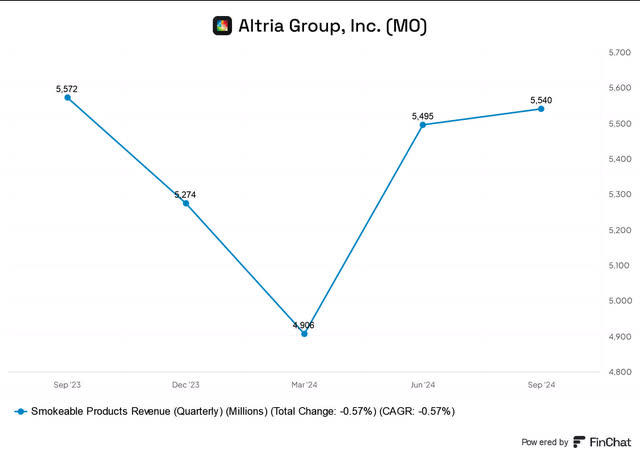

Altria quarterly revenue trend (FinChat)

In Altria Group’s Q3 earnings release, Altria delivered another resilient performance, suggesting the worst of its revenue decline is likely over. As seen above, Altria posted net revenue of $5.54B in its smokeable segment in Q3, nearly flat on a YoY basis. It also marked a sequential improvement from the lows in Q1, even though the company reported persistent weakness in the industry’s tobacco volume trends.

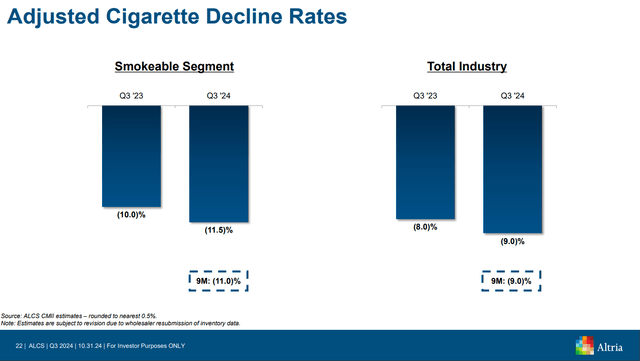

Cigarette decline rates (Altria filings)

As seen above, the tobacco industry experienced an estimated 9% decline in adjusted domestic cigarette volume, worse than last year’s 8% decrease. However, Altria’s smokeable segment posted a more significant fall, with volume dropping 11.5% in adjusted terms. Structural factors, including the shift to smokeless products and competition from illicit products, have likely worsened the legacy segment’s demand dynamics.

In addition, Altria’s premium focus is expected to have contributed to the loss of overall retail market share, even though its premium market share has remained relatively stable. As a result, I assess that it’s increasingly clear that Altria needs to chart a more robust and sustained transition to smokeless products to justify a more significant valuation re-rating against its leading peers.

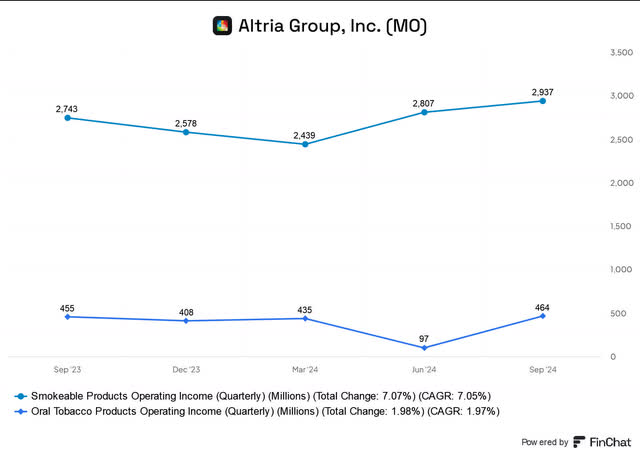

Altria Group segment operating income (FinChat)

Furthermore, the operating income of its smokeless segment pales in comparison to that of its core legacy segment. Hence, Altria needs to accelerate its ability to scale its next-gen products to mitigate the weakness in its core business. While MO has demonstrated its ability to generate operating income profitability in its oral tobacco business, investors are expected to remain cautious unless management can telegraph a more confident outlook for 2025. Hence, I assess that the recent outperformance from MO relative to the market and its sector peers seems to point to a mean-reversion thesis. Therefore, Altria investors are expected to be increasingly cautious as the market reassesses its growth momentum in smokeless products through 2026.

Notwithstanding my caution, I assessed that MO’s continued recovery in its core business has likely corroborated the company’s affirmation of its FY2024 earnings guidance. Hence, the improved clarity has afforded more confidence in income investors seeking to reallocate from cash into fundamentally strong tobacco businesses (MO has an “A+” profitability grade). Accordingly, Altria reiterated its adjusted EPS guidance of between $5.07 and $5.15 for 2024, representing a 2.5% to 4% YoY growth.

Also, the company’s decision to initiate $600M in cost cuts over the next five years through its “Optimize & Accelerate” program underscores its commitment to improving shareholder value. As a result, I believe the company has signaled its focus on enhancing its operating profitability even as it transitions to next-gen products while rearchitecting its cost base. Therefore, it should provide the necessary assurances to income investors to stay vested while MO works out the structural, competitive, and regulatory headwinds relating to its smokeless products.

Is MO Stock A Buy, Sell, Or Hold?

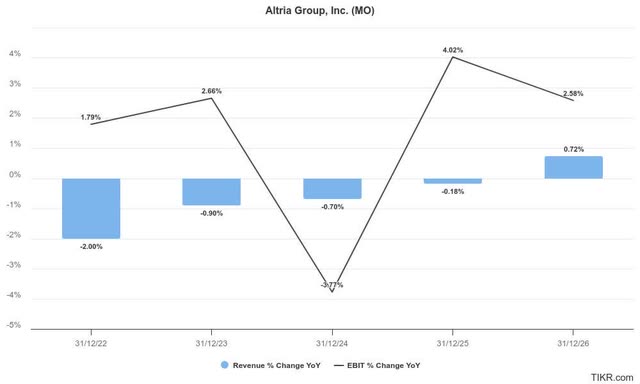

Altria estimates (TIKR)

Wall Street’s estimates on MO remain mixed, suggesting uncertainties relating to Altria’s smokeless transition are anticipated to persist. Despite that, management’s commitment to improving its operating efficiencies should help maintain the market’s confidence in its ability to support the recovery of its operating profitability. Furthermore, MO’s pricing levers should help mitigate the volume decline observed in its legacy business, bolstered by the resilient US consumer spending environment. Consequently, I assess that it should afford MO investors more confidence in hanging on to their holdings, bolstering its attractive “B+” valuation grade (relative to sector peers).

MO valuation metrics (TIKR)

MO’s forward adjusted EBITDA multiple of 9x has narrowed toward its 10Y average of 10.9x. Despite that, its forward dividend yield of 7.6% is expected to underpin the stock’s appeal, bolstered by its robust profitability. However, investors must assess whether a discount against its long-term average is apt, given the significant transition risks, as Altria seeks to secure a market leadership position in the smokeless category.

Investors must also contend with the growth momentum in illicit markets, which could worsen the competitive dynamics against Altria and its peers. More stringent enforcement and heightened regulatory scrutiny are necessary. However, these challenges are expected to persist, given the uncertainties in the effectiveness of the enforcement measures. Altria’s concentration risks in the US market could also be affected by its peers seeking to carve out their market leadership through next-gen products, unhinging MO’s current hold in its legacy tobacco business.

Given MO’s recent outperformance against its peers and the market, I assess that its mean-reversion thesis has played out accordingly. As its valuation relative to its peers and long-term average has narrowed, I determine that investors are likely to turn more cautious, given the need to reflect a reasonable discount to account for the execution risks in its business transformation.

Rating: Downgrade to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!